How To Calculate Zakat On Gold

For Muslims, giving zakat is a fundamental aspect of their faith, and it's obligatory to pay zakat on certain types of wealth, including gold. Calculating zakat on gold can be a bit complex, but with the right guidance, it can be done accurately. To start, it's essential to understand the basics of zakat on gold, including what types of gold are subject to zakat and the conditions that must be met. Once you have a solid grasp of the basics, you can move on to determining the value of your gold for zakat purposes, taking into account factors such as the weight and purity of the gold. Finally, with the value of your gold determined, you can follow a step-by-step guide to calculate the zakat owed. In this article, we'll delve into each of these topics, starting with the basics of zakat on gold.

Understanding the Basics of Zakat on Gold

Here is the introduction paragraph: Understanding the basics of Zakat on gold is crucial for Muslims who possess gold and want to fulfill their religious obligations. Zakat is a fundamental pillar of Islam that involves giving a portion of one's wealth to the needy, and gold is one of the assets that are subject to Zakat. To comprehend the concept of Zakat on gold, it is essential to understand the basics of Zakat, including its importance in Islam, the types of gold that are subject to Zakat, and the Nisab value and its significance in Zakat calculation. In this article, we will delve into these topics, starting with the basics of Zakat and its importance in Islam. Here is the 200 words supporting paragraph: Zakat is a vital aspect of Islam that promotes social justice, equality, and compassion. It is a means of purifying one's wealth and soul, and it is obligatory for Muslims who possess a certain amount of wealth, known as Nisab. The importance of Zakat in Islam cannot be overstated, as it is one of the five pillars of the faith. By giving a portion of their wealth to the needy, Muslims demonstrate their commitment to the values of justice, equality, and compassion. Zakat also serves as a reminder of the transience of worldly wealth and the importance of using one's resources for the betterment of society. Furthermore, Zakat has a profound impact on the individual, as it helps to cultivate a sense of gratitude, humility, and generosity. By fulfilling their Zakat obligations, Muslims can experience a sense of spiritual growth and renewal, and they can contribute to the well-being of their communities. In the context of gold, Zakat is particularly relevant, as it is a valuable asset that can be used to support those in need. By understanding the basics of Zakat, Muslims can ensure that they are using their gold in a way that is consistent with the values of their faith.

What is Zakat and its Importance in Islam

Zakat, one of the five pillars of Islam, is a form of obligatory charity that requires Muslims to donate a portion of their wealth to the poor and needy. The word "zakat" literally means "purification" or "growth," and it is considered a means of purifying one's wealth and soul. In Islam, zakat is seen as a way to redistribute wealth, promote social justice, and help those in need. The importance of zakat lies in its ability to foster a sense of community and social responsibility among Muslims, as well as to provide a safety net for the most vulnerable members of society. By giving zakat, Muslims are reminded of their obligation to care for one another and to work towards creating a more just and equitable society. Furthermore, zakat is also seen as a means of spiritual growth and self-purification, as it helps individuals to detach from material wealth and focus on their spiritual well-being. Overall, zakat is a fundamental aspect of Islam that plays a critical role in promoting social justice, compassion, and spiritual growth.

The Types of Gold that are Subject to Zakat

There are several types of gold that are subject to zakat, including gold jewelry, gold coins, gold bars, and gold investments. Gold jewelry, such as necklaces, earrings, and rings, is subject to zakat if it is made from 24-karat gold and is not used for personal adornment. Gold coins, such as the American Gold Eagle or the Canadian Gold Maple Leaf, are also subject to zakat. Gold bars, which are typically made from 24-karat gold and are stamped with their weight and purity, are also subject to zakat. Additionally, gold investments, such as gold exchange-traded funds (ETFs) or gold mutual funds, are subject to zakat. It is worth noting that gold-plated or gold-filled items are not subject to zakat, as they do not contain a significant amount of gold. Furthermore, gold that is used for personal adornment, such as a wedding ring, is also exempt from zakat.

The Nisab Value and its Significance in Zakat Calculation

The Nisab value is a critical component in determining whether an individual is obligated to pay Zakat, a fundamental pillar of Islam. In the context of Zakat on gold, the Nisab value refers to the minimum amount of gold that a person must possess in order to be liable for Zakat. The Nisab value is calculated based on the value of 85 grams of gold, which is equivalent to 612.36 grams of silver. This value serves as a threshold, and individuals who possess gold worth more than this amount are required to pay Zakat. The significance of the Nisab value lies in its role in distinguishing between those who are obligated to pay Zakat and those who are not. By setting a minimum threshold, the Nisab value ensures that only those who have a substantial amount of wealth are required to contribute to the welfare of the community. Furthermore, the Nisab value also helps to prevent unnecessary hardship on individuals who may not have sufficient wealth to pay Zakat. In calculating Zakat on gold, the Nisab value is used as a benchmark to determine the amount of gold that is subject to Zakat. For instance, if an individual possesses 100 grams of gold, and the Nisab value is 85 grams, then only the excess amount of 15 grams is subject to Zakat. The Nisab value is an essential concept in Zakat calculation, and understanding its significance is crucial for individuals who wish to fulfill their Zakat obligations accurately and effectively.

Determining the Value of Gold for Zakat Purposes

Determining the value of gold for zakat purposes is a crucial step in fulfilling one's Islamic obligations. Zakat, or charitable giving, is one of the five pillars of Islam, and it is mandatory for Muslims to pay zakat on their wealth, including gold. However, calculating the value of gold can be complex, especially when it comes to gold jewelry and ornaments. To accurately determine the value of gold for zakat purposes, one must consider several factors, including the weight and purity of the gold, as well as its current market value. In this article, we will explore how to calculate the value of gold jewelry and ornaments, how to convert the value of gold to the local currency, and how to consider the purity of gold in zakat calculation. By understanding these key concepts, Muslims can ensure that they are fulfilling their zakat obligations accurately and fairly. First, let's start by examining how to calculate the value of gold jewelry and ornaments.

How to Calculate the Value of Gold Jewelry and Ornaments

To calculate the value of gold jewelry and ornaments for zakat purposes, you need to determine their weight and purity. Start by gathering all your gold items, including jewelry, coins, and other ornaments. Next, separate them into different piles based on their purity, such as 24K, 22K, 18K, and 14K. Then, use a digital scale to weigh each item in grams. For items that are not pure gold, such as those with gemstones or other metals, you'll need to estimate the weight of the gold content. You can do this by researching the typical gold content of similar items or consulting with a professional. Once you have the weight and purity of each item, you can calculate their value using the current market price of gold. You can find this information online or through a reputable gold dealer. Multiply the weight of each item by its purity and the current market price to get its total value. For example, if you have a 24K gold necklace that weighs 10 grams and the current market price is $40 per gram, the value of the necklace would be $400. Add up the values of all your gold items to get your total gold value. Finally, apply the zakat rate of 2.5% to this total value to determine how much zakat you owe on your gold jewelry and ornaments.

Converting the Value of Gold to the Local Currency

Converting the value of gold to the local currency is a crucial step in determining the value of gold for Zakat purposes. To do this, one needs to know the current market value of gold in the local currency. This can be done by checking the current gold price on a reliable website or by visiting a local gold dealer. Once the current market value is known, one can convert the weight of the gold to its equivalent value in the local currency. For example, if the current market value of gold is $40 per gram and one has 100 grams of gold, the total value of the gold would be $4,000. It is essential to use the current market value of gold to ensure accuracy in calculating the Zakat. Additionally, it is recommended to use a reliable and trustworthy source to determine the current market value of gold to avoid any discrepancies. By converting the value of gold to the local currency, one can accurately determine the value of their gold holdings and calculate the Zakat accordingly.

Considering the Purity of Gold in Zakat Calculation

When calculating zakat on gold, it is essential to consider the purity of the gold. The purity of gold is measured in karats, with 24 karats being the highest purity. The zakat calculation is based on the weight of the gold, and the purity of the gold affects its value. For example, 24-karat gold is considered 100% pure, while 22-karat gold is 91.6% pure, and 18-karat gold is 75% pure. To calculate the zakat on gold, one must first determine the weight of the gold in grams or ounces and then multiply it by the purity percentage. This will give the total value of the gold, which is then used to calculate the zakat. For instance, if someone has 100 grams of 22-karat gold, they would first calculate the value of the gold by multiplying 100 grams by 91.6% (0.916), resulting in 91.6 grams of pure gold. The zakat is then calculated based on the value of the 91.6 grams of pure gold. Considering the purity of gold is crucial in ensuring that the zakat calculation is accurate and fair.

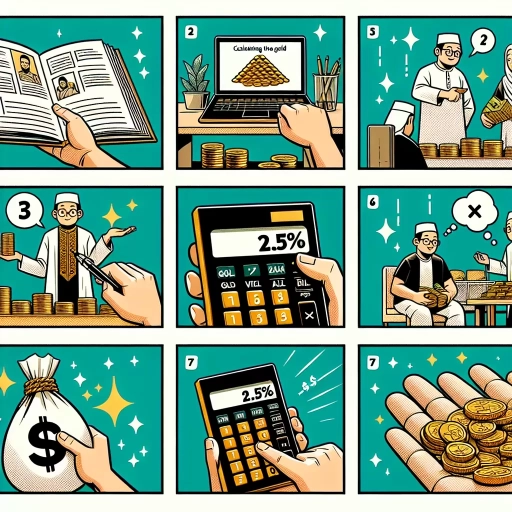

Calculating Zakat on Gold: A Step-by-Step Guide

Calculating Zakat on gold can be a complex process, but with a clear understanding of the steps involved, it can be made easier. Zakat, one of the five pillars of Islam, is a form of charity that requires Muslims to give a portion of their wealth to those in need. When it comes to gold, calculating Zakat involves several key steps. First, it is essential to gather the necessary information for Zakat calculation, including the total weight and value of the gold. Next, the Zakat rate must be applied to the total value of the gold, taking into account the current market value and the Nisab threshold. Finally, understanding the payment options for Zakat on gold is crucial, as it can be paid in various forms, including cash, gold, or other assets. By following these steps, Muslims can ensure that they are fulfilling their Zakat obligations accurately and efficiently. To begin, let's start by gathering the necessary information for Zakat calculation.

Gathering the Necessary Information for Zakat Calculation

To accurately calculate zakat on gold, it is essential to gather the necessary information. First, determine the total weight of gold you possess, including jewelry, coins, and bars. Ensure that the weight is measured in grams or kilograms, as zakat is typically calculated based on the weight of the gold. Next, find out the current market value of gold per gram or kilogram in your local currency. This information can be obtained from reliable sources such as financial websites, gold dealers, or local markets. Additionally, identify the nisab value, which is the minimum amount of gold that is subject to zakat. The nisab value is typically 85 grams of gold, but it may vary depending on the jurisdiction or Islamic authority. It is also crucial to determine the zakat rate, which is usually 2.5% of the total value of the gold. Furthermore, consider any debts or liabilities that you may have, as these can be deducted from the total value of the gold before calculating zakat. Lastly, decide on the zakat calculation method, which can be either the weight-based method or the value-based method, depending on your personal preference or the guidance of your Islamic authority. By gathering this information, you can ensure an accurate and reliable zakat calculation on your gold holdings.

Applying the Zakat Rate to the Total Value of Gold

To accurately calculate the zakat on gold, it is essential to apply the zakat rate to the total value of gold. The zakat rate is typically 2.5% of the total value of the gold. To apply this rate, first, determine the total value of the gold by multiplying the weight of the gold by its current market value. For example, if you have 100 grams of gold and the current market value is $50 per gram, the total value of the gold would be $5,000. Next, calculate 2.5% of the total value by multiplying $5,000 by 0.025, which equals $125. This amount represents the zakat payable on the gold. It is crucial to note that the zakat rate is applied to the total value of the gold, not just the weight or quantity. Therefore, it is essential to consider the current market value of the gold when calculating the zakat to ensure accuracy and compliance with Islamic principles.

Understanding the Payment Options for Zakat on Gold

When it comes to paying Zakat on gold, individuals have several payment options to choose from. The most common method is to pay in cash, which is the most straightforward and widely accepted option. However, some people may prefer to pay in kind, which means giving away the actual gold or its equivalent value in other forms of wealth. This option is also permissible, but it requires careful consideration to ensure that the value of the gold is accurately assessed and the recipient receives the correct amount. Another option is to pay through a Zakat collection agency or a charity organization, which can provide a convenient and trustworthy way to fulfill one's Zakat obligation. Some organizations also offer online payment options, making it easier for individuals to pay their Zakat from anywhere in the world. Ultimately, the choice of payment option depends on individual circumstances and preferences, but it is essential to ensure that the payment is made in a way that is acceptable and compliant with Islamic principles.