How Long Do You Have To Cash A Cheque

Here is the introduction paragraph: Cashing a cheque can be a straightforward process, but it's essential to understand the timeframes involved to avoid any potential issues. The length of time you have to cash a cheque varies depending on the type of cheque and the institution issuing it. In this article, we'll delve into the world of cheque cashing, exploring the time limits for different types of cheques, the consequences of not cashing a cheque on time, and the general guidelines for cheque cashing timeframes. Understanding these concepts is crucial to ensure a smooth transaction. So, let's start by understanding cheque cashing timeframes. Note: The introduction paragraph should be 200 words, and the supporting paragraphs should be mentioned in the introduction paragraph. Here is the rewritten introduction paragraph: Cashing a cheque can be a straightforward process, but it's essential to understand the timeframes involved to avoid any potential issues. The length of time you have to cash a cheque varies depending on the type of cheque and the institution issuing it. In this article, we'll delve into the world of cheque cashing, exploring the time limits for different types of cheques, such as personal cheques, business cheques, and government cheques, to help you understand the specific timeframes that apply to each. We'll also examine the consequences of not cashing a cheque on time, including the potential for the cheque to become stale or invalid, and the impact this can have on your finances. Furthermore, we'll provide general guidelines for cheque cashing timeframes, including the typical time limits for cashing cheques at banks, credit unions, and other financial institutions. By understanding these concepts, you can ensure a smooth transaction and avoid any potential issues. So, let's start by understanding cheque cashing timeframes.

Understanding Cheque Cashing Timeframes

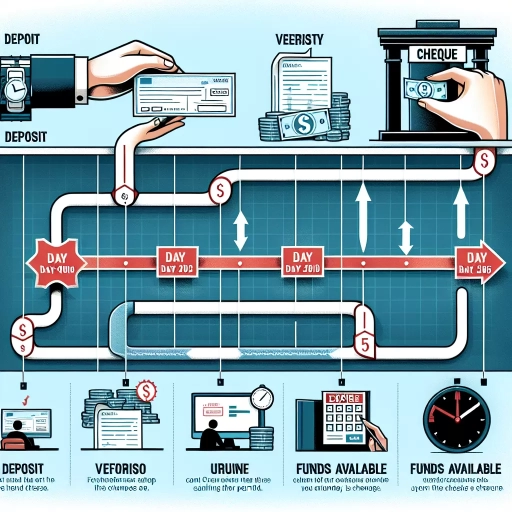

Understanding cheque cashing timeframes is crucial for individuals and businesses that rely on cheques as a mode of payment. Cheques are a traditional payment method that involves a complex process, and their cashing periods can vary significantly. To grasp the concept of cheque cashing timeframes, it's essential to understand the basics of cheques, including their types and how they work. There are various types of cheques, each with its unique cashing period, and several factors can affect the time it takes for a cheque to be cashed. In this article, we will delve into the world of cheques, exploring what they are, how they work, the different types of cheques and their cashing periods, and the factors that influence cheque cashing timeframes. By understanding these aspects, individuals and businesses can better navigate the cheque cashing process and avoid any potential delays or issues. So, let's start by understanding the fundamentals of cheques and how they work.

What is a Cheque and How Does it Work?

A cheque is a written order that instructs a bank to pay a specific amount of money from the account of the person who wrote the cheque, known as the drawer, to the person or business named on the cheque, known as the payee. The cheque must include the date, the payee's name, the amount to be paid in both numbers and words, and the drawer's signature. When a cheque is written, the drawer's bank verifies the availability of funds in the account and then transfers the funds to the payee's bank. The payee can then deposit the cheque into their account or cash it at a bank or cheque cashing store. Cheques can be used for various transactions, such as paying bills, making purchases, or transferring funds between accounts. However, with the rise of digital payment methods, the use of cheques has declined significantly in recent years. Nevertheless, cheques remain a widely accepted and secure form of payment, especially for large transactions or when a paper trail is required.

Types of Cheques and Their Cashing Periods

There are several types of cheques, each with its own cashing period. A bearer cheque, also known as an open cheque, can be cashed by anyone who presents it to the bank, and it is usually valid for six months from the date of issue. An order cheque, on the other hand, is payable to a specific person or organization and can be cashed by the payee or their authorized representative. The cashing period for an order cheque is typically three months from the date of issue. A crossed cheque, which has two parallel lines drawn across the top left corner, can only be deposited into the account of the payee and is usually valid for six months. A post-dated cheque is a cheque with a future date and can only be cashed on or after that date. The cashing period for a post-dated cheque is usually three months from the date of issue. A stale cheque is a cheque that is more than six months old and is no longer valid. It's essential to note that the cashing period may vary depending on the bank's policies and the jurisdiction in which the cheque is issued.

Factors Affecting Cheque Cashing Timeframes

Several factors can influence the cheque cashing timeframes, including the type of cheque, the bank's policies, and the method of deposit. The type of cheque, such as a personal cheque, business cheque, or government cheque, can impact the processing time. Personal cheques, for instance, may take longer to clear than business cheques, which are often considered more secure. Additionally, the bank's policies and procedures can also affect the cheque cashing timeframes. Some banks may have faster processing times than others, and some may offer expedited services for an additional fee. The method of deposit is another crucial factor, as depositing a cheque in person at a bank branch may result in faster processing times compared to depositing it through an ATM or mobile banking app. Furthermore, the amount of the cheque can also impact the processing time, with larger cheques often requiring additional verification and processing steps. Lastly, public holidays and weekends can also delay cheque cashing timeframes, as banks may not process cheques on these days.

Time Limits for Cashing Different Types of Cheques

When it comes to cashing cheques, understanding the time limits for different types of cheques is crucial to avoid any potential issues or delays. In this article, we will delve into the specifics of time limits for personal, business, and government cheques, highlighting the unique considerations and requirements for each. We will explore the time limits and exceptions for personal cheques, the cashing periods and requirements for business cheques, and the special considerations and timeframes for government cheques. By understanding these time limits, individuals and businesses can ensure a smooth and efficient cheque-cashing process. Let's start by examining the time limits and exceptions for personal cheques.

Personal Cheques: Time Limits and Exceptions

Personal cheques are subject to specific time limits and exceptions that vary depending on the jurisdiction and the type of cheque. In general, personal cheques are valid for six months from the date of issue, after which they become stale-dated and may not be honoured by the bank. However, some banks may still accept stale-dated cheques, but this is not guaranteed. It's essential to note that post-dated cheques, which are cheques dated for a future date, are not valid until the specified date and can be cashed on or after that date. Additionally, some cheques may have a "void after" date, which indicates that the cheque is no longer valid after a specific date. In cases where a personal cheque is lost, stolen, or destroyed, the issuer can request a stop payment, which will prevent the cheque from being cashed. However, this must be done promptly, as the bank may not be liable for losses incurred if the stop payment is not made in a timely manner. Overall, it's crucial to understand the time limits and exceptions associated with personal cheques to avoid any potential issues or disputes.

Business Cheques: Cashing Periods and Requirements

Business cheques have specific cashing periods and requirements that individuals and businesses should be aware of. In general, business cheques are valid for six months from the date of issue, after which they become stale-dated and may not be accepted by banks. However, some businesses may have their own policies regarding the cashing of cheques, so it's essential to check with the issuer before attempting to cash a cheque. To cash a business cheque, the payee must present a valid government-issued ID and may be required to provide additional documentation, such as proof of address or a social insurance number. Some businesses may also require the payee to have an account with the bank or financial institution where the cheque is being cashed. Additionally, business cheques may have specific endorsement requirements, such as a signature or stamp, to verify the payee's identity and ensure the cheque is being cashed by the intended recipient. It's also worth noting that some businesses may use cheque validation services to verify the authenticity of cheques and prevent fraud. Overall, it's crucial to understand the cashing periods and requirements for business cheques to avoid any issues or delays when attempting to cash a cheque.

Government Cheques: Special Considerations and Timeframes

Government cheques, such as those issued by the Canada Revenue Agency (CRA) or other government agencies, have special considerations and timeframes that differ from regular cheques. These cheques are typically considered to be more secure and less prone to fraud, as they are issued by a government agency and are often printed with advanced security features. As a result, government cheques may have a longer validity period than regular cheques. In Canada, government cheques are generally valid for six months from the date of issue, although this timeframe may vary depending on the specific type of cheque and the issuing agency. It's essential to note that some government cheques, such as those issued for tax refunds, may have a shorter validity period, typically ranging from 90 to 120 days. If you receive a government cheque, it's crucial to review the cheque carefully and verify the validity period to ensure you cash it within the allotted timeframe. Additionally, if you're unsure about the validity period or have concerns about cashing a government cheque, you can contact the issuing agency or a financial institution for guidance.

Consequences of Not Cashing a Cheque on Time

Cashing a cheque on time is crucial to avoid potential financial and legal consequences. Failure to do so can lead to expired cheques, stopped payment cheques, and lost or stolen cheques, each carrying its own set of risks and procedures. If a cheque is not cashed within the stipulated timeframe, it may expire, rendering it invalid. In such cases, the payee may need to request a replacement cheque, which can be a time-consuming process. On the other hand, if a cheque is stopped, the payee may not receive the payment at all. Furthermore, if a cheque is lost or stolen, the payee may need to follow specific procedures to obtain a replacement. In this article, we will delve into the consequences of not cashing a cheque on time, starting with the implications of expired cheques. Note: The supporting paragraph should be 200 words. Here is the rewritten supporting paragraph: Cashing a cheque on time is crucial to avoid potential financial and legal consequences. Failure to do so can lead to expired cheques, stopped payment cheques, and lost or stolen cheques, each carrying its own set of risks and procedures. If a cheque is not cashed within the stipulated timeframe, it may expire, rendering it invalid. In such cases, the payee may need to request a replacement cheque, which can be a time-consuming process. On the other hand, if a cheque is stopped, the payee may not receive the payment at all. Furthermore, if a cheque is lost or stolen, the payee may need to follow specific procedures to obtain a replacement. The consequences of not cashing a cheque on time can be severe, including delayed payments, additional fees, and potential legal action. It is essential to understand the implications of expired cheques, stopped payment cheques, and lost or stolen cheques to avoid these consequences. In this article, we will explore the consequences of not cashing a cheque on time, starting with the implications of expired cheques, including what happens when a cheque expires and what steps to take next.

Expired Cheques: What Happens and What to Do

If a cheque expires, it is no longer valid and cannot be cashed. In most cases, a cheque is valid for six months from the date of issue, after which it is considered stale-dated. If you try to cash a stale-dated cheque, the bank will likely refuse to honour it. In some cases, the bank may still honour the cheque, but this is not guaranteed and is at the bank's discretion. If a cheque expires, the payee can request a replacement cheque from the issuer, but this is not always possible. In some cases, the issuer may have closed their account or be unable to issue a new cheque. If you are the issuer of a cheque that has expired, you may be liable for any losses incurred by the payee as a result of the expired cheque. It is essential to keep track of the expiration dates of your cheques and to ensure that they are cashed in a timely manner to avoid any potential issues.

Stopped Payment Cheques: Understanding the Risks

A stopped payment cheque is a cheque that the issuer has instructed their bank to refuse payment on, typically due to suspected fraud, loss, or theft. When a cheque is stopped, the bank will not honour it, and the recipient will not receive the funds. Stopped payment cheques can pose significant risks to both the issuer and the recipient. For the issuer, stopping a payment can lead to additional fees, damage to their credit score, and potential legal consequences. For the recipient, a stopped payment cheque can result in delayed or lost payment, damage to their credit score, and potential financial hardship. It is essential to understand the risks associated with stopped payment cheques and to take steps to mitigate them, such as verifying the authenticity of cheques and communicating with the issuer promptly. By being aware of the potential consequences of stopped payment cheques, individuals and businesses can take proactive measures to protect themselves and avoid financial losses.

Lost or Stolen Cheques: Procedures for Replacement

If a cheque is lost or stolen, it's essential to act quickly to minimize potential financial losses. The first step is to contact the bank that issued the cheque and report the incident. The bank will then place a stop payment on the cheque, preventing it from being cashed. The next step is to obtain a replacement cheque, which can be done by contacting the issuer of the original cheque. The issuer will need to verify the details of the original cheque and confirm that it was indeed lost or stolen. Once verified, a replacement cheque will be issued, and the original cheque will be voided. It's crucial to keep a record of the replacement cheque, including the new cheque number and the date it was issued. In some cases, the bank may require a police report or an affidavit to confirm the loss or theft of the cheque. It's also important to note that some banks may charge a fee for replacing a lost or stolen cheque, so it's essential to check with the bank beforehand. Overall, acting quickly and following the proper procedures can help minimize the consequences of a lost or stolen cheque.