How Long For E Transfer To Go Through

Electronic fund transfers, commonly known as e-transfers, have become a staple in modern banking, allowing individuals to send and receive money quickly and efficiently. But have you ever wondered how long it takes for an e-transfer to go through? The answer lies in understanding the intricacies of e-transfer technology and the various factors that influence its processing time. In this article, we will delve into the world of e-transfers, exploring what they are and how they work, the factors that affect their processing time, and the typical timeframes for completion. By the end of this article, you will have a comprehensive understanding of e-transfers and be able to navigate the process with confidence. So, let's start by examining the basics of e-transfers and how they work.

What is E-Transfer and How Does it Work?

E-transfer, also known as Interac e-transfer, is a popular method of transferring funds electronically in Canada. It allows users to send and receive money quickly and securely through online banking or mobile banking apps. But have you ever wondered what e-transfer is and how it works? In this article, we will delve into the world of e-transfers, exploring its definition and purpose, the step-by-step process of sending and receiving e-transfers, and the security measures in place to protect users. By understanding how e-transfers work, you can make informed decisions about using this convenient and efficient payment method. So, let's start by defining what e-transfer is and its purpose.

Definition of E-Transfer and its Purpose

E-transfer, also known as Interac e-transfer, is a popular method of transferring funds electronically in Canada. The primary purpose of e-transfer is to enable individuals and businesses to send and receive money quickly, securely, and conveniently. This digital payment system allows users to transfer funds from their bank account to another person's bank account using their email address or mobile phone number. The recipient can then deposit the funds into their account, making it a hassle-free and efficient way to transfer money. The purpose of e-transfer is to provide a fast, reliable, and cost-effective alternative to traditional payment methods, such as cheques or cash, and to facilitate online transactions, bill payments, and person-to-person transfers. With e-transfer, users can send and receive money 24/7, making it an ideal solution for individuals and businesses that require fast and secure payment processing.

Step-by-Step Process of Sending and Receiving E-Transfers

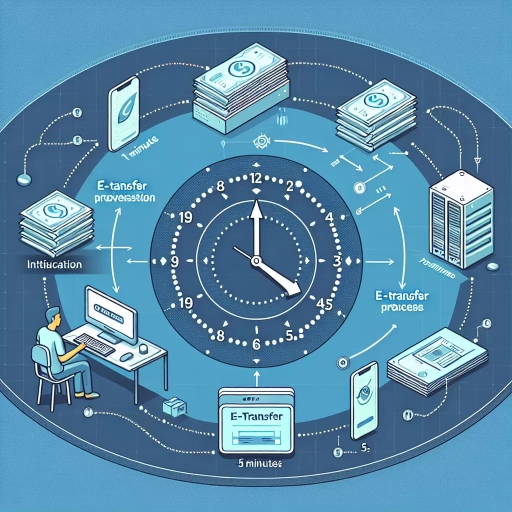

Here is the paragraphy: Sending and receiving e-transfers is a straightforward process that can be completed in a few simple steps. To send an e-transfer, start by logging into your online banking platform and selecting the "e-transfer" or "Interac e-transfer" option. Next, enter the recipient's email address or mobile phone number, as well as the amount you wish to transfer. You will also need to create a security question and answer, which the recipient will need to answer correctly in order to access the funds. Once you have entered all of the required information, review the details carefully and confirm the transfer. The recipient will then receive a notification via email or text message, prompting them to answer the security question and deposit the funds into their account. To receive an e-transfer, simply follow the link provided in the notification and answer the security question. Once you have answered the question correctly, you will be able to deposit the funds into your account. It's that easy! The entire process typically takes just a few minutes to complete, making e-transfers a quick and convenient way to send and receive money.

Security Measures in Place for E-Transfers

To ensure the security and integrity of e-transfers, financial institutions and online banking platforms have implemented various security measures. These measures include encryption, secure socket layer (SSL) technology, and two-factor authentication. Encryption scrambles the data being transmitted, making it unreadable to unauthorized parties, while SSL technology creates a secure connection between the user's browser and the online banking platform. Two-factor authentication adds an extra layer of security by requiring users to provide a second form of verification, such as a code sent to their mobile device, in addition to their login credentials. Furthermore, online banking platforms often have robust firewalls and intrusion detection systems in place to detect and prevent potential security threats. Additionally, many financial institutions have implemented anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent fraudulent activities. These security measures work together to provide a secure and trustworthy environment for e-transfers, giving users peace of mind when sending and receiving money online.

Factors Affecting E-Transfer Processing Time

The processing time of e-transfers can vary significantly depending on several factors. Three key factors that affect the processing time of e-transfers are the banking institution and Interac network, the time of day and day of the week, and the recipient's account type and status. Understanding these factors can help individuals and businesses manage their finances more effectively and plan for timely transactions. The banking institution and Interac network play a crucial role in determining the processing time of e-transfers, as they are responsible for facilitating the transfer of funds between accounts. (Note: The supporting paragraph should be 200 words and should be a continuation of the introduction paragraph) The banking institution and Interac network are the backbone of the e-transfer system, and their efficiency can significantly impact the processing time. The Interac network is a shared network that connects financial institutions across Canada, enabling the transfer of funds between accounts. However, the speed at which transactions are processed can vary depending on the banking institution's technology and infrastructure. Some banks may have more advanced systems that enable faster processing, while others may have older systems that can cause delays. Additionally, the Interac network can experience high volumes of transactions during peak periods, which can also impact processing times. As a result, it is essential to understand the capabilities of your banking institution and the Interac network to manage your expectations and plan for timely transactions. By doing so, you can avoid unnecessary delays and ensure that your e-transfers are processed efficiently. This understanding can help you navigate the e-transfer system more effectively and make informed decisions about your financial transactions.

Banking Institution and Interac Network

The Interac network is a crucial component of the Canadian banking system, enabling fast and secure electronic fund transfers between individuals and businesses. As a banking institution, participating in the Interac network allows for the efficient processing of e-transfers, which are a popular method of transferring funds in Canada. The Interac network facilitates the exchange of financial information and the transfer of funds between participating financial institutions, ensuring that e-transfers are processed quickly and accurately. When an individual initiates an e-transfer, the sending institution verifies the transaction and sends the funds to the Interac network, which then directs the funds to the receiving institution. The Interac network's robust infrastructure and advanced security measures ensure that e-transfers are processed securely and efficiently, minimizing the risk of errors or delays. By leveraging the Interac network, banking institutions can provide their customers with fast and reliable e-transfer services, enhancing the overall banking experience.

Time of Day and Day of the Week

The time of day and day of the week play a significant role in determining the processing time of e-transfers. Generally, e-transfers are processed faster during business hours, which typically fall between 9:00 AM and 5:00 PM, Monday to Friday. During these hours, banks and financial institutions have more staff and resources available to process transactions, resulting in quicker processing times. In contrast, e-transfers initiated outside of business hours, such as evenings, weekends, or holidays, may take longer to process. This is because there are fewer staff members available to process transactions, and the system may be less efficient. Additionally, some banks and financial institutions may have specific cut-off times for processing e-transfers, which can range from 3:00 PM to 5:00 PM, depending on the institution. If an e-transfer is initiated after the cut-off time, it may not be processed until the next business day. Overall, understanding the time of day and day of the week can help individuals plan and manage their e-transfers more effectively, ensuring that their transactions are processed in a timely manner.

Recipient's Account Type and Status

The recipient's account type and status play a significant role in determining the processing time of an e-transfer. If the recipient has a checking or savings account, the transfer is typically processed faster, often within a few minutes to an hour. This is because these accounts are usually linked to the recipient's bank's online banking system, allowing for quick verification and processing. On the other hand, if the recipient has a prepaid debit card or a credit card, the transfer may take longer, often up to 24 hours or more. This is because these types of accounts often require additional verification steps, which can slow down the processing time. Additionally, if the recipient's account is not in good standing, such as being overdrawn or having a hold on it, the transfer may be delayed or rejected altogether. It's also worth noting that some banks and financial institutions may have specific requirements or restrictions for e-transfers, which can also impact processing time. For example, some banks may require the recipient to have a minimum account balance or to have been a customer for a certain amount of time before they can receive e-transfers. Overall, the recipient's account type and status can significantly impact the speed and success of an e-transfer.

Typical E-Transfer Processing Times and Exceptions

E-transfers have become a popular method for sending and receiving money in Canada, offering a convenient and efficient way to transfer funds. However, the processing times for e-transfers can vary depending on several factors, including the financial institutions involved and the time of day the transfer is initiated. Understanding the typical e-transfer processing times and exceptions can help individuals and businesses manage their finances effectively. In this article, we will explore the standard processing times for e-transfers, exceptions and delays that may occur, and what to do if an e-transfer is delayed or failed. By the end of this article, you will have a clear understanding of how e-transfers work and what to expect when sending or receiving money electronically. So, let's start by looking at the standard processing times for e-transfers.

Standard Processing Times for E-Transfers

Standard processing times for e-transfers typically range from a few minutes to a few hours, depending on the financial institution and the recipient's bank. In general, e-transfers are processed in real-time, and the funds are usually available to the recipient immediately. However, some e-transfers may take longer to process, especially if the recipient's bank has specific processing times or if the transfer is flagged for security reasons. On average, e-transfers are processed within 30 minutes to 1 hour, but it's not uncommon for them to be processed in as little as 5-10 minutes. Some banks and credit unions may have faster processing times, while others may take longer. It's also worth noting that e-transfers sent outside of business hours or on weekends may take longer to process, as they are typically processed in batches during business hours. Overall, while e-transfer processing times can vary, most transfers are processed quickly and efficiently, allowing recipients to access their funds in a timely manner.

Exceptions and Delays in E-Transfer Processing

While e-transfers are generally processed quickly, there are instances where exceptions and delays can occur. These exceptions can be attributed to various factors, including the recipient's bank or financial institution, the sender's account type, or technical issues. For instance, if the recipient's bank is not a participating member of the Interac network, the transfer may be delayed or require manual processing. Similarly, if the sender's account is flagged for security reasons or has insufficient funds, the transfer may be put on hold or rejected. Technical issues, such as server maintenance or network congestion, can also cause delays in e-transfer processing. In some cases, the recipient may not receive the transfer immediately due to their bank's processing schedule or cut-off times. Additionally, if the transfer amount exceeds a certain threshold, it may require additional verification or approval, leading to a delay. It's essential for senders and recipients to be aware of these potential exceptions and delays to manage their expectations and plan accordingly. By understanding the possible causes of delays, users can take proactive steps to minimize disruptions and ensure a smooth e-transfer experience.

What to Do if an E-Transfer is Delayed or Failed

If an e-transfer is delayed or failed, there are several steps you can take to resolve the issue. First, check the status of the transfer on your online banking platform or mobile banking app to see if it's still processing or if it's been cancelled. If the transfer is delayed, you can try contacting the recipient to see if they've received the transfer or if there are any issues with their account. If the transfer has failed, you can try re-sending the transfer or contacting your bank's customer support for assistance. Additionally, you can also check with the recipient's bank to see if there are any issues with their end. It's also a good idea to review your account activity to ensure that the funds are still available and that there are no holds or restrictions on your account. If the issue persists, you may want to consider visiting a bank branch in person or contacting your bank's customer support via phone or email for further assistance. In some cases, the bank may require additional information or documentation to resolve the issue, so be prepared to provide any necessary details. By taking these steps, you can help resolve the issue and get your e-transfer processed as quickly as possible.