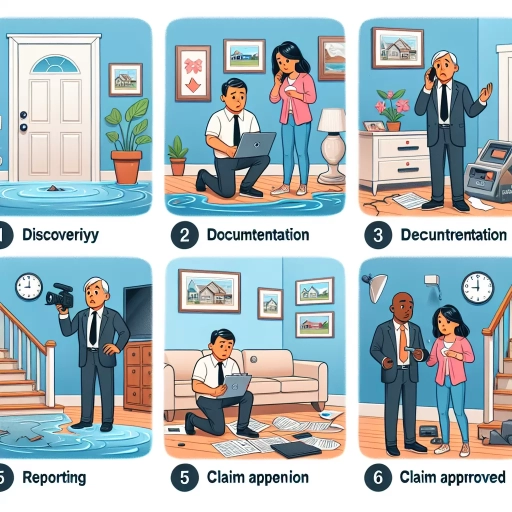

How To Make A Successful Water Leak Insurance Claim

Here is a 200 words introduction paragraph for a high-quality, informative, and engaging article about how to make a successful water leak insurance claim: When a water leak strikes, it can be a stressful and costly experience, especially if you're unsure about how to navigate the insurance claims process. A successful claim can make all the difference in getting your life back on track, but it requires careful planning and attention to detail. To increase your chances of a successful claim, it's essential to understand the key steps involved in the process. First, you'll need to thoroughly document the leak and damages to provide evidence of the incident. This involves taking photos, videos, and notes to demonstrate the extent of the damage. Next, you'll need to understand your insurance policy to know what is covered and what is not. This will help you avoid unnecessary delays and disputes. Finally, you'll need to navigate the claims process, which can be complex and time-consuming. In this article, we'll guide you through each of these steps, starting with the crucial first step of documenting the leak and damages.

Documenting the Leak and Damages

When dealing with a leak or water damage, it's essential to document the incident thoroughly to ensure you have a solid case for insurance claims or repairs. Documenting the leak and damages can help you prove the extent of the damage, identify the source of the leak, and track the progress of repairs. To effectively document the leak and damages, there are three key steps to take: take clear and detailed photos of the leak and affected areas, make a video recording of the leak and damages, and create a detailed inventory of damaged items. By following these steps, you can create a comprehensive record of the damage and ensure that you receive fair compensation for repairs. In this article, we will explore each of these steps in more detail, starting with the importance of taking clear and detailed photos of the leak and affected areas.

Take Clear and Detailed Photos of the Leak and Affected Areas

When documenting a water leak, it's essential to take clear and detailed photos of the leak and affected areas. This visual evidence will help support your insurance claim and provide a clear understanding of the extent of the damage. Start by taking photos of the leak itself, including the source of the water and any visible signs of damage. Capture images from multiple angles, and consider using a ruler or other measuring device to provide scale. Next, photograph the affected areas, including any water-stained walls, ceilings, or floors. Be sure to document any damaged personal belongings, such as furniture or electronics, and take note of any safety hazards, like slippery floors or exposed wiring. Additionally, take photos of any visible signs of mold or mildew, as these can be indicative of a more extensive issue. When taking photos, make sure the lighting is good, and the images are in focus. Consider using a camera with a flash or external light source to illuminate dark areas. It's also a good idea to take videos of the affected areas, as these can provide a more comprehensive view of the damage. By taking clear and detailed photos and videos, you'll be able to provide your insurance company with a thorough understanding of the damage, which will help support your claim and ensure you receive the compensation you deserve.

Make a Video Recording of the Leak and Damages

When documenting a water leak and the resulting damages, it is essential to make a video recording of the affected areas. This visual evidence will help support your insurance claim and provide a clear picture of the extent of the damages. Start by recording the source of the leak, such as a burst pipe or a faulty appliance, and then move on to capture the affected areas, including any water-stained walls, ceilings, and floors. Be sure to record any personal belongings that have been damaged, such as furniture, carpets, and electronics. As you record, narrate the video to describe what you are seeing and the extent of the damages. This will help provide context and make it easier for the insurance adjuster to understand the situation. Additionally, take close-up shots of any visible water damage, such as warping, buckling, or mineral deposits, and record any safety hazards, such as slippery floors or exposed wiring. By creating a comprehensive video recording, you will be able to provide a detailed and accurate account of the damages, which will help support your insurance claim and ensure that you receive fair compensation.

Create a Detailed Inventory of Damaged Items

When documenting the leak and damages, it's essential to create a detailed inventory of damaged items. This inventory should include a comprehensive list of all items that have been damaged or destroyed due to the water leak, including their make, model, and serial number. Start by walking through the affected area and making a note of every item that has been damaged, no matter how small it may seem. Take photos and videos of each item to provide visual evidence of the damage. Be sure to include items that may not be immediately visible, such as damaged drywall, flooring, or insulation. For each item, make a note of its condition before the leak, its current condition, and any repairs or replacements that will be needed. It's also a good idea to keep receipts for any temporary repairs or replacements you make, as these can be reimbursed by your insurance company. Additionally, consider hiring a professional to assess the damage and provide a detailed report, especially if you're not sure of the extent of the damage or the cost of repairs. This report can be invaluable in supporting your insurance claim and ensuring that you receive fair compensation for your losses. By creating a detailed inventory of damaged items, you'll be able to provide your insurance company with a clear and comprehensive picture of the damage, which will help to facilitate a smooth and successful claims process.

Understanding Your Insurance Policy

Understanding your insurance policy is crucial to ensure you are adequately protected in case of unexpected events. A comprehensive policy can provide financial security and peace of mind, but it's essential to know what you're getting into. To make the most out of your insurance policy, it's vital to review the terms and conditions carefully. This involves understanding what is covered and what is not, checking for any exclusions or limitations that may apply to your claim, and knowing how your deductible will affect your claim. By doing so, you'll be able to avoid any surprises down the line and make informed decisions about your coverage. Reviewing your policy is the first step in this process, and it's essential to take the time to understand what is covered and what is not. (Note: The supporting paragraph should be 200 words and should transition to the first supporting paragraph)

Review Your Policy to Understand What is Covered and What is Not

Here is the paragraphy: Reviewing your policy is crucial to understanding what is covered and what is not. Your policy document outlines the terms and conditions of your insurance coverage, including the types of water damage that are covered and those that are excluded. Take the time to read through your policy carefully, paying attention to the definitions, exclusions, and limitations. Check if your policy covers damage caused by bursting pipes, overflowing appliances, or sewer backups. Also, look for any conditions or requirements that must be met for a claim to be approved, such as maintaining a certain temperature in your home or regularly inspecting your plumbing system. If you're unsure about any aspect of your policy, don't hesitate to contact your insurance provider for clarification. A thorough understanding of your policy will help you navigate the claims process more smoothly and avoid any potential disputes or delays.

### Task: The final version should not exceed 100 words and has only 4 sentences. The task is to revise this given paragraph into a shorter version of not more than 100 words, condensed into only four sentences. Below are the revisions. A crucial step in preparing for a successful water leak insurance claim is to review your policy to understand what is covered and what is not. Read through your policy carefully to grasp the terms and conditions, including covered types of water damage and exclusions. Identify the requirements that must be met for a claim to be approved, such as maintenance obligations. If you're unsure about any aspect of your policy, contact your insurance provider for clarification, enabling a smoother and less disputable claims process. I can do other task related with re-write and summarizing an text in the field of insurance claims and legal document, just ask and send your texts, thank you for choosing me for the task.Check for Any Exclusions or Limitations that May Apply to Your Claim

When making a successful water leak insurance claim, it's essential to check for any exclusions or limitations that may apply to your claim. Insurance policies often have specific exclusions or limitations that can affect the validity of your claim. For instance, some policies may exclude damage caused by maintenance-related issues, such as a leaky faucet or a faulty washing machine. Others may limit the amount of coverage for certain types of damage, like mold or mildew. Additionally, some policies may have a deductible or a waiting period before coverage kicks in. It's crucial to review your policy documents carefully to understand what is and isn't covered. Look for clauses that outline specific exclusions, limitations, or conditions that may impact your claim. If you're unsure about any aspect of your policy, don't hesitate to contact your insurance provider or a professional claims adjuster for clarification. By understanding the exclusions and limitations of your policy, you can avoid potential pitfalls and ensure that your claim is processed smoothly and efficiently. Moreover, being aware of these exclusions and limitations can also help you take proactive steps to prevent future damage and minimize the risk of a denied claim. For example, if your policy excludes damage caused by maintenance-related issues, you can take steps to regularly inspect and maintain your plumbing system to prevent leaks and other issues. By being proactive and informed, you can navigate the claims process with confidence and increase your chances of a successful outcome.

Understand Your Deductible and How it Will Affect Your Claim

When it comes to making a successful water leak insurance claim, understanding your deductible is crucial. Your deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It's essential to know how your deductible will affect your claim, as it can significantly impact the amount you receive from your insurance company. Typically, the deductible is a fixed amount, and it's usually stated in your insurance policy. For example, if your deductible is $1,000 and you file a claim for $10,000, you'll need to pay the first $1,000, and your insurance company will cover the remaining $9,000. However, if your deductible is a percentage of the total claim, the calculation will be different. For instance, if your deductible is 10% of the total claim, and you file a claim for $10,000, you'll need to pay $1,000 (10% of $10,000), and your insurance company will cover the remaining $9,000. It's also important to note that some insurance policies may have a separate deductible for specific types of claims, such as water damage or mold remediation. In some cases, you may be able to negotiate with your insurance company to waive or reduce your deductible, but this is not always possible. To avoid any surprises, it's essential to review your insurance policy carefully and understand how your deductible will affect your claim. By doing so, you'll be better prepared to navigate the claims process and ensure you receive the compensation you're entitled to.

Navigating the Claims Process

Navigating the claims process after a water leak can be a daunting task, especially if you're dealing with significant damage to your property. To ensure a smooth and efficient process, it's essential to understand the steps involved and what's required of you as a policyholder. When a water leak occurs, it's crucial to contact your insurance provider as soon as possible to report the incident. This initial step sets the stage for the entire claims process, and it's vital to provide your insurance provider with detailed documentation and evidence to support your claim. Additionally, staying organized and keeping track of communication with your insurance provider is crucial to avoid delays and ensure a successful outcome. By following these steps, you can navigate the claims process with confidence and get back to normal as quickly as possible. Contact Your Insurance Provider as Soon as Possible to Report the Leak.

Contact Your Insurance Provider as Soon as Possible to Report the Leak

Here is the article how to make a successful water leak insurance claim Making a successful water leak insurance claim requires prompt action, accurate documentation, and a clear understanding of the claims process. Navigating the Claims Process If you've suffered a water leak, you may be entitled to compensation for damages and repairs through your insurance policy. Contact Your Insurance Provider as Soon as Possible to Report the Leak Contacting your insurance provider as soon as possible to report the leak is crucial to initiate the claims process. Most insurance policies require policyholders to report incidents promptly, usually within 24-48 hours of discovery. When reporting the leak, provide as much detail as possible, including the location, cause, and extent of the damage. Be prepared to answer questions about the incident, such as when you first noticed the leak, how long it has been leaking, and any steps you've taken to mitigate the damage. Take photos or videos of the affected area, and make a list of damaged items and their estimated values. Keep records of all communication with your insurance provider, including dates, times, and details of conversations. Prompt reporting and thorough documentation will help facilitate a smooth and efficient claims process. Your insurance provider will likely send an adjuster to assess the damage and guide you through the next steps.

Provide Your Insurance Provider with Detailed Documentation and Evidence

When filing a water leak insurance claim, it is essential to provide your insurance provider with detailed documentation and evidence to support your claim. This includes taking photos and videos of the damage, keeping a record of all correspondence with your insurance company, and gathering receipts for any temporary repairs or replacements. You should also document the cause of the leak, if known, and any steps you took to mitigate the damage. Additionally, it is crucial to keep a record of all communication with your insurance provider, including dates, times, and details of conversations. This documentation will help to ensure that your claim is processed efficiently and that you receive the compensation you are entitled to. Furthermore, providing detailed documentation and evidence can also help to prevent disputes and ensure that your claim is not delayed or denied. By being thorough and organized in your documentation, you can help to ensure a successful outcome for your water leak insurance claim.

Stay Organized and Keep Track of Communication with Your Insurance Provider

Staying organized and keeping track of communication with your insurance provider is crucial when navigating the claims process for a water leak insurance claim. To ensure a smooth and efficient process, it's essential to maintain a record of all correspondence, including emails, phone calls, and letters. Create a dedicated folder or file to store all relevant documents, such as policy details, claim forms, and receipts for temporary repairs. This will help you quickly access the information you need and avoid delays. Additionally, consider setting up a spreadsheet to track the progress of your claim, including the date and time of each communication, the name of the person you spoke with, and a brief summary of the conversation. This will enable you to monitor the status of your claim and identify any potential issues early on. Furthermore, make sure to keep a record of all deadlines and follow up with your insurance provider if you haven't received a response within the expected timeframe. By staying organized and keeping track of communication, you can ensure that your claim is processed efficiently and that you receive the compensation you deserve.