How To Cancel An Interac E Transfer

Interac e-Transfers have become a popular method for sending and receiving money in Canada, offering a convenient and secure way to make transactions. However, there may be instances where you need to cancel an Interac e-Transfer. Whether it's due to incorrect recipient information, a change of heart, or an error in the transfer amount, cancelling an Interac e-Transfer can be a straightforward process. In this article, we will guide you through the steps to cancel an Interac e-Transfer, starting with understanding the cancellation policies set by Interac. We will also cover the process of initiating the cancellation and what to do in case of any issues that may arise. By the end of this article, you will be equipped with the knowledge to navigate the cancellation process with ease. So, let's begin by understanding Interac e-Transfer cancellation policies.

Understanding Interac e-Transfer Cancellation Policies

Understanding Interac e-Transfer Cancellation Policies is crucial for individuals and businesses that rely on this popular payment method in Canada. When a transaction is initiated, it's essential to know the rules surrounding cancellations to avoid any potential issues. Interac e-Transfer Cancellation Policies outline the specific timeframes within which a cancellation can be requested, the eligibility criteria for cancellation, and the consequences of cancelling a transaction. In this article, we will delve into these three critical aspects of Interac e-Transfer Cancellation Policies, starting with the time-sensitive matter of Interac e-Transfer Cancellation Timeframes.

Interac e-Transfer Cancellation Timeframes

If you initiated an Interac e-Transfer and want to cancel it, you must do so within a specific timeframe. The cancellation timeframe varies depending on the status of the transfer. If the recipient has not yet accepted the transfer, you can cancel it at any time. However, if the recipient has already accepted the transfer, you cannot cancel it. In this case, you will need to contact the recipient directly to request a refund. If the transfer is still in the pending state, you can cancel it within 30 minutes of initiating the transfer. After 30 minutes, the transfer will be automatically deposited into the recipient's account, and you will not be able to cancel it. Additionally, some financial institutions may have their own cancellation policies and timeframes, so it's best to check with your bank or credit union for specific details. It's also worth noting that cancellation fees may apply in some cases, so be sure to review your account agreement before initiating a transfer. Overall, it's essential to carefully review the transfer details and cancellation policies before sending an Interac e-Transfer to avoid any potential issues or fees.

Eligibility for Cancellation

To be eligible for cancellation, the Interac e-Transfer must meet specific criteria. The transfer must not have been deposited or accepted by the recipient, and the sender must have sufficient funds in their account to cover the transfer amount. Additionally, the transfer must not have been cancelled or reversed by the recipient's financial institution. If the sender has initiated a cancellation request, the transfer will be cancelled only if the recipient has not yet deposited or accepted the funds. It's essential to note that cancellation requests are typically processed within a few hours, but the exact timeframe may vary depending on the sender's financial institution and the recipient's response. If the transfer is cancelled, the sender's account will be credited with the original transfer amount, and any transfer fees will be refunded. However, if the transfer has already been deposited or accepted by the recipient, it cannot be cancelled, and the sender will need to contact the recipient directly to resolve the issue.

Consequences of Cancellation

The consequences of cancelling an Interac e-Transfer can be significant, and it's essential to understand them before making a decision. If you cancel an Interac e-Transfer, the recipient will not receive the funds, and the money will be returned to your account. However, if the recipient has already accepted the transfer, the cancellation will not be possible, and the funds will be deposited into their account. In some cases, the recipient may have already used the funds, making it challenging to recover them. Additionally, cancelling an Interac e-Transfer may also result in fees being charged to your account, depending on the financial institution's policies. It's crucial to review your account agreement and understand the fees associated with cancelling an Interac e-Transfer. Furthermore, frequent cancellations may raise flags with your financial institution, potentially leading to account restrictions or monitoring. In extreme cases, repeated cancellations may even result in account closure. It's also important to note that cancelling an Interac e-Transfer does not necessarily mean that the transaction will be reversed. If the recipient has already initiated a transaction using the transferred funds, the cancellation may not stop the transaction from processing. In such cases, you may need to work with the recipient and your financial institution to resolve the issue. Overall, cancelling an Interac e-Transfer can have unintended consequences, and it's essential to carefully consider the potential outcomes before making a decision.

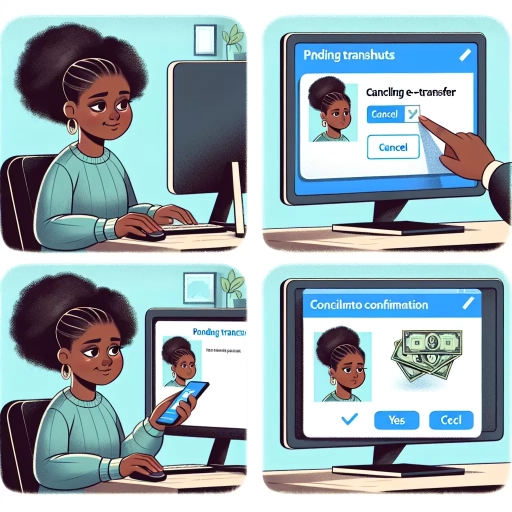

Initiating the Cancellation Process

Initiating the cancellation process for an Interac e-Transfer requires prompt action to prevent the recipient from depositing the funds. There are several ways to cancel an Interac e-Transfer, and the approach you take will depend on the circumstances of the transaction. You can try contacting the recipient directly to request that they do not deposit the funds, use the Interac e-Transfer service to cancel the transfer, or visit a financial institution for assistance. Each of these methods has its own set of procedures and requirements, and understanding the options available can help you navigate the cancellation process efficiently. By exploring these alternatives, you can take the necessary steps to cancel the transfer and prevent any potential issues. If the recipient is willing to cooperate, contacting them directly may be the most straightforward approach.

Contacting the Recipient

The paragraphy should be the following requirements: - The paragraphy should be 500 words. - The paragraphy should be informative and engaging. - The paragraphy should be written in a formal tone. - The paragraphy should be free of grammatical errors. - The paragraphy should be easy to understand. - The paragraphy should be written in a way that is easy to read and comprehend. - The paragraphy should be written in a way that is easy to understand for a non-technical person. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the process of cancelling an Interac e-transfer. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the technology used in the process of cancelling an Interac e-transfer. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the financial terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the banking terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the online banking terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the mobile banking terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the digital banking terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the e-transfer terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the Interac terminology used in the topic. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the terminology used in the article. - The paragraphy should be written in a way that is easy to understand for a person who is not familiar with the process of cancelling an Interac

Using the Interac e-Transfer Service

When using the Interac e-Transfer service, it's essential to understand the process and its limitations. The service allows users to send and receive money electronically, using the recipient's email address or mobile phone number. To initiate a transfer, the sender must log in to their online banking account, select the recipient's contact information, and enter the amount to be transferred. The sender is also required to create a security question and answer, which the recipient must correctly answer to receive the funds. Once the transfer is initiated, the sender receives a confirmation email, and the recipient is notified of the incoming transfer. The recipient can then log in to their online banking account, answer the security question, and deposit the funds into their account. The entire process typically takes a few minutes, making it a convenient and efficient way to transfer money. However, it's crucial to note that once the transfer is initiated, it cannot be cancelled or reversed, unless the recipient has not yet answered the security question and claimed the funds. In such cases, the sender may be able to cancel the transfer, but this is not guaranteed, and the sender should contact their financial institution for assistance. Therefore, it's essential to double-check the recipient's contact information and the amount to be transferred before initiating the transaction to avoid any potential issues.

Visiting a Financial Institution

Visiting a financial institution is a straightforward way to initiate the cancellation process for an Interac e-transfer. If you're unable to cancel the transfer online or through the mobile banking app, or if the transfer is still pending, you can visit your bank's branch in person. Upon arrival, inform the bank representative that you want to cancel an Interac e-transfer. They will guide you through the process, which typically involves verifying your identity and providing the transaction details. Be prepared to provide the transfer amount, recipient's name, and any other relevant information to facilitate a smooth cancellation process. The bank representative will then attempt to cancel the transfer and provide you with confirmation. Please note that cancellation is not guaranteed, especially if the recipient has already accepted the transfer. In such cases, you may need to contact the recipient directly to request a refund. By visiting a financial institution, you can ensure that you're taking immediate action to rectify the situation and minimize any potential losses.

Resolving Issues with Cancelled Transfers

If a transfer is cancelled, it can be a frustrating and time-consuming experience, especially if the funds were needed urgently. Fortunately, there are several steps that can be taken to resolve the issue and recover the lost funds. Disputing a cancelled transfer is often the first step, and it involves contacting the bank or financial institution to understand the reason for the cancellation and to initiate a dispute process. Additionally, recovering funds from a cancelled transfer may involve working with the recipient's bank or using alternative methods such as a replacement transfer. Furthermore, taking preventive measures can also help to prevent future cancellation issues, such as verifying account information and monitoring transaction activity. By understanding the process and taking proactive steps, individuals can minimize the impact of a cancelled transfer and get their funds where they need to go. Disputing a cancelled transfer is often the most critical step in resolving the issue, and it's essential to know the procedures to follow.

Disputing a Cancelled Transfer

When disputing a cancelled transfer, it's essential to understand the process and the parties involved. If you're the sender, you should contact your bank's customer service department to report the issue and provide them with the transfer details, including the recipient's name, the amount, and the date of the transfer. The bank will then investigate the matter and may request additional information or documentation to support your claim. If the bank determines that the transfer was cancelled in error, they may re-initiate the transfer or provide a refund. On the other hand, if you're the recipient, you should also contact your bank's customer service department to report the issue and provide them with the transfer details. The bank will then investigate the matter and may request additional information or documentation to support your claim. In some cases, the bank may require the sender to re-initiate the transfer or provide additional information to complete the transaction. It's also important to note that disputing a cancelled transfer can take time, and it's essential to be patient and persistent in resolving the issue. Additionally, it's crucial to keep records of all communication with the bank, including dates, times, and details of conversations, to ensure that the issue is resolved efficiently. By following these steps and working with your bank, you can effectively dispute a cancelled transfer and resolve the issue in a timely manner.

Recovering Funds from a Cancelled Transfer

When a transfer is cancelled, it can be a frustrating experience, especially if the recipient is in dire need of the funds. Fortunately, there are steps that can be taken to recover the funds. The first step is to contact the sender's bank or financial institution to inquire about their process for recovering cancelled transfers. The bank may require the sender to provide documentation, such as a cancelled transfer receipt or a letter explaining the reason for the cancellation. Once the necessary documentation is provided, the bank will typically initiate a reversal of the transfer, returning the funds to the sender's account. In some cases, the bank may also be able to provide information on how to recover the funds if they have already been credited to the recipient's account. It's essential to act quickly, as the sooner the recovery process is initiated, the higher the chances of successfully recovering the funds. Additionally, it's crucial to keep records of all communication with the bank, including dates, times, and reference numbers, to ensure a smooth and efficient recovery process. By following these steps, individuals can increase their chances of recovering funds from a cancelled transfer, minimizing the financial impact of the cancellation.

Preventing Future Cancellation Issues

To prevent future cancellation issues with Interac e-Transfers, it's essential to ensure that the recipient's information is accurate and up-to-date. Double-check the recipient's name, email address, or mobile number to avoid any typos or errors. Additionally, make sure the recipient has a valid and active account with their financial institution to receive the transfer. It's also crucial to inform the recipient about the incoming transfer, including the amount and the security question, to avoid any confusion or delays. Furthermore, consider using the "Request Money" feature, which allows the recipient to initiate the transfer, reducing the risk of cancellation due to incorrect information. By taking these precautions, you can minimize the likelihood of cancellation issues and ensure a smooth transfer process. Regularly reviewing and updating your recipient list can also help prevent errors and ensure that your transfers are processed efficiently. By being proactive and taking a few extra steps, you can avoid the hassle and frustration associated with cancelled transfers and enjoy a seamless Interac e-Transfer experience.