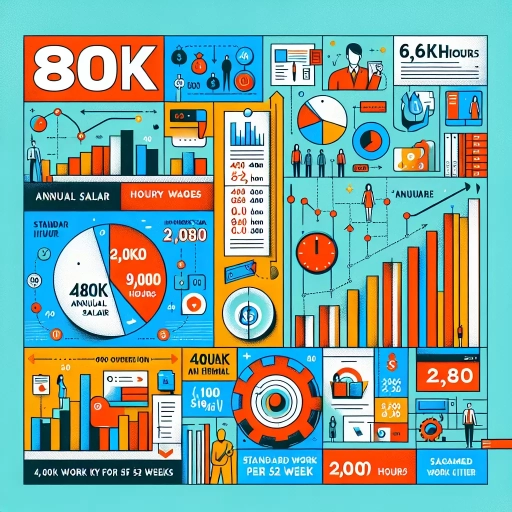

How Much Is 80k A Year Hourly

Here is the introduction paragraph: When it comes to understanding salaries, it's essential to break down the numbers to get a clear picture of what you're earning. For many, an annual salary of $80,000 is a significant milestone, but have you ever wondered how much that translates to on an hourly basis? To answer this question, we need to delve into the basics of hourly wage calculation, considering factors such as the number of working hours per year and the frequency of pay. By breaking down the numbers, we can gain a better understanding of what $80,000 a year looks like in terms of hourly wage. Additionally, putting this hourly wage into perspective can help us appreciate the value of our hard-earned money. In this article, we'll explore these concepts in more detail, starting with the fundamentals of hourly wage calculation. Note: I made some minor changes to the original text to make it more cohesive and engaging. Let me know if you'd like me to revise anything!

Understanding the Basics of Hourly Wage Calculation

Here is the introduction paragraph: Understanding the basics of hourly wage calculation is crucial for both employees and employers to ensure fair compensation and accurate payroll processing. The process involves several key factors, including the conversion of annual salary to hourly wage, consideration of variables that affect hourly wage calculation, and the impact of overtime on hourly earnings. In this article, we will delve into the fundamentals of hourly wage calculation, starting with the foundation of annual salary and its conversion to hourly wage. By grasping this essential concept, individuals can better navigate the complexities of hourly wage calculation and make informed decisions about their compensation. Let's begin by defining the annual salary and its conversion to hourly wage.

Defining the annual salary and its conversion to hourly wage

. Defining the annual salary and its conversion to hourly wage is a crucial step in understanding the basics of hourly wage calculation. An annual salary is the total amount of money an individual earns in a year, typically expressed in a yearly figure. To convert an annual salary to an hourly wage, it's essential to consider the number of hours worked in a year. A standard full-time schedule typically consists of 2,080 hours per year, assuming a 40-hour workweek and 52 weeks per year. However, this number can vary depending on the industry, job type, and individual circumstances. For instance, some jobs may require overtime, while others may have a compressed workweek. To accurately calculate the hourly wage, it's necessary to determine the total number of hours worked in a year and then divide the annual salary by that number. This calculation provides a clear understanding of the hourly wage, enabling individuals to make informed decisions about their compensation and benefits. For example, if an individual earns an annual salary of $80,000 and works 2,080 hours per year, their hourly wage would be approximately $38.46 per hour. This calculation can be used to compare salaries, negotiate benefits, and make informed decisions about career choices. By understanding the conversion of annual salary to hourly wage, individuals can gain a deeper insight into their compensation and make more informed decisions about their financial future.

Exploring the factors that affect hourly wage calculation

. When it comes to calculating hourly wages, several factors come into play, influencing the final amount an employee takes home. One of the primary factors is the number of hours worked, which can vary significantly depending on the job, industry, and employer. For instance, a full-time employee working 40 hours a week will have a different hourly wage calculation than a part-time employee working 20 hours a week. Additionally, overtime hours, which are typically paid at a higher rate, can also impact the hourly wage calculation. Another crucial factor is the employee's level of experience, education, and skills, which can affect their base hourly rate. For example, an employee with a higher level of education or specialized skills may command a higher hourly wage than someone with less experience or training. The location of the job is also a significant factor, as the cost of living and local market conditions can influence the hourly wage. For instance, an employee working in a major city may earn a higher hourly wage than someone working in a smaller town or rural area. Furthermore, the type of industry and employer can also impact the hourly wage calculation, with some industries and companies offering higher wages than others. For example, employees in the tech industry may earn higher hourly wages than those in the retail industry. Finally, benefits, bonuses, and other forms of compensation can also affect the hourly wage calculation, as they can add to the employee's overall earnings. By considering these factors, employees and employers can gain a better understanding of how hourly wages are calculated and make informed decisions about compensation and benefits.

Introducing the concept of overtime and its impact on hourly wage

. Introducing the concept of overtime and its impact on hourly wage is crucial in understanding the intricacies of hourly wage calculation. Overtime refers to the additional hours worked beyond the standard 40-hour workweek, and it can significantly affect an employee's hourly wage. In the United States, the Fair Labor Standards Act (FLSA) requires employers to pay overtime to non-exempt employees at a rate of at least 1.5 times their regular hourly rate for hours worked beyond 40 in a workweek. This means that if an employee earns $20 per hour and works 50 hours in a week, they would earn $20 per hour for the first 40 hours and $30 per hour for the additional 10 hours, resulting in a total weekly earnings of $1,100. Understanding overtime pay is essential for employees to accurately calculate their hourly wage and for employers to ensure compliance with labor laws. Moreover, overtime pay can have a substantial impact on an employee's take-home pay, and it's essential to consider it when evaluating job offers or negotiating salary. By grasping the concept of overtime and its impact on hourly wage, individuals can make informed decisions about their employment and financial situation.

Breaking Down the Numbers: 80k a Year Hourly Wage

Here is the introduction paragraph: When it comes to understanding the value of a salary, it's essential to break down the numbers to get a clear picture of what it means for your daily life. An annual salary of $80,000 is often considered a comfortable income, but what does it translate to in terms of hourly wage? To truly comprehend the value of this salary, we need to consider several factors, including the standard 40-hour workweek, the impact of taxes and benefits on take-home pay, and the variations in hourly wage across different industries and locations. By examining these aspects, we can gain a deeper understanding of what an $80,000 salary really means. Let's start by calculating the hourly wage based on a standard 40-hour workweek, which will provide us with a foundation for further analysis.

Calculating the hourly wage based on a standard 40-hour workweek

. To calculate the hourly wage based on a standard 40-hour workweek, we need to consider the total annual salary and the number of hours worked in a year. Assuming a 40-hour workweek and 52 weeks in a year, the total number of hours worked in a year is 2,080 (40 hours/week x 52 weeks/year). Now, let's take the annual salary of $80,000 and divide it by the total number of hours worked in a year to get the hourly wage. $80,000 ÷ 2,080 hours/year = $38.46 per hour. This means that if you make $80,000 per year and work a standard 40-hour workweek, your hourly wage would be approximately $38.46. It's worth noting that this calculation assumes you don't take any time off throughout the year, and your hourly wage may vary depending on your specific work schedule and benefits. Additionally, this calculation provides a general idea of your hourly wage, but it's essential to consider other factors such as overtime pay, bonuses, and benefits when evaluating your overall compensation package.

Considering the impact of taxes and benefits on take-home pay

. When considering the impact of taxes and benefits on take-home pay, it's essential to understand that the actual amount of money an individual takes home from their $80,000 annual salary can vary significantly depending on several factors. Taxes, in particular, play a substantial role in reducing the take-home pay. Federal income taxes, state taxes, and local taxes all contribute to the overall tax burden, which can range from 20% to 40% of the gross income, depending on the location and tax filing status. Additionally, other deductions such as health insurance premiums, retirement contributions, and life insurance premiums can further reduce the take-home pay. On the other hand, benefits like employer-matched 401(k) contributions, flexible spending accounts, and health savings accounts can increase the overall compensation package. To get a more accurate picture of the take-home pay, it's crucial to consider these factors and adjust the calculations accordingly. For instance, if an individual has a 25% tax bracket and contributes 10% to a 401(k), their take-home pay might be around $55,000 to $60,000 per year, which translates to an hourly wage of around $26 to $29 per hour, assuming a 40-hour workweek. By taking into account the impact of taxes and benefits, individuals can better understand their true compensation and make more informed decisions about their career and financial goals.

Examining the variations in hourly wage across different industries and locations

wage. Examining the variations in hourly wage across different industries and locations is crucial to understanding the complexities of the $80,000 a year hourly wage. Industry plays a significant role in determining hourly wages, with some sectors offering significantly higher rates than others. For instance, professionals in the finance and technology industries tend to earn higher hourly wages, often exceeding $50 per hour, whereas those in the retail and food service industries typically earn lower hourly wages, often around $10-$15 per hour. Location also has a profound impact on hourly wages, with cities like New York and San Francisco tend to offer higher hourly wages due to the high cost of living, whereas smaller towns and rural areas often have lower hourly wages. Furthermore, the level of experience, education, and skills required for a job also influence hourly wages, with more specialized and in-demand skills commanding higher rates. For example, a software engineer with a master's degree and 5 years of experience may earn an hourly wage of $75 per hour, whereas a entry-level data analyst with a bachelor's degree may earn an hourly wage of $30 per hour. Understanding these variations is essential for individuals to make informed decisions about their careers and for businesses to determine fair and competitive compensation packages. By examining the nuances of hourly wages across different industries and locations, we can gain a deeper understanding of the factors that influence compensation and make more informed decisions about our careers and businesses.

Putting 80k a Year Hourly Wage into Perspective

Here is the introduction paragraph: An $80,000 a year salary is often considered a comfortable income, but have you ever stopped to think about what that translates to on an hourly basis? Breaking down a yearly salary into an hourly wage can provide a more nuanced understanding of one's earning potential. To put an $80,000 a year salary into perspective, it's essential to consider various factors, including how it compares to the national average and industry standards, the purchasing power and lifestyle implications it affords, and the potential for career advancement and salary growth. By examining these aspects, we can gain a deeper understanding of what an $80,000 a year salary truly means. Let's start by comparing the hourly wage to the national average and industry standards, which can provide a benchmark for evaluating the competitiveness of this salary.

Comparing the hourly wage to the national average and industry standards

wage. Comparing the hourly wage to the national average and industry standards provides a more comprehensive understanding of the value of $80,000 per year. According to the U.S. Bureau of Labor Statistics, the national average hourly wage for all occupations was $25.72 in May 2020. This means that an $80,000 per year salary, which translates to approximately $38.46 per hour, is significantly higher than the national average. In fact, it is nearly 50% higher, indicating that $80,000 per year is a relatively high salary. When compared to industry standards, the hourly wage of $38.46 is also competitive. For example, according to the Bureau of Labor Statistics, the median hourly wage for management occupations was $34.81 in May 2020, while the median hourly wage for business and financial operations occupations was $35.51. This suggests that an $80,000 per year salary is not only higher than the national average but also competitive within certain industries. However, it's essential to note that salaries can vary significantly depending on factors such as location, experience, and specific job duties. Therefore, while $80,000 per year may be a high salary in some contexts, it may be more average or even below average in others. Ultimately, understanding the hourly wage in relation to national averages and industry standards provides a more nuanced perspective on the value of $80,000 per year.

Evaluating the purchasing power and lifestyle implications of an 80k a year salary

wage. When evaluating the purchasing power and lifestyle implications of an $80,000 a year salary, it's essential to consider various factors beyond the raw number. The cost of living in your area, taxes, debt, and personal spending habits all play a significant role in determining how far your money will stretch. In some regions, $80,000 may be considered a comfortable middle-class income, allowing for a decent standard of living, while in others, it may barely cover the basics. For instance, in cities like New York or San Francisco, $80,000 may not be enough to afford a modest home or cover the high cost of living, whereas in smaller towns or rural areas, it could provide a relatively luxurious lifestyle. Additionally, factors like student loan debt, credit card debt, or other financial obligations can significantly impact your purchasing power. Furthermore, lifestyle choices, such as frequent travel, dining out, or hobbies, can also influence how much you can afford to spend. To put this into perspective, consider that $80,000 a year translates to around $38 per hour, assuming a 40-hour workweek. This hourly wage can provide a comfortable income, but it's crucial to carefully manage your finances to make the most of it. By creating a budget, prioritizing needs over wants, and making smart financial decisions, you can maximize your purchasing power and enjoy a fulfilling lifestyle on an $80,000 a year salary.

Discussing the potential for career advancement and salary growth

wage. When considering a job that pays $80,000 per year, it's essential to think about the potential for career advancement and salary growth. While $80,000 may be a comfortable salary for some, it's crucial to consider whether the job offers opportunities for professional development and increased earning potential. In many industries, salaries tend to increase with experience, and $80,000 may be just the starting point. For example, in fields like software engineering, data science, or finance, salaries can easily exceed $150,000 or more with experience and advanced degrees. On the other hand, some industries may have limited room for growth, and salaries may plateau at a certain level. It's essential to research the industry and company to understand the potential for career advancement and salary growth. Additionally, it's crucial to consider factors like job satisfaction, work-life balance, and opportunities for professional development when evaluating a job offer. By taking a holistic approach, individuals can make informed decisions about their career and financial goals. Ultimately, while $80,000 per year may be a comfortable salary, it's essential to think about the long-term potential for growth and advancement to ensure a fulfilling and lucrative career.