The Complete Guide of the Nepalese Rupee

Follow Nepalese Rupee Forecast March 20, 2024

Current Middle Market Exchange Rate

Prediction Not for Invesment, Informational Purposes Only

2024-03-19

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-18

Summary of Last Month

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-17

Summary of Last Week

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-16

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-15

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-14

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-13

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

Where to purchase Nepalese Rupee?

Recent News

2024-03-12

Everything You Need to Know About Nepalese Rupee

The *Nepalese Rupee* (NPR), a distinct and complex currency, embodies the intoxicating cultural and economic diversity of its homeland. Featuring meticulous designs that simultaneously reflect upon the nation's rich historical tapestry and its deeply entrenched traditions, the NPR has unyieldingly aided in facilitating the economic pulse of the country. Devised as a form of silver 'mohar' coins in 1933 during the reign of King Rana Bahadur Shah, the Nepalese Rupee has been molded by a series of breaks and reincarnations in its structure. As a testament to Nepal's diverse economic times, the currency's evolution is inextricably intertwined with the country's socio-economic developments, monetary policies, and inflation rates. Inflation, a significant economic factor, has had notable implications on the value of the NPR, thereby directly influencing the economic wellbeing and living standards of the Nepalese populace. Intricately interwoven into the fabrics of the nation's economic, political, and social realms, the Nepalese Rupee not only serves as a medium of exchange but also as a reflection of the country's economic strength and resilience. Harnessing a nuanced understanding of the Nepalese Rupee, therefore, forms a doorway to comprehending the multifaceted dynamism of Nepal's economic landscape.

Correlation Coefficient of Nepalese Rupee with Other Currencies

In the realm of currency transactions and international trade, understanding the monetary relationship among different global tenders is crucial. The **Nepalese Rupee**, celebrated for its distinctive history and impact on economics, creates a unique correlation to other global currencies that needs careful exploration. This article aims to unravel the intricate correlation coefficients of the Nepalese Rupee against key global currencies. These coefficients, a measure between -1 and +1, indicate the strength and direction of a linear relationship between currency values. They are instrumental in gauging fluctuating trends and making informed financial decisions. By noting the shift in the Rupee's value and observing its connection to other currencies like the American Dollar, British Pound, or Euro, we can analyze the influence exerted by these currencies on the economic landscape of Nepal, and vice versa. Furthermore, we will also consider factors like inflation, monetary policy, and global economic events which directly impact the correlation. Stay tuned as we delve into the world of monetary dynamics where each numeric shift speaks a story of economic change spurred on by globalization.

Understanding the Value of Nepalese Rupee in the Global Market

The Nepalese Rupee (NPR) serves as the official currency of the Federal Democratic Republic of Nepal. Deeply entrenched in the nation's history, the Rupee's evolution mirrors Nepal's economic progress, bearing the mark of influences from both domestic and global economic shifts. The journey of the Nepalese Rupee elucidates a rich historical timeline. The coin known as the Mohar was its predecessor until 1932, when the Rupee was formally introduced, establishing a consistent currency framework. Keeping up with contemporary trends, Nepal has incorporated new technologies and security features in its currency designs, offering advanced protection against fraud and counterfeiting. In analyzing the value of the Nepalese Rupee in the global market, it's crucial to scrutinize Nepal's overall economic structure and the role of its monetary policy. Nepal, primarily an agrarian economy, has been steadily transitioning into a service-driven economy, with efforts directed towards diversification. These shifts in the economic structure have inevitably impacted the Rupee's value. The Central Bank of Nepal administers the country's monetary policy, a pivotal tool for maintaining the currency's value. Determining interest rates, controlling money supply, and managing foreign exchange reserves, are among the mechanisms through which the Central Bank stabilizes the Rupee. However, the Rupee largely remains pegged to the Indian Rupee (INR), a historical arrangement resonating the close economic ties between the two nations. Additionally, the exposure and connectivity to international trade and foreign investments serve as critical determinants of the Rupee's value. Nepal's trade deficit often exerts depreciating pressure on the Rupee, rendering the nation vulnerable to global economic disruptions; such vulnerability was evident during the financial crisis of 2008-2009. Inflation is an underpinning factor, under the purview of the Central Bank, influencing the Rupee's strength. An unchecked high inflation rate weakens the currency's purchasing power, contributing negatively to its value. In recent years, remittances have been a lifeline for Nepal's economy. Migrant laborers' remittances, primarily from the Middle East and Malaysia, have supported the currency’s stability and have cushioned against negative current account balance. Even so, Nepal's progress towards sustainable economic growth must hinge on fostering internal productivity and reducing dependency on remittances. In conclusion, the value of the Nepalese Rupee in the global market is interwoven with manifold elements, both domestic and international. Navigating the complexities of monetary policy, inflation management, and economic diversification can be key to harnessing the currency's potential and reaffirming Nepal's economic resilience on the global stage.

Historical Trends: Nepalese Rupee versus Major Currencies

The Nepalese Rupee, abbreviated as NPR, has witnessed numerous historical trends and changes against major world currencies. Originating in the early 20th century, the NPR has traversed quite a journey since its inception. At its outset, the NPR was linked to the British Silver Pound, a relationship that significantly influenced its early development. Post-Indian Independence, the NPR was pegged to the Indian Rupee (INR) at a fixed exchange rate, thereby entirely surfacing the economic effects of India's monetary policies into its system. The Nepalese economy has significantly relied on India for trade, remittances and financial aid, hence, influencing the INR-NPR exchange rate. During the 1990s, economic liberalization in India influenced a series of financial reforms in Nepal as well, and the NPR found its modern footing. Further, the NPR's relationship with the USD has also been quite tumultuous, given the latter's position as a global reserve currency. NPR's depreciation against the USD, particularly in recent years, has been attributed to factors such as inflation, Nepal's trade deficit and its developing economy status. The NPR's exchange rate against other major currencies like the Euro (EUR) and the Japanese Yen (JPY) has also been dynamic, reflecting global macroeconomic conditions, domestic economic policy changes, and the level of foreign reserves in the country. The fluctuating NPR trends indicate the country's relative economic stability or volatility vis-a-vis other economies. Such variations are what contributes to its comparative purchasing power and rates of inflation, significantly impacting domestic economic conditions and living standards of the population. While Nepal’s central bank, Nepal Rastra Bank, has taken measures to control exchange rate fluctuations over the years, challenges related to managing inflation, maintaining foreign reserve levels, and managing the balance of payments persist. Thorough analysis and understanding of the NPR's historical trends can provide useful insights about its future trajectory and implications for domestic and foreign stakeholders – traders, immigrants, expatriates, investors, and the government, among others. Therefore, studying the historical trends of the Nepalese Rupee versus major currencies remains a salient subject for those interested in the economic history and monetary policy of Nepal. In light of this, the value of NPR against other currencies serves as an economic barometer, signaling the country's relative economic health and the effectiveness of its fiscal and monetary policies within global platforms.

Factors Influencing the Exchange Rate of Nepalese Rupee

The **Nepalese Rupee (NPR)**, the official currency of Nepal, has been subjected to various trends and fluctuations in its exchange rate. Several key, interconnected factors play crucial roles in influencing these transitions. These factors are influenced by domestic and international economic events, policy decisions, and many other dimensions of global finance. The **economic stability** plays a pivotal role in shaping the currency's value. Stability refers to the condition where macroeconomic variables like inflation, fiscal deficit, and current account deficit are under control. Crucially, a robust and stable economy reinforces the strength of a currency. Inflation, for instance, is a vital influencing factor. A high inflation rate typically devalues the currency as it reduces the purchasing power of money, causing depreciation in the exchange rate. **Interest rates**, also influenced by monetary policy, can sway the currency's value. As interest rates increase, they tend to attract foreign capital, leading to the appreciation of the currency. Conversely, lower interest rates generally lead to capital outflow, causing depreciation of the currency. The **economic indicators** of significant trading partners also impact the exchange rate. For instance, since India is Nepal's largest trading partner, economic conditions in India immensely impact the NPR. If the Indian Rupee depreciates against major currencies, it would likely impact the NPR adversely. **Foreign Exchange reserves** represent another determining factor. A country with substantial forex reserves can stave off volatile movements in the exchange rate. In Nepal’s case, a higher level of reserves helps maintain exchange rate stability with the Indian rupee, and cushions against speculative attack. Lastly, **political stability** significantly influences the perceived strength and reliability of a currency. Political upheaval often creates economic uncertainty, leading to unstable exchange rates. Therefore, stable politics fortifies the rupee's standing on the foreign exchange market. In conclusion, the exchange rate of the Nepalese Rupee hinges upon intricate domestic and international factors. Understanding these dynamics allows for insights into the currency's health and direction, and the broader economic environment. It further highlights the need for sound economic and political stability and strategic international ties.

Exploring the Correlation Coefficient: Nepalese Rupee and Nature Resources

The Nepalese Rupee, serving as the official currency of Nepal, characterized by their unique design and historical correlation with the Indian Rupee, has undergone several transformations influenced majorly by Nepal's geopolitical context and macroeconomic frameworks. More recently, researchers have begun investigating the connection between the value of the Rupee and Nepal's natural resources. Intricate relationships unearthed, highlighting intriguing interdependencies between the economic valuation of currency and the actual value of a country's natural resources. This paper, under the title '_Exploring the Correlation Coefficient: Nepalese Rupee and Nature Resources_', seeks to delve into this profound linkage, dissecting the extent, significance and implications of this correlation. Through comprehensive analysis and robust comparative study feasting on historical data, readers will gain insights into the underlying forces that shape and drive these interesting economic dynamics. This exploration aims to stimulate dialogue and foster comprehension into the uniqueness of the Nepalese Rupee, thereby offering an enriching and educative adventure into the realm of currency, economics, and their relationship with the environment.

Nepalese Rupee: An Overview and Its Unique Aspects

The **Nepalese Rupee (NPR)** generally stands as an emblem of Nepal's economic vibrancy, and it deeply involves in the country's socioeconomic aspects. As a monetary unit and symbol of national pride, this currency holds an unsurpassed essence in its historical, economical, and socio-cultural spheres. The history of the Nepalese Rupee extends back to the late 19th century when it became a distinct currency. It traces its roots to the silver mohar coins that were in vogue during the reign of King Prithvi Narayan Shah. As a product of complex historical evolution, the modern-day Nepalese Rupee exhibits an amalgamation of influences from Roman, Indian, and British numismatic traditions. The Nepalese Rupee undergoes routine re-evaluation and redesign to ensure its reflection of the country's cultural ethos while staying abreast with economic and technological advancements. It has faced numerous design changes, each illustrating significant aspects of Nepal's rich cultural heritage, flora, fauna, and historical embodiments. It also serves as a popular canvas for celebrating the country's distinguished personalities, evoking nationalistic sentiment among the Nepalese population. _The economic implications_ of the Nepalese Rupee are as diverse as its multifaceted nature. It plays a crucial role in facilitating commercial transactions, and its value is a barometer of Nepal's economic health, as it can directly influence inflation and spending power. Stipulations regarding the denomination, circulation, and exchange rate of the Rupee are critical monetary policy instruments in the hands of Nepal Rastra Bank, the Central Bank of Nepal, guiding the country's macroeconomic dynamics. However, the Rupee has seen a fair share of economic challenges, including volatility in its exchange rate, primarily due to its pegged relationship with the Indian Rupee, and susceptibility to inflation. Over the years, monetary policy, sustainable development efforts, and external trade conditions have proven vital in stabilizing the currency and hence fortifying the economic resilience of the nation. To summarize, the Nepalese Rupee, steeped in rich history and couched in the frame of economic realities, is more than a medium of exchange. Its design, value, and dynamics act as a reflective mirror of the nation's cultural heritage, economic status, and progression, carving its unique identity. It continues to play a substantial role in shaping the socioeconomic landscape of Nepal, embodying the ceaseless spirit of the Nepalese people.

The Influence of Natural Resources on the Value of Nepalese Rupee

The Nepalese Rupee is closely tied to Nepal's abundant natural resources, playing an instrumental role in determining its value. Nepal's economy significantly relies on the exploitation of its natural resources, ranging from hydroelectricity, medicinal herbs, to minerals, and this dependency is reflected in the value of the Nepalese Rupee. One of the country's most valuable resources is the Himalayan water reserves – one of the largest in the world. Progressive exploitation of this renewable resource, through hydroelectric plants, forms a vital chunk of the country's GDP. Every year, the export of surplus electricity to bordering countries infuses a significant amount of foreign currency inflow which upwardly impacts the Value of Nepalese Rupee. A planned and sustainable exploitation of this resource not only ensures a consistent supply of electricity and foreign currency reserves, but also steadily increases the value of the rupee as global investors and trading partners gain confidence in the stability and growth potential of the Nepalese economy. Similarly, Nepal is immensely rich in biodiversity with a large variety of medicinal herbs being readily available in its diverse forests. The trade of these herbs to global markets, especially neighboring countries such as India, China, can contribute significantly to the diminution of the trade deficit, resulting in upward pressure on the value of the rupee. This resource diversification tends to enhance the resilience of the Nepalese economy in the face of external shocks, thus fostering a steady appreciation of the rupee. Lastly, Nepal is home to a vast array of mineral resources including limestone, coal, and various precious stones. These are another lucrative source of income, acting as a steady return asset and paving the way for accumulating foreign exchange reserves, and thus influencing the value of the Nepalese rupee. In summary, from a macroeconomic standpoint, the value of the Nepalese Rupee is significantly influenced by the revenue generated from its natural resources. It allows the country to attract foreign investments, minimize trade deficits, and accumulate foreign reserve, thereby strengthening the demand for the rupee. Hence, a well-thought-out and sustainable use of Nepal's natural resources not only ensures their preservation for future generations but also serves as a foundation to build a robust and resilient economy.

Gravity of Correlation between Nepalese Rupee and Nature Resources

The **Nepalese Rupee (NPR)** has a substantial interconnection with an array of natural resources due to its status as a resource-based economy. Exploring this nexus offers intriguing insights on how a nation's wealth has ties to its natural endowments. To begin with, Nepal is primarily agrarian, with this sector historically impacted by the value of the NPR. More specifically, `Agricultural produce`, that constitutes the major export of Nepal, is influenced by the value of the rupee, as it determines the foreign exchange rate. A strong rupee can thus give a competitive edge to Nepalese farmers on the world market. Conversely, the robustness of the rupee also influences the import of key raw materials, such as machinery and petroleum products which impacts natural resources such as **Nepal's forests and water bodies**. These inputs are necessary for sectors like transport, mining and power generation. For instance, a low value of the rupee can impede the importation of machinery necessary for hydropower projects, thus indirectly affecting the utilization of water resources. The **mineral resources** that Nepal is rich in is another example. The devaluation of the rupee drives up the cost of exporting minerals to foreign buyers, which can lead to a reduction in mining activities. This reduction could, in turn, have a repercussion on employment numbers and the overall GDP of the nation. Lastly, let's touch upon the tourism industry, one of the pillar's of Nepal's economy, which greatly relies on the natural beauty that the country boasts. The value of the NPR can significantly steer the flow of international tourists. A weaker rupee could potentially make Nepal a more attractive destination, thereby promoting the tourism industry and the indirect conservation of these natural jewels through the revenue it generates. In conclusion, there is a clear **gravitational correlation** between the Nepalese Rupee and Nepal's natural resources. The areas of agriculture, imports for industries utilizing natural resources, mineral exploitation and tourism all fall under the influence of the NPR's value. Not only do these sectors build our understanding of the intrinsic interconnection but they also give insights into Nepal's economic scenario as a resource-based economy. As such, sound management and value stabilization of the NPR could significantly aid the sustainable use and conservation of Nepal's natural resources. Hence, the necessity for effective monetary policies to stabilize the rupee cannot be underscored enough.

Global Impact of the Nepalese Rupee

The **Nepalese Rupee** (Rs or NPR), the national currency of Nepal is a significant player in the smaller economies around the globe. Introduced in 1932, it replaced the previously used silver mohar at the rate of 2 mohars to 1 rupee. Throughout its history, the Nepalese Rupee is intrinsically linked to Indian Rupee due to the close economic relationship between Nepal and India. The rupee's design, featuring animals, plants, monuments, and respected figures in Nepalese culture, illustrates the country's rich heritage. The rupee, like any currency, is impacted by economic factors such as inflation and monetary policy which in turn influence its performance on the global stage. This introduction will evaluate the history, design, and economic implications of the Rupee, to further understand the importance and global impact of the Nepalese Rupee. Through a comprehensive analysis, we will explore the Rupee's journey from its inception, the changes and challenges undergone, and the influence it has in the region's economic landscape. The Nepalese Rupee, despite being a less prevalent currency in the currency exchange markets, has a powerful story that showcases the economic resilience of smaller nations amidst global financial pressures.

The Economic Influence of the Nepalese Rupee on the Global Market

The Nepalese **Rupee** is a fascinating representation of the dynamism of Nepal's economic history and its evolving role in the global market. As the official currency of Nepal, the Rupee is an integral part of the country's economic fabric, and its influence extends beyond its borders. The **evolution of the Nepalese Rupee** offers an intriguing glimpse into the country's economic journey. First introduced in 1932, the Rupee replaced the silver Mohar at par, signifying a shift to a simplified monetary system. This historical transformation had a profound impact on the nation's economy and offered a platform for Nepal's participation in international trade. The **design of the Nepalese Rupee** is equally noteworthy. Each denomination bears exquisite illustrations, such as the image of King Tribhuvan on the one Rupee note or the rhinoceros depicted on the 1000 Rupee note. These designs not only honor the nation's heritage but also serve to solidify national identity within the global community. Despite being a relatively small player in the global economy, the Nepalese Rupee has, nonetheless, had a significant impact on global markets. The **relative stability** of the Rupee over the past decade has promoted robust trade relationships with neighboring countries, particularly India, boosting the **cross-border economy** and further amplifying the Rupee's influence. However, managing the Rupee's economic impact requires a finely tuned **monetary policy**. The Central Bank, as the monetary authority, employs various tools to maintain a balance between inflation and economic growth. Controlling the money supply, setting interest rates, and regulating the banking sector are just some of the measures employed to ensure the country's economic stability, foreign exchange reserves, and the value of the Rupee. The story of the **Nepalese Rupee** is, therefore, a tale of economic development, cultural heritage, and global influence. The Rupee's journey provides a model of a culturally rich developing nation deftly navigating its way in a complex and rapidly changing global economic landscape.

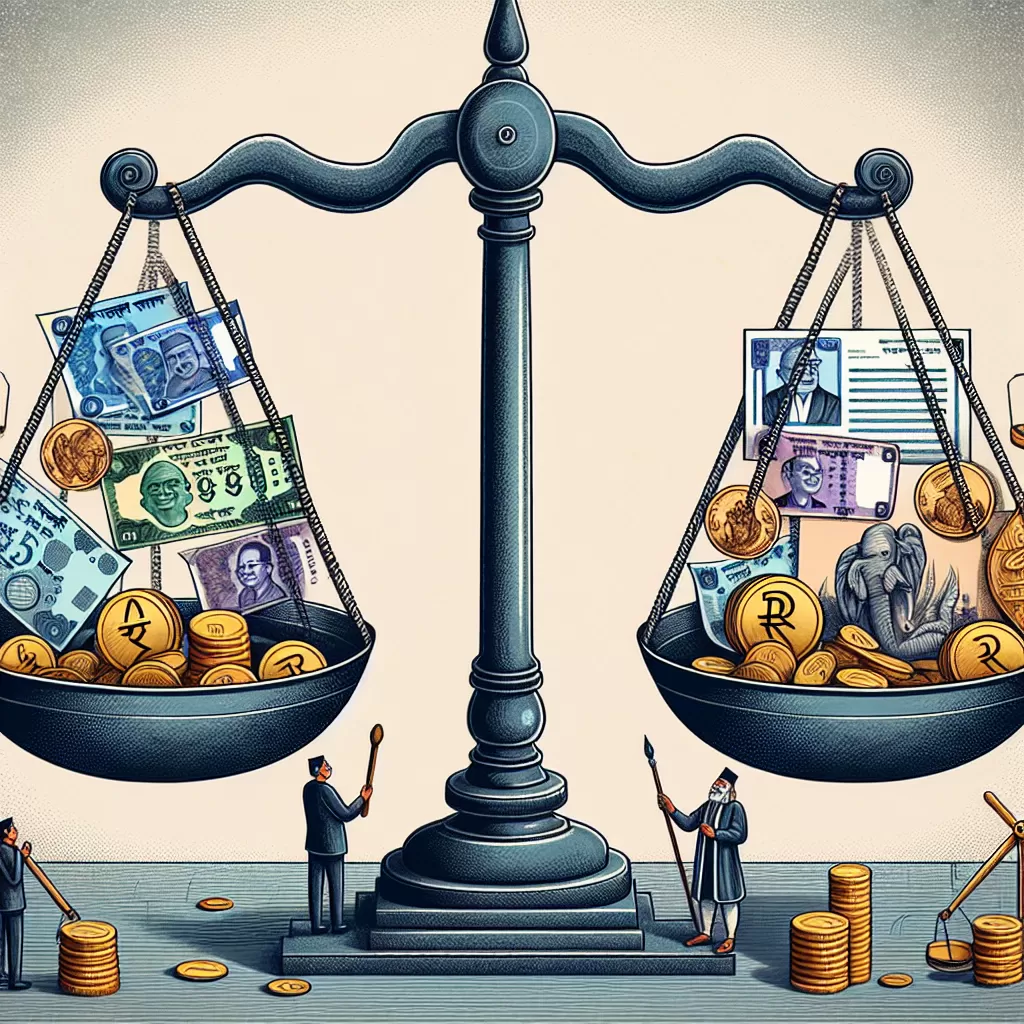

Currency Exchange: Understanding the Global Value of the Nepalese Rupee

The **Nepalese Rupee (NPR)**, the official currency of Nepal, located in South Asia, embodies a great historical and economic narrative. The reference point for its global value - the exchange rate - indicates the quantity of foreign currency that could be traded for one unit of the Nepalese Rupee, reflecting its purchasing power vis-à-vis other currencies. Initially following the silver standard, the Rupee primarily mirrored the value of British India's silver Rupee. Following independence, Nepal established its own Central Bank, the _Nepal Rastra Bank_ in 1956, facilitating full control over its monetary policy. The Central Bank sets interest rates to control inflation, prints money according to economic needs, and manages exchange rates. Such measures significantly impact NPR's global value. The Rupee's design also serves as a patriotic emblem, displaying an assortment of cultural imageries - from Mount Everest, the world's tallest peak, to the national bird, the Himalayan Monal. Conversely, its global value is influenced by various economic factors such as **inflation**, _trade balances_, and _economic growth_. If the Central Bank prints too much money, the market could be flooded with NPR, leading to depreciation. This could inflate prices, resulting in a weaker Rupee in the global scenario. Moreover, the **trade balance** - the difference in value between what a country imports versus exports – also affects the Rupee's value. If exports surpass imports, there will be more demand for NPR in the global market, strengthening its value. Conversely, if Nepal imports more than it exports, the value of the Rupee will likely fall as demand for NPR decreases. Economic growth and stability also play a pivotal role. A stable or growing economy attracts foreign investors and increases foreign capital inflow, bolstering the currency's global value. In sum, understanding the global value of the **Nepalese Rupee** involves a dynamic undertaking, illustrating the interplay of history, monetary policy, and economic factors. Its current state in the international market serves as a crucial indicator of Nepal's economic health, reflecting how the nation competes in our increasingly globalized world.

The Role of the Nepalese Rupee in International Trade

The Role of the Nepalese Rupee in International Trade

The Nepalese Rupee (NPR), the official currency of Nepal, stands as a critical participant in the landscape of international trade. Governed by Nepal Rastra Bank, the central monetary authority of Nepal, the Nepalese Rupee's stability or volatility directly affects the country's import and export competitiveness. Nepal's economy is heavily reliant on imports, especially for capital goods, petroleum products, and electrical equipment, making the strength of the NPR paramount in controlling import costs. Foreign exchange rates, therefore, play a significant role, with a weak Rupee leading to costlier imports, potentially fueling domestic inflation. Conversely, a robust Rupee plays favorably on the import front, dampening inflation effects. However, the dynamic is slightly different when dealing with exports. A weak Rupee can potentially stimulate exports by making Nepalese goods and services comparatively cheaper on international markets, boosting trade competitiveness. Key export sectors such as carpets, clothing, pulses, hides, and jute goods stand to gain in such scenarios. Additionally, remittances from the Nepalese diaspora significantly contribute to the nation's economy. Here too, the Rupee's strength matters, with a weak Rupee meaning more domestic currency for every foreign dollar sent home, effectively incentivizing remittances. On the aesthetic front, the Nepalese Rupee carries rich cultural and historical imprints through its design, featuring national symbols, cultural motifs, and the depictions of distinguished personalities and historical monuments, making it a piece of art and history. Underpinning all these is Nepal's monetary policy, which aims for a stable and competitive Rupee alongside other macroeconomic goals. Dealing with turbulent economic events, changes in the trade landscape, and fluctuations in foreign reserves, the central bank's policies toward the Rupee influence the overall state of the domestic economy and trade competitiveness. Therefore, the role and significance of the Nepalese Rupee in international trade are multifaceted and far-reaching. It's not just a medium of exchange but a key determining factor of the country's economic and trade dynamics. Its stability or volatility shapes the direction of import and export trade flows, the levels of inflation, the inflow of remittances, and the overall health of the nation's economy. Understanding the nuances and complexities of the Nepalese Rupee's role can provide insightful perspectives on Nepal's economic performance and its place in the global trade environment. It's necessary to monitor and analyze the behavior of this important currency vis-à-vis other significant global currencies, as it directly impacts the health and direction of Nepal's trade development and economic progress. It can potentially shape strategic decisions and pave the way for sound economic policy-making.Economic Development Impact on the Nepalese Rupee

The **Nepalese Rupee**, Nepal's official currency, narrates a compelling story of a nation's economic development. Dating back to the 17th century, it has witnessed numerous economic policy adaptations, structural adjustments, and significant shifts in the country's socio-economic landscape. From its inception in 1932, the evolution and design of the Nepalese Rupee have primarily mirrored the economic transformations Nepal has undergone. The fluctuations in its value in relation to other currencies embody the political, economic and social changes that Nepal has experienced over the years. This includes the impact of regional affiliations, globalization dynamics, and monetary policy shifts. As we dive into understanding the intricacies of the Nepalese Rupee, it's imperative that we appreciate the influence of inflation, which has been partly induced by the volatility of external factors as well as internal socio-economic shifts. Expanding knowledge about the Nepalese Rupee offers invaluable insights into the broader aspects of Nepal's economic trajectory and development. Whether the nation's economy thrived or suffered, the Nepalese Rupee has consistently served as a reflection, a snapshot of those very defining moments. Encapsulating these aspects, this examination of the Nepalese Rupee will shed light on the currency's historical transitions and its role in shaping Nepal's economic narrative.

The Role of Economic Policies on the Value of the Nepalese Rupee

The **Nepalese Rupee (NPR)**, the official currency of Nepal, has always played a fascinating yet critical role in Nepal's economic landscape. The currency's evolution, economic significance, and the tremendous influence of monetary policies on its value make it an intriguing subject of financial studies. In the historic context, the Nepalese Rupee was first introduced in 1932, replacing the then-used silver mohar at parity. Despite the changes in coins and notes over time, its value remained linked to the Indian Rupee until the early 1990s due to a fixed exchange rate system. In 1993, the Nepalese government transitioned the country to a free-floating exchange rate system. As a result, the *dynamism of supply-demand forces* was incorporated into the NPR's value determination. These *exchange rate systems* significantly impacted the value of the Nepalese Rupee. Under the fixed exchange rate system, the value remained immune to fluctuations related to economic factors. On the other hand, the floating exchange rate opened the value determination to market dynamism, making it susceptible to inflation, monetary policies, economic stability, and global economic conditions. *Monetary policy,* guided by the Central Bank of Nepal, Nepal Rastra Bank (NRB), shapes inflation trends and economic stability significantly. A prudent monetary policy aims to maintain price stability, control inflation, bolster economic growth, and manage liquidity in the economy. These policy measures, coupled with fiscal policy and public expectations, determine the value and performance of the Nepalese Rupee. Considering inflation, it is essential to recognize that high inflation rates can erode the value of a currency. In such cases, the Central Bank steps in to tighten monetary policy, effectively reducing money supply and curbing inflation. The NPR's value can therefore be *inversely affected by the inflation rate*. Higher inflation can depreciate its value, whereas lower inflation can appreciate it. As globalization and technological advancements have deepened economic integration, the *impact of global economic conditions* and remittances on NPR's value has become more pronounced. The remittances from the Nepalese working abroad, particularly in Gulf countries and Malaysia, form a significant portion of Nepal's economy. Fluctuations in the global economy therefore directly influence the value of the Nepalese Rupee. In conclusion, the *economic policies* adapted by the government directly affect the value of the Nepalese Rupee. These include monetary policy decisions, inflation management, and responses to global economic conditions. As such, a deep understanding of these factors is critical to analyzing the trends and predicting the future value of NPR. Notably, the insights may also shed light on the wider economic landscape and policy management in Nepal.

Historical Analysis: Economic Development and the Nepalese Rupee

The Nepalese Rupee has a significant historical path which has mirrored the economic development of Nepal. The evolution of the Rupee, as the country's official currency, dates back to 1932 when it replaced the silver Mohar at par. Tracing the Rupee’s development offers a rare insight into the captivating socioeconomic journey of the Nepalese people. Connecting the historical path of the Rupee to Nepal's economic direction, it becomes clear that the condition of the currency often directly reflects the country's overall economic health. For instance, periods of drastic inflation which caused depreciation in the Rupee can be tied to times of political instability and slow economic growth. Likewise, relative periods of currency stability often mirror points of incremental economic progress within Nepal. Understanding the Rupee’s design also provides an intriguing snapshot of Nepal’s identity. It is the last Asian currency to feature the portrait of a monarch, bearing the image of King Gyanendra, the last Nepalese monarch. This captured the deeply ingrained monarchy system in the country's societal and political structure up until 2008. Furthermore, its animal and temple motifs represent Nepal's rich cultural heritage, religious diversity, and reverence for nature. Lastly, reviewing the Rupee through the lens of monetary policy, it is evident how it plays a vital role in Nepal's economic efforts. The Central Bank of Nepal consistently implements fiscal measures aimed at controlling inflation and ensuring the Rupee’s stability. This aids in promoting economic growth, managing unemployment levels, and attracting foreign investment, thereby shaping the future economic trajectory of Nepal. In conclusion, the Nepalese Rupee - as a symbol of sovereignty, a tool of monetary policy, and a reflection of cultural identity - ties into Nepal's past and significantly influences its present economic landscape and future prospects. The intermingling narrative of the Rupee and Nepalese history further underscores the inextricable link between currency, economics, and national identity.

Future Projections: Is the Nepalese Rupee Growing Stronger?

Looking ahead, the trajectory of the **Nepalese Rupee (NPR)** remains uncertain but intertwined with the macroeconomic policies of the Nepalese government and the economic landscapes of its trading partners. The performance of the NPR isn't independent and solely dependent on the domestic scene; in fact, it's influenced by a host of external factors such as global financial market conditions, geopolitical events, and most importantly, policies of its major trading partners, particularly India. Monetary decisions by the Central Bank, the Nepal Rastra Bank (NRB), are pivotal to the strength of the NPR. In recent years, NRB has pursued an inflation-targeting approach to ensure monetary stability, but the persistently high inflation rates experienced pose a substantial risk to the strength of the rupee. However, this lens alone isn't sufficient to fully comprehend the dynamics of the NPR. The foreign exchange market, speculative activities, investor sentiments, and capital flows also have an impact. The NPR has often been critiqued for its heavy dependence on the Indian rupee (INR). The INR/NPR exchange rate is pegged, meaning it's set and maintained by the Nepalese government, providing some stability but also making it vulnerable to the performance and volatility of the Indian economy. Analysts often predict the performance of the NPR based in part on the health of the Indian economy. A growing Indian economy bodes well for the NPR, while a struggling one spells potential trouble. Nepal's trade deficit, which continues to widen, adds to the downward pressure on the NPR. The rupee might be expected to depreciate to adjust for the trade imbalance, but the peg to the INR and foreign exchange intervention by the NRB provides an artificial cushion against this natural market adjustment. Despite these challenges, positive strides in the Nepalese economy could bolster the NPR going forward. Nepal's burgeoning sectors, such as tourism, remittance inflow and hydropower, can attract foreign investors, providing the necessary forex earnings and boosting the value of NPR. The question of whether the NPR is growing stronger, therefore, isn’t black and white. It’s couched in the intricacies of domestic monetary policy, international trade patterns, and global economic contexts. The future of NPR is an interplay between these intricate market dynamics and the formidable economic waves that Nepal navigates. Although the future of the NPR isn't crystal clear, the landscape is certainly rich with influential factors that are set to shape its journey moving forward.

Understanding the Impact of Inflation on the Nepalese Rupee

The **Nepalese Rupee (NPR)**, the official currency of Nepal, has a fascinating economic and historical narrative, intricately entwined with the country's progression. Particularly, the influence of inflation on the performance of the NPR is pivotal. By assessing the impact of various economic factors, including changes in the domestic and international market, significant economic policies introduced, and currency exchange fluctuations, we can gain a clearer understanding of the interplay between inflation and the Nepalese Rupee. Over the decades, the NPR has navigated through numerous periods of economic turbulence and rampant inflation. This comprehensive examination will serve to illuminate the intricacies that undertake fluctuations in a nation's currency - in this case, the Nepalese Rupee - under the influence of inflation. Each of these elements plays a notable role in moulding the economic landscape of Nepal and, subsequently, the valuation of its currency. This insight leads us to valuable discussions about the need for efficient monetary policy and sound financial practices to shield the currency from an adverse inflationary blow. In the coming sections, we delve deeper into the trajectory of the NPR under inflationary pressure.

The Dynamics of Inflation in Nepal's Economy

In interpreting the dynamics of inflation within **Nepal's economy**, it is necessary to comprehend the history and nature of the country's currency, the **Nepalese Rupee (NPR)**. Initially pegged to the Indian Rupee, NPR is now independently managed by _Nepal Rastra Bank__ (NRB), Nepal's central banking authority. This development in monetary policy has several significant implications to rising inflation rates. Furthermore, inflation volatility in the country directly correlates to the fluctuations in the value of the NPR. **Inflation** appears as a persistent issue within Nepal's economy, typically provoked by supply constraints and demand factors. Periods of high inflation often coincide with political instability, natural calamities or global financial crises that lead to rapid changes in the NPR's foreign exchange rate. For instance, the 2015 earthquake significantly disrupted supply chains, resulting in skyrocketing prices and thereby escalated inflation rates. The NRB strategically formulates and implements _monetary policy__ to control inflation. In addition to controlling money supply through open market operations, the bank manages reserve requirements and sets discount rates, all of which have direct impacts on the inflation rate. However, small-scale domestic factors such as food prices and external influences like changes in international commodity prices also drive inflation dynamics. Therefore the Market-Based Price index plays a pivotal role. In Nepal, the Consumer Price Index (CPI) is a key indicator analysed to assess inflation trends. An increase in the CPI indicates an inflationary situation leading to depreciation of NPR. This adversely affects domestic purchasing power and raises concerns over economic stability. Understanding inflation in the context of Nepal's economy reveals a labyrinth of interconnected factors, from internal circumstances such as political instability and natural disasters to external forces like international market trends. Hence, effective inflation management goes beyond the traditional tools of monetary policy, necessitating a holistic macroeconomic approach that accounts for domestic and international influences. The scarcity and costliness of essential goods and services due to inflation can eventually lead to a decline in the living standard of people and hinder economic development. Monitoring inflation dynamics and making timely interventions is crucial in order to maintain economic stability. The fluctuations in the value of NPR and inflation rates hold significant implications for government policy-making, the targets set by monetary authorities, and the overall societal living standards. Hence, a comprehensive understanding of these dynamics forms the basis for informed economic planning and policy implementation, likely to foster stability and growth in Nepal's economy.

How Inflation Impacts the Value of the Nepalese Rupee

In terms of understanding the effects of inflation on the value of the Nepalese Rupee, it's highly essential to consider the broader economic context. Essentially, inflation is a process of ongoing price increases for goods and services, which lowers the purchasing power of money. The underlying causes for inflation can be extensive and interconnecting, ranging from excessive government expenditure to an unanticipated rise in international prices. When we focus on Nepal, substantial inflation could mean the Nepalese Rupee becomes less valuable, both domestically and internationally. Let's break this down. Firstly, high inflation devalues the Rupee on a local level as it reduces people's purchasing power. Over time, as the cost of goods and services increase, 1 Rupee will buy less than it used to, leading to practical devaluation. This local devaluation directly impacts livelihoods and the overall standard of living in Nepal, as individuals and families can afford fewer goods and services. Secondly, significant inflation could have international ramifications for the value of the Nepalese Rupee. If inflation in Nepal outpaces that of its trading partners, the Rupee may suffer depreciation relative to other currencies. This exchange-rate effect of inflation could make imports more expensive and lead to a negative balance of trade. Moreover, inflation in Nepal can also affect foreign investor sentiment. High and unstable inflation can signal underlying economic mismanagement and negatively impact business confidence, leading to reduced foreign direct investment (FDI). As FDI falls, this can further pressure the value of the Rupee and contribute to broader economic instability. Finally, it is essential to understand that managing inflation and ensuring the stability of the Rupee is a key priority for Nepal Rastra Bank, Nepal's central bank. Through careful monetary policy, including managing money supply and setting interest rates, the central bank tries to keep inflation predictable and controlled, helping to maintain the value of the Rupee and underpinning the healthy operation of the economy. As such, understanding the connection between inflation and the value of the Nepalese Rupee is a crucial component of broader economic literacy. This inflation effect is not just an abstract concept, but a palpable factor that influences everyday economic realities and future economic prospects for Nepal. Designed_for: "How Inflation Impacts the Value of the Nepalese Rupee"

Measuring the Inflation Rate: Nepalese Rupee Over the Years

Nepalese Rupee is the official currency of Nepal, a vibrant South Asian country nestled among the Himalayan peaks. It traces its origin from the 17th century when it was first introduced as silver mohurs. However, it was only in 1932 that it was formalized into the currency system we know today, under the Nepalese Rastra Bank Act. Throughout its history, the _Nepalese Rupee_ (NPR) has experienced significant changes in its value, primarily dictated by inflation – the rise in the prices of goods and services over time. Inflation is a common phenomenon in most economies and has important implications on purchasing power and the overall economy. In Nepal, it's been a mixed bag, with years of stability punctuated by periods of rapid inflation, in part due to economic policies and external influences. The inflation rate in Nepal is calculated using the **Consumer Price Index** (CPI). The CPI measures the weighted average of prices of a basket of consumer goods and services, including transportation, food, and medical care. It's a key gauge of inflation, providing a snapshot of the cost of living. Over time, as the CPI increases, the purchasing power of the Rupee diminishes, implying inflation. For instance, Nepal witnessed a high inflation rate in the mid-2000s, particularly around 2008-09 when it hit a peak of nearly 13%. This period was characterized by political instability and a global food crisis that led to higher food prices. In contrast, the years between 2000 and 2005 were relatively stable with an average inflation rate of about 4%. However, it's important to note that while inflation erodes the value of money, *moderate inflation* is often considered a sign of a growing economy. It indicates that consumers are spending, which can lead to increased production and economic growth. Therefore, an understanding of the context is crucial in analyzing inflation trends. In recent years, the authorities in Nepal have made efforts to stabilize the inflation rate. Notwithstanding the economic disruptions caused by the COVID-19 pandemic, the inflation rate has been reined in to around 4% in 2020, reflecting the impact of fiscal and monetary policies. In conclusion, the journey of the _Nepalese Rupee_ has been an interesting study in the ebb and flow of an economy that continues to juggle growth and stability. Like other currencies, it has felt the forces of inflation, shaping its value in the process. How it evolves in the future will be a narrative that should continue to intrigue economic minds.

The Impact of Monetary Policy on the Nepalese Rupee

The Nepalese Rupee, denoted as NPR, is the official currency of Nepal and plays a significant role in the country's economy. It is one of the few currencies of Asia that has its roots embedded deep into the country's history and culture. However, like any other currency, it's also influenced by various factors, monetary policy being a significant one. In this context, monetary policy refers to the measures adopted by the Central Bank of Nepal to regulate the supply of money in the economy, mainly implemented through operations in domestic and international financial markets. It impacts not only the value of the Nepalese Rupee but also the entirety of the country's economy. This article delves into the intricate details of the impact of monetary policy on the Nepalese Rupee, providing an understanding of its evolution, current status, and the challenges it faces. The factors that influence the value of the Nepalese Rupee, the effectiveness of the implemented policies, and how these policies affect different sectors of the economy will also be discussed. Whether you are an economics student, financial analyst, or just someone keen on understanding the complexities of currency dynamics, this comprehensive guide will certainly intrigue your intellectual curiosity.

The Basics of Nepal's Central Bank and Its Role in Monetary Policies

The **Nepalese Rupee** (NPR), administered by **Nepal Rastra Bank**, serves a significant role in Nepal's economic framework. As Nepal's central bank, the institution shoulders the crucial responsibility of framing and executing effective monetary policies that impact the country's overall economic health. The principal objective of these policies aligns with promoting stability in the general level of consumer prices — a cornerstone consideration in mitigating the adverse outcomes of inflation and deflation. Originally introduced to replace the Nepalese Mohar at par during the reign of King Tribhuvan in the mid-twentieth century, the NPR has undergone numerous design transformations and security feature enhancements to reflect Nepal's cultural heritage, combat forgery and meet international currency operation standards. Notably, NPR's design highlights prominent features, symbols and figures intrinsic to Nepalese identity — adding an aesthetic and educational dimension to this everyday transactional instrument. The Nepalese Rupee operates under a _managed float exchange rate system_, signifying that its value against foreign currencies is not determined purely by market forces but is managed or influenced by Nepal Rastra Bank's interventions. By buying or selling foreign exchange, the central bank can manipulate the supply and demand for the currency and thereby influence its exchange rate. This measure is instrumental in maintaining external competitiveness, mitigating undue fluctuations, and ensuring macroeconomic stability. A crucial role of the Nepal Rastra Bank is to navigate the delicate balancing act of monetary policy, across inflation control, managing interest rates and ensuring economic stability. Quantitative easing, open market operations, manipulating the cash reserve ratio for banks, and controlling the bank rate and repo rate are few of the tools under the central bank's arsenal to manage liquidity condition, steer economic progress and control inflation. That said, the measure of a country's monetary policy efficacy is not solely the stability of its currency; it also fundamentally relies on the nation's overall economic health. Therefore, the Nepal Rastra Bank keeps a vigilant eye on economic indicators like GDP growth rate, unemployment level, export and import figures, fiscal deficit, among others. In essence, while the Nepalese Rupee serves as a barometer of the country's economic stability, the bank's robust monetary policies act as the steering wheel driving the health of the nation's economy. In conclusion, the transformation and evolution of the **Nepalese Rupee**, its current design, the role of the central bank, and monetary policy management are intrinsic parts of Nepal's economic journey. Each component interrelates and interplays in a manner synergistically contributing to the overall economic streamlining of the Himalayan nation. The delicate dance of monetary policy and the operational functionality of the Nepalese Rupee continue to greatly influence the financial fate of Nepal, shaping its economic identity on the global stage.

Understanding How Monetary Policy Influences the Value of the Nepalese Rupee

The **Nepalese Rupee (NPR)** is the official currency of Nepal, carrying a rich history and an underlying significance captured by its unique design elements reflecting the exquisite culture of the nation. The roots of the Nepalese Rupee date back to the 17th century, representing not only economic value but intricate nuances of Nepal's history and heritage. The coins and notes depict Rastrapati Bhawan, temples, Mount Everest and other historical monuments, communicating symbolic narratives of the country's identity. The value of the **Nepalese Rupee** is significantly influenced by Nepal's monetary policy. The primary objective of the nation's monetary policy is to foster overall macroeconomic stability, focusing mainly on maintaining price and running a sound financial system, which directly relates to the value of the NPR. An inflation-targeting monetary policy regime is employed, where a controlled inflation rate is the prime consideration. Managed by the Nepal Rastra Bank, the Central Bank of Nepal, these policies encompass actions such as manipulating interest rates and adjusting reserve requirements. When the central bank raises interest rates, it generally leads to a stronger Nepalese Rupee. Higher interest rates attract foreign investors seeking better returns on their investments, creating increased demand for the NPR which subsequently raises its value. Conversely, decreases in interest rates can result in a weaker NPR as it becomes less attractive to foreign investors. Similarly, adjusting reserve requirements - the amount of capital that banks need to hold against their liabilities, affects the value of the NPR. If the central bank increases reserve requirements, banks have less money to lend, leading to lower money supply and potentially strengthening the NPR's value due to lower inflation. Conversely, if reserve requirements are decreased, there may be an increased money supply implying potential inflation, which could weaken the NPR's value. Monetary policies also carry indirect effects on the NPR. For instance, specific fiscal policies such as government spending and taxation can impact inflation and economic growth, consequently affecting the value of the currency. High government spending can often lead to increased money supply and inflation, potentially depreciating the currency. On the other hand, taxes affect disposable income and hence, consumption. If the government increases taxes, people may reduce spending, leading to a decline in the money supply, potentially resulting in deflation and increasing the value of the NPR. An understanding of these factors is critical not only for economic planning but also for foreign exchange considerations for international trade or investment. As economies are interdependent in the global landscape, the impact of the Nepalese Rupee's value extends beyond its geographical boundaries. Monitoring and anticipating such currency fluctuations enabled by the monetary policy stance can significantly impact business decisions, economic forecasting, and policy-making strategies. Hence, understanding the intricate relationship between monetary policy and the value of the **Nepalese Rupee** holds paramount importance in the modern-day economic scenario, leading to informed decisions and effective monetary governance.

Historical Impact of Monetary Policies on the Nepalese Economy and the Rupee

The **Nepalese Rupee (NPR)**, the official currency of Nepal, has a rich and complex history, which is deeply entwined with the nation's political, social, and economic narratives. Introduced in 1932 to replace the silver Mohar, the Rupee became an enduring symbol of the nation's sovereignty and economic identity. Under the headings of various monetary policies, the Central Bank of Nepal, i.e., **Nepal Rastra Bank (NRB)**, has chiefly guided the journey of the NPR. The economic policy changes have had both positive and negative impacts on Nepal's fiscal stability and the value of the Rupee. During the 1950s, Nepal established the first formal banking sector and initiated currency reforms to simplify the confusing and archaic currency system. The intention was to bolster economic growth, encourage foreign trade and investments. By putting in place measures such as standardizing currency denominations and instituting a formal banking system, Nepal sought to create a stable financial environment. This proactive monetary policy had a twofold effect, triggering a surge in infrastructure development and public spending, a boon for the Rupee's value. However, the 1980s and 1990s saw emigration, political instability, and fluctuating economic policies create chronic volatility in the value of the Nepalese Rupee. To combat this, the NRB adopted a **Managed Float System** in 1993, which meant the Rupee's value would be determined by market dynamics but with central bank intervention to prevent drastic fluctuations. This policy managed to stabilize the Rupee to an extent, albeit at a lower value. The Rupee's value took another significant hit after the devastating earthquake in 2015. The country's infrastructure was obliterated, pushing Nepal into economic turmoil. Despite the government instituting several monetary policy measures to stabilize the economy, the recovery has been slow, contributing to the Rupee's continuous depreciation. Nevertheless, in recent years, the Nepalese economy has seen steady growth, which has, in turn, played a key role in boosting the Rupee's strength. Various monetary policies aimed at enhancing financial inclusion and developing the micro, small, and medium enterprise sector have shown promising outcomes. In conclusion, the historical impact of monetary policies on the Nepalese economy and the value of the Rupee have been substantial. The ongoing challenge is in crafting well-timed and effective policies that not only stabilize and strengthen the relationship between the Rupee's value and the economy but also drive sustainable growth in a country still grappling with the aftermaths of its turbulent past.