How To Cash A Cheque Online

Here is the introduction paragraph: Cashing a cheque online has become a convenient and time-saving option for many individuals. With the advancement of technology, banks and financial institutions have introduced online cheque cashing services, allowing users to deposit cheques remotely. However, to take advantage of this service, it's essential to understand the basics of cashing a cheque online, including the requirements and preparations needed, as well as the step-by-step process involved. In this article, we will explore the ins and outs of cashing a cheque online, starting with the fundamentals. Understanding the basics of cashing a cheque online is crucial to ensure a smooth and successful transaction, so let's dive in and explore what you need to know to get started.

Understanding the Basics of Cashing a Cheque Online

Cashing a cheque online has become a convenient and time-saving way to deposit funds into your bank account. With the advancement of technology, many banks and financial institutions now offer online cheque cashing services, allowing you to deposit cheques remotely and access your funds quickly. But before you can take advantage of this service, it's essential to understand the basics of cashing a cheque online. In this article, we'll explore what a cheque is and how it works, the types of cheques that can be cashed online, and the benefits of using this service. By understanding these fundamental concepts, you'll be able to navigate the online cheque cashing process with confidence. So, let's start by examining the basics of cheques and how they work.

What is a Cheque and How Does it Work?

A cheque is a written order that instructs a bank to pay a specific amount of money from the account of the person who wrote the cheque, known as the drawer, to the person or business named on the cheque, known as the payee. The cheque must include the date, the payee's name, the amount to be paid in both numbers and words, and the drawer's signature. When a cheque is written, the drawer's bank verifies the availability of funds in the account and then transfers the funds to the payee's bank. The payee can then deposit the cheque into their account or cash it at a bank or other financial institution. Cheques can be used for a variety of transactions, including paying bills, making purchases, and transferring funds between accounts. In the context of cashing a cheque online, the process typically involves scanning or photographing the cheque and uploading it to a mobile banking app or online banking platform, where the funds are then deposited into the payee's account.

Types of Cheques That Can Be Cashed Online

There are several types of cheques that can be cashed online, offering convenience and flexibility to individuals and businesses. The most common types of cheques that can be cashed online include personal cheques, business cheques, payroll cheques, and government cheques. Personal cheques are written by individuals from their personal bank accounts, while business cheques are issued by companies to pay employees, suppliers, or contractors. Payroll cheques are specifically used to pay employees' salaries, and government cheques are issued by government agencies to pay benefits, refunds, or other payments. Additionally, some banks and financial institutions also allow the online cashing of traveller's cheques, cashier's cheques, and money orders. It's essential to note that not all types of cheques can be cashed online, and some may require in-person verification or have specific requirements for online cashing. Therefore, it's crucial to check with the issuing bank or financial institution to confirm the type of cheque and its eligibility for online cashing.

Benefits of Cashing a Cheque Online

Cashing a cheque online offers numerous benefits, making it a convenient and efficient way to access your funds. One of the primary advantages is the speed of processing, as online cheque cashing services typically deposit the funds into your account within a few hours or by the next business day, eliminating the need to wait in line at a physical bank branch. Additionally, online cheque cashing services often have extended hours of operation, allowing you to deposit your cheque at any time, 24/7. This flexibility is particularly useful for individuals with non-traditional work schedules or those who live in areas with limited banking options. Furthermore, online cheque cashing services often provide a secure and reliable way to deposit your cheque, reducing the risk of lost or stolen cheques. Many online cheque cashing services also offer mobile deposit options, allowing you to deposit your cheque using your smartphone, making it even more convenient. Moreover, online cheque cashing services often provide a detailed record of your transaction, making it easier to track your finances and stay organized. Overall, cashing a cheque online provides a fast, flexible, and secure way to access your funds, making it an attractive option for individuals looking to streamline their banking experience.

Requirements and Preparations for Cashing a Cheque Online

Cashing a cheque online has become a convenient and time-saving option for many individuals. However, to ensure a smooth and secure transaction, it's essential to meet specific requirements and make necessary preparations. To successfully cash a cheque online, you'll need to have the right documents and information readily available. This includes having a valid government-issued ID, the cheque itself, and access to your online banking account. Additionally, verifying the cheque's legitimacy and ensuring it's properly endorsed is crucial to avoid any potential issues. Furthermore, setting up your online banking account to accept cheque deposits is also necessary. By understanding what you need to cash a cheque online, how to verify the cheque, and setting up your online banking account, you can ensure a hassle-free experience. So, let's start by exploring what you need to cash a cheque online.

What You Need to Cash a Cheque Online

To cash a cheque online, you will need a few essential items and to complete some preparatory steps. First and foremost, you will need a cheque from a legitimate source, such as your employer, a business, or a government agency. The cheque must be made payable to you and have your correct name and address printed on it. Additionally, you will need a smartphone or computer with a stable internet connection, as well as a digital banking app or online banking platform that supports cheque depositing. You will also need to have a valid bank account in good standing, with sufficient funds to cover any potential fees associated with cashing the cheque. Furthermore, you may need to provide identification, such as a driver's license or passport, to verify your identity and ensure the cheque is legitimate. Some banks may also require you to sign the back of the cheque and include a deposit slip or other documentation. It's also important to check with your bank to see if they have any specific requirements or restrictions for cashing cheques online, such as limits on the amount that can be deposited or specific types of cheques that are accepted. By having all of these items and completing these preparatory steps, you can ensure a smooth and successful online cheque cashing experience.

How to Verify the Cheque and Ensure Its Legitimacy

To verify a cheque and ensure its legitimacy, several steps can be taken. Firstly, check the cheque for any visible signs of tampering, such as torn or altered areas, or if the cheque appears to be photocopied. Next, verify the cheque number, date, and amount to ensure they match the information provided by the issuer. Additionally, check the issuer's signature to ensure it matches their known signature. It's also essential to verify the cheque's routing number and account number to ensure they are valid and match the issuer's account information. Furthermore, contact the issuer to confirm the cheque's authenticity and ensure it has not been cancelled or reported lost or stolen. You can also use online cheque verification services to check the cheque's status and legitimacy. Moreover, be cautious of cheques with low or no security features, such as watermarks, security threads, or microprinting, as these may be indicative of a counterfeit cheque. By taking these steps, you can increase the chances of verifying the cheque's legitimacy and avoiding potential fraud.

Setting Up Your Online Banking Account for Cheque Deposits

Setting up your online banking account for cheque deposits is a straightforward process that can be completed in a few simple steps. First, ensure you have a compatible device, such as a smartphone or tablet, and a reliable internet connection. Next, download and install your bank's mobile banking app or access their online banking platform through their website. If you're a new user, you'll need to register for online banking by providing your account details and creating a username and password. If you're already registered, simply log in to your account using your existing credentials. Once you're logged in, navigate to the "Deposit" or "Cheque Deposit" section, where you'll find instructions on how to proceed with setting up your account for cheque deposits. You may need to agree to the terms and conditions, provide some additional information, or complete a one-time setup process. Some banks may also require you to link your account to a specific deposit location or enable cheque deposit functionality. After completing these steps, you'll be ready to start depositing cheques online using your mobile device or computer. Be sure to review your bank's specific requirements and guidelines for cheque deposits, as these may vary. By setting up your online banking account for cheque deposits, you'll be able to enjoy the convenience of depositing cheques from anywhere, at any time, without having to visit a physical bank branch.

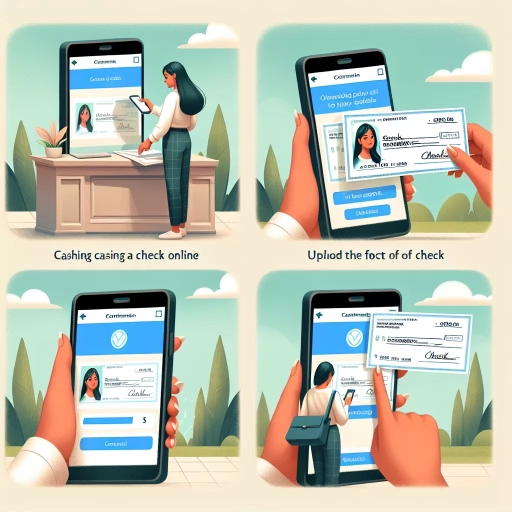

The Step-by-Step Process of Cashing a Cheque Online

Cashing a cheque online is a convenient and efficient way to deposit funds into your bank account. The process involves several steps that ensure the cheque is verified and the funds are transferred securely. To start, you need to scan or photograph the cheque for deposit, capturing all the necessary details. This is followed by uploading the cheque image and filling out the deposit form, which requires you to provide additional information to verify the transaction. Finally, you need to confirm the deposit and receive the funds, which are typically credited to your account within a few days. In this article, we will guide you through the step-by-step process of cashing a cheque online, starting with the first step: scanning or photographing the cheque for deposit.

Scanning or Photographing the Cheque for Deposit

Scanning or photographing the cheque for deposit is a crucial step in the online cheque cashing process. To do this, you'll need a smartphone or a scanner with a clear camera. Ensure the cheque is properly endorsed, with your signature on the back, and that all details are legible. Place the cheque on a flat surface, with good lighting, and take a clear photo of the front and back of the cheque. If using a scanner, follow the manufacturer's instructions to scan the cheque. The image should be in a format accepted by your bank, such as JPEG or PDF. Check with your bank for specific requirements. The image should also meet the bank's quality standards, with clear details and no glare or shadows. If the image is not clear, you may need to retake the photo or rescan the cheque. Once you have a clear image, you can proceed to upload it to your bank's online platform or mobile app, following the prompts to complete the deposit process.

Uploading the Cheque Image and Filling Out the Deposit Form

Uploading the cheque image and filling out the deposit form are crucial steps in the online cheque cashing process. To upload the cheque image, you will need to take a clear and legible photo of the front and back of the cheque using a smartphone or a scanner. Ensure that the cheque is properly endorsed and that all four corners are visible in the image. The image should be in a format accepted by the bank, such as JPEG or PNG. Once the image is uploaded, you will need to fill out the deposit form, which will require you to provide information such as the cheque number, date, payee name, and amount. You may also need to provide additional information, such as your account number and routing number. It is essential to double-check the information for accuracy to avoid any delays or errors in the deposit process. Some banks may also require you to provide a brief description of the cheque or the reason for the deposit. After completing the form, review it carefully and submit it along with the uploaded cheque image. The bank will then review the information and verify the cheque details before processing the deposit.

Confirming the Deposit and Receiving the Funds

Once the bank has verified the cheque and confirmed the deposit, the funds will be credited to your account. This process typically takes a few hours, but it may take longer depending on the bank's policies and the time of day the deposit was made. You can check the status of your deposit by logging into your online banking account or mobile banking app. If the deposit is successful, you will see the funds reflected in your account balance. You can then use the funds to make purchases, pay bills, or transfer money to another account. It's essential to review your account statement regularly to ensure that the deposit was processed correctly and that there are no errors or discrepancies. If you notice any issues, contact your bank's customer service immediately to resolve the problem.