How To Calculate Deadweight Loss

Understanding Deadweight Loss

The Concept of Deadweight Loss

Deadweight Loss, in economics, is primarily concerned with the waste or inefficiency associated with market distortions such as taxes or subsidies. Its core concept revolves around the idea that in any market activity, where allocation is not achieved efficiently, some value from trade that could benefit both the buyer and the seller will not be attained. Consequently, it creates a "deadweight" on societal welfare, hence, the term deadweight loss. The knowledge of deadweight loss is crucial as it impacts both consumers and producers, providing insights on how to evaluate economic efficiency or policies.

Factors Influencing Deadweight Loss

Determining deadweight loss involves consideration of various factors. Firstly, the degree of elasticity, which measures how responsive demand and supply are to price changes, affects the level of deadweight loss. The more elastic the demand or supply curve, the larger the magnification of deadweight loss. Secondly, the size and type of the market distortion also matter; be it tax, subsidy, price control, or quota. Lastly, to determine the deadweight loss, the difference between the price consumers are willing to pay and the price producers are willing to accept must be ascertained.

Implications of Deadweight Loss

Deadweight loss has significant implications in economics and policy-making. It acts as a measure of economic inefficiency, signalling the loss of potential benefits that could be enjoyed in the absence of market distortions. From a policy perspective, understanding the causes and magnitude of deadweight loss is crucial in minimizing and mitigating economic inefficiency.

Calculating Deadweight Loss

The Steps in Calculating Deadweight Loss

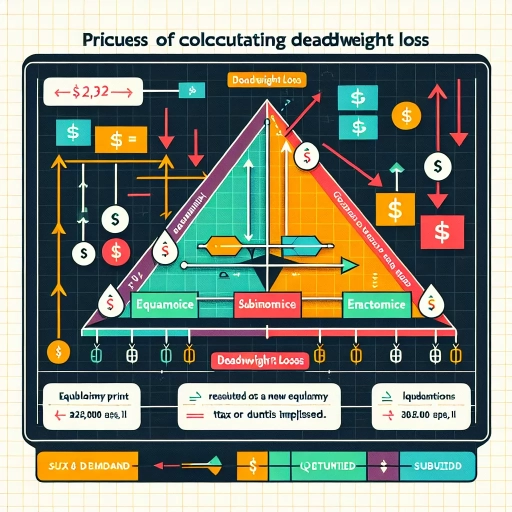

Calculating deadweight loss involves several steps. The first is to determine the point of societal optimum, i.e., where demand meets supply under normal market conditions. Next, identify the situation with market distortion like tax or price control, and determine the quantity traded and the consumer and producer prices. The difference between the two situations gives the deadweight loss, which can visually be represented as a triangle on the supply-demand graph.

Role of Supply and Demand Curves

The supply and demand curves play a vital role in calculating deadweight loss. These curves represent the behavior of buyers and sellers in the market and, when plotted on a graph, help visually determine the deadweight loss. The demand curve shows how the quantity demanded changes with price, while the supply curve shows how the quantity supplied changes with price. The area between these two curves, where natural market price occurs, is where one can visually estimate the deadweight loss.

Real-life Examples of Deadweight Loss Calculation

Real-life examples provide practical insights into how deadweight loss is computed. For instance, consider a market where the equilibrium price without tax is $10, and the quantity traded is 100 units. If a tax is introduced, the consumer price might rise to $12 while the producer price may fall to $8, decreasing the quantity traded to 80. The deadweight loss can be calculated as the area of the triangle formed by the new and old supply-demand points, which would amount to the lost gains from trade.

Reducing Deadweight Loss

Policy Measures to Minimize Deadweight Loss

Policy measures play a pivotal role in reducing deadweight loss. These can include lowering or removing taxes, subsidies, price controls, or other forms of market distortions that cause it. For instance, progressive taxation or per unit taxes can be implemented to decrease the burden and reduce inefficiencies. Moreover, governments can subsidize goods or services that have positive externalities to encourage production and consumption.

Role of Elasticity in Reducing Deadweight Loss

Manipulating the elasticity of supply and demand can also contribute to the reduction of deadweight loss. Given that more elastic demand and supply curves result in larger deadweight losses, measures to make them more inelastic can be taken. This could involve ensuring the availability of substitutes or enhancing the necessity of the good or service.

Importance of Market Efficiency

Promoting market efficiency is a key strategy in reducing deadweight loss. Efficient markets lead to the optimal allocation of resources, which maximizes societal welfare. Therefore, policies and measures should aim at opening up markets, promoting competition, and reducing barriers to trade. Measures such as liberalizing markets, eradicating restrictive trade practices, and encouraging innovation can help in achieving this goal.