How To Transfer Property Title To Family Member In Ontario

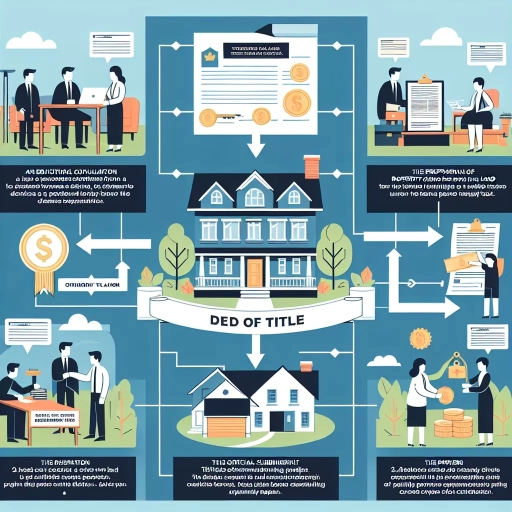

Transferring property title to a family member in Ontario can be a complex and time-consuming process, but it's a crucial step in ensuring the smooth transition of ownership. Whether you're looking to transfer a property to a child, spouse, or other family member, it's essential to understand the process and requirements involved. To successfully transfer property title, you'll need to prepare for the transfer by gathering necessary documents and information, execute the transfer by completing the transfer deed and other legal documents, and register the transfer with the Land Titles Office. Additionally, you'll need to notify relevant parties and update records to finalize the transfer. In this article, we'll delve into the details of each step, starting with Understanding the Process of Transferring Property Title in Ontario.

Understanding the Process of Transferring Property Title in Ontario

When it comes to buying or selling a property in Ontario, understanding the process of transferring property title is crucial. The process involves several key steps and requires the involvement of various parties, including the buyer, seller, and the Land Titles Office. In this article, we will delve into the intricacies of property title transfer in Ontario, exploring the role of the Land Titles Office, the different types of property ownership, and the importance of a property title. We will begin by examining what a property title is and why it is essential in the property transfer process. (Note: The answer should be 200 words)

What is a Property Title and Why is it Important?

A property title, also known as a deed, is a legal document that proves ownership of a property. It is a crucial document that outlines the property's description, location, and the owner's rights and interests. The title is typically held by the property owner, and it serves as proof of their ownership and entitlement to the property. In Ontario, property titles are registered with the Ontario Land Titles Office, which maintains a record of all property titles in the province. The title is important because it provides a clear and public record of property ownership, which helps to prevent disputes and ensures that the property can be bought, sold, or transferred smoothly. Additionally, a property title is required to obtain a mortgage, as lenders need to verify the property's ownership and value before approving a loan. Overall, a property title is a vital document that plays a critical role in the buying, selling, and transferring of properties in Ontario.

The Role of the Land Titles Office in Ontario

The Land Titles Office in Ontario plays a crucial role in the process of transferring property title to a family member. The office is responsible for maintaining accurate and up-to-date records of all land ownership in the province, including property titles, deeds, and other relevant documents. When a property owner decides to transfer their title to a family member, the Land Titles Office is involved in verifying the ownership and ensuring that the transfer is legitimate and compliant with Ontario's land registration laws. The office reviews the transfer documents, including the deed and any other supporting documents, to ensure that they meet the required standards and that the transfer is properly executed. Once the transfer is approved, the Land Titles Office updates the property title records to reflect the new ownership, providing a secure and public record of the transfer. This process helps to prevent errors, disputes, and potential fraud, and provides a clear and transparent record of property ownership in Ontario. By verifying the ownership and ensuring compliance with land registration laws, the Land Titles Office plays a vital role in facilitating the smooth transfer of property title to family members, while also protecting the interests of all parties involved.

Types of Property Ownership in Ontario

In Ontario, there are several types of property ownership, each with its own set of rights and responsibilities. The most common types of property ownership are sole ownership, joint tenancy, and tenancy in common. Sole ownership occurs when one person owns the property outright, giving them complete control and decision-making authority. Joint tenancy, on the other hand, involves two or more people owning the property together, with each owner having an undivided interest in the property. This type of ownership is often used by spouses or common-law partners, as it allows for the automatic transfer of ownership to the remaining owner(s) upon the death of one owner. Tenancy in common is similar to joint tenancy, but each owner has a separate and distinct share of the property, which can be unequal in size. This type of ownership is often used by friends or family members who want to co-own a property. Other types of property ownership in Ontario include life estate, where one person has the right to use the property for their lifetime, and trust ownership, where a trustee holds the property on behalf of a beneficiary. Understanding the type of property ownership is crucial when transferring property title to a family member, as it can affect the transfer process and the rights of the new owner.

Preparing for the Transfer of Property Title to a Family Member

When it comes to transferring property title to a family member, it's essential to approach the process with careful consideration and thorough preparation. This significant transaction involves not only the transfer of ownership but also various tax implications and legal requirements. To ensure a smooth transfer, it's crucial to gather all required documents and information, assess the value of the property for tax purposes, and consider the implications of capital gains tax. By understanding these key aspects, you can navigate the process with confidence and avoid potential pitfalls. In this article, we'll delve into the essential steps involved in preparing for the transfer of property title to a family member, starting with the critical task of gathering required documents and information.

Gathering Required Documents and Information

When preparing to transfer property title to a family member in Ontario, gathering the required documents and information is a crucial step. To initiate the process, you will need to collect various documents, including the current property deed, which is the original document that proves ownership of the property. Additionally, you will need to obtain a copy of the property survey or a sketch of the property, which will help identify the property boundaries and any easements or restrictions. You will also require identification documents, such as a valid passport, driver's license, or Ontario health card, to verify the identity of the transferor and transferee. Furthermore, you may need to provide proof of the family relationship, such as a birth or marriage certificate, to establish the familial connection. It is also essential to gather information about any outstanding mortgages, liens, or other encumbrances on the property, as these will need to be addressed as part of the transfer process. You may need to contact your lender or a title search company to obtain this information. Finally, you will need to determine the type of transfer you want to make, such as a gift or a sale, and gather any relevant documentation, such as a gift letter or a purchase agreement. By collecting and organizing these documents and information, you can ensure a smooth and efficient transfer of property title to your family member.

Assessing the Value of the Property for Tax Purposes

When assessing the value of a property for tax purposes, several factors come into play. The primary goal is to determine the property's fair market value, which is the price it would sell for on the open market. This value is crucial in calculating property taxes, as it directly affects the amount of taxes owed. In Ontario, the Municipal Property Assessment Corporation (MPAC) is responsible for assessing property values. MPAC considers various factors, including the property's location, size, age, and condition, as well as recent sales of similar properties in the area. The assessment is typically conducted every four years, but property owners can request a reassessment if they believe their property's value has changed significantly. It's essential to note that the assessed value may not always reflect the property's actual market value, as it's based on a specific point in time. Property owners can appeal their assessment if they disagree with the value, but it's crucial to understand the process and provide supporting evidence to build a strong case. By accurately assessing the property's value, property owners can ensure they're paying the correct amount of taxes and avoid potential penalties or disputes.

Considering the Implications of Capital Gains Tax

When considering the transfer of property title to a family member in Ontario, it's essential to think about the implications of capital gains tax. This tax is levied on the profit made from the sale of a property, and it can significantly impact the financial situation of the transferor. In Ontario, the capital gains tax rate ranges from 14.02% to 26.76%, depending on the individual's income tax bracket. If the property has appreciated significantly in value since its initial purchase, the capital gains tax liability could be substantial. For instance, if a parent transfers a property worth $1 million to their child, and the property was originally purchased for $500,000, the capital gain would be $500,000. Assuming a 20% capital gains tax rate, the tax liability would be $100,000. This amount would need to be paid by the transferor, which could be a significant financial burden. Furthermore, if the transferor is not a resident of Canada, they may be subject to a 25% withholding tax on the capital gain, which could further increase the tax liability. Therefore, it's crucial to consider the implications of capital gains tax when transferring property title to a family member in Ontario, and to seek professional advice to minimize the tax burden.

Executing the Transfer of Property Title to a Family Member

Completing the Transfer Deed and Other Legal Documents

Registering the Transfer with the Land Titles Office

Notifying Relevant Parties and Updating Records

Here is the introduction paragraph. Transferring property title to a family member can be a complex process, but with the right guidance, it can be done efficiently and effectively. To ensure a smooth transfer, it is essential to complete the transfer deed and other legal documents accurately, register the transfer with the Land Titles Office, and notify relevant parties and update records accordingly. By following these steps, you can ensure that the transfer of property title to a family member is done correctly and without any issues. In this article, we will explore the process of executing the transfer of property title to a family member, including completing the transfer deed and other legal documents, registering the transfer with the Land Titles Office, and notifying relevant parties and updating records. Here is the 200 words supporting paragraph for Completing the Transfer Deed and Other Legal Documents Completing the transfer deed and other legal documents is a crucial step in the process of transferring property title to a family member. The transfer deed, also known as a deed of gift or a quitclaim deed, is a legal document that transfers ownership of the property from the current owner to the family member. It is essential to ensure that the transfer deed is completed accurately and includes all the necessary information, such as the names of the parties involved, the property description, and the consideration (if any). Additionally, other legal documents, such as a title search and a survey, may be required to ensure that the transfer is valid and that there are no unexpected issues with the property. It is recommended that you consult with a real estate attorney or a title company to ensure that all the necessary documents are completed correctly and that the transfer is done in accordance with the laws of your state. By completing the transfer deed and other legal documents accurately, you can ensure that the transfer of property title to a family member is done correctly and without any issues. Here is the 200 words supporting paragraph for Registering the Transfer with the Land Titles Office Registering the transfer with the Land Titles Office is an essential step in the process of transferring property title to a family member. The Land Titles Office is responsible for maintaining records of all property transactions, including transfers of ownership. To register the transfer, you will need to submit the completed transfer deed and other required documents, such as a title search and a survey, to the Land Titles Office. The office will review the documents to ensure that they are accurate and complete, and that the transfer is valid. Once the transfer is registered, the Land Titles Office will update its records to reflect the

Completing the Transfer Deed and Other Legal Documents

Registering the Transfer with the Land Titles Office

Notifying Relevant Parties and Updating Records

Completing the Transfer Deed and Other Legal Documents is a crucial step in the process of transferring property title to a family member in Ontario. This involves preparing and executing the necessary legal documents, including the transfer deed, to ensure a smooth and legally binding transfer of ownership. The transfer deed is a critical document that outlines the terms of the transfer, including the names of the transferor and transferee, the property description, and any conditions or restrictions. It is essential to work with a lawyer or notary public to ensure that the transfer deed and other legal documents are prepared correctly and in compliance with Ontario's laws and regulations. Additionally, other legal documents, such as a will or trust, may need to be updated to reflect the change in ownership. By completing the transfer deed and other legal documents, you can ensure that the transfer of property title to a family member is done efficiently and effectively.

Completing the Transfer Deed and Other Legal Documents

Completing the transfer deed and other legal documents is a crucial step in executing the transfer of property title to a family member in Ontario. The transfer deed, also known as a deed of gift or a quitclaim deed, is a legal document that transfers ownership of the property from the grantor (the current owner) to the grantee (the family member). The deed must be in writing, signed by the grantor, and witnessed by two individuals who are not related to the grantor or grantee. The deed should include the property's legal description, the grantor's and grantee's names and addresses, and a statement indicating that the property is being transferred as a gift or for a specific consideration. In addition to the transfer deed, other legal documents may be required, such as a statement of value, a certificate of independent legal advice, and a spousal consent, if applicable. It is essential to consult with a lawyer to ensure that all necessary documents are prepared and executed correctly to avoid any potential issues or disputes. Once the documents are complete, they must be registered with the Land Titles Office to update the property's title and reflect the change in ownership.

Registering the Transfer with the Land Titles Office

Registering the transfer with the Land Titles Office is a crucial step in the process of transferring property title to a family member in Ontario. This involves submitting the completed transfer deed, along with other required documents, to the Land Titles Office for registration. The registration process typically takes several weeks to complete, during which time the office will verify the information provided and ensure that the transfer is valid. Once the transfer is registered, the new owner's name will be updated on the property title, and they will receive a new title document. It is essential to note that registration fees and taxes may apply, and it is recommended that you consult with a lawyer or real estate professional to ensure that all necessary steps are taken to complete the registration process successfully. Additionally, it is crucial to keep records of the transfer, including the registration documents and any correspondence with the Land Titles Office, as these may be required in the future. By registering the transfer with the Land Titles Office, you can ensure that the property title is updated accurately and that the new owner's rights are protected.