How To Switch Banks

Why Switching Banks Might be Beneficial

Understanding Your Current Financial Situation

The first step in any major financial decision is always to evaluate your current situation. In the case of bank switching, this involves considering the type of banking services you use most frequently, the fees you currently pay, and the level of customer service you receive. If you find that you're dissatisfied with any of these elements, it might be time to switch banks. Be sure to consider not only your immediate needs but also your long-term financial goals. For example, if you're planning to buy a house in the next few years, you may want to choose a bank that offers competitive mortgage rates.

Comparing Other Banks' Offerings

Once you have a clear understanding of your current financial situation, it's time to compare other banks' offerings. There are many comparison tools online that can help streamline this process. Consider features like interest rates, account fees, ATM access, and mobile & online banking capabilities. Additionally, look at each bank's customer satisfaction ratings to get a sense of how they treat their customers. Remember that switching banks can be a hassle, so ensure you're moving to a bank that you can stick with for the long term.

Consider the Convenience

The convenience of a bank can often be overlooked but is crucial. It includes the availability of physical branches or ATMs, the quality of online and mobile banking services, and the responsiveness of their customer service department. Additionally, some people prefer the personal touch offered by smaller banks and credit unions. It’s vital to consider what type of banking experience works best for you.

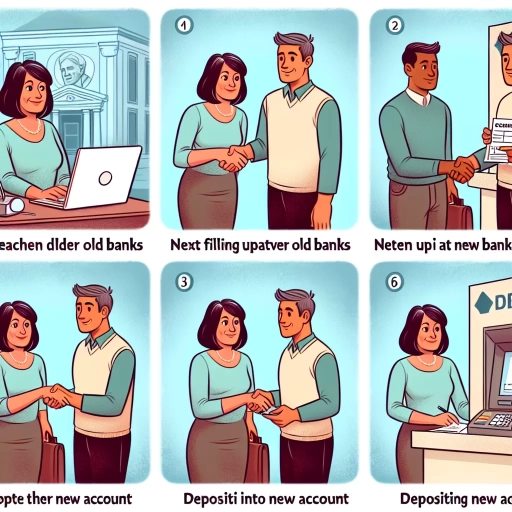

The Steps to Switch Banks Effectively

Open a New Account

The first and most straightforward step in switching banks is to open a new account at your chosen bank. It's usually free, and in many cases, you can open an account online. Be sure to understand any minimum deposit requirements or ongoing balance requirements to avoid any unforeseen fees. Many banks also offer sign-up bonuses to new customers, which can be a nice financial perk.

Transition Your Transactions

After opening your new account, the next step is to start transitioning your transactions. This includes setting up direct deposits, automatic bill payments, and transferring any recurring transfers. While this can be a tedious process, it's crucial to ensure that you don't miss any payments or incur any late fees. Check with both your old and new bank to see if they offer any switch kits or services to help expedite this process.

Close Your Old Account

Once all your transactions have been moved over to your new bank, you can start the process of closing your old account. Be sure to check that all checks and scheduled payments have cleared before you do this. Also, watch out for any closing fees or charges your old bank might impose. In some cases, it's a good idea to leave the old account open for a month or so to ensure all transactions have been successfully shifted.

Tips for a Smooth Bank Switching Experience

Be Patient and Organized

Switching banks can be a tedious and often complex process. However, being organized can make the transition much smoother. Keep all your banking information and documents in one place and make a checklist of all the things you need to do. Additionally, remember that the process can take several weeks, so it’s important to be patient.

Minimize Banking Disruptions

One of the keys to a successful bank switch is ensuring minimal disruption to your day-to-day banking activities. This means setting up your direct deposits and automatic payments with your new bank as soon as possible. Additionally, make sure you have enough funds in your old account to cover any transactions that might still come through.

Clarify All Doubts with the New Bank

Before completely switching, ensure that you fully understand all the terms and conditions associated with your new bank account. If you have any questions or doubts, don’t hesitate to get in touch with their customer service. A thorough understanding of your new bank account can avoid any unpleasant surprises down the road.