How To Read A Cheque

Understanding Cheque Basics

What is a Cheque?

A cheque is a written document that instructs a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. It is a form of bill of exchange, and the payment is typically from the drawer's bank account to the payee. Cheques are a written, dated, and signed instrument that contains an unconditional order directing the bank to pay a definite sum of money to a payee. Understanding cheques is crucial because they are still widely used in business and banking transactions.

Significance of Cheques in Banking

Cheques play an integral role in the banking sector. They allow for large payments to be made securely, without the need for large amounts of cash. Today, businesses, individuals, and even governments continue to use cheques for payment due to the security, convenience, and universally accepted nature of the banking instrument. Digital transactions might be rising, but cheques remain a reliable method of payment and an excellent track record of one's financial transactions. Therefore, knowing how to read a cheque is a valuable skill.

Types of Cheques

There are various types of cheques based on their functionality, including personal cheques, cashier's cheques, certified cheques, traveller's cheques, and more. Each type of cheque serves a specific purpose and exhibits some unique characteristics. For instance, a personal cheque is written by an individual and drawn on their account. In contrast, a cashier’s cheque is issued by a bank and drawn on its own funds. Recognizing the different kinds of cheques can help determine the appropriate one for diverse transaction circumstances.

Decoding the Elements on a Cheque

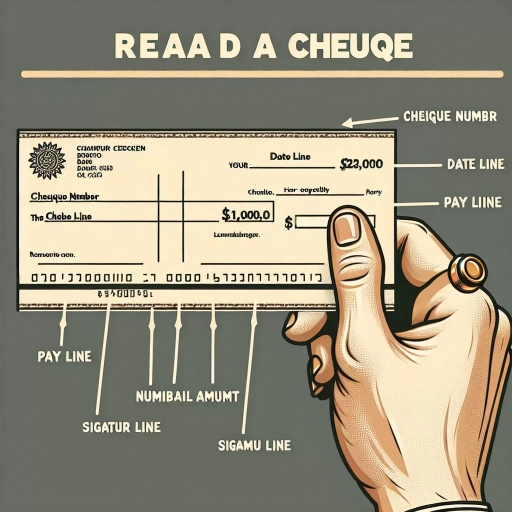

The Payee Line

The payee line on a cheque is where the name of the person or the company who will receive the money is listed. This name must be accurately spelled because spelling mistakes might result in the cheque getting rejected. In addition, if the payee's name is written along with 'And,' the cheque can be encashed only when both persons sign the cheque. Conversely, if 'Or' is used, any one person can withdraw the amount.

The Numeric and Written Amount

Every cheque will have two places where you need to specify the amount. One is a small box where you write the amount numerically, like '100.00' for one hundred dollars. Adjacent to this box, you will find a line where you have to write the same amount in words – 'One Hundred Dollars.' These two amounts must match exactly; any discrepancy can lead to the cheque getting bounced.

The Memo Line and Signature

The memo line is a place for you to put a note or remark linked to the transaction. This note can help remind you why you wrote the cheque or provide helpful details for the person or company receiving it. Most importantly, the bottom right corner of the cheque is for the signature of the account holder. Without this signature, a cheque is not valid and cannot be processed by a bank.

Tips for Proper Cheque Writing

Avoiding Common Mistakes

One of the most common mistakes made while writing cheques is not dating them correctly. Always write the correct date to prevent any chance of misuse. Moreover, mistakes in writing the payee's name or the amount should be avoided as these could lead to cheque bouncing. Always double-check all details before you sign your cheque.

Never Leaving Spaces

Empty spaces before the payee's name, amount in words and figures should be avoided to prevent any unauthorized addition. If required, you can use a line (\) to fill the spaces. This precautionary measure safeguards you against any forgery.

Keeping Records

Keeping a record of each cheque issued can help in tracking your transactions and may come in handy for tax purposes. Most cheque books come with stubs or carbon copies for this purpose. Keeping your cheque book safe and periodically examining your bank statements can ensure all your transactions are accurately accounted for.