How To Close Questrade Account

Here is the introduction paragraph: Closing a Questrade account can be a straightforward process, but it's essential to understand the steps involved to avoid any potential complications. Whether you're switching to a different brokerage firm or no longer need the account, knowing how to close your Questrade account efficiently is crucial. In this article, we will guide you through the process, starting with understanding the Questrade account closure process, followed by navigating the specific steps required to close your account, and finally, discussing post-closure considerations and next steps. By the end of this article, you will be equipped with the knowledge to close your Questrade account with confidence. To begin, let's delve into the details of the account closure process and what you can expect. Understanding the Questrade Account Closure Process is the first step in this journey.

Understanding the Questrade Account Closure Process

Understanding the Questrade account closure process is crucial for investors who wish to terminate their relationship with the platform. The process can be complex, and it's essential to be aware of the implications and requirements involved. There are various reasons why an investor may choose to close their Questrade account, and it's vital to understand these reasons to make an informed decision. Additionally, the type of account held with Questrade can impact the closure process, and investors should be aware of the specific implications for their account type. Before initiating the closure process, it's also essential to complete a pre-closure checklist to ensure a seamless experience. By understanding these aspects, investors can navigate the Questrade account closure process with confidence. One of the primary steps in closing a Questrade account is understanding the reasons behind the decision, which is discussed in the next section.

Reasons for Closing a Questrade Account

When considering closing a Questrade account, it's essential to understand the reasons behind this decision. One of the primary reasons for closing a Questrade account is dissatisfaction with the services provided. This could be due to poor customer support, high fees, or limited investment options. Another reason is a change in investment goals or strategies, which may require a different type of account or investment platform. Additionally, some users may close their Questrade account due to a lack of user-friendly interface or mobile app, making it difficult to manage their investments on-the-go. Furthermore, some investors may choose to consolidate their accounts with a single provider, leading to the closure of their Questrade account. In some cases, users may also close their account due to security concerns or a lack of confidence in the platform's ability to protect their personal and financial information. Lastly, some users may simply no longer need the account, having met their investment objectives or having switched to a different investment strategy. Understanding the reasons for closing a Questrade account is crucial in making an informed decision and ensuring a smooth account closure process.

Questrade Account Types and Closure Implications

Questrade offers various account types, each with its unique features and implications for closure. The most common account types include the Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), Registered Education Savings Plan (RESP), and non-registered accounts. When closing a Questrade account, it's essential to understand the implications of each account type. For RRSP and RESP accounts, there may be penalties for early withdrawal, and the account holder may be required to pay taxes on the withdrawn amount. TFSA accounts, on the other hand, do not have penalties for withdrawal, but the account holder may be subject to taxes on investment income. Non-registered accounts do not have any penalties or tax implications for closure. Additionally, Questrade may charge fees for account closure, transfer, or inactivity, which can range from $25 to $150, depending on the account type and circumstances. It's crucial to review the account agreement and understand the fees and implications associated with closing a Questrade account to avoid any unexpected charges or tax liabilities.

Pre-Closure Checklist for a Seamless Experience

When closing a Questrade account, it's essential to ensure a seamless experience by following a pre-closure checklist. This checklist helps you avoid any potential issues or penalties that may arise during the account closure process. First, review your account activity to ensure there are no open trades, pending transactions, or outstanding fees. Verify that all positions are closed, and any margin calls are resolved. Next, confirm that you have withdrawn all available funds from your account, as Questrade may charge inactivity fees if there are remaining balances. Additionally, check if you have any tax obligations or reporting requirements, such as T4A or T5 slips, and ensure you have received them. It's also crucial to update your account information, including your address and contact details, to prevent any communication disruptions. Furthermore, consider transferring any registered accounts, such as RRSPs or TFSAs, to another financial institution to avoid any potential penalties or fees. Finally, review Questrade's account closure policy to understand any specific requirements or procedures that may apply to your situation. By following this pre-closure checklist, you can ensure a smooth and hassle-free account closure experience with Questrade.

Navigating the Questrade Account Closure Steps

Closing a Questrade account can be a straightforward process if you understand the steps involved. To navigate the account closure process efficiently, it's essential to know where to start, what information you need to provide, and how long the process typically takes. Initiating the closure process online or by phone is the first step, where you'll need to contact Questrade's customer support to begin the account closure process. Additionally, having the required documentation and information readily available will help facilitate a smooth closure. Understanding the timeline for account closure is also crucial, as it will help you plan and manage your finances accordingly. By following these steps, you can ensure a hassle-free account closure experience. To get started, let's dive into the first step: Initiating the Closure Process Online or by Phone.

Initiating the Closure Process Online or by Phone

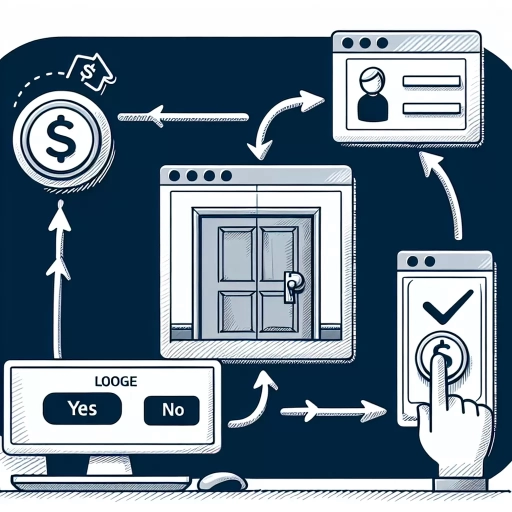

Initiating the closure process for your Questrade account can be done conveniently online or by phone. To start the process online, simply log in to your Questrade account through their official website. Once logged in, navigate to the "Account" or "Settings" section, where you should find an option to close your account. Click on this option and follow the prompts to confirm your decision. You may be required to provide a reason for closing your account, but this is typically optional. If you prefer to close your account over the phone, you can contact Questrade's customer support team directly. They will guide you through the process and answer any questions you may have. Be prepared to provide your account information and confirm your identity to ensure a smooth closure process. Regardless of the method you choose, it's essential to ensure that your account is in good standing, with no outstanding balances or pending transactions, to avoid any potential delays or complications.

Required Documentation and Information for Closure

When closing a Questrade account, it is essential to provide the required documentation and information to ensure a smooth and efficient process. The necessary documents and information may vary depending on the type of account being closed, but generally, you will need to provide identification, account information, and tax-related documents. For identification, you may need to provide a valid government-issued ID, such as a driver's license or passport, to verify your identity. Additionally, you will need to provide your account number, account type, and the reason for closing the account. If you have any outstanding balances or positions, you will need to provide instructions on how to settle them. Furthermore, you may need to provide tax-related documents, such as your Social Insurance Number (SIN) or Individual Tax Number (ITN), to ensure that any tax obligations are met. It is also recommended to review your account statements and confirm that all transactions are accurate and up-to-date before submitting your closure request. By providing the required documentation and information, you can ensure that your Questrade account is closed efficiently and without any issues.

Understanding the Timeline for Account Closure

When navigating the Questrade account closure steps, it's essential to understand the timeline involved in the process. The account closure process typically takes around 10 to 15 business days to complete, but this timeframe may vary depending on the complexity of the account and the speed at which you respond to any requests for additional information. Once you initiate the account closure process, Questrade will begin to settle any outstanding trades and transfer any remaining funds to your bank account. You can expect to receive a confirmation email from Questrade once the account closure process is complete, and you can also check the status of your account closure by logging into your Questrade account online or contacting their customer support team. It's also important to note that you may be required to pay any outstanding fees or penalties associated with your account before it can be closed. Additionally, if you have any open positions or outstanding trades, you may need to close these before your account can be closed. Overall, understanding the timeline for account closure can help you plan and prepare for the process, ensuring a smooth and efficient experience.

Post-Closure Considerations and Next Steps

When closing a Questrade account, it's essential to consider the next steps to ensure a smooth transition of your investments. One crucial aspect is transferring funds to another brokerage or bank, which can be a straightforward process if done correctly. Additionally, understanding any potential fees or penalties associated with closing your account is vital to avoid any unexpected charges. In some cases, you may need to reactivate a closed Questrade account, which can be done with minimal hassle. By being aware of these post-closure considerations, you can make informed decisions about your investments and avoid any potential pitfalls. In this article, we will explore these topics in more detail, starting with the process of transferring funds to another brokerage or bank.

Transferring Funds to Another Brokerage or Bank

Transferring funds to another brokerage or bank is a crucial step after closing your Questrade account. To initiate the transfer, you will need to provide Questrade with the details of the recipient account, including the account number, institution number, and transit number. You can do this by logging into your Questrade account and navigating to the "Funding" or "Transfers" section. From there, you can select the option to transfer funds to another brokerage or bank and enter the required information. Alternatively, you can contact Questrade's customer support team to assist you with the transfer process. It's essential to ensure that the recipient account is in the same name as the Questrade account to avoid any potential delays or issues. Once the transfer is initiated, the funds will typically be processed within 1-3 business days, depending on the recipient institution's processing times. It's also important to note that some institutions may have specific requirements or restrictions for receiving transferred funds, so it's a good idea to check with the recipient institution beforehand to confirm their policies. By following these steps, you can successfully transfer your funds to another brokerage or bank after closing your Questrade account.

Understanding Any Potential Fees or Penalties

When closing a Questrade account, it's essential to understand any potential fees or penalties associated with the process. Questrade charges a $25 fee for closing a registered account, such as a TFSA or RRSP, while non-registered accounts are closed free of charge. Additionally, if you have any outstanding margin balances or short positions, you may be subject to interest charges or penalties until these are settled. Furthermore, if you have any open orders or pending transactions, these may be subject to cancellation fees or other penalties. It's also important to note that closing an account may trigger tax implications, such as capital gains or losses, which could result in additional fees or penalties. To avoid any unexpected fees, it's recommended to review your account activity and settle any outstanding balances before initiating the closure process. By understanding these potential fees and penalties, you can ensure a smooth and cost-effective account closure experience.

Reactivating a Closed Questrade Account if Needed

If you need to reactivate a closed Questrade account, you can do so by contacting Questrade's customer support team. They will guide you through the process and let you know what information and documentation are required to complete the reactivation. Please note that reactivating a closed account may take some time, and you may be required to update your account information and complete any outstanding tasks or requirements before the account can be reopened. Additionally, keep in mind that reactivating a closed account may also trigger a review of your account activity and trading history, which could potentially lead to changes in your account status or trading permissions. It's essential to carefully consider your decision to reactivate a closed account and ensure you understand any potential implications or consequences before proceeding.