How To Pay Osap

Here is the introduction paragraph: Paying off Ontario Student Assistance Program (OSAP) debt can be a daunting task for many students. With the rising cost of tuition and living expenses, it's essential to understand the payment process and develop a plan to manage your debt effectively. To start, it's crucial to have a clear understanding of OSAP and its payment process, including the types of loans and grants available, repayment terms, and interest rates. By grasping these fundamentals, you'll be better equipped to manage your OSAP payments and develop strategies to pay off your debt efficiently. In this article, we'll explore the ins and outs of OSAP payments, provide tips on managing your payments, and offer strategies for paying off your debt. Let's begin by understanding OSAP and its payment process.

Understanding OSAP and Its Payment Process

Understanding the Ontario Student Assistance Program (OSAP) and its payment process is crucial for students in Ontario, Canada, who are seeking financial assistance to pursue their post-secondary education. The program provides financial aid to eligible students to help them cover the costs of tuition, living expenses, and other education-related expenses. To navigate the OSAP system effectively, it is essential to understand the eligibility criteria, the application process, and how the program works. In this article, we will delve into the details of OSAP, including what it is and how it works, the eligibility criteria for receiving OSAP funding, and the step-by-step process of applying for OSAP. By understanding these key aspects, students can make informed decisions about their financial aid options and ensure a smooth transition to post-secondary education. So, let's start by exploring what OSAP is and how it works.

What is OSAP and How Does it Work?

The Ontario Student Assistance Program (OSAP) is a government-funded program designed to help students pay for their post-secondary education. OSAP provides financial assistance to eligible students in the form of grants and loans. To be eligible for OSAP, students must be enrolled in at least 60% of a full course load, be a Canadian citizen, permanent resident, or protected person, and demonstrate financial need. The program is administered by the National Student Loans Service Centre (NSLSC) and the Ontario government. When a student applies for OSAP, they are assessed for both federal and provincial funding. The amount of funding a student receives is based on their family's income, the student's income, and their education expenses. Students can apply for OSAP online through the NSLSC website, and the application process typically takes a few weeks to complete. Once a student's application is approved, they will receive a funding assessment outlining the amount of grants and loans they are eligible for. The funding is then disbursed to the student's school, and the student is responsible for repaying the loan portion of their funding after graduation. OSAP funding can be used to cover a variety of education expenses, including tuition, fees, books, and living expenses. Overall, OSAP is an important program that helps make post-secondary education more accessible and affordable for Ontario students.

Eligibility Criteria for OSAP

To be eligible for the Ontario Student Assistance Program (OSAP), students must meet certain criteria. Firstly, they must be a Canadian citizen, a permanent resident, or a protected person. They must also be a resident of Ontario and demonstrate financial need. Students must be enrolled in at least 60% of a full course load in a program that is approved for OSAP funding. Additionally, they must be in good academic standing and making satisfactory progress towards completing their program. Students with a disability may be eligible for additional funding and support. Furthermore, students who are receiving other government funding, such as the Ontario Access Grant, may still be eligible for OSAP. However, students who are receiving other forms of government funding, such as Employment Insurance, may not be eligible. It's also important to note that students who have defaulted on a previous government student loan may not be eligible for OSAP. Students who are unsure about their eligibility should check the National Student Loans Service Centre (NSLSC) website or contact their school's financial aid office for more information.

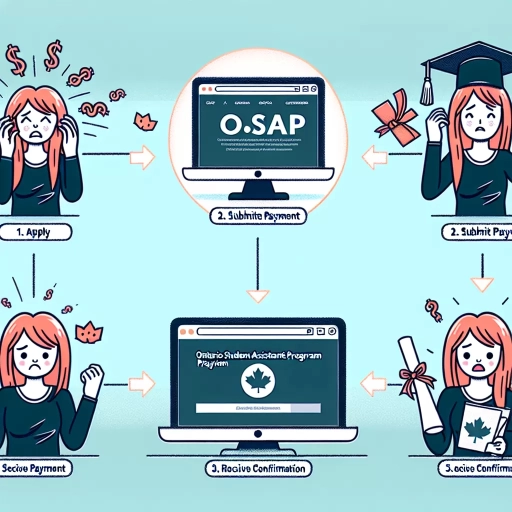

How to Apply for OSAP

To apply for the Ontario Student Assistance Program (OSAP), students must follow a step-by-step process. First, they need to determine their eligibility by checking the Ontario government's website or consulting with their school's financial aid office. Once they've confirmed their eligibility, they can start the application process by creating an account on the National Student Loans Service Centre (NSLSC) website. Students will need to provide personal and financial information, including their social insurance number, income, and family size. They will also need to list their school and program information, including the start and end dates of their studies. After submitting their application, students will receive a funding assessment, which outlines the amount of funding they're eligible for. This assessment will also include information on how much they need to contribute towards their education expenses. Students can then review and accept their funding offer, and the funds will be disbursed to their school or directly to them. It's essential to apply for OSAP at least two months before the start of classes to ensure timely processing and to avoid delays in receiving funding. Additionally, students can also apply for other types of financial aid, such as scholarships and bursaries, to supplement their OSAP funding. By following these steps, students can successfully apply for OSAP and receive the financial support they need to pursue their post-secondary education.

Managing Your OSAP Payments

Managing your OSAP payments effectively is crucial to avoid financial stress and ensure a smooth transition into your post-secondary education. To achieve this, it's essential to have a comprehensive understanding of the various aspects involved in managing your OSAP payments. This includes creating a budget that accounts for your OSAP payments, understanding the payment schedules set by the National Student Loans Service Centre (NSLSC), and exploring the available options for repaying your OSAP loans. By grasping these key concepts, you'll be better equipped to navigate the complexities of OSAP payments and make informed decisions about your financial future. In this article, we'll delve into these topics in more detail, starting with the importance of creating a budget for OSAP payments.

Creating a Budget for OSAP Payments

Here is the paragraphy: Creating a budget for OSAP payments is a crucial step in managing your student loan debt. To start, you'll need to determine how much you owe and when your payments are due. You can find this information on the National Student Loans Service Centre (NSLSC) website or by contacting them directly. Next, calculate your monthly payment amount based on your loan balance, interest rate, and repayment term. Consider using the NSLSC's repayment calculator to get an estimate. Once you have your monthly payment amount, factor it into your overall budget, making sure to prioritize essential expenses like rent, utilities, and food. You may need to make adjustments to your spending habits, such as cutting back on non-essential expenses or finding ways to increase your income. It's also a good idea to set aside a small buffer for unexpected expenses or changes in your income. By creating a budget and sticking to it, you can ensure that you're making timely OSAP payments and avoiding any potential penalties or interest charges. Additionally, consider setting up automatic payments to make it easier to stay on track and avoid missed payments. By taking control of your OSAP payments and creating a budget that works for you, you can reduce financial stress and focus on your studies.

Understanding OSAP Payment Schedules

Understanding OSAP Payment Schedules is crucial for students to manage their finances effectively. The Ontario Student Assistance Program (OSAP) provides financial assistance to eligible students pursuing post-secondary education. The payment schedule is a critical component of the OSAP program, outlining when and how much funding students can expect to receive. Typically, OSAP payments are disbursed in two installments, with the first payment made at the beginning of the academic term and the second payment made midway through the term. The payment schedule is usually based on the student's course load, with full-time students receiving more funding than part-time students. It's essential for students to review their payment schedule carefully to ensure they understand when and how much they will receive. This information can help students budget and plan their finances accordingly, avoiding any potential financial difficulties. Additionally, students can use the National Student Loans Service Centre (NSLSC) online portal to view their payment schedule and track their funding. By understanding their OSAP payment schedule, students can better manage their finances and focus on their academic success.

Options for Repaying OSAP Loans

When it comes to repaying your Ontario Student Assistance Program (OSAP) loan, there are several options available to help you manage your payments. The National Student Loans Service Centre (NSLSC) offers a range of repayment options to suit your financial situation. One option is to make fixed monthly payments, which can be set up through online banking or by contacting the NSLSC directly. You can also choose to make lump sum payments or pay off your loan in full at any time. If you're experiencing financial difficulties, you may be eligible for the Repayment Assistance Plan (RAP), which can temporarily reduce or suspend your payments. Additionally, you may be able to take advantage of the Loan Rehabilitation Program, which can help you recover from defaulted payments and get back on track with your loan repayment. It's also worth noting that you may be eligible for tax credits, such as the Tuition Tax Credit, which can help offset the cost of your education. By exploring these options and working with the NSLSC, you can find a repayment plan that works for you and helps you manage your OSAP payments effectively.

Strategies for Paying Off OSAP Debt

Paying off Ontario Student Assistance Program (OSAP) debt can be a daunting task for many students. However, with the right strategies, it is possible to manage and pay off this debt efficiently. One effective approach is to consolidate OSAP loans, which can simplify the payment process and reduce monthly payments. Additionally, implementing tips for paying off OSAP debt quickly, such as increasing income and reducing expenses, can also help. Furthermore, seeking help from a financial advisor or credit counselor can provide personalized guidance and support for OSAP debt management. By exploring these strategies, individuals can take control of their OSAP debt and work towards a debt-free future. For those looking to simplify their payments, consolidating OSAP loans is a great place to start.

Consolidating OSAP Loans for Easier Payments

Consolidating OSAP loans can be a game-changer for individuals struggling to manage their debt. By combining multiple loans into one, borrowers can simplify their payments and potentially reduce their monthly burden. When consolidating OSAP loans, the interest rates are blended, which can result in a lower overall interest rate. This can lead to significant savings over the life of the loan. Additionally, consolidating loans can also help borrowers avoid missed payments and late fees, as they only need to keep track of one payment due date. Furthermore, consolidating OSAP loans can also provide borrowers with more flexible repayment options, such as extending the repayment period or switching to a fixed interest rate. This can be especially helpful for individuals who are experiencing financial difficulties or are in a low-income situation. By consolidating their OSAP loans, borrowers can take control of their debt and make more manageable payments, ultimately paving the way for a debt-free future.

Tips for Paying Off OSAP Debt Quickly

Here is the paragraphy: Paying off OSAP debt quickly requires a strategic approach. To start, make a budget that accounts for all your income and expenses, and prioritize your OSAP payments. Consider consolidating your loans into a single, lower-interest loan to simplify your payments and reduce your interest rate. Take advantage of the National Student Loans Service Centre's (NSLSC) repayment assistance programs, such as the Repayment Assistance Plan (RAP), which can temporarily reduce or suspend your payments if you're experiencing financial hardship. Make lump sum payments whenever possible, and consider making bi-weekly payments instead of monthly payments to reduce your principal balance faster. Additionally, claim your OSAP interest on your tax return to reduce your taxable income. By following these tips and staying committed to your repayment plan, you can pay off your OSAP debt quickly and efficiently.

Seeking Help for OSAP Debt Management

Seeking help for OSAP debt management is a crucial step towards taking control of your financial situation. If you're struggling to make payments or feeling overwhelmed by your debt, don't hesitate to reach out for assistance. The National Student Loans Service Centre (NSLSC) offers a range of resources and options to help you manage your OSAP debt, including repayment assistance plans, interest relief, and debt forgiveness programs. You can also contact a financial advisor or credit counselor who specializes in student loan debt to get personalized advice and guidance. Additionally, many universities and colleges offer financial counseling services specifically designed to help students and graduates manage their OSAP debt. By seeking help, you can develop a plan to pay off your debt, reduce your stress levels, and achieve financial stability.