How To Close A Business In Ontario

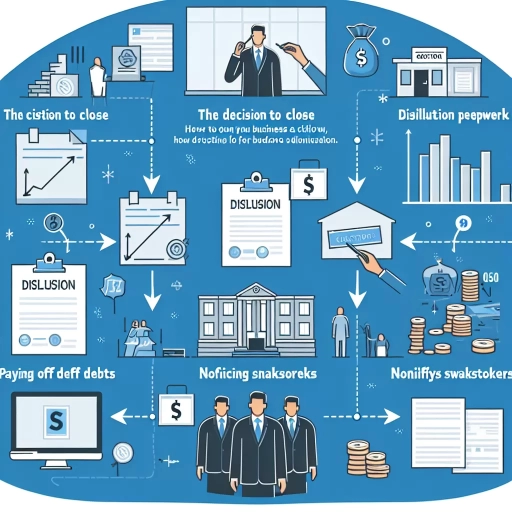

Closing a business in Ontario can be a complex and daunting task, especially for entrepreneurs who are not familiar with the process. It requires careful planning, attention to detail, and compliance with various regulations. To ensure a smooth transition, it is essential to understand the steps involved in closing a business in Ontario. This article will guide you through the process, covering pre-closure planning, the formal closure process, and post-closure obligations. By following these steps, you can avoid costly mistakes and ensure that your business is closed in a timely and efficient manner. In this article, we will start by discussing the importance of pre-closure planning, which involves assessing your business's financial situation, notifying stakeholders, and taking steps to minimize liabilities. By taking the time to plan ahead, you can set yourself up for a successful closure and avoid potential pitfalls. Let's dive into the first step: Pre-Closure Planning.

Pre-Closure Planning

Pre-closure planning is a critical step for businesses facing financial difficulties or considering a change in ownership. It involves a thorough review of the company's financial situation, obligations, and assets to ensure a smooth transition. Effective pre-closure planning can help minimize losses, protect stakeholders' interests, and maximize the value of the business. To achieve this, it is essential to notify key stakeholders, review business obligations, and assess business assets. By doing so, businesses can make informed decisions and take proactive steps to mitigate potential risks. In this article, we will explore the importance of pre-closure planning and provide guidance on how to navigate this complex process. First, we will discuss the importance of notifying key stakeholders, including employees, customers, and suppliers, to ensure a seamless transition and maintain business continuity.

Notify Key Stakeholders

When closing a business in Ontario, it is essential to notify key stakeholders in a timely and professional manner. This includes informing employees, customers, suppliers, creditors, and regulatory bodies about the closure. Notifying employees is crucial, as it affects their livelihood and may require providing severance packages or outplacement assistance. Customers should be informed about the closure to avoid any inconvenience or disruption to their services. Suppliers and creditors need to be notified to settle outstanding accounts and make arrangements for the return of goods or equipment. Regulatory bodies, such as the Canada Revenue Agency and the Ontario government, must be informed to comply with tax and other regulatory requirements. Additionally, notifying key stakeholders can help maintain a positive reputation and minimize potential disputes or liabilities. It is recommended to use formal communication channels, such as letters or emails, and to keep a record of notifications for future reference. By notifying key stakeholders, business owners can ensure a smooth transition and minimize the risk of legal or financial complications.

Review Business Obligations

When reviewing business obligations, it is essential to consider all the financial and legal commitments that the business has incurred during its operation. This includes outstanding debts, loans, and credit card balances, as well as any ongoing contracts or agreements with suppliers, vendors, or partners. Business owners must also review their tax obligations, including any outstanding tax debts or liabilities, and ensure that all tax returns have been filed and payments made. Additionally, they should review their employment obligations, including any outstanding wages or benefits owed to employees, and ensure that all necessary paperwork has been completed. Furthermore, business owners should review their lease or property obligations, including any outstanding rent or mortgage payments, and ensure that all necessary notices have been given to terminate the lease or sell the property. By thoroughly reviewing all business obligations, business owners can ensure a smooth transition and minimize any potential liabilities or disputes during the closure process.

Assess Business Assets

When assessing business assets, it's essential to take a comprehensive approach to determine their value and potential impact on the closure process. Start by identifying all tangible assets, such as equipment, machinery, vehicles, and real estate, and estimate their current market value. Consider hiring a professional appraiser to ensure accurate valuations, especially for complex or high-value assets. Next, evaluate intangible assets, including intellectual property, patents, trademarks, and copyrights, which can be valuable but often overlooked. Assess the condition, functionality, and potential for reuse or resale of each asset to determine its worth. Additionally, consider the costs associated with maintaining, storing, or disposing of each asset, as these can impact the overall value. It's also crucial to review any outstanding loans, leases, or financing agreements tied to specific assets, as these may need to be addressed during the closure process. By thoroughly assessing business assets, you can make informed decisions about how to manage them, potentially generating revenue through sales or auctions, and minimizing liabilities. This, in turn, can help facilitate a smoother and more efficient business closure.

Formal Closure Process

The formal closure process for a business in Canada involves several key steps that must be taken in order to officially dissolve the company. This process is crucial for ensuring that the business is properly wound down and that all necessary parties are notified. The first step in this process is to file articles of dissolution with the relevant provincial or territorial government. This involves submitting the necessary paperwork and paying the required fees. Once the articles of dissolution have been filed, the business must obtain a certificate of dissolution, which serves as official proof that the company has been dissolved. Finally, the business must notify the Canada Revenue Agency (CRA) of its dissolution, which will help to ensure that all tax obligations are met. By following these steps, businesses can ensure a smooth and efficient closure process. To begin, the first step is to file articles of dissolution.

File Articles of Dissolution

When a business in Ontario decides to cease operations, it is essential to formally close the company to avoid any potential liabilities and maintain a good business reputation. One of the critical steps in the formal closure process is filing articles of dissolution with the Ontario government. This document officially notifies the government that the business is no longer operating and intends to dissolve. To file articles of dissolution, the business must first ensure that all outstanding taxes, fees, and debts have been paid, and any necessary resolutions or agreements have been obtained from shareholders or directors. The articles of dissolution must then be prepared and signed by the authorized representative of the business, typically the director or officer. The document must include the business name, corporation number, and a statement indicating that the business has been dissolved. Once the articles of dissolution are filed with the Ontario government, the business will be officially dissolved, and its name will be removed from the corporate register. It is essential to note that filing articles of dissolution does not automatically cancel any licenses, permits, or registrations held by the business. These must be cancelled separately to avoid any potential penalties or fines. By filing articles of dissolution, businesses in Ontario can ensure a smooth and formal closure process, avoiding any potential complications or liabilities.

Obtain a Certificate of Dissolution

To obtain a Certificate of Dissolution, you must file Articles of Dissolution with the Ontario government. This document confirms that your business has been dissolved and is no longer active. The Articles of Dissolution must include the business name, corporation number, and the date of dissolution. You can file the Articles of Dissolution online or by mail, and the filing fee is currently $360. Once the Articles of Dissolution are processed, the Ontario government will issue a Certificate of Dissolution, which serves as proof that your business has been formally dissolved. It's essential to obtain a Certificate of Dissolution to avoid any potential liabilities or penalties associated with an inactive business. Additionally, you may need to provide the Certificate of Dissolution to banks, creditors, or other stakeholders to confirm that your business is no longer operational.

Notify the Canada Revenue Agency

When closing a business in Ontario, it is essential to notify the Canada Revenue Agency (CRA) to ensure that all tax obligations are met and to avoid any potential penalties. The CRA requires businesses to notify them of their closure to update their records and to stop any further tax obligations. To notify the CRA, businesses can use the online service "My Business Account" or call the CRA's Business Enquiries line. The business will need to provide their business number, the date of closure, and the reason for closure. Additionally, the business may need to file a final tax return and pay any outstanding taxes owed. It is also important to cancel any GST/HST accounts, payroll accounts, and other tax accounts associated with the business. By notifying the CRA, businesses can ensure a smooth closure process and avoid any potential issues with the tax authorities.

Post-Closure Obligations

When a business closes its doors, the owners may think that their responsibilities have come to an end. However, this is not the case. Post-closure obligations are a crucial aspect of the business closure process that must be addressed to avoid any potential penalties or liabilities. One of the key post-closure obligations is filing final tax returns, which is a critical step in wrapping up the business's tax affairs. Additionally, paying outstanding taxes and fees is also essential to avoid any further complications. Furthermore, updating business records is necessary to ensure that all financial transactions are accurately documented and accounted for. In this article, we will explore these post-closure obligations in more detail, starting with the importance of filing final tax returns.

File Final Tax Returns

When closing a business in Ontario, it is essential to file final tax returns to ensure compliance with tax laws and regulations. This involves submitting all necessary tax returns, including corporate tax returns, GST/HST returns, and payroll tax returns, to the Canada Revenue Agency (CRA). The final tax returns should include all income earned and expenses incurred by the business up to the date of closure. It is crucial to ensure that all tax returns are accurate and complete to avoid any potential penalties or fines. Additionally, businesses may be required to file other tax-related documents, such as a Statement of Business or Professional Activities, to report any business income or losses. It is recommended that business owners consult with a tax professional or accountant to ensure that all tax obligations are met and that the final tax returns are filed correctly. By filing final tax returns, business owners can ensure a smooth transition and avoid any potential tax-related issues in the future.

Pay Outstanding Taxes and Fees

When closing a business in Ontario, it is essential to pay outstanding taxes and fees to avoid any potential penalties or fines. The Canada Revenue Agency (CRA) requires businesses to settle all tax debts, including corporate income tax, payroll taxes, and Goods and Services Tax (GST) or Harmonized Sales Tax (HST), before ceasing operations. Additionally, businesses must also pay any outstanding fees, such as business registration fees, licensing fees, and permit fees, to the relevant authorities. Failure to pay these taxes and fees can result in the CRA or other government agencies taking collection action, including freezing bank accounts, seizing assets, or even pursuing the business owners personally. To avoid these consequences, business owners should ensure that all tax returns are filed and paid on time, and that any outstanding fees are settled promptly. It is recommended that business owners consult with a tax professional or accountant to ensure that all tax obligations are met and that the business is in good standing before closing. By paying outstanding taxes and fees, business owners can avoid any potential complications and ensure a smooth transition during the closure process.

Update Business Records

When closing a business in Ontario, it is essential to update business records to reflect the change in status. This involves notifying relevant government agencies, financial institutions, and other stakeholders about the business closure. The first step is to update the business registration with the Ontario government by filing a notice of dissolution or cancellation of the business name. This can be done online through the Ontario Business Registry or by submitting a paper application. Additionally, the business must notify the Canada Revenue Agency (CRA) about the closure, which may involve filing a final tax return and cancelling any GST/HST accounts. The business must also update its records with financial institutions, such as banks and credit unions, to close any business accounts and cancel any credit cards or loans. Furthermore, the business should notify any suppliers, creditors, and customers about the closure, and make arrangements to settle any outstanding debts or obligations. It is also important to update any business licenses and permits, and to notify any professional associations or regulatory bodies about the closure. By updating business records, the business can ensure a smooth transition and avoid any potential liabilities or penalties.