How Does Mortgage Renewal Work

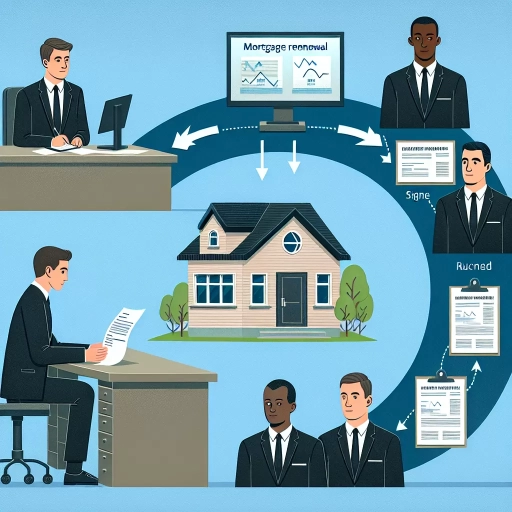

When a homeowner's mortgage term comes to an end, they are faced with the decision of whether to renew their mortgage or explore alternative options. Mortgage renewal is a critical process that can have a significant impact on a homeowner's financial situation. To navigate this process effectively, it is essential to understand the ins and outs of mortgage renewal. This includes understanding the concept of mortgage renewal, preparing for the renewal process, and navigating the various options available. In this article, we will delve into the world of mortgage renewal, starting with the basics of what mortgage renewal entails. Understanding Mortgage Renewal is the first step in making informed decisions about your mortgage, and it is crucial to grasp this concept before moving forward. By the end of this article, you will have a comprehensive understanding of the mortgage renewal process and be equipped to make the best decisions for your financial future. Understanding Mortgage Renewal is the foundation of this process, and it is where we will begin our exploration.

Understanding Mortgage Renewal

When it comes to managing your mortgage, understanding the renewal process is crucial to making informed decisions about your financial future. As your mortgage term comes to an end, you'll have the option to renew your mortgage, which can be a complex and overwhelming process. But what exactly is mortgage renewal, and how does it work? In this article, we'll delve into the world of mortgage renewal, exploring the key differences between renewal and refinancing, and highlighting the benefits of renewing your mortgage. By the end of this article, you'll have a clear understanding of the mortgage renewal process and be equipped to make the best decision for your financial situation. So, let's start by exploring the basics of mortgage renewal and how it works.

What is Mortgage Renewal and How Does it Work?

Mortgage renewal is the process of extending or replacing an existing mortgage agreement with a lender, typically at the end of the original mortgage term. When a mortgage is up for renewal, the borrower has the option to renegotiate the terms of the loan, including the interest rate, amortization period, and payment schedule. The lender will typically send a renewal offer to the borrower, outlining the proposed terms and conditions of the new mortgage agreement. The borrower can then choose to accept the offer, negotiate the terms, or shop around for a better deal with a different lender. If the borrower fails to respond to the renewal offer, the lender may automatically renew the mortgage at the existing interest rate and terms. It's essential for borrowers to carefully review the renewal offer and consider their financial situation, credit score, and market conditions before making a decision. By understanding the mortgage renewal process, borrowers can make informed decisions and potentially save thousands of dollars in interest payments over the life of the loan.

Key Differences Between Mortgage Renewal and Refinancing

When it comes to managing your mortgage, two options often come to mind: mortgage renewal and refinancing. While both involve revisiting your existing mortgage, they serve distinct purposes and have different implications. The primary difference between mortgage renewal and refinancing lies in their objectives. Mortgage renewal is the process of extending or renewing your existing mortgage agreement with your current lender, typically at the end of the original term, which can range from 1 to 10 years. This option allows you to maintain your current mortgage balance, interest rate, and repayment terms, with the possibility of negotiating a new interest rate or term. On the other hand, refinancing involves replacing your existing mortgage with a new one, often with a different lender, to access a larger loan amount, lower interest rate, or more favorable terms. Refinancing can help you tap into your home's equity, consolidate debt, or switch from a variable to a fixed-rate mortgage. Another key difference is the associated costs. Mortgage renewal typically involves minimal to no fees, whereas refinancing often comes with costs such as appraisal fees, legal fees, and potential penalties for breaking your existing mortgage contract. Additionally, refinancing may require you to re-qualify for the new mortgage, which can be a more rigorous process than mortgage renewal. In terms of flexibility, refinancing offers more options, as you can choose a new lender, mortgage type, and repayment terms. Mortgage renewal, however, is generally limited to your current lender and existing mortgage terms. Ultimately, the choice between mortgage renewal and refinancing depends on your financial goals, current mortgage situation, and personal preferences. If you're looking to maintain your existing mortgage with minimal changes, mortgage renewal might be the way to go. However, if you need to access more funds, lower your interest rate, or switch to a more favorable mortgage product, refinancing could be the better option.

Benefits of Renewing Your Mortgage

Here is the paragraphy: Renewing your mortgage can have numerous benefits. For one, it allows you to take advantage of current interest rates, which may be lower than when you first signed your mortgage. This can lead to significant savings on your monthly payments and overall interest paid over the life of the loan. Additionally, renewing your mortgage provides an opportunity to reassess your financial situation and adjust your payment terms to better suit your needs. You may be able to switch from a variable to a fixed-rate mortgage or vice versa, depending on your financial goals and risk tolerance. Furthermore, renewing your mortgage can also give you access to additional funds, such as a home equity line of credit, which can be used for home renovations, debt consolidation, or other large expenses. By renewing your mortgage, you can also avoid the hassle and costs associated with selling your home and purchasing a new one. Overall, renewing your mortgage can be a smart financial move that can help you save money, achieve your financial goals, and enjoy greater peace of mind.

Preparing for Mortgage Renewal

Preparing for mortgage renewal can be a daunting task, especially for homeowners who are unsure of what to expect. With the right preparation and knowledge, however, you can navigate the process with confidence and make informed decisions about your mortgage. To start, it's essential to review your current mortgage terms and conditions, assessing your financial situation and credit score to determine the best course of action. Additionally, exploring your options for mortgage renewal can help you identify potential opportunities for savings and improved terms. By taking a proactive approach to mortgage renewal, you can ensure a smooth transition and set yourself up for long-term financial success. In this article, we'll delve into the key considerations for preparing for mortgage renewal, starting with a crucial first step: reviewing your current mortgage terms and conditions.

Reviewing Your Current Mortgage Terms and Conditions

When reviewing your current mortgage terms and conditions, it's essential to understand the specifics of your loan agreement. Start by gathering your mortgage documents and reviewing the interest rate, loan amount, amortization period, and repayment terms. Check if you have a fixed or variable interest rate, and if it's a closed or open mortgage. A fixed interest rate remains the same throughout the term, while a variable rate can fluctuate. A closed mortgage has penalties for early repayment, whereas an open mortgage allows for prepayment without penalties. Next, review your payment schedule, including the frequency and amount of payments. Consider whether you've made any lump sum payments or increased your regular payments, which can impact your outstanding balance. Additionally, check if you have any mortgage insurance, such as CMHC or Genworth, and understand the coverage and premiums. It's also crucial to review any prepayment privileges, such as the ability to make extra payments or increase your regular payments. By thoroughly reviewing your current mortgage terms and conditions, you'll be better equipped to make informed decisions when it's time to renew your mortgage.

Assessing Your Financial Situation and Credit Score

Assessing your financial situation and credit score is a crucial step in preparing for mortgage renewal. Your financial situation has likely changed since you first took out your mortgage, and your lender will want to know about these changes. Start by gathering all relevant financial documents, including pay stubs, bank statements, and tax returns. Calculate your income, expenses, debts, and assets to get a clear picture of your financial health. You should also check your credit score, as it plays a significant role in determining the interest rate you'll qualify for. A good credit score can help you negotiate a better interest rate, while a poor credit score may lead to a higher interest rate or even mortgage rejection. You can request a free credit report from the two major credit reporting agencies in Canada, Equifax and TransUnion, and review it for any errors or negative marks. By understanding your financial situation and credit score, you'll be better equipped to navigate the mortgage renewal process and make informed decisions about your mortgage options.

Exploring Your Options for Mortgage Renewal

When your mortgage is up for renewal, you have several options to consider. One option is to stick with your current lender and negotiate a new interest rate. This can be a convenient choice, as you won't have to go through the hassle of switching lenders or providing new financial information. However, it's essential to shop around and compare rates from other lenders to ensure you're getting the best deal. You may also want to consider switching to a different type of mortgage, such as a variable rate or a fixed rate, depending on your financial situation and goals. Another option is to refinance your mortgage, which can provide you with access to additional funds or a lower interest rate. This can be a good choice if you need to consolidate debt or make home renovations. Additionally, you may want to consider working with a mortgage broker, who can help you navigate the renewal process and find the best option for your needs. Ultimately, it's crucial to carefully evaluate your options and choose the one that best aligns with your financial goals and situation.

Navigating the Mortgage Renewal Process

Navigating the mortgage renewal process can be a daunting task, especially for homeowners who are not familiar with the intricacies of mortgage financing. As your mortgage term comes to an end, it's essential to take a proactive approach to ensure you're getting the best deal possible. This involves receiving and reviewing your mortgage renewal offer, negotiating the terms to suit your needs, and finalizing the renewal process. By understanding these key steps, you can make informed decisions and avoid potential pitfalls. In this article, we'll delve into the mortgage renewal process, starting with the first crucial step: receiving and reviewing your mortgage renewal offer.

Receiving and Reviewing Your Mortgage Renewal Offer

When your mortgage is up for renewal, your lender will typically send you a renewal offer in the mail or via email. This offer will outline the terms of your new mortgage, including the interest rate, payment schedule, and any changes to your loan amount or amortization period. It's essential to carefully review this offer to ensure it meets your current financial needs and goals. Start by checking the interest rate offered, as it may be higher or lower than your current rate. If it's higher, you may want to consider shopping around for a better rate or negotiating with your lender. Next, review the payment schedule to ensure it aligns with your budget and financial obligations. You should also verify that the loan amount and amortization period are correct, as any changes could impact your monthly payments. Additionally, check for any new fees or charges associated with the renewal, such as administration or appraisal fees. If you're satisfied with the terms of the offer, you can simply sign and return the agreement. However, if you're not happy with the terms or want to explore other options, you can use this opportunity to shop around for a better deal or consult with a mortgage broker for guidance.

Negotiating Your Mortgage Renewal Terms

When negotiating your mortgage renewal terms, it's essential to be prepared and strategic. Start by reviewing your current mortgage contract and understanding the terms and conditions. Make a list of the key elements you want to negotiate, such as the interest rate, amortization period, and prepayment options. Research the current market rates and compare them to your existing rate to determine if you can secure a better deal. Consider working with a mortgage broker who can help you shop around and negotiate on your behalf. When approaching your lender, be confident and assertive, and be prepared to walk away if the terms aren't favorable. You can also use the threat of switching to a competitor as leverage to negotiate a better rate. Additionally, consider negotiating other terms such as the ability to make lump sum payments or increase your monthly payments. By being informed and prepared, you can effectively negotiate your mortgage renewal terms and secure a better deal.

Finalizing Your Mortgage Renewal and Next Steps

When finalizing your mortgage renewal, it's essential to carefully review the terms and conditions of your new mortgage agreement. Ensure you understand the interest rate, amortization period, and any prepayment penalties. Once you're satisfied with the terms, sign and return the agreement to your lender. After the renewal is processed, you'll receive a confirmation letter outlining the details of your new mortgage. It's crucial to review this document carefully to ensure everything is accurate. If you have any questions or concerns, don't hesitate to reach out to your lender. Additionally, consider setting up automatic payments to ensure you never miss a payment. You may also want to explore other mortgage options, such as switching to a different lender or refinancing your mortgage, to determine if you can secure a better interest rate or terms. By taking the time to carefully review and understand your mortgage renewal, you can ensure a smooth transition and make informed decisions about your financial future.