How To Read T4

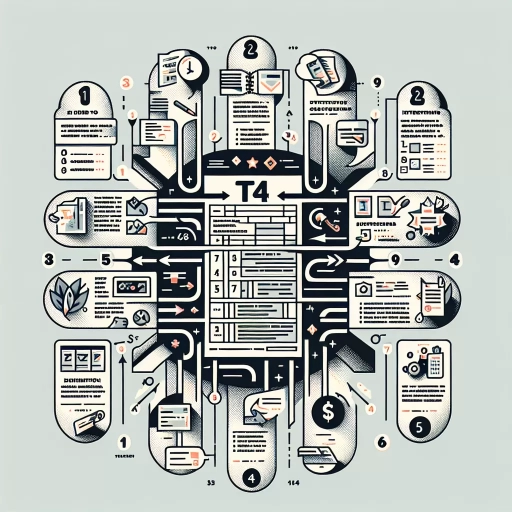

Here is the introduction paragraph: Reading a T4 slip can be a daunting task, especially for those who are new to the workforce or unfamiliar with tax terminology. However, understanding the information on a T4 is crucial for accurately filing taxes and avoiding any potential errors or penalties. In this article, we will break down the basics of T4 slips, including what information is included and how to read it. We will also explore how to interpret the information on a T4, including how to identify key figures such as income, deductions, and taxes withheld. Finally, we will discuss how to use the information on a T4 for tax purposes, including how to report income and claim deductions. By the end of this article, you will have a clear understanding of how to read and use a T4 slip. Let's start by understanding the basics of T4.

Understanding the Basics of T4

Understanding the basics of T4 is essential for individuals and employers in Canada to navigate the complexities of tax season. A T4 slip is a crucial document that provides information about an employee's income and taxes withheld, and it plays a vital role in the tax filing process. To grasp the fundamentals of T4, it's necessary to understand what T4 is and its purpose, the key components of a T4 slip, and who issues these slips and why. By exploring these aspects, individuals and employers can ensure accurate and timely tax filing, avoiding potential penalties and errors. In this article, we will delve into the world of T4, starting with the basics: what is T4 and its purpose.

What is T4 and its Purpose

T4, also known as thyroxine, is a hormone produced by the thyroid gland that plays a crucial role in regulating metabolism, growth, and development. The primary purpose of T4 is to stimulate the production of proteins, which are essential for the growth and maintenance of tissues, including muscles, bones, and skin. T4 also helps to regulate the body's metabolic rate, influencing how the body uses energy from the food we eat. In addition, T4 is involved in the development and maturation of the brain, nervous system, and reproductive system. When T4 levels are within the normal range, the body functions optimally, and we feel energetic, focused, and healthy. However, when T4 levels are imbalanced, it can lead to a range of health problems, including hypothyroidism (underactive thyroid) or hyperthyroidism (overactive thyroid). Understanding T4 and its purpose is essential for diagnosing and managing thyroid-related disorders, and for maintaining overall health and well-being.

Key Components of a T4 Slip

A T4 slip is a crucial document that outlines an employee's income and tax deductions for a given year. The key components of a T4 slip include the employee's name, address, and social insurance number, as well as the employer's name, address, and business number. The slip also details the employee's employment income, including their gross income, federal and provincial income tax deductions, and Canada Pension Plan (CPP) and Employment Insurance (EI) contributions. Additionally, the T4 slip may include other income and deductions, such as union dues, charitable donations, and pension adjustments. The slip is typically divided into several boxes, each representing a specific type of income or deduction, making it easy to understand and reference. For example, Box 14 represents the employee's employment income, while Box 16 represents the federal income tax deducted. By reviewing the key components of a T4 slip, employees can gain a clear understanding of their income and tax obligations, and ensure they are accurately reporting their income on their tax return.

Who Issues T4 Slips and Why

The Canada Revenue Agency (CRA) requires employers to issue T4 slips to their employees by the last day of February each year. Employers who pay salaries, wages, tips, bonuses, or other remuneration to employees must provide a T4 slip for each employee who earned more than $500 in a calendar year. This includes full-time, part-time, and seasonal employees, as well as employees who are no longer with the company. The T4 slip provides a record of the employee's income and the amount of income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums deducted. Employers must also file a T4 summary with the CRA, which summarizes the total amount of income and deductions reported on all T4 slips. The purpose of issuing T4 slips is to provide employees with the information they need to complete their income tax returns accurately and to ensure that employers are reporting their employees' income and deductions correctly.

Reading and Interpreting T4 Information

When it comes to understanding your T4 information, it's essential to know what each box represents. The T4 slip is a crucial document that outlines your employment income and the various deductions made throughout the year. To accurately read and interpret your T4 information, you need to understand the different components that make up this document. This includes decoding Box 14, which represents your employment income, understanding Box 16, which outlines your Canada Pension Plan (CPP) contributions, and explaining Box 18, which details your Employment Insurance (EI) premiums. By grasping these key components, you'll be better equipped to navigate your T4 slip and make informed decisions about your finances. Let's start by breaking down the employment income section, specifically Decoding Box 14: Employment Income.

Decoding Box 14: Employment Income

Decoding Box 14: Employment Income is a crucial step in understanding your T4 slip. Box 14 represents the total employment income you earned from your employer during the tax year. This amount includes your regular salary, wages, commissions, bonuses, and any other taxable benefits you received. To decode Box 14, start by looking at the number in this box, which is usually a large figure. This number represents your total employment income before any deductions or taxes were taken off. Next, check the corresponding box on your pay stub to ensure the amount matches. If there are any discrepancies, contact your employer to resolve the issue. It's essential to verify the accuracy of Box 14, as it directly affects your net income and tax obligations. Additionally, if you have multiple T4 slips, you'll need to add up the amounts in Box 14 from each slip to get your total employment income. By accurately decoding Box 14, you'll be able to understand your employment income and make informed decisions about your taxes and financial planning.

Understanding Box 16: Employee's CPP Contributions

Understanding Box 16: Employee's CPP Contributions is a crucial aspect of reading and interpreting T4 information. Box 16 represents the total amount of Canada Pension Plan (CPP) contributions deducted from an employee's earnings throughout the year. This amount is calculated based on the employee's pensionable earnings, which include most types of employment income, but exclude certain types of income such as tips and investment income. The CPP contribution rate is set by the government and is a percentage of the employee's pensionable earnings. In 2022, the CPP contribution rate is 4.95% for employees, and this rate is applied to earnings between $3,500 and the maximum pensionable earnings, which is $64,900. The employer also contributes an equal amount to the CPP, but this is not reflected in Box 16. The amount in Box 16 is used to calculate the employee's net income, which is reported in Box 14, and is also used to determine the employee's eligibility for certain government benefits, such as the Guaranteed Income Supplement (GIS). It's essential for employees to review Box 16 to ensure that their CPP contributions are accurate and to understand how they impact their take-home pay.

Box 18: Employee's EI Premiums Explained

Box 18 of your T4 slip shows the total amount of Employment Insurance (EI) premiums you paid during the tax year. EI premiums are mandatory contributions made by employees to fund the Employment Insurance program, which provides financial assistance to individuals who lose their jobs, are injured, or are on maternity or parental leave. The amount in Box 18 represents the total EI premiums deducted from your paycheques throughout the year. This amount is not included in your taxable income, but it is used to calculate your net income, which is the amount of income you have available to pay taxes. The EI premium rate is set by the government and is a percentage of your insurable earnings, which are your earnings from employment that are subject to EI premiums. The premium rate and the maximum insurable earnings are adjusted annually, so the amount in Box 18 may vary from year to year. It's essential to review Box 18 to ensure that the correct amount of EI premiums has been deducted from your pay and to understand how it affects your net income and tax obligations.

Using T4 Information for Tax Purposes

When it comes to using T4 information for tax purposes, it's essential to understand the various ways this information can impact your tax return. A T4 slip is a crucial document that outlines your employment income and taxes withheld, and it plays a significant role in determining your tax obligations. To ensure you're making the most of your T4 information, it's crucial to know how to report T4 income on your tax return, claim related deductions and credits, and avoid common errors that can lead to delays or even audits. By understanding these key concepts, you can navigate the tax filing process with confidence and accuracy. In this article, we'll explore these topics in-depth, starting with the basics of reporting T4 income on your tax return.

Reporting T4 Income on Your Tax Return

When reporting T4 income on your tax return, it's essential to ensure accuracy and completeness to avoid any potential delays or issues with your refund. The T4 slip, also known as the Statement of Remuneration Paid, is a critical document that outlines your employment income, taxes deducted, and other relevant details. To report T4 income correctly, start by gathering all your T4 slips from your employer(s) and reviewing them for any errors or discrepancies. Verify that your name, social insurance number, and employment details are accurate. Next, locate the "Box 14" section on your T4 slip, which shows your total employment income. This amount should be reported on Line 101 of your tax return. Additionally, you'll need to report any other income types, such as tips, bonuses, or commissions, which may be included in Box 14. If you have multiple T4 slips, you'll need to add up the total income from all slips and report it on Line 101. Don't forget to claim any deductions or credits you're eligible for, such as the Canada Pension Plan (CPP) or Employment Insurance (EI) premiums. If you're self-employed or have other income sources, you may need to complete additional forms, such as the T2125 Statement of Business or Professional Activities. By carefully reviewing your T4 slips and accurately reporting your income, you'll ensure a smooth tax filing process and avoid any potential issues with the Canada Revenue Agency (CRA).

Claiming T4-Related Deductions and Credits

When it comes to using T4 information for tax purposes, claiming T4-related deductions and credits is a crucial step in maximizing your tax refund. As an employee, you may be eligible for various deductions and credits based on the information reported on your T4 slip. For instance, if you have union dues or professional fees deducted from your pay, you can claim these amounts as deductions on your tax return. Additionally, if you have a registered retirement savings plan (RRSP) or a registered education savings plan (RESP), you may be eligible for credits related to these plans. Furthermore, if you have a disability or are a caregiver, you may be eligible for credits such as the disability tax credit or the caregiver credit. To claim these deductions and credits, you will need to report the relevant information from your T4 slip on your tax return, using the corresponding lines and schedules. It is essential to carefully review your T4 slip and ensure that you are claiming all the deductions and credits you are eligible for, as this can significantly impact your tax refund. By taking the time to understand and claim T4-related deductions and credits, you can ensure that you are getting the most out of your tax return.

Avoiding Common T4-Related Tax Errors

When it comes to using T4 information for tax purposes, it's essential to avoid common errors that can lead to delays, penalties, or even audits. One of the most common mistakes is misreporting income, which can occur when employees fail to report all their T4 slips or incorrectly enter the information on their tax return. To avoid this, ensure you have all your T4 slips and carefully review the information, including your name, social insurance number, and income amounts. Another error is failing to claim all eligible deductions and credits, such as the Canada Pension Plan (CPP) and Employment Insurance (EI) premiums. Make sure to review your T4 slip and claim all eligible deductions and credits on your tax return. Additionally, be aware of the differences between T4 and T4A slips, as T4A slips report different types of income, such as scholarships, fellowships, and research grants. By being mindful of these common errors and taking the time to review your T4 information carefully, you can ensure accuracy and avoid potential issues with the Canada Revenue Agency (CRA).