How To Write A Check Canada

In the digital age we live in, writing a paper cheque may seem like a relic of a bygone era. Despite the surge in electronic payments, cheques still hold a significant place in Canadian finance for their convenience, traceability, and control over funds disbursement timing. This comprehensive article aims to equip you with indispensable knowledge of how to accurately and securely write a cheque in Canada, warding off common errors that may lead to inconvenience or fraud. We start with 'Understanding the Basics of a Cheque in Canada', in which we explore the fundamental elements of a Canadian cheque. We then provide a meticulous 'Step-By-Step Guide for Writing a Cheque in Canada', simplifying this seemingly daunting task for beginners. Lastly, we highlight 'Common Mistakes to Avoid When Writing a Cheque in Canada' to ensure each cheque you pen is flawlessly legit. Now, let’s delve into the nitty-gritty of the essential components of a cheque in Canada.

In the digital age we live in, writing a paper cheque may seem like a relic of a bygone era. Despite the surge in electronic payments, cheques still hold a significant place in Canadian finance for their convenience, traceability, and control over funds disbursement timing. This comprehensive article aims to equip you with indispensable knowledge of how to accurately and securely write a cheque in Canada, warding off common errors that may lead to inconvenience or fraud. We start with 'Understanding the Basics of a Cheque in Canada', in which we explore the fundamental elements of a Canadian cheque. We then provide a meticulous 'Step-By-Step Guide for Writing a Cheque in Canada', simplifying this seemingly daunting task for beginners. Lastly, we highlight 'Common Mistakes to Avoid When Writing a Cheque in Canada' to ensure each cheque you pen is flawlessly legit. Now, let’s delve into the nitty-gritty of the essential components of a cheque in Canada.Understanding the Basics of a Cheque in Canada

Understanding the basics of a cheque in Canada requires a comprehensive breakdown of not only its fundamental concept, but also its role and inherent components within the Canadian banking system. As an integral instrument of the financial landscape, cheques harbour relevance and significance to both individuals and businesses alike. This insightful article delves into the intricate workings of cheques, beginning with the basic concept of a cheque. The journey continues as we explore the role of cheques within the Canadian banking framework, followed by an in-depth analysis of the components that make up a cheque. Not unlike an investigative narrative, this article employs digital storytelling techniques to pose an engaging dissection of the cheque in Canadian context. Without further ado, let us initiate this journey by delving into the concept of a cheque, its origin, and its quintessential nature in the realm of Canadian finance.

The concept of a Cheque

The concept of a cheque in the Canadian financial system plays a crucial role in daily transactions. A cheque, essentially, is a written order that instructs a bank or credit union to pay a specified amount from the account holder's account to a particular individual or organization. While it might appear as a straightforward piece of paper to an untrained eye, a standard Canadian cheque contains multiple key elements that contribute to its lawful validity and operational functionality. One prime importance is the date section where the account holder stipulates the day the cheque can be cashed or deposited, propelling account management convenience. The 'Pay to the order of' line, on the other hand, indicates the payee's name or organization intended to receive the money. Following this is the numeric box and written line representing the payment amount – these must match to avoid discrepancies and potential banking issues. In addition, there's a memo line for optional use to make a note about the payment’s purpose. Finally yet importantly, the signature line unequivocally affirms the account holder's consent for the transaction to go through. Although digital payments are proliferating, cheques continue to hold their value owing to their traceability and non-immediacy of payment withdrawal. This aspect is particularly valuable for businesses requiring comprehensive financial records and individuals or entities looking for payment flexibility. Consequently, understanding how to write a cheque correctly in Canada remains a key personal finance skill.

Role of Cheques in Canadian Banking System

The role of cheques in the Canadian banking system is crucial, despite the rise of digital payment systems. Cheques, being a traditional mode of payment, continue to be used routinely for business transactions, rent deposits, personal funds transfers, and various other financial transactions in Canada. They provide a tangible and reliable method of transferring large sums of money without the risks associated with carrying cash. Cheques have different features that contribute significantly to the functionality of the Canadian banking system. One key feature is the robustness of the security measures embedded in them. Each cheque in Canada comes with a unique serial number, the bank's MICR (Magnetic ink character recognition) code, and the account holder's information. This makes each transaction traceable and safe from fraudulent activities. Another significant aspect of cheques in the Canadian banking system is their role in facilitating business-to-business transactions. Companies often have to handle large amounts of money and prefer using cheques to manage their accounts better. This is because cheques leave a paper trail, which provides a detailed transaction record that companies can use for their auditing purposes. Cheques also offer Canadian consumers the flexibility of scheduled payments. For instance, post-dated cheques, a common practice in Canada, allow individuals to plan their payments in advance. Whether it's for rent, bills, or loan repayments, post-dated cheques are a popular choice due to their convenience and reliability, particularly when timing is critical. Lastly, even with the availability of modern digital transaction methods, there is still a section of the population that either prefers the tangibility of cheques or lacks access to digital banking services. For these customers, cheques play a vital role as a convenient and traditional payment option. Therefore, the role of cheques in the Canadian banking system is multifaceted and significant. The suitability of cheques for large payments, the security features they possess, the tangible record they create, and their convenience and universality all combine to make cheques an integral part of the Canadian banking landscape. While digital payments continue to rise in popularity, the humble cheque remains an essential linchpin in the Canadian financial system.

Components of a Cheque

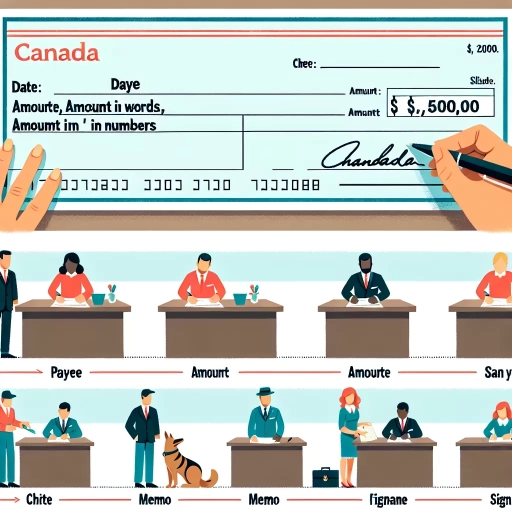

Understanding every component of a cheque is pivotal for both writers and recipients of cheques in Canada. Cheques, though seen as a traditional mode of payment, remain to be one of the safest and most efficient methods of moving money from one account to another. It is a written document instructing a bank or a credit union to pay a specific amount from the cheque writer's account to the individual or entity named on the cheque. In essence, a cheque is comprised of several components. The 'date' is one such critical component that references the day the cheque was written. Accurately dating a cheque helps track transactions and provides a potential safeguard against fraud. Next, 'the payee' refers to the individual or entity to whom the cheque is written. Being precise is important to avoid confusion or possible fraudulent redirection of funds. Another substantial aspect is the 'amount' - the sum the cheque issuer is instructing the bank to pay to the payee. It must be written both numerically and in words to eliminate ambiguity. The part containing handwritten words is called the 'legal line', and in the event of a disparity between the numerical and written amounts, the amount written in words is considered legally valid. Further, the 'memo line' constitutes an optional but advantageous component. Any pertinent details or reminders about the purpose of the cheque can be recorded here. This can come in handy for both the payer and payee during account auditing or reconciliation. Lastly, 'the signature line' is arguably the most vital part of a cheque. It is where the account holder provides their signature to authorize the transaction. Without this, a cheque is deemed incomplete and invalid, rendering it unable to be processed. The understanding of these components ensures smoother transactions, reduces probability for miscommunication, and augments financial security. Therefore, mastering the basics of writing a cheque in Canada is not only a stepping stone to financial responsibility, but also a prerequisite for secure and effective transactions.

Step-By-Step Guide for Writing a Cheque in Canada

When it comes to financial operations, writing a cheque may seem old-fashioned, yet it's still a crucial knowledge to have in the Canadian financial system. It's not uncommon to see an individual staring blankly at a cheque, unclear about what to write in each field. This demonstrates the need for an insightful, detailed step-by-step guide to guide individuals through this process. This guide will be divided into three critical segments: Filling Out the Date, Writing the Payee and the Amount, and Signing the Cheque. Each section will provide clear directions to avoid common mistakes, ensuring that your cheque is accepted without any hassles. Let's dive into the first crucial aspect of cheque-writing: Filling Out the Date. As simple as it may sound, this section provides vital details that often get overlooked, yet it sets the timing for the entire transaction. Follow along as we unveil each step in a way that caters to your understanding, respecting your time and effort, and ultimately, enhancing your financial literacy.

Filling Out the Date

After determining the payee information on your cheque, you'll then move on to fill out the date. This task, though minute, is highly crucial and contributes to the validity of your cheque. Writing the date on a cheque in Canada requires a specific format, which often includes the day, month, and year. Canadian banks typically accept cheques with dates in the format of “DD/MM/YYYY,” although some financial institutions may also accept the “MM/DD/YYYY” format. Don't forget to include all four digits for the year to avoid any confusion. When writing the date, make sure it's the current date or a future one, otherwise known as a post-dated cheque. Legally in Canada, you’re allowed to post-date a cheque, but be aware that it can be cashed in at any time irrespective of the date written on it. If your account doesn’t have sufficient funds when the cheque is cashed, it will bounce and you could incur penalties. Take note, writing the wrong date is one of the common mistakes people make in the cheque payment process. To avoid this, double-check the date you've written. You are not permitted to use white-out or make alterations if you err in this step; instead, you'll need to start with a fresh cheque. Writing the date accurately reduces the chances of your cheque being refused due to a technical error. Furthermore, be cautious during the transition into a new year—you don't want to mistakenly use the previous year in your date. Doing so would render the cheque stale-dated after six months from the date written on it. Filling out the date on a cheque may seem like a straightforward task, yet it is one of paramount importance. Understanding how to correctly do this supports secure and effective cheque transactions, thereby ensuring your payments will be successfully processed by Canadian banks.

Writing the Payee and the Amount

Writing the payee detailed on a cheque is an essential step that requires utmost precision and complete knowledge. This process involves identifying who the recipient or beneficiary of said amount is. The name that's written in the 'Pay to the order of' section is rendered as the payee. When writing out a cheque in Canada, you must ensure the payee’s name is spelled accurately. There's no room for errors, as even the slightest mistake could lead to possible complications in the cheque being cashed or deposited. Next, comes the step of detailing the amount. It must be inscribed, without fail, in two separate locations on the cheque - first in the numeral box on the right, and then it must be spelled out in the line beneath the payee's name. Doing so reinforces the intended amount and reduces any chances of fraudulent activities. The Canadian banking system is very particular about their numeral and word agreement. In the event of a contradiction, the amount illustrated in words will be honored. Hence, precision becomes crucial when writing this information. Penmanship, although may seem underrated, can really make a difference. Neat, clean, and conspicuous numerals and words can ease the processing of your cheque. Guard against any alterations by starting right at the end of both spaces and draw a line through any remaining space. Another noteworthy point is to avoid using dashes or slashes between numbers to prevent ambiguity. For instance, 'twenty-five' instead of '20/5'. If you are required to transfer cents as well, do remember to include them as fraction values over 100. For instance, $25.50 would be written as “Twenty five & 50/100”. Typically, writing a cheque is straightforward; however, it embodies a certain level of responsibility and attention to detail. Ensuring the correct payee and accurate amount is first and foremost when writing a cheque in Canada. Thus, this can be seen as a collaborative mix of knowledge, precision, neatness, and precaution.

Signing the Cheque

Signing the Cheque

After meticulously filling in the recipient's name, indication of the exact amount in words, numerals, and the transaction purpose, the completion of cheque writing lies in the act of signing the cheque. This is arguably the most crucial part of writing a cheque. Your signature is the authorization that activates the cheque, verifying that you, the account holder, approve all details inscribed on it. Without it, your cheque is merely a piece of paper. In Canada, the section for the signature is typically found at the bottom right corner of the cheque. The importance of the consistency of your signature cannot be overstated. Always ensure that the signature you inscribe on the cheque matches the original signature you provided to your bank during account set-up. This is because your bank uses this signature for validation, as a safeguard against fraud. Any slight deviation might raise suspicion and cause unnecessary complications. Another key consideration is ensuring the security of your cheque after signing. Never issue a signed blank cheque, as this can be easily manipulated and misused - a loophole in cheque use that potential fraudsters can exploit. Even so, remember that the activation of the cheque does not automatically mean funds are transferred immediately. Such a transaction requires processing time, usually taking between one to six business days in Canada. Keep track of your payments and maintain an accurate account balance to avoid the unfortunate incident of a bounced cheque. Lastly, it's advisable to use a non-erasable ink pen to sign your cheque. It's a minor detail but serves a significant purpose in enhancing cheque security. Components such as these are invaluable in increasing the success rate of your transactions, contributing to mastering the art of cheque-writing in Canada. Practice precision and attentiveness while signing your cheques--the financial transparency and security it provides are well worth the effort. And don't be shy to ask your bank for clarification if you're unsure. They are there to assist you in maintaining your financial health, ensuring every cheque you write is valid and secure.Common Mistakes to Avoid When Writing a Cheque in Canada

Writing a cheque may seem like a straightforward process, but many individuals unknowingly make critical errors that can result in their cheque being dishonored or misused. When dealing with cheques in Canada, it is vital to avoid three common mistakes that can lead to complications. First, using an incorrect date format is a common error that many individuals make. As you may or may not be aware, the Canadian cheque format follows the day-month-year arrangement. Consequently, misunderstanding or forgetting this format can lead to confusion and potential refusal of the cheque when presented for payment. Secondly, a misalignment of the numerical and written amount is an error that can result in significant financial consequences. This occurs when there is a mismatch between the written and numerical indication of the cheque amount. Finally, a forgotten signature is a basic yet frequently overlooked mistake. For a cheque to be valid, it requires an authenticated signature. Forgetting this crucial step invalidates the cheque irrespective of the other details correctly filled in. In the following sections, we will elaborate on these common mistakes starting with the Incorrect Date Format. We will dive deeper into its implications and how you can easily avoid this error when writing a cheque in Canada.

Incorrect Date Format

Incorrect Date Format: A Crucial Yet Common Mistake An element commonly overlooked during the check-writing process in Canada is the date format. This mistake, although seemingly trivial, can lead to the invalidity of the cheque, or even worse- legal complications below the surface. It’s imperative to note that in Canada, the standard date format is DD-MM-YYYY - Day, followed by Month and then the Year. This format differs significantly from others used internationally such as the United States' MM-DD-YYYY format. Misinterpreting this format can lead to a discrepancy between the intended payment date and the one noted on the cheque. When the intended date and the noted date fail to align, it opens a pandora's box of potential problems, including a delay in cheque processing or outright rejection of the payment by the bank. Apart from these transactional issues, there's also a risk of a future misunderstanding between you and the cheque's recipient. Understanding this, it is important to always double-check the date before finalizing your cheque. Making sure it is in the right format - '16-09-2023', for example - can save both time and avoid a heap of problems. Prioritizing attention to detail plays a pivotal role in creating flawless transactions. By avoiding such critical mistakes, one can ensure a smoother experience when handling cheques in Canada, reinforcing trust and confidence in this age-old payment method. In the digital era where instant transfers and mobile payments reign supreme, cheque writing may seem old-fashioned. However, mastering the art of this traditional form of payment remains crucial, starting with getting the date right—the first time, every time. Understanding the intricacies of this process can make a world of difference and steer you clear of unwanted issues down the line - because when it comes to financial matters, precision is key.

Misalignment of Numeric and Written Amount

Misalignment of numeric and written amount is a common mistake that often occurs when writing a cheque in Canada. This misalignment can potentially lead to significant issues, including financial discrepancies, misinterpretation, or even refusal of the cheque by the recipient's bank. It is crucial to understand that the space designated for writing the numeric and written amounts must align perfectly to avoid any doubt or confusion in the cheque processing. When indicating the numeric amount, it should be written close to the dollar sign, leaving no space for additional numbers. This may prevent any fraudulent activities, like someone adding extra numbers to increase the amount. In contrast, the written amount, spelled out in words, should precisely reflect the numeric amount, and it should be written without any gaps or scribbles. For example, if the cheque is for $150, the numeric amount should be written as '150' right next to the '$' symbol, not leaving a gap that might allow fraudulent additions. Simultaneously, the written amount should be 'one hundred and fifty', written right across the line without any gaps that might allow extraneous insertions. Remember, banks can refuse to honor a cheque if the numeric and written amounts do not match exactly, leading to unnecessary hassles. Understanding the correct way of writing a cheque can save you from unexpected surprises, preserve your financial integrity, and maintain the ease of your transactions. So, avoid the misalignment of the numeric and written amount—a common yet potentially consequential mistake—when writing a cheque in Canada.

Forgotten Signature

Many people find themselves making the same types of mistakes when writing a cheque in Canada. One of the most common errors is a forgotten signature. Underestimating the importance of a signature on your cheque is a mistake you wouldn't want to commit. It's not just a harmless stroke of the pen; it holds far more weight than a mere technicality. A signature is the main personal identifier on your cheque, a distinct marker that is uniquely yours. It serves as the final seal of authorization, allowing funds to be transferred from your account to someone else's. In the eyes of financial institutions, a cheque without a signature is an empty promise. It indicates that the issuer did not officially authorize the transaction, hence, simply put, it becomes as good as void. Moreover, banking protocols in Canada mandate that any cheque presented without a signature be deemed ‘incomplete’ and not fit for payment. This oversight can result in delayed payments, cause a setback on financial obligations and even offend or confuse recipients who may think the issuer intentionally neglected to sign the cheque. It might also court unwelcome suspicion towards your account's security, and lead to needless scrutiny by banking authorities. Thus, a forgotten signature may seem like a minor issue, but it can have substantial repercussions. It can disrupt a smooth flow of transactions and potentially damage the trust relationships between parties. The best course of action is to take your time and cautiously review your cheque before handing it over. Make sure every required field is filled, notably the crucial element of your signature, accentuating the adage that 'haste often makes for waste,' especially in financial matters. In conclusion, dodging the common mistake of a forgotten signature on your cheque in Canada is tantamount to avoiding unnecessary hassle, ensuring seamless transactions, and maintaining credibility in your financial dealings.