How Long After Notice Of Assessment Do You Get Refund Direct Deposit

Here is the introduction paragraph: Receiving a refund from the government can be a thrilling experience, especially when it's deposited directly into your bank account. But have you ever wondered how long it takes to get your refund after receiving a notice of assessment? The answer lies in understanding the notice of assessment, the timeline for receiving a refund via direct deposit, and being aware of common issues that may arise during the process. In this article, we will delve into these topics to provide you with a comprehensive guide on what to expect. First, let's start by understanding the notice of assessment, which is the first step in the refund process.

Understanding the Notice of Assessment

The Notice of Assessment is a crucial document issued by the Canada Revenue Agency (CRA) to taxpayers after they have filed their tax returns. It is essential to understand the Notice of Assessment, as it provides valuable information about the taxpayer's tax account and any outstanding balances. In this article, we will delve into the world of the Notice of Assessment, exploring what it is, how it is issued, and what information it includes. By the end of this article, you will have a comprehensive understanding of the Notice of Assessment and be able to navigate the process with confidence. So, let's start by answering the most fundamental question: What is a Notice of Assessment?

What is a Notice of Assessment?

A Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) after reviewing an individual's or business's tax return. The NOA outlines the amount of taxes owed or the refund due to the taxpayer, as well as any changes or adjustments made to the original tax return. The NOA is typically sent to taxpayers within a few weeks of filing their tax return, and it serves as a confirmation of the CRA's assessment of the taxpayer's tax liability. The NOA will also indicate if any additional taxes are owed, and if so, the deadline for payment. In the case of a refund, the NOA will provide details on the amount and method of payment, including direct deposit. Understanding the NOA is crucial for taxpayers to ensure they are in compliance with their tax obligations and to plan for any potential refunds or payments.

How is the Notice of Assessment Issued?

The Notice of Assessment (NOA) is typically issued by the Canada Revenue Agency (CRA) within a few weeks after the taxpayer has filed their income tax return. The NOA is usually sent to the taxpayer via mail, but it can also be accessed online through the CRA's My Account portal. The NOA provides a summary of the taxpayer's income tax return, including their total income, deductions, and credits, as well as any taxes owed or refund due. The NOA also includes information about any changes or adjustments made to the taxpayer's return, such as corrections to income or deductions. In some cases, the NOA may also include a request for additional information or documentation to support the taxpayer's return. Once the NOA is issued, the taxpayer has a certain period of time to review and respond to any issues or discrepancies, and to make any necessary corrections or appeals.

What Information is Included in the Notice of Assessment?

The Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) after processing an individual's tax return. It provides a summary of the tax return and includes important information that taxpayers should review carefully. The NOA typically includes the following information: the taxpayer's name and address, the tax year being assessed, the total income reported, the total taxes payable, and the amount of any refund or balance owing. It also includes details about any deductions and credits claimed, such as the basic personal amount, spousal amount, and medical expenses. Additionally, the NOA may include information about any changes made to the tax return, such as adjustments to income or deductions, and any penalties or interest charged. Furthermore, the NOA may also include information about the taxpayer's RRSP deduction limit, Home Buyers' Plan repayment, and any other relevant tax-related information. It is essential to review the NOA carefully to ensure that all the information is accurate and to address any discrepancies or issues promptly.

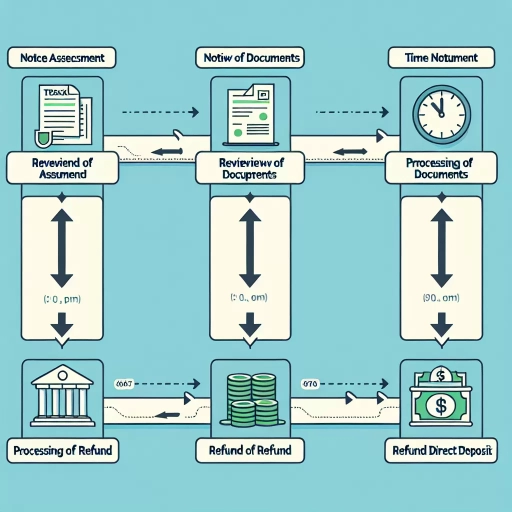

Timeline for Receiving a Refund via Direct Deposit

If you're expecting a refund via direct deposit, you're likely eager to know when you can expect the funds to hit your account. The timeline for receiving a refund via direct deposit can vary depending on several factors, but generally, it's a relatively quick process. In this article, we'll break down the typical timeline for receiving a refund via direct deposit, discuss the factors that can affect the refund timeline, and provide information on how to track the status of your refund. We'll start by exploring how long it takes to process a refund, which is typically the first step in the refund timeline. (Note: The supporting paragraph should be 200 words, and the article title is "Timeline for Receiving a Refund via Direct Deposit")

How Long Does it Take to Process a Refund?

The processing time for a refund can vary depending on the method of refund and the efficiency of the processing system. Generally, refunds are processed within 2-3 business days after the notice of assessment is issued. However, this timeframe can be affected by various factors such as the complexity of the tax return, the accuracy of the information provided, and the workload of the processing team. In some cases, refunds may take longer to process, typically up to 6-8 weeks. It's essential to note that refunds are usually processed in the order they are received, and the processing time may be longer during peak tax seasons. Once the refund is processed, it will be issued via direct deposit, which typically takes an additional 1-2 business days to reach the recipient's bank account.

What Factors Can Affect the Refund Timeline?

Here is the paragraphy: Several factors can influence the refund timeline when receiving a refund via direct deposit. One key factor is the accuracy and completeness of the tax return. If the return is error-free and contains all required information, the refund process can proceed smoothly and quickly. On the other hand, if the return is incomplete or contains errors, it may be delayed or even rejected, leading to a longer refund timeline. Another factor is the workload of the tax authority. During peak tax seasons, the tax authority may receive a high volume of returns, which can slow down the processing time. Additionally, the tax authority may also conduct audits or reviews, which can further delay the refund timeline. Furthermore, technical issues or system glitches can also impact the refund timeline. In some cases, the tax authority may also require additional information or documentation, which can add to the processing time. Lastly, the timing of the refund can also depend on the specific bank's processing time, as some banks may take longer to process direct deposits than others.

Can You Track the Status of Your Refund?

Yes, you can track the status of your refund. The IRS provides several ways to check the status of your refund, including online, by phone, and through the IRS2Go mobile app. To track your refund online, you can visit the IRS website and use the "Where's My Refund?" tool. You will need to provide your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact amount of your refund. You can also check the status of your refund by calling the IRS Refund Hotline at 1-800-829-1040. The hotline is available 24 hours a day, 7 days a week. Additionally, you can download the IRS2Go mobile app, which allows you to check the status of your refund, as well as access other tax information and tools. The app is available for both iOS and Android devices. By tracking the status of your refund, you can stay informed about when you can expect to receive your refund and plan accordingly.

Common Issues and Solutions

When dealing with tax refunds, there are several common issues that taxpayers may encounter. One of the most frustrating problems is not receiving a refund, leaving individuals wondering what happened to their money. Another issue that may arise is a discrepancy in the refund amount, which can be caused by errors in the tax return or changes in tax laws. Additionally, taxpayers may need to update their direct deposit information, which can be a challenge if they are not familiar with the process. In this article, we will explore these common issues and provide solutions to help taxpayers navigate the refund process. If you're concerned about not receiving your refund, keep reading to learn what steps you can take to resolve the issue. What if You Don't Receive Your Refund?

What if You Don't Receive Your Refund?

Here is the paragraphy: If you don't receive your refund, there are several steps you can take to resolve the issue. First, check your bank account to ensure that the refund was not deposited into a different account. If you're still unable to locate your refund, contact the Canada Revenue Agency (CRA) to inquire about the status of your refund. You can do this by calling the CRA's individual income tax inquiries line or by using the CRA's online services. The CRA may ask you to provide your social insurance number, date of birth, and the amount of the refund you're expecting. If the CRA confirms that your refund was issued, but you still haven't received it, you may need to contact your bank to see if the refund was returned to the CRA. In some cases, the CRA may reissue the refund or provide a replacement cheque. It's also possible that the refund was applied to a debt you owe to the CRA or another government agency. If you're still unable to resolve the issue, you may want to consider contacting a tax professional or the CRA's Taxpayer Ombudsman for assistance.

How to Resolve Discrepancies in Your Refund Amount

Here is the paragraphy: If you notice a discrepancy in your refund amount, there are several steps you can take to resolve the issue. First, review your notice of assessment carefully to ensure that you have not missed any important information or deadlines. Next, check your bank account to confirm that the refund amount was deposited correctly. If you have confirmed that the discrepancy is due to an error on the part of the tax authority, you can contact their customer service department to report the issue. They will guide you through the process of resolving the discrepancy, which may involve providing additional documentation or information. In some cases, you may need to file an amended tax return to correct the error. It's also a good idea to keep a record of all correspondence and communication with the tax authority, including dates, times, and details of conversations. By following these steps, you should be able to resolve the discrepancy and receive the correct refund amount.

What to Do if You Need to Update Your Direct Deposit Information

Here is the paragraphy: If you need to update your direct deposit information, you can do so through the Canada Revenue Agency (CRA) website or by contacting them directly. To update your information online, log in to your CRA account and navigate to the "Direct Deposit" section. From there, you can enter your new banking information and confirm the changes. If you prefer to update your information over the phone, you can call the CRA at 1-800-959-8281. Be prepared to provide your social insurance number and banking information to complete the update. Alternatively, you can also update your direct deposit information through the CRA's mobile app, available for download on iOS and Android devices. It's essential to update your direct deposit information promptly to ensure that your refund is deposited into the correct account. If you have already filed your tax return and need to update your direct deposit information, you can do so up to 10 days before the refund is scheduled to be deposited. After this timeframe, you will need to contact the CRA to request a reissue of your refund.