How To Set Up E Transfer

Understanding the Concept of E-Transfer

The Basics of E-Transfer

The world has become digital, and with this evolution comes new ways of conducting transactions. One such way is the use of E-transfers. Essentially, an E-Transfer is a convenient way to send, receive, or request money online from anyone with an email address or mobile number and a bank account in Canada. This method requires no sharing of personal or financial information, making it a secure and confidential way to send or receive funds. Being knowledgeable about E-Transfer will help you understand how easily and effectively you can make transactions at your comfort level, whether for personal or business purposes.

Required Elements to Setup an E-Transfer

Setting up an E-Transfer might sound complex but, with the right information, it is not. For the process to be successful, a few elements are necessary. First, you need an account with a participating financial institution. Second, access to online or mobile banking is vital. Third, you should have the email address or mobile number of the person you wish to send money to. The familiarity of these required elements helps in understanding each step of setting up an E-Transfer and the importance of each in the overall transaction process.

Benefits of Using E-Transfer

The benefits of E-Transfer are many and significant to consider. It offers a fast, secure, and simple alternative to traditional methods of money transfer. In most cases, transfers happen within 30 minutes, cutting down on waiting periods of other transaction methods. E-Transfer also eliminates the need to share sensitive information, such as bank account numbers, with the recipient. Finally, the convenience of being able to send, request, or receive money at any time and from any place with internet access cannot be overstated, posing E-Transfer as a method of transaction worth exploring.

Setting Up an E-Transfer

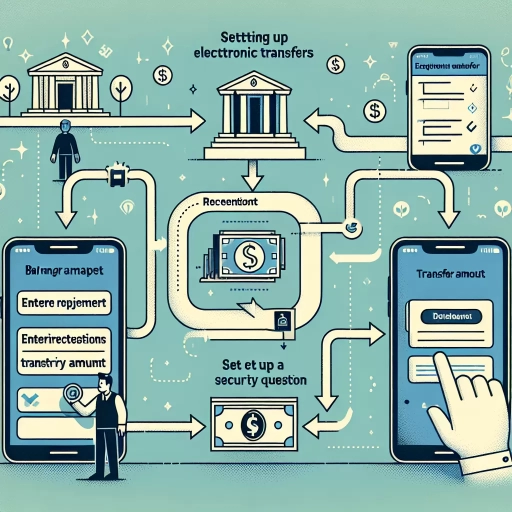

Step-by-step Guide to Setting Up an E-Transfer

Setting up an E-Transfer involves a series of straightforward steps. Begin by logging into your online or mobile banking platform. Look for the E-Transfer option, usually located in the “Transfers” section. Select “Send Money” or "Request Money" as appropriate, then choose the account from which you wish to transfer the funds. Enter the recipient’s email address or mobile number, the amount you wish to transfer, and a security question that only the recipient will be able to answer. Lastly, confirm the details and send the transfer. These steps serve as a guide to successfully setting up an E-Transfer.

Common Challenges and Solutions in Setting Up an E-Transfer

Though setting up an E-Transfer is straightforward, challenges can occur. The most common is the failure of the recipient to receive the transfer notification either due to incorrect details or spam filter settings in their email. To solve this, ensure that you enter the correct recipient's details and ask the recipient to check their spam or junk email folders. Another issue is the delay in receipt of funds, which can be due to system maintenance or network issues. In such cases, contacting your bank for clarification is advisable. Understanding these possible challenges and how to navigate them allows for a smoother E-Transfer experience.

Protecting Yourself When Using E-Transfer

E-Transfer transactions are secure, but this does not mean that they are impervious to breaches. To protect yourself, do not share your security answer with the recipient through email or text. Instead, call or inform them in person. Also, always log out of your banking session after completing your transactions and regularly check your account activity for any unauthorized transactions. Taking these precautions helps ensure that your E-Transfer experience is not only convenient but also safe.

Maximize the Use of E-Transfer

Common Uses of E-Transfer

E-Transfer provides a wide range of use cases. For personal purposes, it can be used to split bills with friends, give monetary gifts, pay rent, or send money to family members. For business, e-transfer can be utilized for paying employees, sending invoices, receiving payments from customers, or disbursing funds. Understanding these potential uses enables you to explore the numerous possibilities of E-Transfer beyond its basic function.

Saving Time and Money with E-Transfer

Through E-Transfer, you can save significant time and money. Say goodbye to long lines at the bank and waiting days for money orders or checks to clear. Plus, no more postage fees or courier costs for sending checks, saving you money in the long run. Embracing the efficiency of E-transfer allows you to streamline your monetary transactions while saving valuable resources.

Building Trust with E-Transfer

With increasing cases of online scams, trust and security have become paramount. E-Transfer, with its security features and ease of use, helps build trust between transacting parties. Additionally, the fact that the method is backed by leading financial institutions reassures users of its credibility. Thus, apart from its primary function, E-Transfer also plays a role in fostering trust in online transactions.