How Do I Get A Gst Number

Understanding the process of securing a GST (Goods and Services Tax) number is an essential step for every business owner, entrepreneur, and tax professional today. The GST number serves as an identifier for each taxpayer and plays a vital role in the financial transparency and tax compliance of businesses. This comprehensive article will thoroughly guide you on the steps to acquire a GST number, ensuring you are well-informed and equipped for the process. Firstly, we will delve into understanding the concept of GST registration, followed by enlightening you with the eligibility criteria for GST registration. Lastly, we will provide an in-depth explanation of the process of applying for GST registration. So sit back as we simplify this sometimes complex process in 'Understanding GST Registration.'

Understanding the process of securing a GST (Goods and Services Tax) number is an essential step for every business owner, entrepreneur, and tax professional today. The GST number serves as an identifier for each taxpayer and plays a vital role in the financial transparency and tax compliance of businesses. This comprehensive article will thoroughly guide you on the steps to acquire a GST number, ensuring you are well-informed and equipped for the process. Firstly, we will delve into understanding the concept of GST registration, followed by enlightening you with the eligibility criteria for GST registration. Lastly, we will provide an in-depth explanation of the process of applying for GST registration. So sit back as we simplify this sometimes complex process in 'Understanding GST Registration.'Understanding GST Registration

Financial literacy necessitates understanding various aspects of the economic ecosystem; among them, GST Registration stands paramount. This article delves into three essential facets of GST Registration, aiming to offer clear insights and shed light on its overarching relevance in the financial world. To begin with, 'What is GST Registration?' provides a detailed explanation of this concept, giving readers comprehensive insights into this significant financial process. Following which, 'Why is GST Registration Mandatory?' focuses on unveiling the paramount importance and legal repercussions of GST Registration, highlighting why a business cannot afford to overlook this crucial factor. Lastly, the article discusses in-depth about 'Types of GST Registration', presenting readers with the diverse kinds of GST Registration readily available in the market. Correspondingly, this holistic approach aims to empower individuals and businesses in making informed decisions concerning their financial landscape. Now, let's delve into the anatomy of GST Registration, starting from understanding the very basic concept of 'What is GST Registration?'.

What is GST Registration?

GST Registration is a critical process for businesses operating in India. Essentially, Goods and Services Tax (GST) registration refers to the process where businesses register themselves under the GST Act and obtain a unique GST Identification Number, commonly known as GSTIN. Under the 2017 GST Act, businesses with a turnover exceeding the prescribed threshold must register, and it's applicable on all businesses entities dealing in the buying and selling or provision of services in India. Being GST registered ensures that a business is legally recognized as a supplier of goods or services. It comes with numerous benefits that not only boost the growth of the business but also offer a competitive edge. First, it eradicates the cascading effect of taxes that have long been a burden on companies. With GST, businesses pay a single tax, reducing their operational costs. Second, GST registration creates an ecosystem that encourages voluntary compliance due to the seamless flow of credit. GST registration is a digital and straightforward process, and a business can complete it online, further increasing convenience. The business provides necessary details, after which a unique GSTIN is assigned, effectively digitizing tax administration. This unique 15-digit number is state-specific and has the PAN number embedded in it. GST's transparent mechanism also ensures that tax evasion becomes difficult, helping businesses establish their credibility. Moreover, GST registration receptors the trading status on a national level, permitting a business to sell outside their state, therefore opening up new business avenues. Lastly, it makes the business eligible for various tax benefits under the GST regime. In a nutshell, GST registration is not merely an obligatory process, but it's a strategic tool that businesses can use to their advantage. It ensures businesses are a part of the unified tax system that aims at strengthening the economy and leveling the playing field for businesses. Understanding the importance of GST registration in the business life cycle is essential for seamless operations and for achieving the desired business growth.

Why is GST Registration Mandatory?

of any business operation in India centers around the Goods and Services Tax (GST) policing the flow of goods and services within the nation. Directly impacting every fiscal component, GST registration is more than a legal prerequisite - it's a revenue enhancer, a credibility booster, aiding the overall structuring; thus it stands critical to every business strategy. GST registration ensures a seamless flow in the credit chain, leading to overall reduction in the tax burden and functioning costs for the enterprise. It is a uniform tax system that replaces multiple indirect taxes such as central excise, state VAT, and service tax, unifying the nation's market. Thus, it aids in eliminating the cascading effect of the double taxation system. This simplified tax structure significantly reduces compliance costs, saving on the number of returns filed and the time needed to file them. Further, it provides the right to collect tax from purchasers and pass on tax credit benefit on goods or services, thereby helping to maintain a competitive market structure. Being GST registered also lends legitimacy to the business, it builds a company's reputation and provides a competitive advantage over non-registered businesses. It enhances the business visibility and thrusts the brand reputation, thereby uplifting a positive brand image. Moreover, GST registered businesses have the ease of doing business interstate, they can enrol themselves online, minimizing the physical proximity to the tax department. Another criticality arises for ecommerce businesses; as per the government mandate, it's compulsory for them to have a GST number. Moreover, GST registration opens doors to benefits such as availability of various government e-marketplaces and subsidies. The government of India under the Make In India policy, has launched the e-marketplace for online procurement of goods and services. This has been done to increase the participation of micro, small, and medium-sized enterprises (MSMEs) in the supply of major government projects. All this combined, GST registration becomes an indispensable part of any business. It not only simplifies the tax structure and compliance for businesses but also instills a sense of credibility and legitimacy. GST registration is, therefore, not just a constitutional mandate but also a business enabler, a propeller of growth and prosperity for an enterprise. Thus, every business owner, before asking "How do I get a GST number?", must first comprehend the importance of "Why is GST registration mandatory?"

Types of GST Registration

of understanding GST registration lies in exploring the various types of GST registration available. The crux of it revolves around providing a diversified yet programmatic framework for businesses of all stature to register themselves under a systematic structure. There are three primary types of GST registrations: Regular, Composition, and Casual Taxable Person. Regular GST Registration is predominantly for businesses and individuals who are supplying goods and services. This type is majorly applicable for businesses whose turnover surpasses the threshold limit of Rs. 20 lakhs (Rs 10 lakhs for NE and hill states) mandated by the Indian Government. When the supplier is a Regular taxpayer, tax is payable on supply and Input Tax Credit (ITC) is also available. One can freely do interstate sales without any restrictions or additional compliance under this GST registration. Next is the Composition GST Registration, with a threshold limit set between ₹ 1.5 crores and ₹ 75 lakhs, designed for smaller businesses that cannot meet the demands of intricate compliance mechanisms. Its primary aim is to bring simplicity and reduce the burden of compliance for small taxpayers. In this scheme, the taxpayer will pay the tax at a nominal rate of his turnover, and the tax rate is comparatively lower than Regular GST. The drawback it encompasses is that interstate supply is not allowed, and one cannot avail Input Tax Credit (ITC). The third type is Casual Taxable Person GST registration, a unique concept introduced in the GST system. It is required for those non-resident suppliers who come to a different state of India occasionally for business purposes but do not have a fixed place of business in the state. Under this registration, the individual is required to pay tax in advance based on estimated turnover for the specified period, generally held valid for 90 days. Understanding the types of GST registration is crucial as it provides a lens to view a reflection of the echelons of the economy the government is trying to protect and promote via GST. These forms of GST registration reflect the intent to include everyone, irrespective of their business size and regionality, in a single, comprehensive tax framework. By deciphering these types, one recognizes the inclusive spirit of the GST system, making it easier to comprehend how to get a GST number.

Eligibility Criteria for GST Registration

The eligibility criteria for Goods and Services Tax (GST) registration in India is determined by three main factors which are Business Turnover Threshold, Business Nature and Type, and Other Eligibility Criteria. These factors play a pivotal role in defining which business entities are mandated to register for GST, and which ones are exempted. Every business owner should be aware of these significant factors in order to ensure full legal compliance, reduce unnecessary liabilities, and benefit from the advantages of a registered GST entity. Starting with the Business Turnover Threshold, the GST Act specifies that any business with an aggregate turnover exceeding Rs 20 lakhs (Rs 10 lakhs for North-Eastern States, Himachal Pradesh, Uttarakhand, and hill states) is mandatorily required to register under GST. Additionally, other variables, such as the nature and type of the business, as well as certain special eligibility criteria, substantially influence this mandatory registration requirement. Hence, let’s delve into the specifics of Business Turnover Threshold, a critical determining factor in GST registration eligibility.

Business Turnover Threshold

In determining the eligibility criteria for GST registration, a highly significant factor is the business' turnover threshold. Fiscal turnover or Gross Annual Turnover refers to the cumulative sale value of goods or services made by a business within a given financial year. It does not deduct any costs, thereby referring to the absolute revenue generated by a business. According to the GST law, businesses that have exceeded a particular business turnover threshold are mandated to register for GST in India. This limit is crucial as it assists in filtering out smaller businesses from the ambit of GST to alleviate potential administrative burdens. For instance, in most states in India, the threshold for GST registration is set at INR 20 lakhs in sales turnover for service providers, while for traders and manufacturers, the limit is INR 40 lakhs. However, for northeastern and hill states, the limit is pegged lower, at around INR 10 lakhs and INR 20 lakhs respectively, primarily due to their unique geographical and economic circumstances. Beyond these baseline thresholds, there are other optional thresholds wherein businesses, even though they do not cross the mandatory limit, can willingly opt to register for GST. This voluntary registration can bring additional benefits such as the capacity to claim input tax credit, thus easing the overall tax burden. At the same time, a business crossing the turnover threshold on an all-India basis is required to obtain a GST number in every single state where it conducts business. This translates to the business having multiple GST numbers and goes on to depict the inextricable correlation between the turnover threshold and GST registration. Furthermore, the business turnover threshold is not constant and can be subjected to changes by the government based on the dynamic economic scenario. Comprehending the implications of this threshold, therefore, becomes instrumental in understanding the broader GST registration process. It is suggested to consult with your local tax advisor to confirm the most recent thresholds for your business. Thus, in order to figure out whether or not your business needs a GST number, one of the most critical steps is to assess your business' turnover threshold. It's a strong indicator of your fiscal performance as well as a determinant of your GST registration eligibility. This threshold ensures that the registration process is applied systematically across varied business sizes and sectors, upholding the premise of equitable tax imposition through GST.

Business Nature and Type

of understanding how to get a GST number lies in gaining insight into the nature and type of your business. Your business model's nature critically affects your eligibility for GST registration, and it's important to consider this while applying. Different rules apply depending on whether your business falls into the category of goods or services. For instance, if your business involves selling goods, the threshold for GST registration is an annual turnover exceeding Rs 40 lakhs in most Indian states. On the other hand, if your business is service-based, the registration becomes mandatory if your annual turnover exceeds Rs 20 lakhs. The differential threshold value for goods and services is based on the inherent distinction in their business nature. Often, a business dealing with goods will have a larger turnover due to the physical nature of the products, while service-based businesses may not have the same revenue due to their intangible nature. This distinction under the GST regime reflects the variations in business models, ensuring the process is equally fair and beneficial for different types of businesses. Apart from the nature of the business, the type of business also plays a significant role. Whether you operate as a sole proprietor, partnership, limited liability partnership (LLP), private limited company, or public limited company will also impact your eligibility for GST. Each business type has different operational structures, financial liabilities, and legal obligations. For instance, while sole proprietors and partnerships have unlimited liabilities, LLPs, private or public limited companies have limited liabilities. It is essential to understand that GST registration is not a one-size-fits-all process but rather an eligibility criteria-based one. Therefore, the registration requirements vary significantly based on the business nature and type. Whether you need to apply for GST depends on the scale of your operations, the geographical location of your business, and your business type. Understanding the specificities of these aspects will help make the process of obtaining a GST number more straightforward and less complicated. In conclusion, the nature and type of business greatly influence the eligibility criteria for GST registration. Musings over whether a business dealing with goods or services, and the type of ownership, are both essential factors to consider before applying. So, before jumping into the GST registration process, getting a comprehensive understanding of the nature and type of your business will keep unnecessary complications at bay, making the overall process more efficient.

Other Eligibility Criteria

of GST Registration is its Eligibility Criteria and one of the more specific underpinning aspects within this context is 'Other Eligibility Criteria'. This encompasses numerous sub-areas that are critical to understand as they are equally important as the primary conditions, all of which contributing to one's qualification in obtainng a GST number. Consider, for instance, the economic factors. As part of the Other Eligibility Criteria, businesses and traders who have an aggregate turnover exceeding Rs. 40 lakhs are obligated to apply for GST registration. However, the threshold is Rs. 10 lakhs for both hilly and north-eastern states. This economic benchmark ensures that businesses of varying sizes are all held accountable for GST, leading to a balanced and fair system. Moreover, individuals registered under the previous tax laws such as Value Added Tax (VAT), Excise laws, and Service Tax are also required to register for GST. This stipulation ensures the smooth transition towards a unified system of taxation, enhancing clarity and reducing confusion around altered tax measures. Another noteworthy criterion concerns non-residents who carry out transactions in India. Regardless of the turnover, all non-resident taxable individuals must register under GST, thereby ensuring that foreign entities engaged in economic activities in the country are well integrated into the tax system. In addition, those who are required to pay tax under Reverse Charge Mechanism (RCM) or need to deduct tax at source (TDS) or collect tax at source (TCS), as well as agents of a supplier and Input Service Distributor (ISD), regardless of their turnover, are mandated to register for GST. This broadens the tax base and encourages steady revenue flow. Also, suppliers who provide goods through an e-commerce platform are expected to register for GST irrespective of their turnover. E-commerce operators are no exception to this rule. This step is embarked on to capture the digital economic platforms within the GST regime and brings about a level playing field for all types of commerce - traditional or digital. Conclusively, qualifying for GST registration goes beyond the primary preconditions and navigates into the realm of other eligibility criteria that ensure comprehensive coverage and adherence to these tax obligations. The 'Other Eligibility Criteria' encapsulates the dynamism of the GST system, accommodating various situations and addressing them individually. This variety of conditions caters to the vast expanse of economic scenarios, resulting in an efficient and robust tax system.

Applying for GST Registration

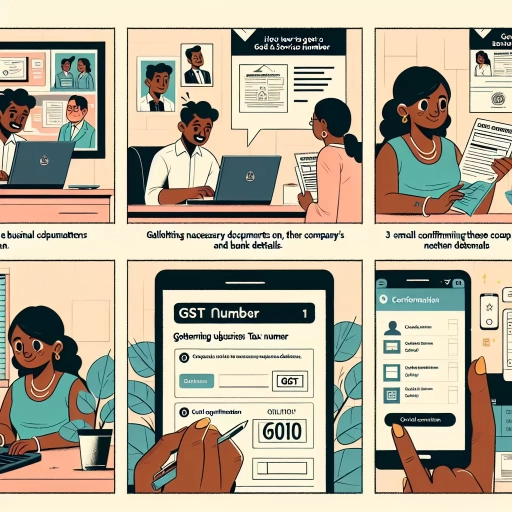

of the article focuses on the importance of obtaining GST registration for businesses. This is a consequential step that ensures compliance with the regulatory standards set by the government. The process of GST Registration fundamentally involves three main parts- the online application process, collecting & submitting the prerequisite documents, and payment of GST registration fees. A detailed knowledge of these aspects not only facilitates a seamless registration process but also saves businesses from hefty penalties of non-compliance. Beginning with the online application process, prospective applicants would need to access the GST portal to initiate their registration. Armed with the right information, the online application can be an uncomplicated procedure that expedites the overall registration process. However, just like any legal process, there is essential documentation that needs accompaniment with the application. Various documents ranging from PAN card, bank account details, business addresses to annexures substantiating the business are required for GST registration. Following this, the payment of necessary registration fees ensures completion of the registration process. As this article unravels, readers will gain comprehensive insights into each of these segments, starting with an in-depth look into the online application process.

Online Application Process

The Online Application Process for obtaining a GST number has been made user-friendly and seamless by the government, ensuring businesses can easily navigate through the procedure without any difficulties. Initially, the applicant needs to log on to the official GST portal. After launching the website, you will find an option stating ‘Services.' Under this tab, select the ‘Registration’ option and then click on ‘New Registration.’ Here, applicants are required to provide all their necessary details such as legal name, district, email address, mobile number, and the State or Union territory where the business operates. Once this process is completed, the portal generates the Temporary Reference Number (TRN) that is sent to your registered email and mobile number. This TRN is used to log back into the portal. After logging in, you'll need to fill in the remaining three parts of the form, which include providing vital details about your business, such as its name, address, details about goods or services, bank details, and other specifications pertinent to your business. Now, the most important part of the application process is the verification and the upload of documents, which differ based on the business type and the selected registration. Applicants must upload clear and correct documents supporting their business and personal identity. It is always recommended to cross-verify all the details entered to avoid any potential misunderstandings or errors, which could lead to a delay in the overall procurement procedure. Lastly, the application form needs to be digitally verified through Digital Signature Certificate (DSC) for companies and Limited Liability Partnership (LLP) or through Electronic Verification Code (EVC) which could be e-Aadhaar method, OTP verification, or application reference number (ARN) method. This entire process aims to provide validation to the business entity while ensuring the credibility of its operations, serving as the bedrock of the indirect tax regime. By entering valid information and providing the necessary documents promptly, one can quickly navigate through this process and get their GST registration number without any hassle. The complexities of the process might seem daunting initially, but with careful attention to detail and following the explicit instructions on the portal, it is not too difficult to get through. In case businesses encounter any issues during the application process, the government provides help via GST portal helpline numbers and by responding to queries raised on the portal.

Required Documents for GST Registration

After considering the necessity and benefits of applying for GST registration, it is equally vital to become familiar with the required documents for GST registration. For individuals, sole proprietors, or hindu undivided families (HUF), a valid PAN card and Aadhaar card are the basic prerequisites. Additionally, individual sellers or service providers also need to provide proof of business location, which can be a rental agreement or electricity bill if the premises are rented, or property papers if they are owned. Furthermore, bank account details and a few business-related documents such as partnership deed (in case of partnership firms), incorporation certificate (for private limited companies), and society or trust deed (for societies and trusts) are also required. For registration as a non-resident taxable person under GST, valid passport details, residential proof in the home country, business details in India, and an authorized representative's documents are essential. Nonetheless, small traders and manufacturers with a turnover below the GST registration limit can opt for the GST composition scheme under which they need to provide their PAN number, Aadhaar card, proof of business place, and bank account statement. Remember, it is important to have all documents digitally signed by a signatory or a representative authorized to sign such documents. In the case of companies, a resolution passed by BODs/Board of Members and Letter of Authorization/ Board resolution for authorized signatory must be provided. One should also be ready with digital images, SSL certifications, canceled checks, NOC, affidavits, permissions, licenses, or consents when asked for. Companies also need to submit the Memorandum of Association (MOA)/Articles of Association (AOA), the Certificate of Incorporation, and a copy of the bank statement. In case of sole proprietorships, address proof in the proprietor’s name is mandatory. To ensure smooth GST registration, it is advised that applicants cross-verify their documents with the checklist provided on the GST portal. Ignorance or omission of any required document can be a potent cause of GST registration application rejection. Hence, staying informed and well-prepared is a key step in ensuring a successful GST registration process. Ahead lies the complex yet calculated world of GST filing and returns, but with systematic preparation and timely adherence to the rules laid out for GST, navigating this process can be made straightforward and effective. Therefore, it's essential to understand these documentation requirements when applying for a GST registration.

GST Registration Fees

GST registration is a crucial step for businesses to become a part of the tax framework in their respective regions. The fee for GST registration varies depending on the nature of the business entity looking to apply. Sole proprietors, partnership firms, LLPs, companies, and corporate bodies are subject to different registration charges. While the government may offer free registration for businesses with an annual turnover that falls within the prescribed limits (20 lakh for most states and 10 lakh for north-eastern states in India), charges are levaled for businesses that exceed these limits. However, one should note that while registration might be free, there may be additional costs associated with it as GST consultants and chartered accountants often charge a fee for their services to facilitate registration. These service charges can range from anywhere between INR 1000 to INR 5000. These are educated figures and the amounts may vary based on the complexity of the business structure and the geographical location. Additionally, businesses failing to register for GST within the stipulated timeline must pay a penalty. This penalty amounts to 10% of the tax amount due or a minimum of INR 10,000. Thus, it is critical for businesses to comply with the GST registration norms to avoid such penalties. Moreover, registration allows businesses to avail various benefits under the GST regime, like input tax credit, inter-state sales without restrictions, and legal recognition as a supplier of goods and services. While the registration fee might seem like additional overhead, it should be considered as an investment towards the business's compliance with the nation's tax framework. Plus, it reduces the risk of any legal consequences arising out of non-compliance. Overall, the GST registration fee, whether it's a service charge paid to professionals or a penalty for non-compliance, plays a pivotal role in ensuring the business's legal standing. Consequently, it contributes to the harmonization of the business's operations with national fiscal policies.