The Complete Guide of the Kenyan Shilling

Follow Kenyan Shilling Forecast March 20, 2024

Current Middle Market Exchange Rate

Prediction Not for Invesment, Informational Purposes Only

2024-03-19

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-18

Summary of Last Month

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-17

Summary of Last Week

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-16

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-15

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-14

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-13

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

Where to purchase Kenyan Shilling?

Recent News

2024-03-12

Everything You Need to Know About Kenyan Shilling

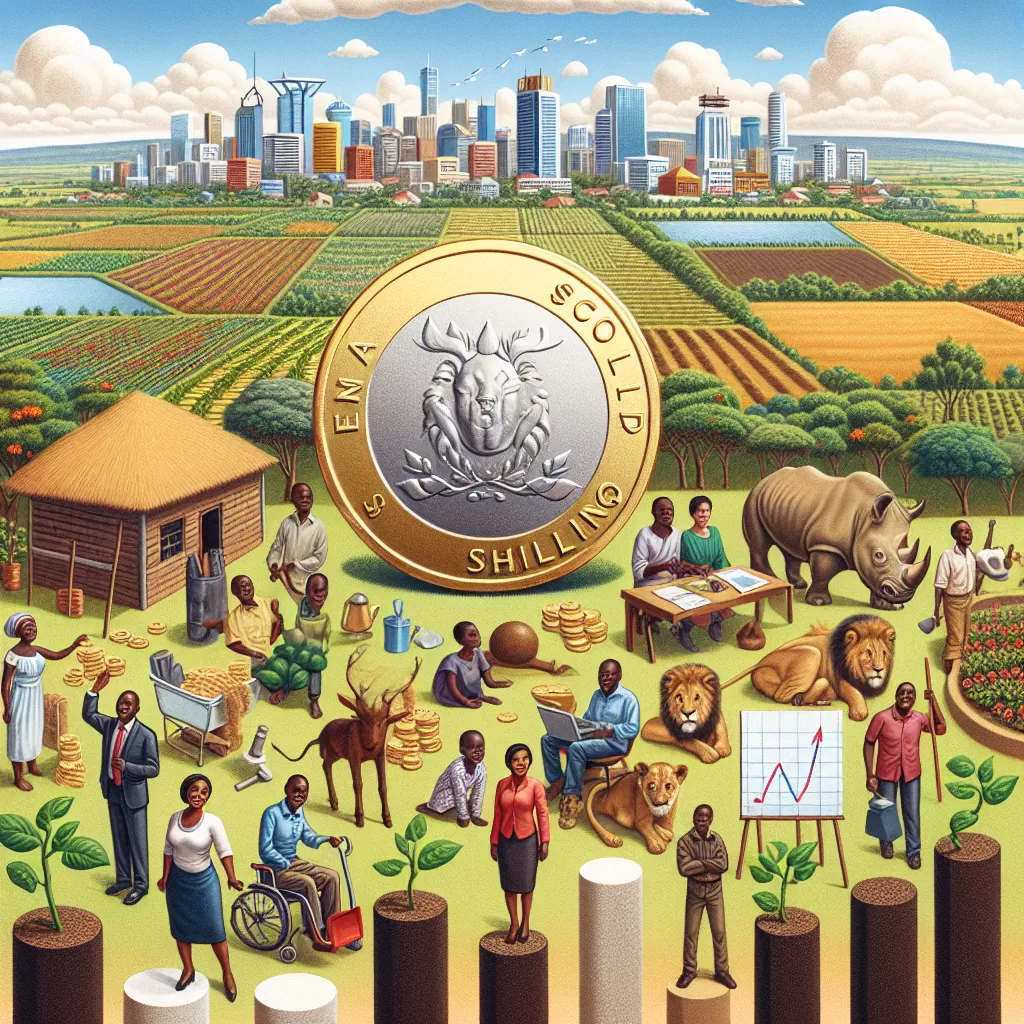

The **Kenyan Shilling**, abbreviated as KES, serves as the lifeblood of the vibrant economy of one of the leading countries in East Africa, Kenya. It's a currency backed with a rich history and palpable impact in local, regional, and global economic interactions. Incepted in 1966 as a replacement for the East African Shilling, the Kenyan Shilling has evolved over time, each era of its development imprinted in its design, symbolizing Kenya's cultural heritage and socioeconomic transformation. The Bank of Kenya meticulously manages this distinguished currency, deploying apt monetary policies to control its circulation, value, and consequently, the inflation rates. The Kenyan Shilling's influence stretches far beyond its borders, largely contributing to East Africa's economic dynamics, and significantly impacting global trade owing to Kenya's position as a hub for tea and coffee exports. Understanding the Kenyan Shilling isn't merely about knowing a currency; it's about grasping the economic pulse of Kenya and how the shilling shapes and is shaped by multifaceted geopolitical and economic forces. As we delve deeper into this topic, you'll discover the Kenyan Shilling's intriguing journey, the processes involved in its management, and its profound role in global economics. In essence, the Kenyan Shilling isn't just a currency; it's a story of resilience, evolution, and economic prowess.

Correlation Coefficient of Kenyan Shilling with Other Currencies

The **Kenyan Shilling**, as one of Africa's key currencies, significantly impacts both regional and international economy. Its exchange rate movements against other notable currencies are fueled by myriad economic, political, and social factors. By exploring the correlation coefficient of the Kenyan Shilling with other currencies, we unearth patterns that provide valuable insights into global financial trends and monetary policies. This direct relationship or inverse proportionality to other currencies can give economic analysts, governmental bodies, and business investors an advantageous position in predicting economic turmoils, planning fiscal measures, or devising investment strategies. *Understanding the Kenyan Shilling's correlation coefficient* dwells not just on monetary value and policy, but also includes the influence of international markets, comparative inflations, trade deficit or surplus, foreign reserves, and even socio-political events. This correlation coefficient yields a concrete measure of how two currencies move in relation to each other, providing the necessary data to forecast potential economic scenarios and implement appropriate safeguarding measures. Join us as we delve into the world of currency correlation and its implications for the global economic landscape, with a particular focus on the Kenyan Shilling. Your global economic outlook will never be the same after this exploratory journey into understanding how the Kenyan Shilling influences and is influenced by the world's other major currencies.

Interpreting the Correlation Coefficient of Kenyan Shilling to USD

The correlation coefficient is a statistical measure that looks at the interdependence of two random variables, in this case, the Kenyan Shilling (KES) and the US Dollar (USD). Wandering between -1 and 1, the correlation coefficient offers a quantitative lens to study the strength of this currency relationship. When the coefficient is close to +1 or -1, it means there is a stronger positive or negative relationship respectively. Analyzing the correlation coefficient of the Kenyan Shilling to the USD provides an insight into the relationship between these two currencies. A positive correlation implies that when the value of the USD increases, so does the value of the KES. Contrastingly, a negative correlation would mean that an increase in the value of the USD leads to a decrease in the value of the KES. By observing this correlation coefficient, we can influence monetary policy decisions and implement effective strategies in managing inflation rates. Understanding this interplay is not just crucial for the Central Bank of Kenya, but also for investors who want to diversify their portfolio internationally. It gives them a hint of the likely behavior of KES vis-a-vis the USD based on existing and anticipated economic policies or global financial trends. Determining this coefficient also allows us to trace back and understand how past economic events, policy changes, and global pressures have influenced the Kenyan Shilling. The reflection of these historical events in the value of KES can be an excellent tool for predicting future trends and formulating economic policies. As the correlation coefficient is influenced by several factors - including trade activities, foreign direct investment, government debt, geopolitical stability, and more - it becomes a useful tool in shaping economic strategies. By reflecting on its historical trend, we can predict the risk associated with both currencies and adjust our investment strategies accordingly. In conclusion, interpreting the correlation coefficient of the Kenyan Shilling to the USD is a significant metric in understanding the economic ties of these two nations. It effects both macroeconomic angles such as government policy and trade engagements and microeconomic factors like individual investment decisions. The changes in this coefficient can thus shed light on the wider picture of global economic forces and their impact on local currency trends.

Understanding the Correlation Between Kenyan Shilling and British Pound

The Kenyan Shilling (KES) is the official currency of Kenya, it has a nuanced history and its performance depends on a broad economic spectrum. Its relationship with the British Pound (GBP) is rooted in history, as Kenya was once under British rule and its economy closely tied to Britain's. Understanding the correlation between the Kenyan Shilling and the British Pound requires a grasp of both historical and economic factors. Historically, the KES was pegged to the GBP, meaning its value directly corresponded with the British Pound's strength. After gaining independence, Kenya moved to a free-floating currency system in 1993. Economically, the exchange rate between KES and GBP is influenced by various factors such as inflation rates, interest rates, and political stability, among others. For instance, when inflation rates in Kenya rise faster than those in the UK, the Shilling will likely depreciate against the Pound. This is because inflation decreases the purchasing power of money, making the Kenyan Shilling less attractive for investors, who will sell off their shillings, leading to depreciation. Interest rate differentials also impact the exchange rate. If interest rates are more attractive in Kenya compared to the UK, it may entice investors to purchase assets denominated in KES, leading to an appreciation of the Shilling. Similarly, political instability or policy uncertainty in Kenya can lead to a weakening of the Shilling against the Pound, as these conditions can cause investors to move their capital to safer or more predictable environments. Trade balance, another key economic aspect, can also influence the KES/GBP exchange rate. If Kenya's exports to the UK exceed its imports from the UK, the Shilling could appreciate against the Pound due to higher demand for KES. On the contrary, if the reverse is true, the Shilling can depreciate against the Pound due to higher demand for GBP. It's also pertinent to notice that the strength of other global economies and currencies like the US Dollar and Euro may indirectly affect the KES/GBP exchange rate. A stronger Dollar or Euro can weaken the Pound, causing a ripple effect on the Kenyan Shilling. In conclusion, the correlation between the Kenyan Shilling and the British Pound is a complex interplay of various historical and economic factors, including interest and inflation rates, political stability, trade balances, and strength of other global currencies. Understanding these factors offers a comprehensive insight into the dynamics of the KES/GBP relationship.

Analysis of Kenyan Shilling's Correlation with Euro

The Kenyan Shilling (`KES`) has consistently exhibited an intriguing relationship with the Euro (`EUR`). As two distinct currencies originating from different economic zones, the analysis of their correlation provides an insightful perspective on the global financial scene. It is a relationship that showcases the reality of economic interdependence between developing economies and developed ones. Throughout history, **the Kenyan Shilling has often demonstrated a volatile correlation with the Euro**. This volatility is attributable to multifarious factors such as the Eurozone's economic health, Kenya's trade policies, and global market trends. To understand this dynamic, one crucial concept is that of exchange rates. An exchange rate refers to the value of one currency for the purpose of conversion to another. The Euro's effect on the Kenyan Shilling is predominantly linked to Kenya’s trade relations with the Eurozone. As a major trading partner, changes in the value of the Euro directly impact the value of the Kenyan Shilling. When the Euro appreciates, the **cost of imports from Eurozone countries increases, leading to inflationary pressure** on the Kenyan economy. Conversely, when the Euro depreciates, imports become cheaper, reducing inflationary pressure. Fluctuations in the Eurozone’s economy also influence the value of the Kenyan Shilling. When the Eurozone economy thrives, the Euro strengthens, making European imports more expensive for Kenya and potentially leading to a trade deficit. In contrast, if the Eurozone economy falters, the weakening Euro could ease the import cost for Kenya, potentially encouraging a trade surplus. Interestingly, the correlation is not always negative; **economic turmoil in the Eurozone region does not always mean a depreciating KES**. For instance, during the 2008 global economic crisis, the Kenyan Shilling relatively held its own against a plummeting Euro. This counterintuitive scenario can be attributed to the role of global market trends and speculative trading, which sometimes subvert conventional market expectations. In summary, the relationship between the Kenyan Shilling and the Euro is an integral barometer of the broader economic interplay between Kenya and the Eurozone. This correlation, characterized by complexities and contradictions, is a testament to the inherent uncertainties of international finance. The analysis of the Kenyan Shilling-Euro correlation thus remains invaluable in understanding the economic trajectory of the Kenyan economy in the global perspective. **Please note:** Currency markets are inherently volatile, and numerous micro and macroeconomic factors can influence exchange rates at any given time.

Exploring the Correlation Coefficient between Natural Resources and the Kenyan Shilling

The history and overall economic significance of currencies worldwide reveal fascinating insights into regional and global trends, with one such example being the evolution, design, and economic impact of the Kenyan Shilling. In this context, this paper aims to explore the intriguing correlation coefficient between natural resources and the Kenyan Shilling. Natural resources, known for their integral role in shaping a country's economy, might possess a significant relationship with the value and performance of the Kenyan currency. The Kenyan Shilling, operated by the Central Bank of Kenya, has been the legal tender since 1966, and its varying exchange rates and inflationary pressures deserve thorough scrutiny. In this research, we delve into the intricate dynamics between the monetary policy, inflation rate, demand-supply trends, and the external factors such as the export of natural resources and their bearing on the Kenyan currency. Our exploration seeks to ascertain how directly, and significantly, such correlations influence the Shilling and the overall economic scenario in Kenya. This comprehensive study promises to unravel new dimensions of the economic sphere, possibly sparking further investigations into the complex interdependencies of a country's natural wealth and its currency.

Understanding the Basics of the Kenyan Shilling Exchange Rate

Understanding the basics of the Kenyan Shilling exchange rate entails a deep dive into the currency's history, the forces impacting its value, and its role in East Africa’s economic landscape. Originating from the Arabic word 'Shilling', the **Kenyan Shilling** (KES) was established as Kenya's official currency in 1966, replacing the East African Shilling after the country gained independence. The Central Bank of Kenya, the nation’s monetary authority, regulates the Shilling's issuance and circulation, maintaining a managed float exchange rate system. The Shilling's value, therefore, fluctuates according to the market's supply and demand dynamics. The value of the Kenyan Shilling against other currencies depends on several factors, primarily **inflation rates**, **interest rates**, and Kenya's **balance of trade**. Higher inflation decreases the Shilling’s value as it diminishes its purchasing power. Similarly, higher interest rates can strengthen the Shilling by attracting more foreign capital, raising the demand for the currency, and vice-versa. A negative trade balance, with imports exceeding exports, may weaken the Shilling as demand for foreign currency rises, leading to higher exchange rates. Additionally, Kenya's economic and political stability play significant roles in determining the Shilling's exchange rate. Positive growth indicators and stable governance attract foreign investment, increasing the demand for the Shilling, and in turn, bountifully strengthening its value. However, civil unrest or political instability might lead to reduced foreign investment hence a decrease in demand for the KES, subsequently weakening its value. On a broader scale, global economic trends and investor sentiment also play essential roles in defining the Kenyan Shilling exchange rate. During periods of global economic uncertainty or risk aversion, international investors and traders tend to prefer 'safe-haven' currencies such as the US Dollar or the Swiss Franc, leading to weakened emerging market currencies like the Kenyan Shilling. Understanding the numerous factors affecting the Kenyan Shilling exchange rate provides crucial insights into Kenya's economic health and its connections with the global economy. With evolving monetary policies, global economic shifts, and Kenya's increasing integration into the world economy, the dynamics affecting the Kenyan Shilling are continuously evolving, making this an area of continual interest for economists, traders, and investors alike.

The Influence of Natural Resources on the Kenyan Economy

Kenya's economy, one of the largest and most diverse in Africa, is significantly influenced by its rich natural resources. The currency of this vibrant economy, the Kenyan Shilling, has experienced varied fluctuations over time, largely due to economic factors, tied intrinsically to the country's endowment of natural resources. Kenya, often regarded as a 'Garden of Eden', boasts a wealth of resources including minerals, such as titanium and gold, and elements like fluorspar, which fuel the industries, contributing to the nation's Gross Domestic Product (GDP). The mining sector, though still nascent, continually infuses wealth into the economy thereby impacting the national currency. The sector's contribution to the GDP rose to 1.2% in 2015, potentially affecting the shilling's valuation in relation to other global currencies. Agriculture, however, forms the backbone of the Kenyan economy. The agricultural sector, which employs over half of the country's workforce, significantly influences Kenya's economic stability and, consequently, the shilling's strength. Tea, coffee, fresh produce, and more recently, the floriculture industry, contribute massively to the country's export revenue. This export income aids in strengthening the country's foreign exchange reserves, positively impacting the value of the Kenyan Shilling. Moreover, the energy sector, particularly the renewable energy industry, has shown immense potential in recent years. Kenya's advancements in this sector, leveraging its abundant geothermal, solar, and wind resources, have the potential to improve energy availability for industrial usage and thereby stimulate economic growth. However, despite the wealth of natural resources, Kenya also faces various economic challenges. Unpredictable weather patterns, impacting agricultural output, inflation, and corruption are a few of the hurdles impacting Kenya's economic growth and the stability of its currency. Despite these challenges, the Kenyan Shilling has shown resilience and continues to be one of the most stable currencies in Africa. In conclusion, the Kenyan Shilling reflects the fortunes of its abundant natural resources. The nation's economic fortunes based on its rich resources, translates directly into the strength and stability of its currency, the Kenyan Shilling. As the country continues to leverage and manage its resources effectively, one could expect the economy, and the Shilling, to grow stronger in the global market.

Decoding the Relationship between Kenyan Shilling and Natural Resources

The Kenyan Shilling (KES), over the years, has stood as a key thread in the economic fabric of Kenya. It's a primary medium of exchange that holds deep-rooted links with Kenya's diverse natural resources. The inverse proportional relationship between the value of the Kenyan Shilling and the revenue generated from these resources can be signified by the **resource curse** theory. The idea poses questions about why countries rich with natural resources often have less economic growth and development compared to countries with few natural resources. Kenya, brimming with resources such as wildlife, minerals, and fertile agricultural lands, has seen an impacting journey in this respect. Recent times have shown us this phenomenon in action with an increasing export of these natural resources leading to commodity price booms. Simultaneously, these booms exert an upwards pressure on the KES. This **Dutch disease effect** can see the KES value appreciate, making exports expensive, leading to a potentially less competitive export sector. Conversely, when the Kenyan economy faces detrimental instances, such as drought or decline in tourism, this exerts downwards pressure on the KES. It further implicates the volatile change the Kenyan Shilling experiences in relation to the performance of the country's natural resources sector. The import and export balance, directly influenced by these natural resources, plays a significant role in determining the currency's worth. One of the solutions to mitigate these risks is **diversifying the economy** outside the set traditional sectors. It reduces the dependence on the natural resource sector and encourages a balanced growth. In addition, sound and stable financial and monetary policies need to be applied diligently. Market-based exchange rates should be introduced, and real rates should be at a level that equates savings and investment to ensure sustained economic growth. In conclusion, the Kenyan Shilling is not just a physical currency; it proves to be a testament to Kenya's economic journey, reflecting the economic decisions and factors at play. An understanding of this intricate relationship between the KES and Kenya's natural resources is quintessential for implementing sound economic policies in aiming towards a stable and prosperous future. For the best strategy to keep this economic thread stable relies not just on the utilization of natural resources but also focuses on economic diversification and appropriate monetary policies. After all, a community's well-being and its economic prosperity are best gauged by the strength and stability of its currency — in this case, the enduring Kenyan Shilling.

The Global Impact of the Kenyan Shilling

The Kenyan Shilling, denoted by KES, is an integral player in the vibrant East African economy. Its evolution, design, and economic impact, not just locally but also globally, have underscored its importance in international trade and investment. This currency, born out of a complex history involving colonial powers and the aspiration for economic self-determination, has grown to become a symbol of the nation's progression towards financial maturity. Moreover, its design, carrying imagery telling the story of the Kenyan people's culture, historical periods, and economic activities, has a significance that transcends the economic sphere. Economic attributes of the Kenyan Shilling, such as exchange rates against major world currencies, interest rates, and inflation trends, directly impact the country's monetary policy. These parameters are crucial in determining the overall health and stability of Kenya's economy. Therefore, examining the Kenyan Shilling entails digging deep into these layers of history, socio-cultural context, economics, and politics that shape its present status and future potential. This article explores the multi-faceted currency that is the Kenyan Shilling, its inception, development over the years, and its current standing in the global economic arena. Delving into the Kenyan Shilling allows for a broader understanding of Kenya's economic development and how it impacts the world economy.

The Role of the Kenyan Shilling in East Africa's Economy

The Kenyan Shilling (symbol: KSh; code: KES) plays an indispensable role in the economic framework of East Africa. Since it's inception in 1966, supplanting the East African Shilling, KES has been crucial in driving economic activities in Kenya, and, effectively, on a broader scale, East Africa. Firstly, the Kenyan Shilling has significantly impacted international trade in the region. Kenya, being part of the East African Community (EAC), uses the Shilling as her primary medium of exchange for goods and services. Its exchange rate, therefore, influences trade relations between the member countries and with external trading partners. For instance, when the shilling appreciates, it increases the purchasing power of Kenyans to import goods and services, effectively helping local businesses to acquire resources at a comparatively lower cost. Conversely, when the shilling depreciates, it makes Kenyan exports cheaper, stimulating demand for locally produced goods and services abroad. This dynamic contributes profoundly to Kenya's international trade balance and its role within the EAC. Secondly, the stability of the Kenyan Shilling is critical in determining the economic climate in East Africa. Kenya, having one of the most robust economies in the region, heavily influences neighboring countries. Stability or instability of the KES sends ripples across the East African markets, affecting inflation, interest rates, and overall business environment. For example, rapid inflation could lead to an increase in interest rates, consequently making borrowing expensive and slowing down economic growth. Thus, key stakeholders, including the Central Bank of Kenya, have consistently strived to maintain stability in the currency's value through fiscal and monetary policy measures. Lastly, the Kenyan Shilling plays an essential role in tracking the economic performance of the country. Factors such as inflation rates, balance of trade, fiscal policies, and foreign direct investment (FDI) can alter the value of the KES. Hence, analyzing these factors and their impact on the currency value can offer insightful macroeconomic perspectives on the Kenyan economy. In conclusion, the Kenyan Shilling, as a medium of exchange, a store of value, and a unit of account profoundly shapes the East African economic landscape. As Kenya continues to play an influential role in this region, the significance of the Kenyan Shilling remains profound.

Exchange Rate Trends of the Kenyan Shilling

The Kenyan Shilling (KES), since its introduction as the official currency of Kenya, has undergone several changes in regard to its exchange rate and overall economic impact. Historically, the exchange rate of the KES has been impacted by several factors, such as economic policies, inflation rates, and the overall strength of the global economy. Formerly pegged to the British Pound, the Shilling was valued at a rate of 20 Shillings per pound at its inception. However, post the abolition of the currency board in 1966, the Shilling adopted a floating exchange rate system, which led to fluctuations in its value. In the 1970s and 1980s, Kenya underwent periods of high inflation, leading to a decrease in the value of the Shilling. The government responded by implementing fiscal policies aimed at controlling inflation and stabilizing the economy. This period marked a significant downturn in the value of the Shilling, with devaluation measures leading to an exchange rate of 14 Shillings to the US Dollar by the 1990s. However, as the Kenyan economy adapted to the floating exchange rate system, the Shilling began to gain stability. In the 2000s, as Kenya embarked on structural economic reforms, the Shilling experienced a period of relative stability. Despite occasional downward pressures due to global events, the general trend has been one of steady growth and resilience. In recent years, the Kenyan Shilling has coped rather well, despite being weathered by global economic storms like the 2008 financial crisis and currently the COVID-19 pandemic. This resilience is largely credited to Kenya’s strong economic fundamentals, strategic position in East Africa, and robust monetary policy framework that responds aptly to external shocks. Furthermore, the Kenyan Central Bank's prudent management has contributed to the Shilling's stability. The Central Bank's proactive exchange rate policy, including regular interventions in the foreign exchange market, has helped in the holding of the currency's value against major currencies. Today, the exchange rate of the Kenyan Shilling remains relatively stable as it retains its autonomy against huge global economies. While it does show some volatility due to external dynamics, the central bank's active management and Kenya's continually improving economic conditions promise a favorable outlook for the Shilling. In conclusion, the Kenyan Shilling's exchange rate trend has fluctuated over time, influenced by both external shocks and internal economic dynamics. With keen navigation through global economic trends and consistent domestic economic policy interventions, the currency embodies resilience and adaptability. Notwithstanding some shades of volatility, the progression of the Shilling exemplifies successful policy transformations, from fixed to floating exchange rates, demonstrating its capacity to weather economic storms and find equilibrium in a globalized world.

Kenyan Shilling: Understanding its Impact on Global Trade

The **Kenyan Shilling** (KES), as the official currency of Kenya, holds a significant role in both local and global economies. Ever since it replaced the East African Shilling in 1966, this currency has played a pivotal role in defining Kenya's economic foothold in international markets. Internationally, the **Kenyan Shilling** is considered a 'soft currency' or 'weak currency'. This term refers to its fluctuating exchange rate against 'hard currencies' such as the US Dollar, Euro or British Pound. Due to this volatility, the **KES** is often more vulnerable to fluctuations in exchange and inflation rates, which can directly impact global trade engagements. The trade balance between imports and exports ultimately influences the valuation of the **KES** and its purchasing power parity on the international podium. The Central Bank of Kenya, tasked with managing the currency, has employed various monetary policy tools including interest rate adjustments, reserve requirements, issuance of government bonds, and open market operations to stabilize the **KES**. These measures help facilitate trade, control inflation, and manage economic growth. Kenya's economy largely relies on sectors such as agriculture and tourism that generate hard currency. The earnings from these sectors are a key determinant of the strength of the **Kenyan Shilling**. For instance, any disruption in these sectors, due to climatic changes or geopolitical instability, could lead to a decline in the **KES** rating against other global currencies, affecting trade and the wider economy. Kenya's position as East Africa's largest economy and its key role in the African Continental Free Trade Area (AfCFTA) adds an extra layer of importance to the **KES**. The currency's stability influences the ease of doing business, investment decisions, and economic collaborations across borders. Any fluctuations in the **Kenyan Shilling** can lead to shifts in trade relations and investment inflows, affecting scalability of business and economic growth not just domestically, but in the broader East African region. To encapsulate, the **Kenyan Shilling** may not be a hard currency but its influence on global trade is substantial. The health of the Kenyan economy and the international perception of **KES** stability directly drive the currency's impact on global trade. Strategies aimed at fostering economic stability, diversification and resilience will continue to enhance the role of the **Kenyan Shilling** in global trade dynamics.

Economic Development Impact of the Kenyan Shilling

The **Kenyan Shilling (KES)**, the official currency of Kenya since 1966, has exerted a profound influence on the country's socioeconomic landscape. Reflecting Kenya's economic trajectory, interwoven with its political history, it has emerged as a potent economic symbol and tool in the East African territory. Since its inception post the East African Currency Board era, its evolution mirrors the nation's efforts to establish robust monetary policy, manage inflation, and foster sustainable economic growth. This impact has been manifold, affecting the interplay of local and foreign trade, investment climate, public debt, and macroeconomic stability. The dynamics of the Kenyan Shilling, therefore, play a significant role in shaping economic and social development in Kenya. Further explorations into this subject will reveal correlations between currency fluctuations and broader economic trends. Consequently, an in-depth understanding of the currency's influence can offer valuable insights into the nation's economic health, providing a precursor to the fiscal stability and investor sentiment in Kenya. The story of the Kenyan Shilling is the unfurling narrative of the country's continuous strive towards economic solidity.

Role of the Kenyan Shilling in Kenya's Economy

The **Kenyan Shilling** plays a pivotal role in Kenya's economy, serving as its primary unit of exchange. Though its strength fluctuates relative to other global currencies, the Shilling consistently exists as a symbol of Kenya's economic autonomy. Upon independence in 1963, Kenya adopted the Shilling, replacing the East African Shilling used during colonial times. This sovereignty of currency was a pivotal assertion of Kenya's new found economic independence. Notably, the Shilling was pegged to the British Pound until 1973, then later floated against other currencies, reflecting historical ties and the transition to a globally competitive economy. The Central Bank of Kenya is responsible for maintaining monetary stability, issuing notes and coins, and managing the exchange rate. Therefore, the Shilling's value predominantly reflects domestic economic policies rather than global financial turbulence. Over the decades, inflation has intermittently challenged the Shilling's value, exacerbated by pressures such as political instability or drought. The Central Bank uses tools such as interest rate adjustments to maintain price stability, directly affecting the Shilling's strength. Despite such hurdles, the evolution of the Shilling continues. Today, there is a push towards digitization and mobile money, evidenced by innovations such as M-Pesa, a mobile money transfer service. This shift reflects broader trends in global finance, positioning Kenya at the forefront of mobile banking. The Shilling's design represents Kenya's national identity, conveying its cultural history, wildlife, and key economic sectors. The current generation notes, unveiled in 2019, showcase the nation's iconic features like the Kenya African National Union symbol, the Big Five wildlife, and various economic landscapes including agriculture and tourism. In conclusion, the Kenyan Shilling is more than just a unit of transaction; it is a living testament to Kenya's economic resilience and ambition. Despite fluctuations and challenges, the Shilling remains fundamental to Kenya's economy, embodying the nation’s vibrant economic past and its dynamic future.

Impact of Kenyan Shilling Fluctuations on Trade

The Kenyan Shilling (KES), as the official currency of Kenya, plays a pivotal role in the country's economy by influencing its trade dynamics. Firstly, it's important to understand that the **value of the Kenyan Shilling**, much like any currency, is subject to fluctuation due to factors such as inflation, interest rates, government debt and political stability, amongst others. These fluctuations, in turn, have a notable **impact** on Kenya's trade. When the Kenyan Shilling appreciates (increases in value), it effectively **lowers the price of imports** and makes Kenyan exports more expensive in the international market. This scenario can significantly reduce the country's overall balance of trade. In contrast, a depreciation of the Kenyan Shilling increases the cost of imports, thereby encouraging local consumption and strengthening domestic industries. Nevertheless, while this may seem beneficial, it's also a double-edged sword. An unchecked depreciation of the national currency can lead to inflation, as the increased cost of imports raises domestic prices on goods and services. Furthermore, the **fluctuations of KES** can also dictate the country's investment climate. A weak Kenyan Shilling can deter foreign investors, as it implies a higher risk of losing money if the currency depreciates further. This could result in capital flight, a scenario whereby investors withdraw their investments due to perceived financial instability, leaving the economy vulnerable. In terms of monetary policy, the Central Bank of Kenya (CBK) is tasked with managing the inflation rate and ensuring the stability of the Kenyan Shilling. The CBK's role involves balancing the delicate economic equilibrium of trying to stimulate growth while also keeping inflation within manageable bounds. It does this by adjusting monetary policies such as interest rates and reserve requirements. In summary, the Kenyan Shilling's **fluctuations have a multi-layered impact** on Kenya's trade, affecting everything from the price of goods and services domestically and internationally, to foreign investments and monetary policy. Managing these currency swings effectively is imperative for the country's economic stability and growth. Irrespective of these challenges, the resilience and dynamism of the Kenyan economy have continued to grow, proving its place as one of Africa's leading economies.

Kenyan Shilling and Its Influence on Foreign Investment

The **Kenyan Shilling** (KES), the official currency of Kenya, plays a critical role in attracting and influencing foreign investment. Over time, the performance of the Shilling in the foreign exchange market has profoundly affected the inflow and outflow of foreign investment in the country. Kenya's economy, particularly its interest rates and inflation, is significantly impacted by the strength and stability of the Kenyan Shilling. Depreciation of the Shilling usually fosters foreign direct investment (FDI) because when the Shilling weakens against foreign currencies, investment in Kenya becomes cheaper for foreign investors, leading to them increasing their investments. On the other hand, appreciation of the Shilling can deter FDIs, as higher costs may discourage foreign investors. The design of the Kenyan Shilling has evolved historically, reflecting the nation's cultural heritage, history, and economic progression. Coins generally depict leaders and symbols significant to Kenya, while notes illustrate themes of agriculture, tourism, manufacturing, academia, and governance. This depiction not only represents Kenya's unique identity and values but appeals to the aesthetic sense of investors, impacting their perceptions and attitudes towards investment. A well-managed monetary policy by the Central Bank of Kenya, aimed at stabilizing the Shilling's value, controls inflation, and maintains lower interest rates, which is typically conducive for FDI. If inflation rates rise unexpectedly, the value of the Shilling decreases, leading to increased costs and reduced profits for foreign investors. Conversely, a steady monetary policy can help maintain a stable and predictable business environment, thus encouraging more significant foreign investment. In conclusion, the Kenyan Shilling's value in the foreign exchange markets, its design, and Kenya's monetary policy play a crucial role in attracting foreign investment. Investors closely monitor these factors when making decisions related to investing in Kenya. A stable Kenyan Shilling, coupled with attractive currency design and a stable monetary policy, can contribute significantly to increasing foreign investment, fostering economic growth, and hence, benefiting the Kenyan economy at large.

Understanding the Impact of Inflation on the Kenyan Shilling

The **Kenyan Shilling (KES)**, Kenya's sovereign currency since 1966, has witnessed significant fluctuations over time due to various factors, paramount among which is inflation. Inflation, or the general rise in prices over time, severely impacts the value of currency, eroding its purchasing power. This introduction shall primarily delve into **Understanding the Impact of Inflation on the Kenyan Shilling**. The principle of inflation is simple – as prices rise, each unit of currency buys fewer goods and services. This adversely affects economies because the real value of money declines, affecting living standards. In the context of Kenya, the inflation rate has sometimes soared sharply, sending shockwaves through the economy, subsequently threatening the strength and stability of the Shilling itself. However, it's crucial to note that inflation doesn't operate in isolation; it's intertwined with other macroeconomic factors like governmental monetary policy, trade balances, GDP growth, and global economic trends — all acting as key drivers in determining the value of the KES. This comprehensive examination of inflation's impact on the Kenyan Shilling aims not only to enhance our understanding of these dynamics, but also to foster insights into the broader picture of Kenya's economy in both the historical and current context.

Understanding the Concept of Inflation

To thoroughly understand the impact of inflation on the Kenyan Shilling, we first need to clarify what **inflation** is. In basic terms, inflation is a general increase in prices and fall in the purchasing value of money. It affects all aspects of the economy, from consumer spending, business investment, government expenditure, to the actions of the central bank. In the Kenyan context, the **Kenyan Shilling (KSH)** has had its fair share of inflationary pressures. These pressures are often fuelled by various factors like fiscal policy decisions, monetary policy, and economic shocks. The Central Bank of Kenya, the institution governing the monetary system, plays a significant role in controlling or mitigating these inflationary pressures. Historically, the Kenyan Shilling has undergone noteworthy fluctuations due to inflation. There have been periods of high inflation, often realized in the devaluation of the Shilling. The effects spill over to common necessities like food, housing, and transport becoming more expensive. This increase in the cost of living often leads to business uncertainty, which can negatively impact investment and economic growth. More recently, the Kenyan Shilling has seen moderate inflation due to prudent monetary policy measures enacted by the Central Bank of Kenya. They have strived to maintain a stable and low inflation environment conducive for economic growth. The bank uses tools like the Monetary Policy Rate (MPR) to influence interest rates, money supply, and ultimately, inflation. By understanding inflation and its impact on the Kenyan Shilling, we can better comprehend the relationship between inflation and the economy's overall health. The Kenyan Shilling's value, as with any other currency, is not static but changes according to these broader macroeconomic dynamics. This understanding also allows for more informed strategic decisions - whether you are an individual, business, or a policy maker. In conclusion, **inflation has a direct and significant impact on the Kenyan Shilling**. The Central Bank of Kenya plays a pivotal role in regulating these shifts. By understanding the dynamics of the local economy and the interactions between monetary decisions and inflation, we can better predict and react to these changes, contributing to more robust fiscal and economic health for Kenya. Remember, by understanding the concept of inflation, we are at a better position to interpret economic trends and make informed financial decisions.

How Inflation Affects the Kenyan Shilling

Inflation, a persistent increase in the general price level of goods and services, is a significant economic factor that affects the Kenyan Shilling (**KES**). The rise in inflation undermines the value of the **KES**, causing it to purchase less than it could previously, essentially diminishing its purchasing power. Throughout history, the Kenyan government has taken numerous steps to control inflation and, consequently, stabilize the **KES**. However, an in-depth review of these approaches evidences a fluctuating effectiveness. When inflation is high, the Central Bank of Kenya often raises interest rates, a reactionary measure designed to slow down the rate of economic growth and, by extension, rates of inflation. This action has crucial implications for the Forex market. As higher interest rates make the **KES** more attractive to foreign investors, it consequently increases demand for the Kenyan currency and strengthens its value compared to other currencies. Another strategy employed involves the Kenyan government using foreign currency reserves to directly intervene in the currency market, a move intended to prevent pronounced fluctuations in the value of the **KES**. Moreover, inflation can introduce volatility into the foreign exchange market, thereby affecting exchange rates. High rates of inflation often spur the central bank to implement stringent monetary policies, which tend to increase the value of the **KES**. However, if these strategies fail to contain inflation, it can result in the depreciation of the **KES**. The depreciation in turn leads to increased costs of imported goods, which ultimately fuels inflation further, creating an inflation-depreciation spiral. Inflation has both indirect and direct impacts on a country's economic activities, as it affects the overall economic stability and confidence in the economy. Understanding the dynamics of inflation, its causes, and combating measures is crucial to comprehending the trend and fluctuations in the value of the **KES**. Lastly, the Kenyan government, like other nations, needs to continually monitor and manage inflation rates given its potent influence over the denominator of the country's wealth, the Kenyan Shilling. In conclusion, the evolution of the **KES** and its journey vis-a-vis inflation is a complex interplay of various factors. The Kenyan government's efforts to combat inflation, albeit with varying degrees of success, underline the importance of inflation control in ensuring the strength and stability of a country's currency.

Economic Strategies to Mitigate Inflation in Kenya

Kenya's vibrant economy has, over time, illustrated both robust growth and significant challenges, the most outstanding of which is inflation. The Kenyan Shilling (KES), the country's national currency, stands at the core of these economic events. In recent years, rising inflation rates have sparked concerns about the KES's purchasing power, compelling strategic monetary policy interventions. One might wonder, *how did we get here?* Historically, Kenyan monetary policy, as executed by the Central Bank of Kenya (CBK), aimed at maintaining price stability. However, the complex interplay between the KES's value, inflation rates, and the general economic landscape has sometimes led to precarious situations. Rising inflation rates imply a decrease in the KES's value as the cost of goods and services escalates. High inflation erodes the public's purchasing power, fosters economic uncertainty, and can fuel a vicious cycle of further price increases. This situation, inevitably, impacts economic growth and stability. Given the sensitive nature of this matter, the CBK has utilized a mix of monetary policy interventions to curtail rising inflation, illustrating the adaptability and resilience of the country's financial system. The CBK often resorts to adjusting the Central Bank Rate (CBR) - the interest rate at which it lends to commercial banks. By doing so, it indirectly influences the rate at which money circulates in the economy. Increasing the CBR makes borrowing more expensive, thus reducing money supply and slowing consumption. This strategy helps regulate demand, suppress inflationary pressure, and stabilize the KES's value. Furthermore, in order to sustain its anti-inflation efforts, the CBK frequently uses open market operations (OMOs). By buying and selling government securities, the CBK can influence liquidity and, by extension, control inflation. Additionally, the use of minimum reserve requirements for banks helps safeguard the financial system's stability. By mandating that banks set aside a portion of their deposits as reserves, the CBK regulates the money banks can lend, hence indirectly controlling inflation. In conclusion, the intersection of the Kenyan Shilling's value, rising inflation, and strategic economic mitigation measures paints a remarkable picture of resilience. The CBK's interventions, primarily through monetary policy adjustments, and the use of tools such as the Central Bank Rate, open market operations, and minimum reserve requirements, underscore the continuous efforts to stabilize the economy. These strategies aim to maintain the KES's purchasing power and support sustainable growth, serving as an enduring testament to Kenya's economic resilience.

Exploring the Role of Kenyan Shilling in Monetary Policy

The **Kenyan Shilling**, most often symbolized by **KES**, serves as the backbone of the Kenyan economy, playing a fundamental role in the nation's monetary policy. Throughout history, the Kenyan Shilling has undergone transformations in response to the shifting economic landscape, regional trading patterns, and distinctive blends of monetarism. Influenced by intricate economic strategies and regulatory practices, it has reacted to both local and global economic trends, and inturn impacting Kenya's fiscal stability and economic vitality. The adoption of the Shilling as Kenya's national currency at the time of independence in 1964 marked a significant point in Kenya's economic history. Since then, its performance has been subject to a myriad of influencing factors comprising inflation, foreign exchange rates, interest rates, and economic shocks among others. In this light, the exploration of the Kenyan Shilling's trajectory provides insight into the broader discourse of Kenya's economic development, imparting an understanding into the nuances and complexities of monetary policy management. The following sections will delve into the role of the Kenyan Shilling in monetary policy making, highlighting its evolutionary journey, influences, and implications on Kenya's economic milieu.

The Evolution of Kenyan Shilling and Its Impact on Economic Stability

The **Kenyan Shilling**, recognized through its symbol **KES** or simply **Ksh**, is the official currency of Kenya, evolution of which has had a significant impact on the country's economic stability. As an essential measure for trade, investment, and growth, currency evolution directly influences the stability and growth prospects of an economy. The Kenyan Shilling traces its roots back to 1966 when it successfully replaced the East African Shilling at par, soon after the independence in 1963. This replacement was a bold yet inevitable step for Kenya to establish a solid foundation for its economy and embrace sovereignty, a necessary step for any emerging nation. While the Kenyan Shilling has undergone various design changes over the years, the intricacies of these changes highlight the rich cultural heritage, glorious history, and the national identity of Kenya. The currency designs, intricately detailed, feature national heroes, notable wildlife, and significant landmarks, reflecting the blend of Kenya's respect for its past and its hopes for the future. The overall economic stability of Kenya is significantly influenced by the strength and value of the Kenyan Shilling. The Central Bank of Kenya, through its *monetary policy*, has continually adopted strategies to control inflation — a profound enemy of any currency's value. However, this policy hasn't always delivered expected results, leading to instances of high inflation, notably in the 1990s and late 2000s. Such periods have witnessed a weakened Shilling, elevating import costs and causing economic instability. Despite these enacted policies, the Kenyan Shilling has endured periods of vulnerability. This instability owes its roots to the country's *balance of trade* — the ratio of exports versus imports. While Kenya exports considerable amounts of goods such as coffee, tea, and flowers, the heavy reliance on imports, especially oil and machinery, has widened the trade gap. A wider trade gap increases reliance on foreign currencies for transactional purposes and weakens the domestic currency, thereby instigating economic uncertainty. Yet, despite the odds, the Kenyan Shilling continues to learn, grow, and change. The impact of its evolution on the Kenyan economy isn't restricted to economic measures alone. It replicates into the living conditions, the social standards, and the overall development landscape of Kenya. Therefore, understanding the Kenyan Shilling is significant not merely for assessing the economic stability of the nation but can provide potent insights for potential investors, businesses, and policymakers aiming to make informed decisions. As Kenya continues to march on its developmental path, the journey of its currency, the Shilling, is a tale itself, a tale of resilience, adaptability, and hope.

The Interaction Between Kenyan Shilling and Inflation Rates

Kenya's economy has a strong correlation with the performance of its currency, the Kenyan Shilling (KES). Understanding this interaction, particularly with reference to inflation rates, provides valuable insight into the economic trajectory of Kenya over time. Historically, the Kenyan Shilling has experienced periods of both stability and volatility. The Central Bank of Kenya, responsible for issuing the currency, has strived to maintain its stability against major world currencies. However, global economic factors, such as changes in commodity prices, foreign investors' sentiments, and macroeconomic policies, often have direct impacts on the shilling's value. A depreciating shilling often leads to inflation — a continuous increase in prices of goods and services. The connection here is straightforward - as the value of the shilling drops, import costs rise. Kenya, a net importing country, in order to cover these increased costs, tends to adjust prices, leading to inflation. With such inflation, the purchasing power of the shilling reduces, indicating the critical link between the performance of the KES and inflation. Yet, the story of inflation and the Kenyan Shilling is twofold. While depreciation can lead to inflation, inflation itself can also cause the depreciating of the shilling. In periods of high inflation, investors tend to offload the currency, as its ability to hold value is eroded. This offloading often results in oversupply, thus depreciating the currency's value. Effectively, there exists a cyclical relationship between the shilling and inflation. Fluctuations in one often result in changes in the other, creating a feedback loop that can potentially stimulate or hamper economic growth. The Central Bank of Kenya's role in monitoring and managing this delicate balance cannot be overstated. This interaction between the Kenyan Shilling and inflation rates provides an interesting study on the subtle dynamics of a developing country's economy. It underscores the importance of fiscal discipline, sensible monetary policy, and a judicious balance of imports and exports. It brings to light the many economic variables that require constant monitoring and management for an economy to thrive. This explanation is by no means exhaustive, as other factors such as politics, infrastructure development, and geopolitical tensions also play significant roles. However, it serves as an introductory guide to understanding the intricate relationship between the Kenyan Shilling and inflation rates. Through this lens, we can start to fathom the economic story of Kenya and its future prospects.

How Central Bank of Kenya Uses Kenyan Shilling to Influence Monetary Policy

The **Kenyan Shilling (KES)** is the primary unit of currency in Kenya, not only used as a medium of exchange but also as a crucial tool in influencing the nation's monetary policy, operated by the Central Bank of Kenya (CBK). Effectuation of monetary policy is carried out in an endeavor to maintain stability in prices in order to support sustainable economic growth. The CBK uses the Kenyan Shilling in a variety of ways to effect changes in Kenya's monetary landscape. First and foremost, CBK adjusts the interest rates – what we often refer to as the Central Bank Rate (CBR) – to stimulate or slow economic activity. If economic activity must be stimulated, CBK lowers the CBR. This leads to a decrease in the cost of borrowing in Kenyan Shillings, hence encouraging investment and expenditure. Conversely, if the economy appears overheated, it hikes the CBR. This makes Kenyan Shillings more expensive to borrow, effectually reducing both spending and investment. The second method CBK uses to influence monetary policy involves Open Market Operations (OMOs). This technique affects the volume of Kenyan Shillings available in the market. CBK uses OMOs to buy or sell government securities in the open market. For instance, when there is a need to increase money supply, the CBK buys securities, injecting Kenyan Shillings into the economy. On the other hand, when there’s an excess supply of money, CBK sells securities, pulling Shillings out of the economy, thus tempering inflationary pressures. Additionally, the CBK utilizes reserve requirements as a tool to control the money supply. Financial institutions are required to hold a certain proportion of their deposits in the form of legal reserves. Increasing the reserve requirements reduces the amount of available Kenyan Shillings for lending, decreasing the money supply and curbing inflation. Conversely, reducing reserve requirements increases the amount available for loaning, boosting the money supply and potentially stimulating economic activity. In a bid to promote trade and maintain foreign exchange stability, CBK also monitors the exchange rate of Kenyan Shilling against major currencies. A robust and stable Shilling helps in reducing import costs and inflationary pressures, hence safeguarding the purchasing power of Kenyan citizens. In conclusion, the Central Bank of Kenya, with the Kenyan Shilling as its linchpin, plays a paramount role in maintaining monetary stability, balancing inflation and promoting sustainable economic growth in Kenya. Through their diligent control measures and monetary interventions, they ensure financial order, undoubtedly underpinning Kenya's progress towards economic prosperity.

Kenyan Shilling Banknotes

-

Kenyan Shilling (KES) 100 Banknotes

-

Kenyan Shilling (KES) 1000 Banknotes

-

Kenyan Shilling (KES) 200 Banknotes

-

Kenyan Shilling (KES) 50 Banknotes

-

Kenyan Shilling (KES) 500 Banknotes