How To Receive Money From Western Union

Here is the introduction paragraph: Receiving money from Western Union is a straightforward process that can be completed in a few simple steps. To get started, it's essential to understand the services offered by Western Union, including the various transfer options and fees associated with each. Once you have a clear understanding of the services, you can prepare to receive your money by gathering the necessary documents and information. Finally, you can pick up your cash at a Western Union location or have it deposited directly into your bank account. In this article, we will guide you through the process of receiving money from Western Union, starting with an overview of their services. Please let me know if this introduction paragraph meets your requirements.

Understanding Western Union Services

Western Union is a leading global money transfer service that enables individuals and businesses to send and receive money across the world. With a vast network of agents and a range of transfer options, Western Union provides a convenient and reliable way to transfer funds. To understand Western Union services, it's essential to know the types of money transfer services they offer, including online transfers, in-person transfers, and mobile transfers. Additionally, it's crucial to be aware of the transfer fees and exchange rates associated with each service, as these can impact the amount of money received by the recipient. Furthermore, understanding the transfer limits and requirements, such as identification and documentation, is vital to ensure a smooth transaction. By knowing these aspects of Western Union services, individuals can make informed decisions when sending or receiving money. With this knowledge, let's dive into the various types of Western Union money transfer services available.

Types of Western Union Money Transfer Services

Western Union offers a variety of money transfer services to cater to different needs and preferences. One of the most popular services is the Money in Minutes service, which allows senders to transfer funds to recipients in minutes. This service is ideal for emergency situations or when the recipient needs the money urgently. Another service is the Next Day service, which guarantees that the funds will be available to the recipient the next business day. This service is suitable for non-urgent transfers and offers a more affordable option. Western Union also offers a Direct to Bank service, which allows senders to transfer funds directly to the recipient's bank account. This service is convenient and eliminates the need for the recipient to physically visit a Western Union location. Additionally, Western Union offers a Mobile Money Transfer service, which enables senders to transfer funds to the recipient's mobile wallet. This service is particularly useful in areas where access to traditional banking services is limited. Furthermore, Western Union offers a Prepaid Card service, which allows senders to load funds onto a prepaid card that can be used by the recipient to make purchases or withdraw cash. This service is ideal for senders who want to control how the recipient uses the funds. Overall, Western Union's diverse range of money transfer services provides flexibility and convenience for both senders and recipients.

Western Union Transfer Fees and Exchange Rates

Western Union is a popular money transfer service that allows individuals to send and receive money globally. However, when using Western Union, it's essential to understand the transfer fees and exchange rates involved. The transfer fees vary depending on the transfer method, payment method, and the recipient's location. For example, sending money online or through the mobile app is generally cheaper than sending it in-person at a physical location. Additionally, using a debit card or bank account to fund the transfer is often less expensive than using a credit card. The exchange rates used by Western Union are also a crucial factor to consider. The company uses a wholesale exchange rate, which is the rate at which banks and other financial institutions exchange currencies. However, Western Union also adds a margin to this rate, which can range from 1-5% depending on the currency and transfer amount. This margin is how Western Union makes a profit on the transfer. To give you a better idea, here are some estimated transfer fees and exchange rates for popular currencies: Sending $100 to Mexico: Transfer fee: $5-$10, Exchange rate: 1 USD = 19-20 MXN. Sending $100 to India: Transfer fee: $10-$15, Exchange rate: 1 USD = 70-75 INR. Sending $100 to the UK: Transfer fee: $5-$10, Exchange rate: 1 USD = 0.75-0.80 GBP. It's worth noting that these fees and exchange rates are subject to change and may vary depending on the specific transfer details. To get the most up-to-date information, it's best to check Western Union's website or consult with a representative. By understanding the transfer fees and exchange rates, you can make informed decisions when using Western Union to send or receive money.

Western Union Transfer Limits and Requirements

Western Union transfer limits and requirements vary depending on the country, payment method, and type of transfer. Generally, the maximum amount that can be sent through Western Union is $5,000 per transfer, but this limit can be lower in some countries. For example, in the United States, the maximum amount that can be sent online is $3,000, while in-person transfers have a higher limit of $5,000. In some countries, such as India, the maximum amount that can be sent is $2,999. Additionally, some payment methods, such as credit cards, may have lower transfer limits. To send money through Western Union, you will typically need to provide identification, such as a driver's license or passport, and proof of address. You will also need to provide the recipient's name, address, and phone number. In some cases, you may need to provide additional documentation, such as proof of income or employment. Western Union also has a system in place to detect and prevent suspicious transactions, so you may be asked to provide additional information or documentation to verify the transfer. It's also worth noting that Western Union has a daily transfer limit, which varies by country and payment method. For example, in the United States, the daily transfer limit is $5,000, while in some other countries, it may be lower. Overall, it's a good idea to check with Western Union directly to determine the specific transfer limits and requirements for your country and payment method.

Preparing to Receive Money from Western Union

Receiving money from Western Union can be a convenient and efficient way to get funds from friends, family, or business associates. To ensure a smooth transaction, it's essential to be prepared. This involves understanding the necessary documents required to receive Western Union transfers, locating a Western Union agent near you, and being familiar with the Western Union tracking process. By having the right documents, you can avoid delays and ensure that you receive your money quickly. Additionally, knowing where to find a Western Union agent can save you time and effort. Furthermore, understanding how to track your transfer can give you peace of mind and allow you to stay updated on the status of your transaction. In this article, we will explore these topics in more detail, starting with the required documents for receiving Western Union transfers.

Required Documents for Receiving Western Union Transfers

To receive a Western Union transfer, you will need to provide certain documents to verify your identity and ensure a smooth transaction. The required documents may vary depending on the country, state, or region you are in, as well as the type of transfer you are receiving. Generally, you will need to provide a valid government-issued ID, such as a driver's license, passport, or state ID. You may also need to provide proof of address, such as a utility bill or bank statement, to confirm your identity and address. In some cases, you may be required to provide additional documentation, such as a birth certificate or social security card, to comply with anti-money laundering regulations. It's best to check with the Western Union agent or location where you plan to pick up the transfer to confirm the specific documents required. Additionally, you will need to know the Money Transfer Control Number (MTCN) provided by the sender, as well as the sender's name and the amount of the transfer. Having all the necessary documents and information ready will help ensure a quick and hassle-free transaction.

Locating a Western Union Agent Near You

To locate a Western Union agent near you, you can use the company's online agent locator tool, which is available on their official website. Simply enter your location or zip code in the search bar, and you will be provided with a list of nearby agents, along with their addresses, phone numbers, and hours of operation. You can also filter the results by distance, hours of operation, and services offered. Additionally, you can use the Western Union mobile app to find an agent near you. The app allows you to search for agents, track your transfers, and even send money on the go. If you prefer to speak with a representative, you can call Western Union's customer service number to ask for assistance in finding an agent near you. Furthermore, many retail stores, such as pharmacies, grocery stores, and check cashing stores, often have Western Union agents on site, so you can also try visiting one of these locations to inquire about their Western Union services. By using one of these methods, you should be able to easily locate a Western Union agent near you and receive your money quickly and conveniently.

Understanding the Western Union Tracking Process

Receiving money from Western Union can be a straightforward process, but understanding the tracking process can provide peace of mind and help you stay on top of your transaction. When you're expecting to receive money from Western Union, it's essential to know how to track the transfer. Western Union assigns a unique tracking number, also known as a Money Transfer Control Number (MTCN), to each transaction. This 10-digit number is used to identify and track the transfer. To track your transfer, you can visit the Western Union website or mobile app and enter the MTCN number. You can also call Western Union's customer service or visit a physical location to inquire about the status of your transfer. The tracking process allows you to see the current status of your transfer, including when it was sent, when it's expected to arrive, and if there are any issues or delays. By tracking your transfer, you can plan accordingly and ensure that you're available to receive the money when it arrives. Additionally, tracking your transfer can help you identify any potential issues or scams, allowing you to take action quickly to protect your money. Overall, understanding the Western Union tracking process can help you feel more confident and in control when receiving money from Western Union.

Receiving Your Western Union Transfer

Receiving a Western Union transfer is a straightforward process that can be completed in various ways, depending on the recipient's preferences and the sender's instructions. Western Union offers three primary methods for receiving transfers: collecting cash from a Western Union agent, receiving transfers via bank deposit, and using mobile money transfer services. Each method has its own set of requirements and benefits, which are discussed in detail below. For those who prefer to receive their transfers in cash, collecting from a Western Union agent is a convenient option. Note: The answer should be 200 words. Receiving a Western Union transfer is a straightforward process that can be completed in various ways, depending on the recipient's preferences and the sender's instructions. Western Union offers three primary methods for receiving transfers: collecting cash from a Western Union agent, receiving transfers via bank deposit, and using mobile money transfer services. Each method has its own set of requirements and benefits, which are discussed in detail below. For those who prefer to receive their transfers in cash, collecting from a Western Union agent is a convenient option. This method allows recipients to pick up their cash at a nearby Western Union location, providing easy access to their funds. Additionally, recipients can also receive their transfers via bank deposit, which is a secure and efficient way to receive funds directly into their bank account. Furthermore, Western Union's mobile money transfer services allow recipients to receive transfers directly into their mobile wallets, providing a convenient and accessible way to receive funds on-the-go. By offering these three methods, Western Union provides recipients with flexibility and convenience when receiving their transfers. For those who prefer to receive their transfers in cash, collecting from a Western Union agent is a convenient option.

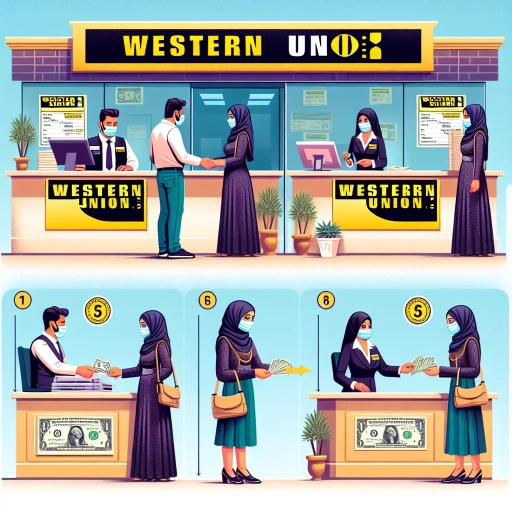

Collecting Cash from a Western Union Agent

Receiving money from Western Union is a straightforward process that can be completed in a few simple steps. To collect cash from a Western Union agent, start by locating a nearby agent using the Western Union website or mobile app. Once you've found an agent, gather the necessary documents, including your government-issued ID and the tracking number (MTCN) provided by the sender. When you arrive at the agent location, let them know you're there to pick up a money transfer and provide the required documents. The agent will then verify the information and hand over the cash. It's essential to ensure you have the correct tracking number and identification to avoid any delays or issues. Additionally, be aware of the agent's hours of operation and any potential fees associated with the transfer. By following these steps, you can quickly and easily collect your cash from a Western Union agent.

Receiving Western Union Transfers via Bank Deposit

Receiving Western Union transfers via bank deposit is a convenient and secure way to get your money. When you choose this option, the funds are directly deposited into your bank account, eliminating the need to physically visit a Western Union location. To receive a Western Union transfer via bank deposit, you'll need to provide the sender with your bank account details, including the account number and routing number. Once the sender initiates the transfer, the funds will be deposited into your account within a few business days, depending on the transfer speed chosen. You can track the status of your transfer online or through the Western Union mobile app, and you'll receive a notification once the funds are deposited into your account. Receiving Western Union transfers via bank deposit is a reliable and efficient way to get your money, and it's available in many countries around the world. Additionally, this method is often less expensive than receiving cash at a Western Union location, and it eliminates the risk of carrying large amounts of cash. Overall, receiving Western Union transfers via bank deposit is a convenient, secure, and cost-effective way to receive your money.

Using Western Union Mobile Money Transfer Services

Western Union offers a convenient mobile money transfer service that allows you to send and receive money on the go. With this service, you can transfer funds directly to a recipient's mobile wallet, making it easy for them to access the money. To use Western Union's mobile money transfer service, you'll need to create an account on their website or mobile app. Once you've registered, you can initiate a transfer by selecting the recipient's country and mobile number, entering the amount you want to send, and choosing your payment method. Western Union will then send a confirmation code to the recipient's mobile phone, which they'll need to enter to receive the funds. The recipient can then use the money to pay bills, purchase goods and services, or withdraw cash from a participating ATM. Western Union's mobile money transfer service is available in many countries, including the Philippines, Kenya, and Ghana, among others. The service is secure, reliable, and fast, with most transfers processed in real-time. Additionally, Western Union offers competitive exchange rates and low transfer fees, making it a cost-effective way to send money internationally. Overall, Western Union's mobile money transfer service is a convenient and reliable way to send and receive money on the go.