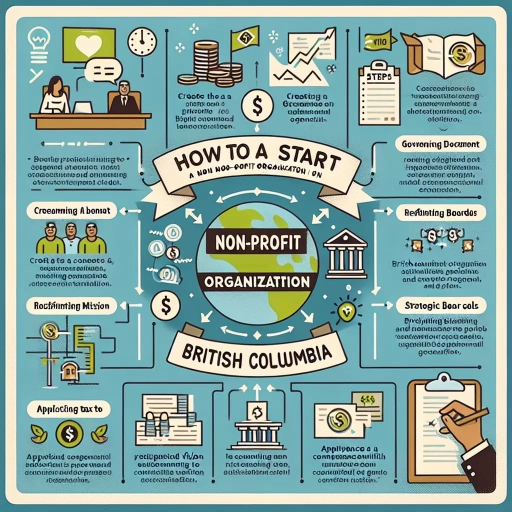

How To Start A Non Profit In Bc

Starting a non-profit organization in British Columbia can be a rewarding and challenging experience. With the right guidance, you can turn your passion into a successful and sustainable organization that makes a positive impact in your community. To get started, it's essential to understand the basics of starting a non-profit in BC, including the different types of non-profits, their purposes, and the laws that govern them. Once you have a solid grasp of the basics, you can move on to registering and incorporating your non-profit, which involves obtaining the necessary licenses and permits, and creating a strong foundation for your organization. This includes developing a business plan, building a board of directors, and establishing a financial management system. By following these steps, you can set your non-profit up for success and make a lasting difference in the lives of others. Let's start by understanding the basics of starting a non-profit in BC.

Understanding the Basics of Starting a Non-Profit in BC

Starting a non-profit organization in British Columbia can be a rewarding and challenging experience. To ensure the success of your venture, it is essential to understand the basics of non-profit organizations in BC. This includes defining the purpose and mission of your non-profit, understanding the different types of non-profit organizations in the province, and familiarizing yourself with BC's non-profit legislation and regulations. By grasping these fundamental concepts, you can establish a solid foundation for your organization and set it up for long-term success. In this article, we will delve into these essential topics, starting with the importance of defining the purpose and mission of your non-profit, which will serve as the guiding force behind your organization's goals and objectives.

Defining the Purpose and Mission of Your Non-Profit

Defining the purpose and mission of your non-profit is a crucial step in establishing a clear direction and focus for your organization. Your purpose statement should concisely outline the reason for your non-profit's existence, while your mission statement should describe the specific goals and objectives you aim to achieve. A well-crafted purpose and mission statement will serve as a guiding force for your organization, helping to inform decision-making, inspire stakeholders, and drive progress towards your goals. When defining your purpose and mission, consider the following key elements: what problem or need does your non-profit aim to address, what values and principles will guide your work, and what specific outcomes do you hope to achieve. By taking the time to carefully craft your purpose and mission statement, you will be able to establish a strong foundation for your non-profit and set yourself up for long-term success.

Understanding the Different Types of Non-Profit Organizations in BC

In British Columbia, non-profit organizations are categorized into different types based on their purpose, structure, and activities. Understanding these types is essential for individuals and groups looking to start a non-profit in BC. The most common types of non-profits in BC include charities, societies, and cooperatives. Charities are organizations that are established for a charitable purpose, such as relieving poverty, advancing education, or promoting health. They are registered with the Canada Revenue Agency (CRA) and are eligible to issue tax receipts for donations. Societies, on the other hand, are non-profit organizations that are incorporated under the Societies Act of BC. They can be established for a wide range of purposes, including cultural, recreational, or community development. Cooperatives are member-owned and member-controlled organizations that operate for the benefit of their members. They can be established for various purposes, such as providing housing, healthcare, or financial services. Other types of non-profits in BC include foundations, which are organizations that are established to hold and manage assets for charitable purposes, and community land trusts, which are organizations that hold land for the benefit of a community. Understanding the different types of non-profit organizations in BC is crucial for determining the best structure and purpose for a new non-profit, as well as for ensuring compliance with relevant laws and regulations.

Familiarizing Yourself with BC's Non-Profit Legislation and Regulations

Familiarizing yourself with BC's non-profit legislation and regulations is a crucial step in starting a non-profit organization in the province. The Societies Act, which came into effect in 2016, is the primary legislation governing non-profit organizations in BC. This act outlines the rules and regulations for incorporating, operating, and dissolving a non-profit society. It's essential to understand the key aspects of the Societies Act, including the requirements for incorporation, the roles and responsibilities of directors and officers, and the rules for meetings and decision-making. Additionally, non-profits in BC must also comply with the Income Tax Act, the Canada Not-for-profit Corporations Act, and other federal and provincial laws. The BC Registry Services website provides a wealth of information on non-profit legislation and regulations, including guides, forms, and FAQs. It's also recommended to consult with a lawyer or accountant who is familiar with non-profit law in BC to ensure compliance with all relevant laws and regulations. By taking the time to familiarize yourself with BC's non-profit legislation and regulations, you can ensure that your non-profit organization is set up for success and is operating in compliance with the law.

Registering and Incorporating Your Non-Profit in BC

Registering and incorporating your non-profit organization in British Columbia is a crucial step in establishing a legitimate and sustainable entity. To successfully navigate this process, it is essential to understand the key steps involved. Firstly, choosing a unique name for your non-profit organization is vital to avoid confusion and ensure brand identity. This involves conducting a thorough search of existing names and ensuring compliance with BC's naming regulations. Once a suitable name is selected, the next step is preparing and filing the articles of incorporation, which outlines the organization's purpose, structure, and governance. Additionally, obtaining a business number and registering for taxes is necessary to comply with federal and provincial tax laws. By following these steps, your non-profit organization can establish a strong foundation for future growth and success. To begin this process, let's start with the first crucial step: Choosing a Unique Name for Your Non-Profit Organization.

Choosing a Unique Name for Your Non-Profit Organization

Choosing a unique name for your non-profit organization is a crucial step in establishing your brand identity and differentiating yourself from other organizations. In British Columbia, the name of your non-profit must comply with the Societies Act, which requires that the name be distinctive and not likely to be confused with the name of another organization. To ensure that your chosen name meets these requirements, you can conduct a name search through the BC Corporate Registry's database. It's also a good idea to check if the desired web domain and social media handles are available to maintain consistency across all platforms. Additionally, consider the values and mission of your organization when selecting a name, as it will be a representation of your brand and values. A unique and memorable name will help you stand out and make a lasting impression on your audience. Furthermore, a well-chosen name can also help you establish a strong brand identity, which is essential for building trust and credibility with your stakeholders. By taking the time to carefully select a unique and meaningful name, you can set your non-profit organization up for success and create a lasting impact in your community.

Preparing and Filing the Articles of Incorporation

Preparing and filing the Articles of Incorporation is a crucial step in registering and incorporating your non-profit organization in British Columbia. The Articles of Incorporation is a legal document that outlines the fundamental structure and purpose of your organization, and it must be filed with the British Columbia Corporate Registry. To prepare the Articles, you will need to gather information about your organization, including its name, purpose, and structure. You will also need to decide on the number of directors and the distribution of voting rights. The Articles must be signed by the incorporators, who are the individuals responsible for incorporating the organization. Once the Articles are prepared, they must be filed with the Corporate Registry, along with the required filing fee. The filing fee is currently $350, and it can be paid online or by mail. After the Articles are filed, the Corporate Registry will review them to ensure that they meet the requirements of the Societies Act. If the Articles are approved, the Corporate Registry will issue a Certificate of Incorporation, which is proof that your organization has been incorporated. The Certificate of Incorporation is an important document that you will need to obtain a business number, open a bank account, and apply for tax-exempt status. Overall, preparing and filing the Articles of Incorporation is a critical step in establishing your non-profit organization in British Columbia, and it is essential to ensure that the process is done correctly to avoid any delays or complications.

Obtaining a Business Number and Registering for Taxes

Obtaining a Business Number and Registering for Taxes is a crucial step in registering and incorporating your non-profit organization in BC. A Business Number is a unique nine-digit number assigned to your organization by the Canada Revenue Agency (CRA) and is used to identify your organization for tax purposes. To obtain a Business Number, you will need to register for a GST/HST account, a payroll account, and a corporate income tax account. You can register for these accounts online through the CRA website or by phone. Once you have obtained your Business Number, you will need to register for taxes, including GST/HST, payroll taxes, and corporate income taxes. You will also need to obtain any necessary provincial tax accounts, such as a PST account. It is recommended that you consult with an accountant or tax professional to ensure that you are meeting all of your tax obligations. Additionally, you will need to file annual tax returns and other required tax forms with the CRA and the province of BC. By obtaining a Business Number and registering for taxes, you will be able to operate your non-profit organization in compliance with tax laws and regulations.

Building a Strong Foundation for Your Non-Profit in BC

Here is the introduction paragraph: Building a strong foundation is crucial for the success and sustainability of any non-profit organization in British Columbia. A well-planned foundation will enable your organization to effectively achieve its mission, secure funding, and build a positive reputation in the community. To establish a solid foundation, it is essential to develop a comprehensive business plan and budget, establish a board of directors and governance structure, and create a fundraising strategy and secure initial funding. By focusing on these key areas, you can set your non-profit up for long-term success and make a meaningful impact in the community. In this article, we will explore each of these critical components in more detail, starting with the importance of developing a comprehensive business plan and budget.

Developing a Comprehensive Business Plan and Budget

Developing a comprehensive business plan and budget is a crucial step in building a strong foundation for your non-profit organization in BC. A well-crafted business plan outlines your organization's mission, goals, and strategies for achieving them, while a budget provides a detailed financial roadmap for the next year or more. A comprehensive business plan should include an executive summary, a description of your organization's mission and goals, an analysis of your target market and competition, a description of your products or services, a marketing and sales strategy, a management and organizational structure, and a financial plan. Your budget should include projected income and expenses, a breakdown of funding sources, and a plan for managing cash flow. A comprehensive business plan and budget will help you secure funding, make informed decisions, and ensure the long-term sustainability of your organization. It's also important to review and update your business plan and budget regularly to reflect changes in your organization and the external environment. By developing a comprehensive business plan and budget, you'll be well on your way to building a strong foundation for your non-profit organization in BC.

Establishing a Board of Directors and Governance Structure

Establishing a board of directors and governance structure is a crucial step in building a strong foundation for your non-profit organization in BC. A well-structured board of directors provides strategic guidance, oversight, and accountability, ensuring your organization operates effectively and efficiently. To establish a board, you'll need to recruit a diverse group of individuals with relevant skills, expertise, and experience. Typically, a board consists of 5-15 members, including a chair, treasurer, and secretary. When selecting board members, consider factors such as their understanding of your organization's mission, their ability to contribute to decision-making, and their commitment to your cause. It's also essential to ensure that your board reflects the diversity of the community you serve. In BC, the Societies Act requires that at least 2/3 of your board members be residents of the province. Once your board is established, you'll need to develop a governance structure that outlines roles, responsibilities, and decision-making processes. This includes defining the board's authority, establishing committees, and creating policies and procedures for governance, finance, and human resources. A well-defined governance structure will help ensure that your organization operates transparently, accountably, and in compliance with regulatory requirements. By establishing a strong board of directors and governance structure, you'll be able to build trust with stakeholders, secure funding, and achieve your organization's mission.

Creating a Fundraising Strategy and Securing Initial Funding

Creating a fundraising strategy is a crucial step in securing initial funding for your non-profit organization in BC. A well-planned strategy will help you identify potential donors, build relationships, and make a compelling case for support. Start by researching your target audience, including individual donors, foundations, corporations, and government agencies. Develop a donor database and track interactions, donations, and communication. Set clear fundraising goals, both short-term and long-term, and establish a budget for fundraising activities. Identify your unique selling proposition (USP) and craft a persuasive pitch that highlights your organization's mission, impact, and financial transparency. Utilize various fundraising channels, such as online giving, events, direct mail, and social media, to reach your target audience. Consider applying for grants from foundations, corporations, and government agencies, and build relationships with key stakeholders. Additionally, explore alternative funding sources, such as crowdfunding, sponsorships, and in-kind donations. By creating a comprehensive fundraising strategy, you'll be well-equipped to secure initial funding and set your non-profit organization up for long-term success.