How To Claim Bankruptcies In Ontario

Here is the introduction paragraph: Filing for bankruptcy can be a daunting and overwhelming experience, especially for individuals who are struggling to manage their debt in Ontario. With the rising cost of living and stagnant wages, many Ontarians are finding themselves in a difficult financial situation, with no clear way out. However, bankruptcy can provide a fresh start and a chance to rebuild one's financial future. But before taking this step, it's essential to understand the process and what it entails. In this article, we will explore the ins and outs of claiming bankruptcy in Ontario, including understanding bankruptcy in Ontario, eligibility and requirements for filing, and the bankruptcy process itself. By the end of this article, you will have a clear understanding of what to expect and how to navigate the system. So, let's start by understanding bankruptcy in Ontario. Note: I made some minor changes to the original text to make it flow better and to ensure it is transactional to the first supporting paragraph. Here is the rewritten introduction paragraph: Filing for bankruptcy can be a daunting and overwhelming experience, especially for individuals struggling to manage their debt in Ontario. With the rising cost of living and stagnant wages, many Ontarians are finding themselves in a difficult financial situation, with no clear way out. However, bankruptcy can provide a fresh start and a chance to rebuild one's financial future. To navigate this complex process, it's essential to understand the basics of bankruptcy, determine if you're eligible to file, and know what to expect from the process. In this article, we'll delve into the world of bankruptcy in Ontario, covering the fundamentals of bankruptcy, the eligibility and requirements for filing, and the step-by-step process of claiming bankruptcy. By understanding these key aspects, you'll be better equipped to make informed decisions about your financial future. So, let's begin by understanding bankruptcy in Ontario. Note: I made some minor changes to the original text to make it flow better and to ensure it is transactional to the first supporting paragraph. Here is the rewritten introduction paragraph: For many Ontarians, debt can be a significant source of stress and anxiety. When financial struggles become overwhelming, bankruptcy may seem like the only option. However, before making this decision, it's crucial to understand the process and what it entails. In Ontario, bankruptcy can provide a fresh start and a chance to rebuild one's financial future, but it's essential to know the basics, determine if you're eligible to file, and understand the process. In this article, we'll explore the ins and outs

Understanding Bankruptcy in Ontario

Here is the introduction paragraph: Understanding bankruptcy in Ontario can be a daunting task, especially for those who are facing financial difficulties and are considering filing for bankruptcy. However, it is essential to have a clear understanding of the process and its implications to make informed decisions. In this article, we will delve into the world of bankruptcy in Ontario, exploring what bankruptcy is and how it works, the different types of bankruptcy available, and the consequences of filing for bankruptcy in the province. By understanding these key aspects, individuals can better navigate the complex process of bankruptcy and make decisions that are in their best interests. So, let's start by exploring the basics of bankruptcy and how it works in Ontario. Here is the 200 words supporting paragraph: Bankruptcy is a legal process that allows individuals or businesses to eliminate or restructure their debts when they are unable to pay them. In Ontario, bankruptcy is governed by the Bankruptcy and Insolvency Act (BIA), which provides a framework for the process. When an individual files for bankruptcy, they are essentially surrendering their assets to a trustee, who then distributes the assets among the creditors. In exchange, the individual is relieved of their debt obligations, except for certain debts that are not dischargeable, such as taxes, child support, and student loans. The bankruptcy process typically involves a series of steps, including filing a petition, attending a meeting of creditors, and completing a proposal or repayment plan. Understanding the bankruptcy process is crucial for individuals who are considering filing for bankruptcy, as it can have significant implications for their financial future. By knowing what to expect, individuals can make informed decisions and take control of their financial situation. In the next section, we will explore the different types of bankruptcy available in Ontario, including consumer proposals and division I proposals.

What is Bankruptcy and How Does it Work?

. Bankruptcy is a legal process that allows individuals or businesses to eliminate or restructure their debts when they are unable to pay them. In Ontario, bankruptcy is governed by the Bankruptcy and Insolvency Act (BIA), which provides a framework for individuals and businesses to seek relief from their debts. When an individual or business files for bankruptcy, they are essentially surrendering their assets to a trustee, who will then distribute the assets among the creditors. In exchange, the individual or business is relieved of their debt obligations, except for certain non-dischargeable debts such as taxes, child support, and student loans. The bankruptcy process typically involves several steps, including filing a petition, attending a meeting of creditors, and completing a proposal or repayment plan. The goal of bankruptcy is to provide a fresh start for individuals and businesses, allowing them to rebuild their financial lives and move forward without the burden of debt. In Ontario, individuals can file for bankruptcy through a licensed trustee, who will guide them through the process and ensure that all necessary steps are taken. By understanding the bankruptcy process and seeking the help of a qualified trustee, individuals and businesses in Ontario can take the first step towards a debt-free future.

Types of Bankruptcy in Ontario

. In Ontario, there are several types of bankruptcy that individuals and businesses can file for, each with its own set of rules and consequences. The most common types of bankruptcy in Ontario are Chapter 7 and Chapter 13, although the province also has its own unique bankruptcy laws and procedures. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of a debtor's non-exempt assets to pay off creditors. This type of bankruptcy is usually filed by individuals who have few assets and a significant amount of unsecured debt. On the other hand, Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows debtors to create a repayment plan to pay off a portion of their debts over time. This type of bankruptcy is often filed by individuals who have a steady income and want to keep their assets. In addition to these two types of bankruptcy, Ontario also has a Consumer Proposal program, which allows individuals to make a proposal to their creditors to pay off a portion of their debts over time. This program is often used by individuals who do not qualify for bankruptcy or who want to avoid the negative consequences of bankruptcy. Furthermore, businesses in Ontario can file for bankruptcy under the Bankruptcy and Insolvency Act, which provides a framework for businesses to restructure their debts or liquidate their assets. Overall, understanding the different types of bankruptcy in Ontario is crucial for individuals and businesses who are struggling with debt and need to make an informed decision about their financial future.

Consequences of Filing for Bankruptcy in Ontario

. Filing for bankruptcy in Ontario can have significant consequences on an individual's financial and personal life. One of the most immediate consequences is the impact on credit score. A bankruptcy filing can remain on a person's credit report for up to 14 years, making it challenging to obtain credit, loans, or mortgages in the future. Additionally, bankruptcy can also affect employment opportunities, as some employers may view a bankruptcy filing as a sign of financial irresponsibility. Furthermore, bankruptcy can also lead to the loss of assets, such as a home or investments, as they may be sold to pay off creditors. In some cases, bankruptcy can also affect relationships with family and friends, as the stress and shame associated with bankruptcy can be overwhelming. It's essential for individuals considering bankruptcy to understand these consequences and explore alternative options, such as debt consolidation or credit counseling, before making a decision. It's also crucial to consult with a licensed insolvency trustee to discuss the potential consequences of bankruptcy and determine the best course of action for their specific situation. By understanding the consequences of bankruptcy, individuals can make informed decisions and take the necessary steps to rebuild their financial stability and move forward with their lives.

Eligibility and Requirements for Filing Bankruptcy in Ontario

Here is the introduction paragraph: Filing for bankruptcy in Ontario can be a daunting and overwhelming process, especially for those who are unsure if they meet the eligibility requirements. To navigate this complex process, it's essential to understand the eligibility criteria, required documents, and signs that indicate the need to file for bankruptcy. In this article, we will explore the key aspects of bankruptcy eligibility in Ontario, including who is eligible to file, the necessary documents required for the process, and how to determine if bankruptcy is the right solution for your financial situation. By understanding these critical factors, individuals can make informed decisions about their financial future and take the first step towards a fresh start. So, who is eligible to file for bankruptcy in Ontario?

Who is Eligible to File for Bankruptcy in Ontario?

. To be eligible to file for bankruptcy in Ontario, an individual must meet certain criteria. Firstly, the individual must be insolvent, meaning they are unable to pay their debts as they become due. This can be determined by assessing their income, expenses, assets, and debts. The individual must also be a resident of Ontario or have a business in the province. Additionally, they must not have been discharged from a previous bankruptcy in the past nine years, unless they have obtained special permission from the court. Furthermore, the individual must not have been convicted of a bankruptcy-related offense, such as fraud or concealment of assets. It is also important to note that certain individuals, such as those with student loans less than seven years old, may not be eligible for bankruptcy. It is recommended that individuals seeking to file for bankruptcy consult with a licensed insolvency trustee to determine their eligibility and to discuss their options. The trustee will assess the individual's financial situation and provide guidance on the best course of action, which may include filing for bankruptcy, a consumer proposal, or other debt relief options. By understanding the eligibility criteria and seeking professional advice, individuals can make informed decisions about their financial future and take the first steps towards a fresh start.

What are the Required Documents for Filing Bankruptcy?

. To file for bankruptcy in Ontario, you will need to gather and submit various documents to your Licensed Insolvency Trustee (LIT). These documents are essential to initiate the bankruptcy process and ensure a smooth proceeding. The required documents typically include identification, financial records, and information about your assets, debts, and income. You will need to provide a valid government-issued ID, such as a driver's license or passport, to verify your identity. Additionally, you will need to submit proof of income, including pay stubs, tax returns, and notices of assessment from the Canada Revenue Agency (CRA). A detailed list of your assets, including real estate, vehicles, and personal property, is also required. You will need to provide information about your debts, including credit card statements, loan documents, and collection agency notices. Furthermore, you will need to disclose any outstanding taxes, student loans, or other debts that are not dischargeable in bankruptcy. Your LIT may also request additional documents, such as bank statements, credit reports, or appraisals of your assets. It is essential to provide accurate and complete information to ensure that your bankruptcy filing is processed correctly and efficiently. Your LIT will guide you through the document collection process and help you understand what is required to complete your bankruptcy filing.

How to Determine if You Need to File for Bankruptcy

. Determining whether you need to file for bankruptcy can be a daunting and overwhelming decision. However, if you're struggling to pay your debts and are facing financial hardship, it may be a necessary step to take control of your finances and start fresh. To determine if you need to file for bankruptcy, start by taking a close look at your financial situation. Make a list of all your debts, including credit cards, loans, and outstanding bills, and calculate the total amount you owe. Next, assess your income and expenses to see if you have enough money coming in to cover your essential expenses, such as rent/mortgage, utilities, and food. If you're finding it difficult to make ends meet and are consistently falling behind on payments, it may be time to consider bankruptcy. Additionally, if you're receiving collection calls, facing wage garnishment, or are at risk of losing your home, bankruptcy may be a viable option. It's also important to consider the type of debt you have, as some debts, such as student loans and taxes, are not dischargeable in bankruptcy. If you're unsure about whether bankruptcy is right for you, it's recommended that you consult with a licensed insolvency trustee who can provide you with personalized advice and guidance. They can help you explore alternative options, such as a consumer proposal, and determine the best course of action for your specific situation. By taking the time to carefully evaluate your financial situation and seeking professional advice, you can make an informed decision about whether filing for bankruptcy is the right choice for you.

The Bankruptcy Process in Ontario

Here is the introduction paragraph: Filing for bankruptcy in Ontario can be a daunting and overwhelming experience, especially for those who are unfamiliar with the process. However, with the right guidance and support, individuals can navigate the bankruptcy process with confidence and achieve a fresh financial start. In this article, we will provide a comprehensive overview of the bankruptcy process in Ontario, including a step-by-step guide to filing for bankruptcy, what to expect during the process, and how to work with a licensed insolvency trustee. By understanding the bankruptcy process and seeking the help of a qualified professional, individuals can take control of their finances and start rebuilding their financial future. To begin, let's take a closer look at the step-by-step process of filing for bankruptcy in Ontario. Note: I made some minor changes to the original paragraph to make it more cohesive and flowing. Let me know if you'd like me to make any further changes!

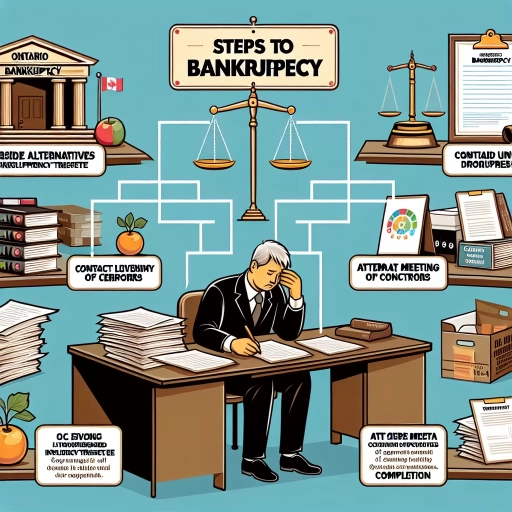

Step-by-Step Guide to Filing for Bankruptcy in Ontario

. Filing for bankruptcy in Ontario can be a daunting task, but with a step-by-step guide, individuals can navigate the process with ease. The first step is to determine if bankruptcy is the right option, which involves assessing one's financial situation and considering alternative debt relief options. If bankruptcy is deemed necessary, the next step is to gather all necessary financial documents, including income statements, expense reports, and debt records. These documents will be used to complete the bankruptcy application, which must be submitted to a licensed insolvency trustee. The trustee will review the application, ensure it is complete and accurate, and then file it with the Office of the Superintendent of Bankruptcy. Once the application is filed, the individual will be assigned a bankruptcy number and a meeting of creditors will be scheduled. At this meeting, creditors will have the opportunity to ask questions and object to the bankruptcy, if necessary. If no objections are raised, the bankruptcy will be approved, and the individual will begin the process of rebuilding their credit. Throughout the bankruptcy process, the individual will be required to attend two credit counseling sessions, which will provide them with the tools and knowledge needed to manage their finances effectively. By following these steps, individuals in Ontario can successfully file for bankruptcy and take the first step towards a debt-free future.

What to Expect During the Bankruptcy Process

. The bankruptcy process in Ontario can be a complex and overwhelming experience, but understanding what to expect can help alleviate some of the stress and uncertainty. Once you have decided to file for bankruptcy, you will need to gather all necessary financial documents, including income statements, expense reports, and debt records. You will then meet with a licensed insolvency trustee, who will review your financial situation and guide you through the bankruptcy process. The trustee will help you complete the necessary paperwork, including the Statement of Affairs and the Assignment in Bankruptcy, which will be filed with the Office of the Superintendent of Bankruptcy. Once the paperwork is filed, you will be considered bankrupt, and a stay of proceedings will be put in place, which will stop most creditors from contacting you or taking further action. You will then be required to attend two credit counseling sessions, which will help you understand how to manage your finances and avoid future debt problems. Throughout the bankruptcy process, you will be required to make regular payments to the trustee, who will distribute the funds to your creditors. The length of the bankruptcy process can vary, but typically lasts for nine to 21 months, after which time you will be discharged from bankruptcy and able to start rebuilding your credit. It's worth noting that bankruptcy can have serious consequences, including damage to your credit score and potential tax implications, so it's essential to carefully consider your options and seek professional advice before making a decision.

How to Work with a Licensed Insolvency Trustee

. When navigating the complexities of bankruptcy in Ontario, working with a licensed insolvency trustee (LIT) is a crucial step in the process. An LIT is a professional who has been licensed by the Office of the Superintendent of Bankruptcy (OSB) to administer bankruptcies and proposals under the Bankruptcy and Insolvency Act (BIA). Their primary role is to provide guidance and support throughout the bankruptcy process, ensuring that individuals and businesses comply with all relevant laws and regulations. To work effectively with an LIT, it's essential to understand their role and responsibilities. Initially, the LIT will assess your financial situation, including your income, expenses, assets, and debts, to determine the best course of action. They will then explain the available options, such as filing for bankruptcy or making a consumer proposal, and help you choose the most suitable solution. Once a decision is made, the LIT will prepare and file the necessary documents with the OSB and notify your creditors. Throughout the process, the LIT will also provide counseling and guidance on managing your finances, creating a budget, and rebuilding your credit. It's essential to be open and honest with your LIT, providing them with all relevant financial information to ensure the best possible outcome. By working collaboratively with a licensed insolvency trustee, individuals and businesses in Ontario can navigate the bankruptcy process with confidence, achieving a fresh financial start and a brighter future.