How Does Remitly Work

Remitly is a popular online money transfer service that allows users to send money across borders quickly and securely. With Remitly, individuals can transfer funds to over 140 countries worldwide, making it a convenient option for those who need to send money to loved ones or pay bills abroad. But have you ever wondered how Remitly works? In this article, we will delve into the inner workings of Remitly, exploring its transfer process, benefits, and features. We will start by breaking down the step-by-step process of how Remitly works, including the requirements and procedures involved in sending and receiving money. We will also examine Remitly's transfer process, discussing what users need to know to ensure smooth and successful transactions. Additionally, we will highlight the benefits and features of using Remitly, including its competitive exchange rates, low fees, and user-friendly interface. By the end of this article, you will have a comprehensive understanding of how Remitly works, starting with the basics in our next section, How Remitly Works: A Step-by-Step Guide.

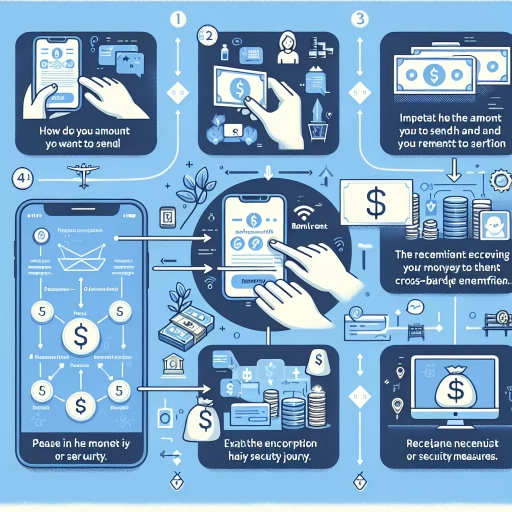

How Remitly Works: A Step-by-Step Guide

Remitly is a popular online money transfer service that allows users to send money across borders quickly and securely. With Remitly, users can send money to over 140 countries worldwide, making it a convenient option for those who need to send money to friends, family, or business partners abroad. But have you ever wondered how Remitly works? In this article, we will take a step-by-step look at the process of using Remitly, from signing up and creating an account, to adding recipients and sending money, and finally, tracking and managing transactions. By the end of this article, you will have a clear understanding of how Remitly works and how you can use it to send money across borders. So, let's get started by exploring the first step in using Remitly: signing up and creating an account.

Signing Up and Creating an Account

Signing up and creating an account with Remitly is a straightforward process that can be completed in a few easy steps. To get started, users can visit the Remitly website or download the mobile app, available for both iOS and Android devices. Once on the platform, users will be prompted to select their country of residence and the country to which they wish to send money. Next, they will need to provide some basic personal and contact information, including their name, email address, and phone number. Users will also be required to create a secure password and agree to Remitly's terms and conditions. After submitting this information, Remitly will send a verification email to the user's registered email address, which they must click on to activate their account. Once the account is activated, users can proceed to add their payment method, such as a bank account or debit card, and start sending money to their loved ones abroad. Throughout the sign-up process, Remitly's user-friendly interface and clear instructions make it easy for users to navigate and complete the necessary steps. Additionally, Remitly's robust security measures, including two-factor authentication and encryption, ensure that users' personal and financial information is protected at all times. By following these simple steps, users can quickly and securely create a Remitly account and start enjoying the benefits of fast, reliable, and affordable international money transfers.

Adding Recipients and Sending Money

Adding recipients and sending money with Remitly is a straightforward process. To add a recipient, users can click on the "Add Recipient" button on the Remitly dashboard and enter the recipient's name, address, and contact information. Users can also add multiple recipients and manage their recipient list for future transactions. Once a recipient is added, users can select the recipient and the amount they want to send, and choose the delivery method, such as bank deposit, cash pickup, or home delivery. Remitly offers competitive exchange rates and low fees, making it a cost-effective option for sending money internationally. Users can also track the status of their transactions in real-time, ensuring that their money is delivered safely and efficiently. Additionally, Remitly offers a range of payment options, including bank transfers, debit cards, and credit cards, making it easy to fund transactions. With Remitly, users can send money to over 140 countries worldwide, making it a convenient option for those who need to send money to friends and family abroad. Overall, adding recipients and sending money with Remitly is a quick, easy, and secure process that can be completed in just a few steps.

Tracking and Managing Transactions

Remitly's tracking and management system allows users to monitor their transactions in real-time, ensuring transparency and control throughout the process. Once a transfer is initiated, users can track its status through the Remitly app or website, receiving updates on the transfer's progress, including when the funds are sent, received, and delivered. This feature provides users with peace of mind, knowing exactly where their money is and when it will arrive. Additionally, Remitly's system allows users to manage their transactions by providing detailed information on transfer history, including the amount sent, exchange rate, and fees. This information is easily accessible, enabling users to keep track of their spending and stay organized. Furthermore, Remitly's system also allows users to cancel or modify transactions, giving them flexibility and control over their transfers. Overall, Remitly's tracking and management system is designed to provide users with a seamless and stress-free experience, allowing them to focus on what matters most – sending money to their loved ones.

Remitly's Transfer Process: What You Need to Know

When it comes to sending money across borders, Remitly is a popular choice for many individuals. The company's transfer process is designed to be efficient, secure, and transparent. But what exactly happens when you initiate a transfer with Remitly? In this article, we'll delve into the details of Remitly's transfer process, covering key aspects such as exchange rates and transfer fees, transfer speed and delivery options, and security measures and compliance. By understanding these factors, you'll be better equipped to navigate the transfer process and make informed decisions about your international money transfers. So, let's start with the first crucial aspect: exchange rates and transfer fees. How do these costs impact your transfer, and what can you expect from Remitly?

Exchange Rates and Transfer Fees

When sending money internationally, it's essential to understand exchange rates and transfer fees to ensure you get the best deal. Exchange rates refer to the value of one currency in relation to another, and they can fluctuate constantly due to market forces. Transfer fees, on the other hand, are charges imposed by financial institutions or money transfer services for facilitating the transaction. Remitly, like other money transfer services, uses mid-market exchange rates, which are the average exchange rates available in the wholesale currency markets. This means that Remitly doesn't charge a markup on the exchange rate, ensuring that customers get a fair deal. However, Remitly does charge a small transfer fee, which varies depending on the transfer amount, destination, and payment method. The fee is typically a flat rate or a percentage of the transfer amount, and it's clearly disclosed before the transaction is processed. To give you a better idea, Remitly's transfer fees range from 0.5% to 2.5% of the transfer amount, depending on the transfer details. For example, if you're sending $1,000 to Mexico, the transfer fee might be around $10-$25. It's worth noting that Remitly also offers a "Express" transfer option, which allows for faster delivery but comes with a higher transfer fee. Overall, Remitly's transparent exchange rates and competitive transfer fees make it a reliable choice for international money transfers.

Transfer Speed and Delivery Options

Remitly's transfer process is designed to be fast, secure, and convenient. When it comes to transfer speed, Remitly offers two options: Express and Economy. Express transfers are typically delivered within minutes, while Economy transfers take 3-5 business days. The delivery speed you choose will depend on the recipient's location and the transfer amount. For example, if you're sending money to the Philippines, Express transfers can be delivered in as little as 3 minutes, while Economy transfers take 3-5 business days. Remitly also offers a range of delivery options, including bank deposits, cash pickups, and home delivery. In some countries, Remitly also offers mobile money transfers, allowing recipients to receive funds directly to their mobile wallets. Additionally, Remitly's transfer process is transparent, with real-time tracking and updates, so you can stay informed about the status of your transfer. Overall, Remitly's transfer process is designed to provide fast, secure, and convenient money transfers, with a range of delivery options to suit your needs.

Security Measures and Compliance

Remitly's transfer process is designed with security and compliance in mind. The company adheres to strict regulations and guidelines set by government agencies and financial institutions to ensure the safe and secure transfer of funds. Remitly is registered with the US Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and is licensed to operate in multiple states. The company also complies with the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which require financial institutions to implement anti-money laundering (AML) and know-your-customer (KYC) policies. Additionally, Remitly uses robust encryption and secure socket layer (SSL) technology to protect customer data and prevent unauthorized access. The company also has a dedicated team that monitors transactions for suspicious activity and reports any potential issues to the relevant authorities. Furthermore, Remitly is a member of the National Money Transmitters Association (NMTA) and adheres to the organization's best practices for security and compliance. By prioritizing security and compliance, Remitly provides its customers with a safe and reliable way to send and receive money across borders.

Benefits and Features of Using Remitly

Remitly is a popular online money transfer service that offers numerous benefits and features to its users. One of the key advantages of using Remitly is its competitive exchange rates and low fees, making it an affordable option for sending money across borders. Additionally, Remitly's easy and convenient transfer process allows users to send money quickly and efficiently, without the need for lengthy paperwork or complicated procedures. Furthermore, Remitly's reliable and secure money transfer service provides users with peace of mind, knowing that their transactions are protected and will be delivered safely. With these benefits in mind, let's take a closer look at how Remitly's competitive exchange rates and low fees can help users save money on their international money transfers.

Competitive Exchange Rates and Low Fees

Remitly offers competitive exchange rates and low fees, making it an attractive option for individuals and businesses looking to send money internationally. With Remitly, you can enjoy exchange rates that are often better than those offered by traditional banks and other money transfer services. This means that your recipient will receive more money in their local currency, making your transfer go further. Additionally, Remitly's low fees are transparent and easy to understand, with no hidden charges or surprises. You can choose from a range of transfer options, including Economy, Express, and Market Rate, each with its own fee structure and delivery time. This flexibility allows you to tailor your transfer to your specific needs and budget, ensuring that you get the best value for your money. By using Remitly, you can save money on transfer fees and exchange rates, making it a cost-effective solution for your international money transfer needs.

Easy and Convenient Transfer Process

Remitly's transfer process is designed to be easy and convenient, allowing users to send money across borders with minimal hassle. The process begins with the user creating an account on the Remitly platform, which can be done quickly and easily online or through the mobile app. Once the account is set up, users can initiate a transfer by entering the recipient's details, including their name, address, and bank account information. Remitly's system then guides the user through the transfer process, providing clear and concise instructions every step of the way. The user can choose from a variety of transfer options, including express and economy transfers, depending on their needs and budget. Remitly's system also provides real-time exchange rates and transfer fees, so users can see exactly how much their recipient will receive. Once the transfer is initiated, Remitly's system takes care of the rest, ensuring that the funds are delivered quickly and securely to the recipient's bank account. Throughout the process, users can track the status of their transfer in real-time, receiving updates and notifications as the transfer progresses. Overall, Remitly's transfer process is designed to be fast, secure, and easy to use, making it a convenient option for those looking to send money across borders.

Reliable and Secure Money Transfer Service

Remitly is a reliable and secure money transfer service that provides users with a safe and efficient way to send money across borders. With Remitly, users can trust that their transactions are protected by robust security measures, including encryption and two-factor authentication. The platform also adheres to strict regulatory standards, ensuring that all transactions are compliant with anti-money laundering and know-your-customer laws. Additionally, Remitly's secure servers and data centers are protected by state-of-the-art firewalls and intrusion detection systems, providing an extra layer of security for users' sensitive information. Furthermore, Remitly's customer support team is available 24/7 to assist with any issues or concerns, providing users with peace of mind and confidence in the security of their transactions. With Remitly, users can send money with confidence, knowing that their transactions are secure, reliable, and compliant with regulatory standards.