The Complete Guide of the Dalasi

Follow Dalasi Forecast March 20, 2024

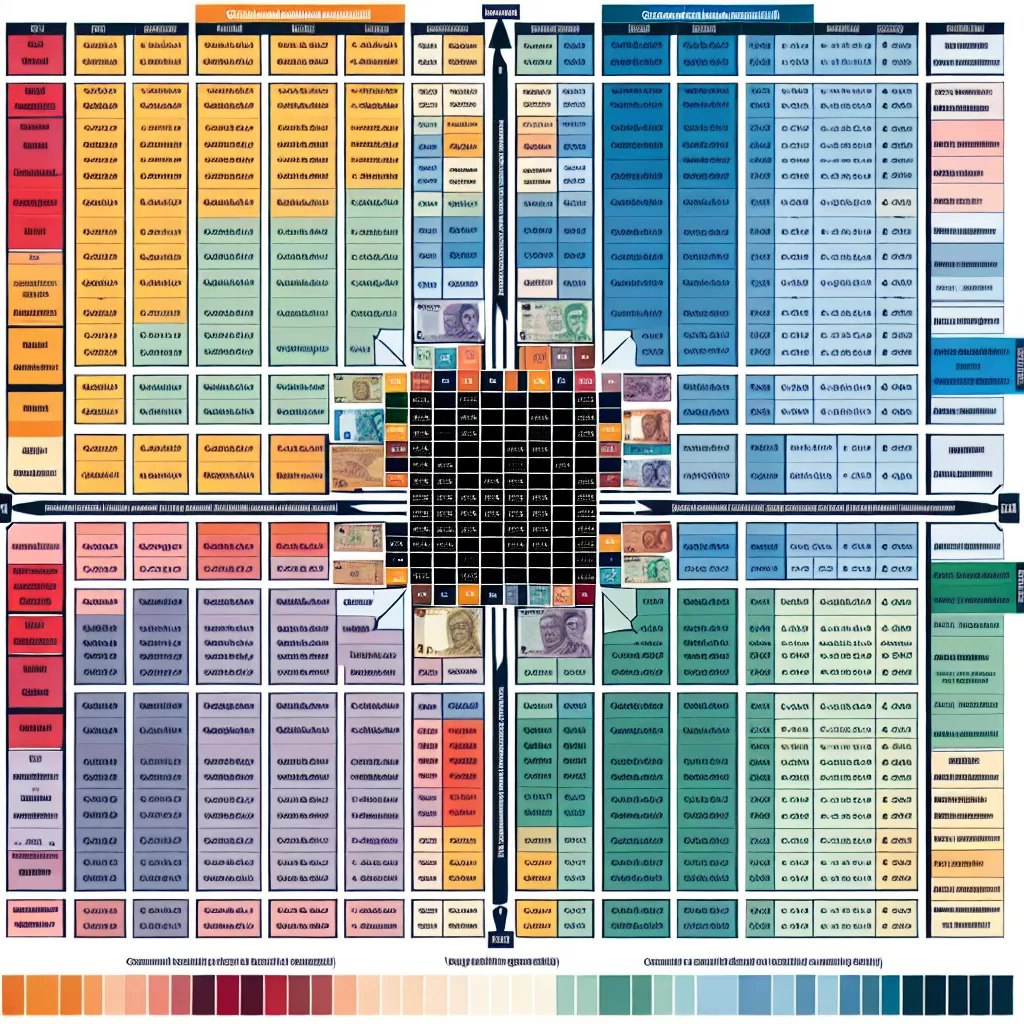

Current Middle Market Exchange Rate

Prediction Not for Invesment, Informational Purposes Only

2024-03-19

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-18

Summary of Last Month

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-17

Summary of Last Week

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-16

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-15

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-14

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-13

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

Where to purchase Dalasi?

Recent News

2024-03-13

2024-03-12

Everything You Need to Know About Dalasi

The **Dalasi** is a significant element within a much larger conversation regarding global currency, economic power, and historical influence. Introduced in 1971 as the official currency of the Gambia, it has played a central role in shaping the nation's economic destiny. The currency, which replaced the former Gambian pound, also exemplifies the Gambia's transition from a British colony to a sovereign nation. Understanding the Dalasi's evolution offers profound insights into not just its socio-economic landscape, but also Gambia's dynamic interaction with the world economy. Inflation, monetary policy, and other financial factors further underscore its importance. The Dalasi not only facilitates financial transactions; it tells a compelling story of a nation's strive, survival, and ambition in a complex, competitive global marketplace. Comprehending the Dalasi's journey from inception to the present day, its design transformations, economic implications, and crucial role in impacting Gambia's socio-economic fabric could widen your understanding of global economic interdependencies and the power play of currencies. Be prepared to delve into the intriguing world of the Dalasi—where history, economics, and currency converge and contour the fascinating scenery of Gambia's monetary narrative.

Correlation Coefficient of Dalasi with Other Currencies

The **Dalasi** is the national currency of The Gambia, a small country located in West Africa. NEstablished in 1971, it replaced the British West African pound at a rate of 1 Dalasi = 5 shillings. At its introduction, it was on par with the British pound, but in the years since, its value has fluctuated significantly due to various economic conditions and governmental policies. The `Correlation Coefficient of Dalasi with Other Currencies` offers a statistical measure of the degree to which changes to the value of the Dalasi correspond to fluctuations in other global currencies. Given the interconnectedness of today's global finance markets, understanding these relationships is crucial to both macroeconomic policy-making and micro-level financial decisions. It also factors into understandings of bilateral trade between The Gambia and its international trading partners. With these correlations at hand, it's possible to provide precise and science-based predictions about the future trajectory of the Dalasi. Together, these insights may serve as a robust analytical tool in understanding the past, present, and future financial dynamics of The Gambia and the global economy at large.

Understanding the Dalasi's Value in the Global Market

The Dalasi (GMD), the official currency of Gambia, plays a considerable role in its national economy. Like many currencies on the other side of the Atlantic, the Dalasi's value has fluctuated in the global market, largely attributed to economic factors such as inflation, changes in monetary policy, and the country's overall economic stability. The Dalasi, introduced in 1971, was created to replace the British West African pound and to solidify Gambia's identity as a nation. The design of the Dalasi's notes and coins reflects this, showcasing the country's national heritage and symbols. The Dalasi underwent re-denomination in 2015 in response to inflation, a typical move seen across multiple economies while addressing currency value depreciation. Like other African currencies, the Dalasi's value is significantly influenced by external commodity price shocks and internal vulnerabilities. Additionally, the Gambia's economy heavily relies on tourism, a sector sensitive to global events. Therefore, these factors contribute significantly to the fluctuating value of the Dalasi in the global market. Monetary policy, another element in determining the Dalasi's value, is controlled by the Central Bank of Gambia. In response to economic indicators such as inflation, the Bank can adjust monetary policy, influencing exchange rates and, hence, the international standing of the Dalasi. However, a high level of inflation, often seen in Gambian history, leads to depreciation and consequentially a lower value of the Dalasi in the international market. Understanding the fluctuating nature of the Dalasi's value can provide an interesting insight into the effects of national and global economic events on small, tourism-dependent economies. The future value of the Dalasi in the global market will likely continue to weave a complex tapestry, highlighting the interplay between domestic monetary policy, external global influences, and local economic realities. Notwithstanding its ups and downs, the Dalasi undeniably remains an embodiment of the Gambia's economic resilience.

Comparative Analysis of Dalasi and Major World Currencies

The **Dalasi** is the official currency of the Gambia, a relatively small country in West Africa. Commissioned in 1971, it replaced the Gambian pound at a ratio of 1 pound to 5 dalasis. As a decimal currency, the dalasi is subdivided into 100 bututs — similar to how dollars divide into cents or pounds divide into pennies. Over the past decades, the value of the Dalasi has seen a substantial decline when assessed against major world currencies like the **Euro**, **Dollar**, and **Pound**. There are many contributing factors, primarily the inflation rate, foreign exchange policies, global economic conditions, and Gambia's economic performance. Inflation involves the increase in prices and fall in the purchasing power of money, a phenomenon unfortunately prevalent with the Dalasi. Currently, the Gambia has a high inflation rate, which naturally devalues the Dalasi locally and globally. Notably, the Gambia lacks significant endowment of natural resources. It heavily relies on agriculture, with about 75% of the population dependent on crops like peanuts, millet, and maize for livelihood. The nation is largely reliant on imports for essentials such as food oils, machinery, and manufacturing goods; this vast import dependence contributes to the trade deficit, further pressuring the Dalasi. Comparatively, major world currencies like the **US Dollar**, **British Pound**, and **Euro** are backed by thriving economies with diversified sectors including manufacturing, technology, finance, service sectors and are not as greatly impacted by individual commodity fluctuations. These economies exercise advanced monetary policies, have lower inflation rates, and maintain healthier trade balances – adding to their currencies' strength. These currencies, particularly the Dollar and Euro, serve as reservable currencies worldwide, further enhancing their value against smaller currencies such as the Dalasi. A comparative analysis between the Dalasi and major world currencies showcases the complexities of the _global forex markets_. It highlights the influence of economic fundamentals like inflation, national income, economic health, and political stability on currency strength. It also serves as a macroeconomic preview of the intertwined relationship between local economic performance and global currency markets. Though the Dalasi has seen consistent decline over the years, strategic policies geared towards improving economic conditions, promoting foreign investments, reducing inflation, and diversifying the economy can lead to an uptick in its inherent and comparative strength. In conclusion, this analysis is a clear demonstration of how economic indicators and policies can play significant roles in the valuing or devaluing of a nation's currency against the world's major currencies. It is a testament to the depth and breadth of influence that economics holds in the interconnected world of international finance.

Trends Impacting the Relationship of Dalasi with Other Currencies

As an expert on global currencies, it is fascinating to observe the factors influencing the currency exchange rates, particularly the complex market dynamics reflected in the Dalasi, the official currency of Gambia. One main trend that impacts the conversion value of Dalasi, like other currencies, is economic stability. For instance, fluctuations in interest rates will directly influence the strength of the Dalasi. If Gambia boasts strong economic growth and stable interest rates, investors are more likely to commit their funds, strengthening the Dalasi in turn. However, political stability too plays a crucial role. Uncertainty or political turmoil tend to dissuade overseas investors, leading to a drop in the value of the Dalasi. Hence, a stable and transparent government can bolster the currency's strength. Trade balance - the difference between country's exports and imports - is another factor that impacts the Dalasi. If Gambia’s exports exceed its imports (a trade surplus), the Dalasi typically strengthens. Inflation is an additional and significant variable affecting Dalasi's value. Elevated inflation diminishes purchasing power and erodes the value of the Dalasi versus other currencies. Lastly, speculations and market predictions tend to impact foreign exchange rates, including the Dalasi. Currency markets are influenced by traders who speculate on the rise or fall in currency values based on global economic trends, geopolitical events, or economic indicators. It is interesting to note that the global economy's interconnected and interdependent nature implies that these trends are not isolated in their effects. Events in one part of the world can ripple across to others resulting in a butterfly effect, thereby influencing the Dalasi's strength. A deeper understanding of these factors, careful monitoring of the economic climate, and sound financial forecasting can help navigate the complexities inherent in currency exchange rates, specifically in relation to the Dalasi. In summary, the value and strength of the Dalasi in relation to other global currencies are influenced by a variety of interconnected factors from inflation rates and economic stability to political conditions and trade balance. Understanding these multifaceted influences is key in predicting and taking advantage of the shifting currency market. Tracking these trends can provide valuable insights into the future movements of the Dalasi and bolster one’s currency strategies.

Exploring the Correlation Coefficient between Natural Resources and the Dalasi

The **Dalasi**, as the official currency of Gambia, holds a unique position in the African economic landscape. Gambia's natural resource wealth has long been a significant determinant of the strength and stability of the Dalasi. This article explores the complex correlation between Gambia's natural resource extraction and the value of the Dalasi. Specifically, it seeks to determine the nature of the correlation coefficient between these two economic variables and to understand the key driving forces behind this correlation. It analyses resource-export data, foreign exchange rates, and domestic economic health indicators to examine the historical data and trends. A principal question underlies this research: "*Does an increase in natural resource exports, a sign of economic health, invariably lead to strengthening of the Dalasi?*" On the one hand, excelling in natural resource production and exports could lead to an influx of foreign currency, thereby bolstering the Dalasi. Conversely, overreliance on natural resources could make the economy vulnerable to global market shocks and pressurize the Dalasi. Through this examination, we will give stakeholders insight into the workings of Gambia's economy and provide tools for policy-making and financial market predictions.

Understanding the Dalasi: Gambia's Official Currency

The Dalasi (GMD) is the official currency of the Gambia, a small West African nation. The **dalasi** was introduced in 1971, replacing the Gambia Pound at a rate of 1 pound = 5 dalasi, to signify the country's break from its colonial past and affirm its independent economic identity. The dalasi is divided into 100 bututs, the Gambian equivalent of cents in the U.S. dollar. Until 1971, the Gambia used British currency but subsequently, when the dalasi was issued, the _Gambia Currency Board_ was responsible for the manufacture and distribution. In '72, the _Central Bank of Gambia_ took over these responsibilities. When it comes to design, the dalasi notes venerate the country's rich history and diverse culture. The currency [gambian dalasi notes](https://upload.wikimedia.org/wikipedia/commons/a/a7/Gambia_-_50_Dalasis_%282015_issue%29.jpg) depicts notable national symbols and figures whose contributions have helped shape the country. These include former freedom fighters, traditional musical instruments, wildlife, and representations of the country's agricultural sector. In the Gambia economy, the dalasi's value fluctuates often due, in part, to the country's reliance on imports. The Gambian economy is heavily dependent on importation of goods and services which can lead to **foreign exchange shortages** and put downward pressure on the currency. The economic challenges of the Gambia significantly impact the value of the dalasi against other currencies, with the effects often felt by the average Gambian citizen through rising prices and inflation. Additionally, there's a historical pattern of **inflation** in the Gambian economy. Inflation can steadily erode a currency’s value over time, reducing people's purchasing power and impacting living standards. Recognizing the potential damage, the government and the Central Bank of Gambia have implemented various monetary and fiscal policies to try to maintain stability and improve the dalasi's value. In conclusion, understanding the dalasi not only throws light on Gambia's economic dynamics but also helps to unravel its past struggles and its aspirations for the future. The country's economic fortunes are inexplicably linked to the performance of its national currency. Thus, a focus on improving the dalasi's strength and stability is an integral part of the country's socioeconomic development plan.

Natural Resources in Gambia: Their Impact on the Dalasi

Gambia, a relatively minuscule country located in West Africa, is flush with a variety of natural resources that significantly influence its economic stance, as reflected by the performance of its currency, the Dalasi. **Economic Value of Natural Resources** The Gambia's economy is primarily agricultural, with nearly 75% of the populace involved in farming activities such as rearing livestock, fishing, and crop cultivation. Predominantly, these natural resources add appreciable value to the country's Gross Domestic Product (GDP) and in turn, impact the Dalasi. The revenue generated from exporting goods like peanuts, fish, and cotton adds to the national income and strengthens the currency. **Impact of Seasonality** Additionally, the seasonal nature of these agricultural resources importantly affects the Dalasi. During abundant harvests, when these resources are plentiful, there is likely to be an economic boom, resulting in the strengthening of the Dalasi. However, during off-peak seasons when production is reduced, there may be an economic slowdown causing the Dalasi to weaken. **Role of Inflation** Inflation is another critical factor affecting the value of the Dalasi. Gambia’s dependence on imported goods often results in a trade deficit. In an inflationary environment, the cost of these imports rises, causing the Dalasi to depreciate. However, a robust agricultural sector can help offset this by increasing exports and reducing reliance on foreign goods. **Effect of Tourism** Aside from traditional agricultural resources, the Gambia's scenic beauty and diverse wildlife have made it a burgeoning tourist destination. This tourism sector generates significant foreign exchange earnings, contributing to the strengthening of the Dalasi. To conclude, the economic performance of Gambia, as mirrored by the Dalasi, hinges heavily upon its natural resources. Variations in agricultural production cycles, inflation, and the performance of the tourism sector crucially determine the valuation of the Dalasi. It is therefore pivotal for Gambia to optimally exploit and manage its natural resources to ensure a stable and robust economy. By adopting sustainable practices and diversifying its economy, Gambia can build a solid foundation for a strong Dalasi.

Statistical Analysis: The Link between Gambia's Natural Resources and the Dalasi

The Gambia, a small West African nation, has a rich assortment of natural resources, with a diverse economy primarily pivoted on agriculture, tourism, and remittances. One striking feature of this vibrant nation is its currency, the Dalasi (GMD), whose performance is intrinsically tied with Gambia's natural resources. Most notably, the **Agricultural sector** significantly affects the value of the Dalasi. A large portion of Gambia's economy is made up of farming, which includes the cultivation of rice, maize, millet, sorghum, and peanuts. Additionally, the country is well-known for its fishing and livestock farming. The healthier the output from these natural resources, the stronger the Dalasi's value becomes in the international exchange market. This principle is because these agricultural outputs lead to exports which bring foreign currency into the Gambia. As export rates increase, the demand for Dalasi also increases, thus bolstering its value. Tourism, another key player in the Gambian economy, is largely driven by the country's enthralling natural beauty and abundant wildlife — a treasured natural resource. The **tourism industry** attracts plentiful foreign currency. When the tourism sector thrives, it injects a considerable amount of Forex into the Gambian economy, leading to a heightened demand for the Dalasi and subsequently, its rise in value. Aside from these, Gambia's remittances also significantly influence the Dalasi. Many Gambians work abroad and send back home remittances in foreign currency. This stimulates demand for the Dalasi, enhancing its value while buffering it against potential currency instability. However, given that the value of the Dalasi is volatility, a bountiful supply of these natural resources alone does not entirely pronounce a strong Dalasi. Several factors can diminish their positive influence, such as the **inflation rate**, economic policy, and political stability. For the Dalasi to maintain or gain value, the nation has to keep inflationary pressures in check, adopt sound economic policies, and ensure political stability. In conclusion, it is evident that Gambia's natural resources — from its fertile lands to its mesmerizing wildlife — play a crucial role in the value of the Dalasi. However, they do not operate in isolation; a harmony of various other aspects such as well-tuned fiscal policies and economic stability is necessary to strengthen the currency. The intricate dance between these factors underscores the importance of a wholesome approach to managing the Gambian economy and the Dalasi.

The Global Impact of the Dalasi

The **Dalasi**, the official currency of the Gambia, plays a substantial role in the global economy. Since its emergence in 1971, it has demonstrated a rich history of economic ups-and-downs, revealing its impact not only within its borders but also on international trade. The structure and the design of the Dalasi lend interesting insights into the culture, progress, and economic potency of the Gambia, tracing the footprints of their economy through the lens of historical developments and policies backed by the Central Bank of The Gambia. Understanding the economic intricacies of the Dalasi provides a broader picture of Gambian fiscal policy, its reaction to inflation, and its efforts in maintaining a balanced economy. Providing a deep dive into this topic offers a richer understanding of not just the Dalasi, but also the interplay between currency, economics, and history in a global context. The exploration of the Dalasi's impact within the global economic infrastructure helps us appreciate the unique inter-dependencies within international monetary systems and provides a distinct lens through which the dynamics of global finances can be studied.

The Dalasi: Understanding Its History and Value

The **Dalasi** is the official currency of The Gambia, a small West African country, and has been in circulation since 1971, replacing the British West African pound. The decision to shift away from colonial-era currency was intended to solidify national identity and gain monetary independence. The Gambia's independent central bank, aptly named the [Central Bank of The Gambia](https://www.cbg.gm/), was established in 1971 and given the sole authority to issue the Dalasi and control monetary policy. The original denominations were in 1, 5, 10, 25, and 50 butai coins, and 1, 5, 10, and 100 Dalasi banknotes. Today, a variety of coin and banknote denominations exist which make this currency flexible and adaptable for the everyday needs of Gambian citizens. Given The Gambia's economic structure, the Dalasi's value is vulnerable to global economic shifts, especially changes in global commodity prices, as The Gambia relies heavily on groundnut (peanut) exports. It's important to mention that the dalasi is also subject to the monetary policy decisions made by the Central Bank of The Gambia, with inflation control being a key concern, as in any economy. Inflation can be both a symptom and a catalyst of economic instability. In scenarios where inflation is high, the purchasing power of the Dalasi decreases, meaning people cannot buy as much with the same amount of money. As a result, high inflation can reduce people's real income and reduce the standard of living. The Central Bank has various tools to manage this, such as influencing interest rates, controlling money supply, and implementing reserve requirements. From a design perspective, the Dalasi reflects the country's culture, history, and values. On the banknotes, you will find images of notable Gambian figures and scenes that depict the nation's rich heritage and its agricultural backbone. This aesthetically significant feature enhances the cultural connection and even pride among the citizens. Hence, the Dalasi is not merely a medium of exchange in The Gambia. It is a symbol of national identity, pride, independence and a tool that, with the right guidance, might contribute significantly to the country's ongoing developmental efforts. As we watch and understand the history and value of the dalasi, it underlines the broader global principle: currencies tie into the heartbeat of nations, affecting not just financial transactions but the very socio-economic fabric of societies.

The Influence of Dalasi on Global Economy

The Dalasi, Gambia's official currency, has had a significant, yet nuanced, impact on the global economy. Since its introduction in 1971, replacing the British West African pound, the Dalasi has served as a symbol of economic independence for this small West African nation, showcasing its unique economic journey. The value of the Dalasi in the international market has fluctuated throughout its history. This can be attributed to factors such as political instability, economic policy changes, and trade balance. For instance, during periods of political uncertainty, the Dalasi has often depreciated against major global currencies like the US dollar and the euro. Conversely, it has sometimes stabilized or appreciated when robust economic reforms were implemented or when external aid flows increased. Through these fluctuations, the Dalasi remains an encapsulating study in how a smaller country's currency can impact the world economic system. Although its influence might not be directly noticeable like those of the United States Dollar, Euro or Chinese Yuan, the Dalasi has indirect global effects. For instance, its relative value can impact the cost competitiveness of Gambia's key exports, such as peanuts, fish, and cotton, thereby affecting global commodity prices to some extent. Moreover, fluctuations in the value of the Dalasi can also indirectly influence foreign direct investment into Gambia, affecting the western economies that invest heavily in the country. Overall, the Dalasi is not just a medium of exchange or a store of value within Gambia; it is a dynamic piece of the larger global economic jigsaw. While its impact may be relatively muted due to Gambia's small size, its influence is still meaningful within its economic sphere of influence, particularly in the context of bilateral trade and investment ties with its major economic partners. In a broader perspective, the Dalasi's story is a compelling tale of how political, economic, and social realities mold the path of a currency. It is a testament to the interconnectedness of the global economy, where a change in a small part can echo across the much larger whole.

The Role of the Dalasi in International Trade

The __Dalasi__ (GMD) has been the official currency of the Gambia, a small West African country since 1971 when it replaced the Gambian pound. It plays a critical role in the country's economy and the broader international trade environment. From an economic standpoint, the Dalasi's value significantly impacts the Gambia's trade balance. When the Dalasi depreciates on the international market, it makes Gambian exports cheaper and therefore more competitive. This attracts international customers, thereby boosting the Gambia's export sector and improving its trade balance. This, however, presents a double-edged sword as it also makes imports more expensive which can lead to inflation and a reduced purchasing power for Gambian consumers. The Central Bank of the Gambia (CBG) plays a vital role in managing the value of the Dalasi. By using monetary policy instruments like open market operations and the reserve requirement, the CBG can influence the supply and demand for the Dalasi, thus controlling its value. This, in turn, can help manage inflation and stabilize the Gambian economy. In the context of international trade, the Dalasi's role extends beyond mere economics. It represents the Gambia's sovereignty and economic independence. When the Gambia decided to implement the Dalasi as its currency in 1971, it marked its economic liberation from the British pound and its associated colonial history. The design of the Dalasi – featuring important historical figures and national symbols – also serves as a medium for cultural expression and national pride. However, the Dalasi's limited international strength and the high dependency on imports present economic challenges for the Gambia. Currency instability and inflation often lead to price spikes and economic uncertainty. This makes fiscal discipline, diversification of the economy and an effective usage of monetary policy instruments necessary to strengthen the Dalasi's value in the future. With its integral role in the national economy and international trade, the journey of the Dalasi reflects both the struggles and potentials of The Gambian economy. In conclusion, the Dalasi plays a multifaceted role in international trade; it is not only an economic tool for trade and monetary policy but also a symbol of national identity and independence. It reflects the Gambia's economic history while also being integral to its future development. With the right strategies and effective policies, the Gambia can harness the potential of the Dalasi to propel its economy towards a more prosperous future.

Economic Development in the Context of Dalasi

The Dalasi, recognized as the official currency of Gambia, plays an integral role in shaping the country's economic landscape. Established in 1971 to replace the British West African pound, the Dalasi has been a symbol of the nation's economic sovereignty and a key tool in the management of its monetary policy. This distinct currency, with its unique design showcasing notable Gambian landmarks and figures, reflects the rich cultural heritage of the nation. The Dalasi's economic influence extends beyond serving as a medium of exchange, as it impacts inflation rates, exchange rates, and overall economic stability. Experience with fluctuating exchange rates and inflation have meant considerable challenges and learning curves for Gambia's monetary authorities. This has resulted in a widening range of interpretations of monetary policy and the effectiveness of policy interventions in response to economic shocks. However, the Dalasi remains central to economic activity, underpinning trade, investment, and fiscal policy. This discussion examines the economic development of Gambia in the context of the Dalasi, exploring how its performance, the monetary policy surrounding it, and the economic ebb and flow shaped by it, contribute to the nation's economic narrative.

Historical Overview of the Dalasi

The **Dalasi** is the official currency of Gambia, a small West African nation. Since its introduction in 1971, it has persistently played a pivotal role in Gambia's economy, serving as a vital tool for commerce and trade. Originally, it replaced the British West African pound, as the Gambia sought to assert its economic independence following its independence from British colonial rule in 1965. The currency consists of both coins and notes, with the breakdown being quite diverse. Coins range from bututs in denominations of 1, 5, 10, 25, 50 to Dalasi coins of D1, D5, D10, D25, D50, D100. Banknotes on the other hand are denominated in D5, D10, D20, D25, D50, D100, and D200. The varied denominations help in facilitating different scales of financial transactions, improving the economy's liquidity and reinforcing economic activities. An important aspect in the economic history of the Dalasi is its fluctuation due to inflation and geopolitical factors. Notably, during periods of political instability and economic downturns, the value of the Dalasi has fallen sharply. On the opposite end, when the Gambian economy has experienced growth, primarily stimulated by tourism and agricultural exports, the Dalasi value has strengthened. Another significant element of this currency is its design, which embodies the rich historical and cultural heritage of Gambia. The coins and notes prominently display the vivid imagery of the nation's fauna, flora, and important landmarks, indicative of Gambia's pride in its unique identity. The Central Bank of the Gambia, the institution that governs monetary policy, has been faced with the complex task of managing the Dalasi value. Efforts to control inflation, stabilize the exchange rate and ensure economic growth are persistent challenges. In conclusion, the Dalasi, as a currency, has experienced a complex journey since its inception but has remained a significant economic symbol for Gambia. It's both a tool for financial transactions and a representation of Gambia's unique identity. Through all its highs and lows, it has been and continues to be the heartbeat of the Gambian economy.

Impact of the Dalasi on Gambia's Economy

The **Dalasi** is the national currency of Gambia, a small West African country. Its introduction dates back to 1971, when it replaced the Gambian pound. Throughout its evolution, the Dalasi has played an instrumental role in shaping Gambia's economy. The currency isn't just a medium of exchange in the country; it also reflects the economic health and stability of Gambia on the global stage. The **value of the Dalasi** has experienced fluctuations over time, which have been influenced by various factors, primarily the state of the economic, political and social landscape in Gambia. For example, during periods of political stability and economic growth, the Dalasi has tended to appreciate, reflecting an increase in investor confidence and improvement in key economic indicators. On the other hand, during periods of economic downturn, political instability or other crises, the Dalasi has tended to depreciate. In terms of **monetary policy**, the Central Bank of Gambia has occasionally intervened in the foreign exchange market in efforts to stabilize the Dalasi. For instance, the bank may take action to soak up excess liquidity or to stimulate economic activities by influencing interest rates. Nonetheless, such interventions have been met with mixed success due to the pervasive structural and macroeconomic challenges that Gambia faces. **Inflation** is another critical aspect that impacts the value of the Dalasi. High inflation rates can erode the purchasing power of the Dalasi, resulting in increased cost of living for the Gambian households. Conversely, low and stable inflation can boost the purchasing power of the Dalasi, encouraging economic growth and prosperity. As such, managing inflation has been a key objective of the Central Bank of Gambia. The **design of the Dalasi** is also worthy of mention. The banknotes and coins feature various symbolic elements that reflect Gambia's history, culture, and natural habitat. This makes the currency not just a medium of exchange, but also a vivid representation of the nation's identity. In summary, the Dalasi continues to play a critical role in Gambia's economy as a barometer of economic health, a tool in monetary policy, and an embodiment of national identity. The Central Bank of Gambia, guided by its mandate, continues to work tirelessly to ensure the stability of the Dalasi, hence promoting economic growth and prosperity for all Gambians.

Future Predictions for the Dalasi in Global Economy

As we stand on the precipice of global economic shifts, the Gambian Dalasi (GMD), the national currency of The Gambia, could potentially play a vital role in the future of world finance. Projections indicate a modest but steady growth over the coming years, buoyed particularly by donor support and recovering tourism. The currency is subject to internal and external economic variables, and understanding these is key to facilitating such projections. Originating from a sub-Saharan West African nation, the Dalasi has survived through various economic upheavals and stringent fiscal policies. The currency was introduced in 1971, replacing the Gambian pound, and continues to circulate in coins and paper notes. The current set of banknotes in circulation illustrating the rich Gambian fauna on the reverse side and local activities on the front serve not only as a symbol of national identity but also as economic indicators. Historically, the Gambian economy has been characterized by low inflation, healthy fiscal deficits, and depreciation of the Dalasi. However, it has progressively improved driven by significant policy adjustments, structural and governance reforms, alongside prudent macroeconomic and financial policies. Given the current global economic forecast, the Dalasi is anticipated to maintain relative stability in the exchange rates and inflation, promoting both local and international business. Undeniably, weather-dependent sectors which contribute substantially to The Gambia's GDP such as agriculture and tourism, significantly influence the valuation and stability of the Dalasi. The periodic fluctuations largely reflect the alternating tourist seasons and climate change impacts on agriculture output. However, the government has introduced measures aimed at diversifying the economy, subsequently reducing its susceptibility to external shocks. In parallel is an ambitious plan to increase domestic revenue mobilization to ensure economic stability. In terms of international trade, the increasing remittances from the Gambian diaspora contribute significantly to the exchange rate dynamics. The Gambian government, in collaboration with international monetary institutions, is improving financial infrastructures and electronic money transfer services to facilitate this cross-border financial flow. Simulation of future trends, using economic and financial modelling, undoubtedly projects positive growth for the Dalasi within the global economy, given the current progressive governmental and fiscal policies. However, these projections are susceptible to unforeseen global economic conditions such as the recent COVID-19 pandemic, which has seen a surge in global economic uncertainties. Nevertheless, the Gambian government has responded proactively with a series of economic contingency plans, stimulus packages and recovery strategies to cushion the economy. These measures have enhanced investors' confidence leading to improved international relations and increased foreign investment, further strengthening the Dalasi's global position. In conclusion, the Dalasi's future holds promise, centered not just on the currency's intrinsic economic impact but largely on The Gambia's growth trajectory. Continual investments in diversifying economic sectors, improving governance, and adopting favorable intercontinental and international trade protocols and policies will gradually strengthen and solidify the Dalasi's future in the global economy.

Understanding the Impact of Inflation on the Dalasi

The **Gambian Dalasi (GMD)** is an inextricable component of the economic reality for the citizens of the Gambia. Ever since its introduction in 1971 as a replacement for the British West African Pound, the Dalasi has undergone a significant transformation spurred on by shifts in national monetary policy, global trading trends, and local economic conditions. But perhaps one issue that deserves intricate scrutiny is the impact of **inflation** on the Dalasi. Inflation, a persistent increase in the general price level of goods and services in an economy over a period of time, can considerably affect the purchasing power of a currency and consequently, the standard of living for the population. Over the years, the Gambia has experienced varying degrees of inflation, challenging the value and stability of the Dalasi. The purpose of this discourse is to elucidate on these interactions, focusing particularly on how inflation has impacted the Dalasi, the shifts in economic trends it has induced, and the policies put forward in an attempt to manage these changes. Understanding this dynamic is pivotal for anyone eager to comprehend the Gambia's macroeconomic landscape and the role of the Dalasi within it.

The Relationship Between Inflation and the Value of Dalasi

The **Gambian Dalasi** has undergone significant transformations since its inception; determining its value and the implications of these shifts can provide fascinating insights into Gambia's economic trajectory. In particular, the relationship between inflation and the Dalasi is of considerable interest. Inflation, broadly speaking, is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. In other words, if inflation is high or increasing, a unit of currency will buy fewer goods and services, decreasing the real value of that currency. When applied to the Dalasi, we can understand inflation's profound impact on the value of the Gambian currency. In general, Gambia has experienced relatively high inflation rates. Mountainous inflation creates downward pressure on the value of the Dalasi. When prices rise quickly, the Dalasi becomes weaker as it can buy less than before. The more rapid the acceleration of inflation, the faster the erosion of the Dalasi's purchasing power. This relationship between the Dalasi's value and inflation is largely governed by Gambia's monetary policy, specifically as established by the Central Bank of The Gambia (CBG). CBG has the foundational objective to maintain price stability. When inflation is on the horizon, CBG may opt to tighten monetary policy by raising interest rates. This constrain on money supply lessens the inflationary pressure and thereby diminishes the erosion of the Dalasi's value. However, it is important to note that in real-world practice, the relationship between inflation and the Dalasi's value can be complicated further by external factors, including the balance of trade, government debt, and political stability among others. Therefore, understanding the underlining mechanisms between inflation and the value of Dalasi allows for a broader perspective on the state of an economy and its currency. Conclusively, a comprehensive grasp of the relationship between inflation and the value of Dalasi is not merely a theoretical concern. It is of paramount importance for constructing long-term financial strategies and forecasting future economic conditions. Specifically, understanding how inflation and other economic factors affect the Dalasi's value can guide decisions on investment, savings, and even consumption in Gambia's economy. The historical and ongoing dynamics of Gambia's inflation rates elucidate broader trends in its economic development and, ultimately, the purchasing power of the Dalasi. As we continue to observe these transformations, further valuable insights into Gambia's economic narrative will likely arise.

Historical Impact of Inflation on the Dalasi

The Gambian Dalasi, since its inception, has undergone numerous changes due to the pressures of inflation. From an economic standpoint, a closer analysis of its progression uncovers how intertwined the Dalasi's evolution is with the dynamics of the Gambian economy. The Dalasi, originally introduced in 1971 to replace the Gambian pound, instantly became the major medium of exchange for goods and services in Gambia. Over the years, the central bank has leveraged fiscal policies to manipulate the Dalasi's supply in an attempt to manage inflation rates and maintain overall economic stability. Around the 1980s, Gambia witnessed accelerated levels of inflation, a macroeconomic phenomenon that eroded the Dalasi's purchasing power. This period, defined by rampant inflation, severely affected the common Gambian's standard of living as the price of everyday commodities skyrocketed. Around the same period, Gambia had to transition from an economy heavily dependent on agriculture toward more diversified sectors, such as tourism and manufacturing. In the midst of such a shift, the critical role of the Dalasi as an exchange medium was heavily felt. In more recent times, the Gambian economy has faced further inflationary pressures due to the global economic climate. Currency devaluation, influenced by external factors including trade disruptions and an unpredictable international currency market, has led to a continuous weakening of the Dalasi. Despite these economic woes, the Central Bank of Gambia has maintained its commitment to controlling inflation, and thus protecting and having the Gambian Dalasi hold its ground. Efficient and strategic monetary policy measures have been implemented to mitigate the adverse effects of inflation. The inflation-adjusted real value of the Dalasi, although faced with challenges, has displayed its resilience. For instance, in 2012, despite the severe food crisis that led to soaring food prices and increased inflation rates, the Dalasi managed to steadily regain its value. Broadly speaking, the journey of the Dalasi reflects the larger economic narrative of Gambia. From its inception till date, the currency's inflation-adjusted value has persisted through both good and challenging times. Through prudent monetary policy measures, the Dalasi has navigated the tumultuous currents of inflation, reflecting both the country's economic fortitude as well as the currency's innate resilience. The Dalasi, thus, stands as a testament to Gambia's economic journey, influenced heavily by the historical evolution of inflation.

Forecasting the Future: Inflation and the Dalasi

The **Dalasi**, the official currency of Gambia, has undergone numerous fluctuations in its value through history. As economists endeavor to predict the future of the Dalasi, one crucial factor to consider is inflation. Indeed, inflation profoundly impacts the exchange rate and purchasing power of a currency. Inflation denotes the rate at which the overall level of prices for goods and services is rising. As inflation surges, the value of the base currency (Dalasi, in this case) depreciates, which means each Dalasi buys fewer goods and services. This devaluation impairs the purchasing power of consumers and businesses, negatively affecting the economy. The relationship between inflation and currency is intrinsically linked to Gambia's monetary policy. The Central Bank of Gambia (CBG) manages the monetary policy and has the mandate to control inflation. To manipulate inflation rates, CBG can alter the liquidity in the economy by modifying the reserve requirement or the interest rate. An increase in interest rates often attracts foreign investors seeking better returns, triggering an appreciation of the Dalasi. Furthermore, inflation influences foreign exchange rates. A higher inflation rate relative to other countries implies a depreciation of the Dalasi. This depreciation could potentially benefit Gambia's export sector as it makes local goods cheaper for foreign buyers, thereby boosting trade. However, it simultaneously makes imports more expensive, which can lead to decreased economic welfare if surging import costs are not offset by export gains. The history of the Dalasi provides insights into the interactions between inflation, monetary policy, and the currency's value. For instance, it has encountered periods of high inflation resulting from significant government spending or a drop in foreign exchange earnings, which led to depreciation. During other periods, careful fiscal and monetary management has constrained inflation, leading to a more stable Dalasi. In forecasting the future of the Dalasi, economists employ various models considering factors such as inflation expectations, the output gap, and the difference in inflation rates between Gambia and trade partners. However, predicting exact movements in currency value remains challenging due to the myriad of dynamic and interrelated variables involved. In summary, the value of the **Dalasi** in the future will be significantly influenced by inflation rates, which are managed by the CBG's monetary policy. While high inflation could depreciate the **Dalasi**, offering potential advantages in the export realm, it can also diminish individual buying power and increase import costs. As economists endeavor to predict the Dalasi's future, comprehensive analysis and forecasting will remain paramount, but also inherently complex due to the multifaceted interactions at play.

Understanding the Monetary Policy: An In-depth Look at the Dalasi Currency

The complex world of currency economics often poses an intriguing allure, bridging the realms of financial theory and tactile monetary policy. Central to this discourse is an exploration of monetary systems from across the globe. One such example, the **Dalasi** currency, offers a unique perspective into understanding diverse economic developments. The Dalasi, being the main currency of the Republic of The Gambia - a small country in West Africa, embodies the impact of economic policies on a currency's evolution despite its geopolitical location. It offers boundless insights into the intricate interplay of economic factors, monetary policies, and inflation rate within a microcosm. This journey unfolds an in-depth understanding of dynamics fuelling the Dalasi's dance with The Gambia's monetary policy. From its conception in 1971 replacing the Gambia pound, the Dalasi's course has been shaped by both internal and external influences. It showcases a roller-coaster journey marked by dramatic shifts and stability phases, enabling us to dissect how small economies manage their monetary policy. This discourse promises not just a closer look at the Dalasi, but also a broader understanding of economics at play in smaller nations. Dive in as we embark on this revealing journey that illuminates how monetary policies shape the narrative of a nation's currency.

An Overview of the Dalasi: The Gambian Currency

The **Dalasi**, the official currency of Gambia, is an integral component of the Gambian economy that has evolved over time in relation to historical events and economic policies. Depending on external market forces, the currency value fluctuates, demonstrating the inherent volatility of the global economy. Initially introduced in 1971, the Dalasi replaced the former currency, the British West African pound, contextualizing Gambia's emergence from the traces of colonialism. The Dalasi is comprised of a hundred denominations known as **bututs**. Appealing in design, these coins and banknotes reflect Gambia's rich cultural heritage and natural ecosystem. Banknotes often feature portraits of various Gambian citizens, symbolizing solidarity and unity, while coins depict native wildlife. The Dalasi in this way can be seen as embodying the nation's identity. Gambia's central bank, the Central Bank of Gambia, is responsible for issuing and controlling the circulation of the Dalasi. This institution's monetary policies have a direct influence on the value of the Dalasi, along with Gambia's inflation rates and economic status. Their strategies primarily aim to maintain price stability, ensuring that inflation is kept under control, and to promote a stable and robust financial system. These policies can significantly impact the purchasing power of the Dalasi domestically and internationally. The strength of the Dalasi is closely tied to Gambia's economic health and the impact of exchange rates. A stronger Dalasi can result in goods becoming more expensive for foreigners and foreign goods becoming cheaper for Gambians, affecting the balance of trade. However, volatile exchange rates can affect the currency's stability, and hence the economy as a whole. Therefore, managing the value of the Dalasi in relation to other currencies is an important focus for the Gambian government. The story of the **Dalasi** is that of Gambia itself, tied to the nation's history, economic development, and vision for the future. This tangible representation of economic value is far more than just a medium of exchange; it is an embodiment of the nation's identity, heritage, policies, and economic health. The evolution and perseverance of the Dalasi over time underscores the resilience and dynamic nature of the Gambian economy.

Historical Analysis: The Evolution of the Dalasi

The **Dalasi**, being the official currency of the Republic of The Gambia, has a rich and profound history that reflects both the political and economic trajectory of the nation. As a former British colony, The Gambia was originally using the British Pound, reflecting the colonial ties of the region. However, the Central Bank of The Gambia made a clean break from the British rule when the Dalasi was introduced in 1971, replacing the Gambia Pound at a ratio of 5 Dalasi to 1 Pound. This change in currency was not purely an economic move, but a strong political decision aimed at asserting national sovereignty. In terms of design, the Dalasi has gone through various innovative changes, including alterations to their imagery and security features. The denominations of the Dalasi display historical and national importance showcasing former presidents, indigenous wildlife, and other cultural symbols of The Gambia, implicitly telling the vibrant stories of the proud nation. Economically, the **Dalasi** has experienced a roller coaster ride. Often affected by the country's political stability, agricultural output, tourism, and external remittances, its value has seen periods of stability, decline, and appreciation. Like many developing countries, The Gambia has contended with challenges of inflation, which have a direct impact on the value of the Dalasi. Understanding the monetary policy in The Gambia is crucial in comprehending the economic underlying of the Dalasi. The Central Bank of The Gambia, which is the monetary authority, has utilised various monetary policy tools, such as adjusting the benchmark interest rate and using open market operations, to control inflation, maintain financial stability, and stimulate economic growth. However, these actions can directly affect the value of the Dalasi. Notably, in recent years, the movement towards digitisation of currency and use of digital wallets is gradually becoming a significant part of The Gambia’s financial culture, although the Dalasi in physical form continues to be widely used. Broadly speaking, understanding the Dalasi is not just about understanding a form of currency but it gives you an insight into the socio-economic dynamics of The Gambia as a whole. In retrospect, the history and evolution of the Dalasi paint a picture of struggles, resilience, and gradual change in one of West Africa's smallest countries.

Current Trends and Developments in Monetary Policy affecting the Dalasi

The **Dalasi** is the official currency of Gambia, a small but vibrant country located on the western coast of Africa. Its importance extends beyond mere trade facilitation and it reflects the distinct economic and socio-cultural values of the nation. The Central Bank of Gambia regulates the issuance and circulation of the Dalasi. International Monetary Fund (IMF) reports indicate that the Dalasi has experienced significant fluctuations over recent years due to a variety of factors, including shifts in domestic monetary policy. The Gambian economy is characterized by a heavy reliance on the agricultural sector, tourism, and remittance inflow, making it susceptible to external shocks and volatile currency movements. Recently, The Central Bank has instituted a more restrictive monetary policy to tame inflation and stabilize the Dalasi. This has involved raising policy rates and tightening credit to reduce the amount of money in circulation. Historically, increased government spending in Gambia has often led to high inflationary pressure, negatively impacting the Dalasi's value. The Central Bank's intervention attempts to counter this by striving to keep inflation at a manageable rate. The recent changes have seen a strengthening of the Dalasi relative to major international currencies, though the ongoing economic fallout from COVID-19 continues to pose risks. Development partners such as the IMF have recommended that Gambia continue to employ a flexible exchange rate regime. This allows the Dalasi to adjust in response to market dynamics and protect the country's foreign exchange reserves. Structurally, the Dalasi is divided into 100 bututs, and it is issued in both coin and banknote forms, with various designs reflecting important historical and cultural themes. Recently, The Central Bank has undertaken monetary reforms aimed at improving currency stability and reducing macroeconomic imbalances. This includes the introduction of new banknote designs to deter counterfeiting, enhance durability and maintain public confidence in the currency. In conclusion, recent trends and developments in the Gambian financial field suggest a more robust, proactive monetary policy framework, designed both to safeguard the Dalasi's value and to ensure macroeconomic stability. Continuous efforts are driven towards the modernization of payment systems and the digital transformation of financial services, which can potentially change the game for the Dalasi. The ability of the Central Bank to adjust to these trends while maintaining the integrity of the Dalasi offers a test and opportunity for Gambia’s monetary policy.