How To Buy Costco Stock In Canada

Here is the introduction paragraph: For Canadian investors looking to diversify their portfolios, buying Costco stock can be a lucrative opportunity. As one of the world's largest retailers, Costco's stock has consistently performed well, making it an attractive option for those seeking long-term growth. However, navigating the process of buying Costco stock in Canada can be complex, especially for those new to investing. To successfully purchase Costco stock, it's essential to understand the company's stock structure, meet the necessary requirements, and execute the purchase through a reputable brokerage firm. In this article, we'll guide you through the process, starting with a crucial first step: Understanding Costco's Stock Structure.

Understanding Costco's Stock Structure

Understanding Costco's stock structure can be a complex task, especially for those new to investing. However, breaking down the basics can provide clarity and confidence for investors looking to add this retail giant to their portfolio. One key aspect to grasp is the ticker symbol and stock exchange listing of Costco, which is essential for buying and selling shares. Additionally, it's crucial to understand whether Costco is a publicly traded company in Canada, as this affects investment opportunities for Canadian investors. Furthermore, recognizing the difference between Costco's US and Canadian stock listings is vital for making informed investment decisions. By exploring these fundamental aspects, investors can gain a deeper understanding of Costco's stock structure and make more informed decisions. So, let's start by examining what is Costco's ticker symbol and stock exchange listing?

What is Costco's ticker symbol and stock exchange listing?

Costco's ticker symbol is COST, and it is listed on the NASDAQ stock exchange under the same ticker symbol. This means that if you're looking to buy or sell Costco stock, you'll need to use the ticker symbol COST when placing your trade. As a NASDAQ-listed company, Costco's stock is traded on the NASDAQ exchange, which is one of the largest and most well-known stock exchanges in the world. By knowing Costco's ticker symbol and stock exchange listing, you can easily find and trade the company's stock through your brokerage account or online trading platform.

Is Costco a publicly traded company in Canada?

Costco is a publicly traded company in Canada, listed on the Toronto Stock Exchange (TSX) under the ticker symbol COST. As a publicly traded company, Costco's financial information and stock performance are publicly available, allowing investors to make informed decisions about buying and selling its stock. In Canada, investors can purchase Costco stock through a brokerage firm or online trading platform, such as TD Direct Investing, RBC Direct Investing, or Questrade. To buy Costco stock in Canada, investors will need to open a trading account with a registered brokerage firm, fund the account, and then place an order to buy the desired number of shares. It's essential to note that investing in the stock market involves risks, and it's crucial to conduct thorough research and consider your financial goals and risk tolerance before making any investment decisions.

What is the difference between Costco's US and Canadian stock listings?

Costco's US and Canadian stock listings differ in their ticker symbols and exchange listings. In the US, Costco is listed on the NASDAQ stock exchange under the ticker symbol "COST". In Canada, Costco is listed on the Toronto Stock Exchange (TSX) under the ticker symbol "COST.TO". Although the ticker symbols are similar, they represent different listings on different exchanges. This means that if you're a Canadian investor, you'll need to purchase the Canadian-listed shares (COST.TO) to avoid any potential currency exchange or conversion issues. Additionally, the Canadian listing may be subject to different regulatory requirements and trading rules compared to the US listing. It's essential to understand these differences to ensure a smooth and informed investment process.

Meeting the Requirements to Buy Costco Stock in Canada

Here is the introduction paragraph: Investing in Costco stock can be a lucrative opportunity for Canadians looking to diversify their investment portfolio. However, before making a purchase, it's essential to understand the requirements to buy Costco stock in Canada. To get started, you'll need to meet specific eligibility criteria, including citizenship or residency requirements, minimum investment thresholds, and account setup with a Canadian brokerage firm. In this article, we'll explore these requirements in detail, starting with the question: Do I need to be a Canadian citizen or resident to buy Costco stock?

Do I need to be a Canadian citizen or resident to buy Costco stock?

To buy Costco stock in Canada, you don't necessarily need to be a Canadian citizen or resident. However, you will need to meet certain requirements and follow specific steps. If you're a non-resident, you can still invest in Costco stock through a Canadian brokerage account or a registered retirement savings plan (RRSP). You'll need to provide identification and proof of address, and you may be subject to certain tax implications. It's recommended that you consult with a financial advisor or tax professional to understand the specific requirements and any potential tax consequences. Additionally, you may need to open a Canadian dollar-denominated account to purchase Costco stock, as it's listed on the Toronto Stock Exchange (TSX) under the ticker symbol COST. Overall, while citizenship or residency is not a requirement, it's essential to understand the rules and regulations surrounding non-resident investments in Canada.

What are the minimum investment requirements to buy Costco stock in Canada?

To buy Costco stock in Canada, you'll need to meet the minimum investment requirements set by the brokerage firm or online trading platform you choose. The minimum investment requirements vary among brokerages, but most require a minimum deposit of $100 to $1,000 to open a trading account. Some popular online brokerages in Canada, such as Questrade, CIBC Investor's Edge, and TD Direct Investing, have minimum investment requirements ranging from $100 to $500. Additionally, you'll need to consider the cost of buying the stock, which includes the trading commission, exchange fees, and any other applicable fees. The trading commission for buying Costco stock in Canada can range from $4.95 to $9.99 per trade, depending on the brokerage firm and the type of account you have. It's essential to review the fees and minimum investment requirements of different brokerages before opening an account to ensure you meet the requirements and can afford the costs associated with buying Costco stock.

Do I need to open a brokerage account with a Canadian bank or online trading platform?

To buy Costco stock in Canada, you don't necessarily need to open a brokerage account with a Canadian bank. While banks like TD, RBC, and CIBC offer brokerage services, you can also consider online trading platforms like Questrade, Wealthsimple, or Interactive Brokers. These platforms often provide lower fees, more investment options, and user-friendly interfaces. If you already have a bank account with a Canadian bank, you can still use their brokerage services, but it's essential to compare fees and services before making a decision. Some online trading platforms may also offer more competitive pricing, especially for frequent traders or those with larger investment portfolios. Ultimately, the choice between a bank or online trading platform depends on your individual needs and investment goals.

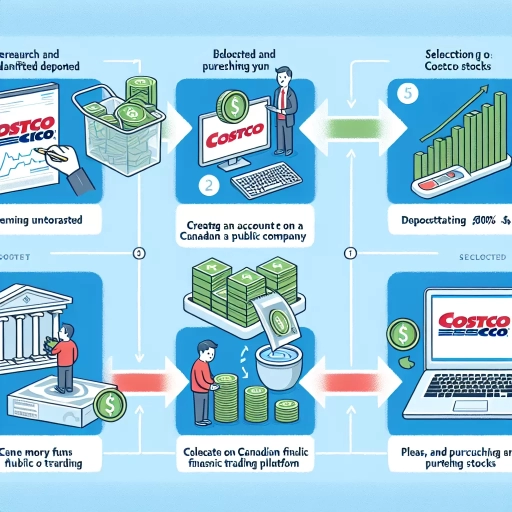

Executing the Purchase of Costco Stock in Canada

Here is the introduction paragraph: If you're a Canadian investor looking to add Costco stock to your portfolio, you're likely wondering how to execute the purchase. With numerous online brokerage firms and investment options available, it can be overwhelming to navigate the process. To ensure a smooth transaction, it's essential to understand the fees associated with buying Costco stock in Canada, as well as the various investment options, such as robo-advisors and index funds. In this article, we'll explore these topics in more detail, starting with the crucial step of finding a reputable online brokerage firm in Canada to buy Costco stock. Here is the 200 words supporting paragraph: When it comes to buying Costco stock in Canada, it's essential to choose a reputable online brokerage firm that meets your investment needs. A reputable firm will provide a secure and user-friendly platform, competitive fees, and a wide range of investment products. To find a reputable firm, research and compare different options, reading reviews and checking for regulatory compliance. Look for firms that are members of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Additionally, consider factors such as account minimums, trading fees, and customer support. By doing your due diligence, you can ensure a safe and successful transaction. For example, some popular online brokerage firms in Canada include Questrade, TD Direct Investing, and CIBC Investor's Edge. Once you've selected a reputable firm, you can proceed with confidence, knowing that your investment is in good hands. Now, let's dive deeper into the process of finding a reputable online brokerage firm in Canada to buy Costco stock.

How do I find a reputable online brokerage firm in Canada to buy Costco stock?

To find a reputable online brokerage firm in Canada to buy Costco stock, start by researching well-established and regulated online brokerages that offer trading in US-listed stocks, such as Questrade, CIBC Investor's Edge, and TD Direct Investing. Look for firms that are members of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), which provide an added layer of protection for investors. You can also check online reviews and ratings from reputable sources, such as the Canadian Securities Administrators (CSA) and the Better Business Bureau (BBB), to get an idea of the firm's reputation and customer satisfaction. Additionally, consider factors such as trading fees, account minimums, and the range of investment products offered. It's also a good idea to read and understand the firm's terms and conditions, as well as their policies on trading, margin, and risk management. By doing your due diligence, you can find a reputable online brokerage firm in Canada that meets your needs and helps you achieve your investment goals.

What are the fees associated with buying Costco stock in Canada?

Here is the paragraphy: When buying Costco stock in Canada, there are several fees to consider. The most significant fee is the trading commission, which can range from $5 to $30 per trade, depending on the brokerage firm and the type of account you have. For example, Questrade, a popular online brokerage firm in Canada, charges a commission of $4.95 per trade for stocks. Other fees to consider include the management expense ratio (MER), which is a fee charged by the fund manager for managing the fund, and the exchange-traded fund (ETF) management fee, which is a fee charged by the ETF provider. Additionally, some brokerage firms may charge a fee for inactivity, maintenance, or transfer. It's essential to review the fee schedule of your brokerage firm before buying Costco stock to understand the total cost of ownership. Furthermore, if you're buying Costco stock through a registered retirement savings plan (RRSP) or a tax-free savings account (TFSA), you may be subject to additional fees, such as administration fees or transfer fees. To minimize fees, consider using a low-cost brokerage firm, such as Wealthsimple or CIBC Investor's Edge, and take advantage of commission-free trading promotions.

Can I buy Costco stock through a robo-advisor or index fund in Canada?

You can buy Costco stock through a robo-advisor or index fund in Canada. Many robo-advisors, such as Wealthsimple, Questwealth Portfolios, and Justwealth, offer Costco stock as part of their investment portfolios. Additionally, you can also invest in index funds that track the S&P/TSX 60 Index or the S&P 500 Index, which include Costco stock as one of their holdings. Some popular index funds in Canada that include Costco stock are the Vanguard FTSE Canada All Cap Index ETF, the iShares Core S&P/TSX Total Market Index ETF, and the BMO S&P 500 Index ETF. By investing in a robo-advisor or index fund, you can gain exposure to Costco stock while also diversifying your portfolio across various asset classes and industries.