How To Receive E Transfer

Understanding E-transfers: The Basics

What is an E-transfer?

An e-transfer, also known as an electronic transfer, is a safe and secure method used to transfer funds from one bank account to another via online banking or mobile apps. The process behind it involves utilizing the established and trusted networks of banks and financial institutions. E-transfers have gained popularity due to their speed, safety, and convenience, eliminating the need for physical checks or cash. This method has been particularly beneficial for businesses, especially in the era of digital transformation, enabling seamless transactions.

Benefits of E-Transfers

E-transfers hold several advantages over traditional banking methods. These include instant fund transfer, eliminating the need to visit a bank physically, high security as the transaction is protected by multiple layers of encryption, and the ability to send money internationally. Additionally, e-transfers support the growth of e-commerce and online businesses, and contributes to a cashless society, reducing the risks associated with handling cash, such as theft.

Pre-requisites for Conducting an E-Transfer

To make an e-transfer, all you need is an online or mobile banking account with a participating financial institution. The recipient also needs to have a bank account, but it does not necessarily have to be with the same institution. Most banks and credit unions in the United States and Canada offer this service. You also need to have the email address or mobile phone number of the person you want to send money to. It’s essential to ensure that all your details and the recipient's' details are accurate to avoid any issues or delays.

Steps to Receive an E-Transfer

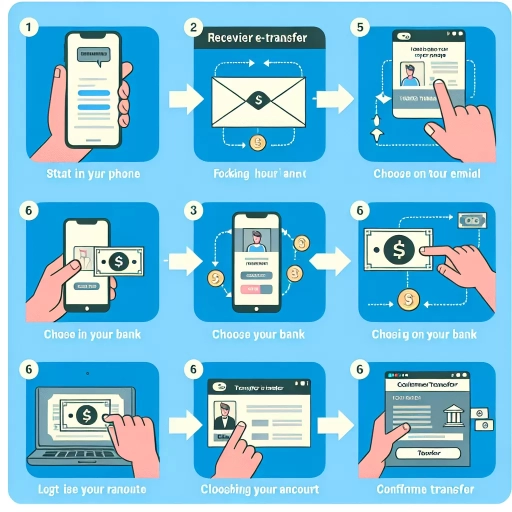

Notifying the Recipient

Once an e-transfer is initiated, the recipient receives an email or a text message notification. This message contains the details of the transfer, including the sender's name and the required steps to accept the e-transfer. This notification is usually received instantly or within a few minutes from the time the transfer has been initiated. It’s essential to verify the sender's details and the accuracy of the amount transferred before proceeding.

Processing the E-Transfer

The recipient has to follow the link provided in the notification email or text message. This link will redirect the recipient to the online banking portal of their financial institution. The recipient then needs to log in using their banking personal identification number (PIN) and accepts the transfer. The amount gets deposited directly to the recipient's bank account, and the sender gets a notification that the funds have been accepted.

Security Measures in Accepting E-Transfers

The security aspect of e-transfer is of utmost importance. When accepting an e-transfer, the recipient will often have to provide a security answer, previously shared between the sender and the recipient. This security question ensures the identity of the recipient and provides an added layer of security to the transaction. Moreover, it is recommended to conduct e-transactions through secured and private networks avoiding public WiFi to prevent potential cyber threats.

Common Issues and Resolutions in E-Transfers

Not Receiving the E-Transfer Notification

There can be situations where the recipient may not receive the e-transfer notification. This can occur due to various reasons like entering an incorrect email address or mobile number, or the notification being directed to the spam folder. To resolve this, it's always advisable to double-check the email address or mobile number before initiating a transfer. Recipients can also check their spam folder in case of non-receipt of notification.

Issues in Processing the Transfer

Sometimes, the recipient might face problems while processing the transfer. It could be due to incorrect security answers, temporary technical issues, or the expiration of the transfer (as e-transfers have a time limit within which they must be accepted). In such cases, coordinating with the sender or contacting customer support from the respective financial institution can help resolve most issues.

Security Concerns

E-transfers are generally safe, but there might be security challenges like phishing attempts and hacking threats. To overcome this, it's better to use a unique and non-personalized answer for the security question, change the online/mobile banking password regularly, and never share the security answer via email or text. Additionally, always ensure to use a secure and private network while conducting e-transactions.