How To Get A Sin Card

Obtaining a Social Insurance Number (SIN) is a crucial step for individuals who want to work in Canada or access government services and benefits. A SIN is a unique nine-digit number assigned to Canadian citizens, permanent residents, and certain temporary residents. To get a SIN, you must meet specific eligibility criteria and provide required documents. In this article, we will guide you through the process of obtaining a SIN, including the eligibility and required documents, the application process, and what to do after receiving your SIN. First, let's start with the basics: who is eligible for a SIN and what documents do you need to provide to support your application.

Eligibility and Required Documents

Obtaining a Social Insurance Number (SIN) is a crucial step for individuals who want to work in Canada or access government services and benefits. To ensure a smooth application process, it's essential to understand the eligibility criteria and required documents. In this article, we'll delve into the key aspects of SIN eligibility and documentation, including checking if you're eligible for a SIN, gathering the necessary documents for a successful application, and understanding the different types of SINs available. By the end of this article, you'll be well-equipped to navigate the SIN application process with confidence. So, let's start by checking if you're eligible for a SIN.

Check if You're Eligible for a SIN

To check if you're eligible for a Social Insurance Number (SIN), you must meet specific requirements. Generally, you're eligible for a SIN if you're a Canadian citizen, a permanent resident, or a temporary resident who is authorized to work in Canada. This includes international students, foreign workers, and individuals with a study or work permit. You may also be eligible if you're a protected person, such as a refugee claimant or a person who has been granted protected person status. Additionally, some individuals may be eligible for a SIN if they're a Canadian citizen or permanent resident who is living outside of Canada, but have a valid reason for needing a SIN, such as working for a Canadian employer or receiving Canadian government benefits. It's essential to note that you can only apply for a SIN if you have a valid reason for needing one, and you must provide the required documents to support your application. If you're unsure about your eligibility, you can check the official Government of Canada website or consult with a Service Canada representative for guidance.

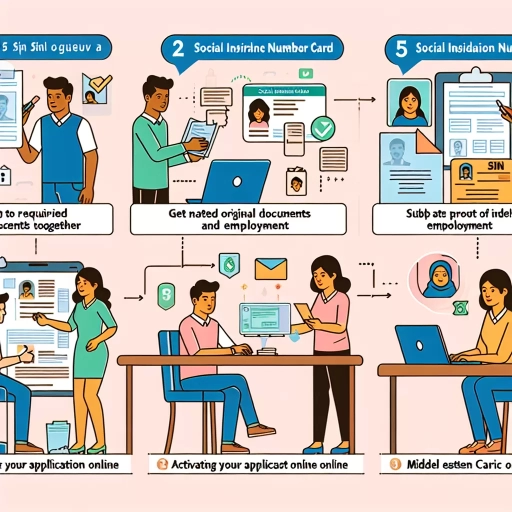

Gather Required Documents for a SIN Application

To apply for a Social Insurance Number (SIN), you will need to gather the required documents to prove your identity and status in Canada. The documents you need will depend on your situation, but generally, you will need to provide proof of identity, proof of immigration status, and proof of Canadian citizenship or permanent residence. For proof of identity, you can use a valid Canadian passport, a valid permanent resident card, or a valid certificate of Indian status. If you are a refugee claimant, you can use a valid refugee protection claimant document. For proof of immigration status, you can use a valid permanent resident card, a valid work permit, or a valid study permit. If you are a Canadian citizen, you can use a valid Canadian passport or a valid birth certificate. If you are a permanent resident, you can use a valid permanent resident card or a valid record of landing. You may also need to provide additional documents, such as a marriage certificate or a divorce decree, if your name has changed. It's essential to ensure that all documents are original and not photocopies, as photocopies will not be accepted. Additionally, if your documents are not in English or French, you will need to provide a certified translation. Once you have gathered all the required documents, you can submit your application for a SIN.

Understand the Different Types of SINs

A Social Insurance Number (SIN) is a unique nine-digit number issued by the Government of Canada to Canadian citizens, permanent residents, and certain temporary residents. There are different types of SINs, each with its own specific purpose and eligibility criteria. The most common types of SINs include: * **Individual Tax Number (ITN)**: An ITN is a temporary SIN issued to individuals who are not eligible for a permanent SIN, such as international students or foreign workers. ITNs are usually valid for a specific period and must be renewed or replaced with a permanent SIN when the individual's immigration status changes. * **Permanent Resident SIN**: A permanent resident SIN is issued to individuals who have been granted permanent resident status in Canada. This type of SIN is usually valid for life, unless the individual's immigration status changes. * **Canadian Citizen SIN**: A Canadian citizen SIN is issued to individuals who are born in Canada or have obtained Canadian citizenship through naturalization. This type of SIN is usually valid for life, unless the individual's citizenship status changes. * **Newborn SIN**: A newborn SIN is issued to parents of newborn babies, usually at the hospital where the baby was born. This type of SIN is usually valid for life, unless the child's immigration or citizenship status changes. It is essential to note that each type of SIN has its own specific eligibility criteria and required documents. For example, to apply for a permanent resident SIN, an individual must provide proof of permanent resident status, such as a permanent resident card or a confirmation of permanent residence document. Similarly, to apply for a Canadian citizen SIN, an individual must provide proof of Canadian citizenship, such as a Canadian passport or a citizenship certificate. In summary, understanding the different types of SINs is crucial to ensure that individuals apply for the correct type of SIN and provide the required documents to support their application. This will help to avoid delays or rejections in the application process.

The Application Process

The application process for a Canadian passport is a straightforward and efficient process that can be completed in a few simple steps. To apply for a passport, you have three convenient options: applying in person at a Service Canada office, applying by mail or through a third-party, or understanding the processing time for your application. Each option has its own set of requirements and benefits, and it's essential to choose the one that best suits your needs. By understanding the application process, you can ensure a smooth and hassle-free experience. In this article, we will explore each of these options in detail, starting with applying in person at a Service Canada office.

Apply in Person at a Service Canada Office

To apply in person at a Service Canada office, you will need to gather all the required documents and visit a Service Canada office near you. You can find the nearest office by using the Service Canada Office Locator tool on their website. Once you arrive at the office, let the staff know that you are there to apply for a SIN. They will guide you through the process and provide you with the necessary application form. You will need to provide proof of identity, such as a birth certificate or a valid passport, as well as proof of Canadian citizenship or immigration status. If you are a temporary resident, you will need to provide a valid work permit or study permit. The staff will review your application and verify your documents. If everything is in order, they will issue your SIN on the spot. The entire process typically takes around 10-15 minutes. It's recommended to apply in person if you need a SIN urgently or if you have any questions or concerns about the application process. Additionally, applying in person allows you to get immediate assistance and feedback from the Service Canada staff.

Apply by Mail or Through a Third-Party

Applying by mail or through a third-party is another option for obtaining a SIN card. To apply by mail, you will need to download and complete the Application for a Social Insurance Number (SIN) form from the Service Canada website. Ensure you fill out the form accurately and sign it. You will also need to provide required documents, such as proof of identity and citizenship or immigration status. Once you have gathered all the necessary documents, mail them to the address listed on the form. It is recommended to use a trackable mail service to ensure your application is received. If you are applying from outside Canada, you can also use a third-party, such as a Canadian embassy or consulate, to submit your application. They will forward your application to Service Canada for processing. In both cases, it may take several weeks to receive your SIN card by mail. It is essential to note that you will not be able to start working until you receive your SIN card, so plan accordingly.

Understand the Processing Time for Your Application

The processing time for your Social Insurance Number (SIN) application can vary depending on the method of application and the speed of mail delivery. If you apply in person at a Service Canada office, you can usually get your SIN on the same day. However, if you apply by mail, the processing time can take up to 4-6 weeks. It's essential to ensure that your application is complete and accurate to avoid any delays. If your application is incomplete or requires additional documentation, it may take longer to process. You can check the status of your application online or by contacting Service Canada directly. It's also important to note that if you're a temporary resident, your SIN will be valid for the duration of your stay in Canada, and you may need to reapply if you extend your stay.

After Receiving Your SIN

After receiving your Social Insurance Number (SIN), it's essential to understand the next steps to ensure you can use it effectively and securely. To start, you'll need to activate your SIN and begin using it for various transactions, such as opening a bank account or applying for a job. Additionally, it's crucial to keep your SIN confidential and secure to prevent identity theft and other forms of fraud. You should also be aware of the process to update your SIN information if necessary, such as a name change or address update. By following these steps, you can ensure that your SIN is used correctly and securely. Activate Your SIN and Start Using It to begin your journey with your new SIN.

Activate Your SIN and Start Using It

After receiving your SIN, you can activate it and start using it immediately. To activate your SIN, you will need to provide it to your employer, bank, or other relevant institutions. This will allow them to verify your identity and update their records. Once your SIN is activated, you can use it to file your taxes, access government benefits, and open a bank account. It's essential to keep your SIN confidential and secure to prevent identity theft. You should only share your SIN with trusted individuals and institutions, and never share it online or over the phone unless you are sure of the recipient's identity. Additionally, you should report any changes to your name or address to Service Canada to ensure your SIN record is up-to-date. By activating your SIN and using it responsibly, you can access various government services and benefits, and take control of your financial and personal information.

Keep Your SIN Confidential and Secure

Here is the paragraphy: After receiving your SIN, it's essential to keep it confidential and secure to prevent identity theft and fraud. You should never share your SIN with anyone unless it's absolutely necessary, such as with your employer, bank, or government agencies. Be cautious when sharing your SIN over the phone or online, and never provide it in response to unsolicited requests. Keep your SIN card in a safe and secure location, such as a locked cabinet or a safe deposit box. Avoid carrying your SIN card with you unless necessary, and never lend it to anyone. If you need to provide your SIN to someone, make sure to verify their identity and ensure they have a legitimate reason for requesting it. Additionally, be aware of phishing scams and fake websites that may ask for your SIN. If you suspect someone has accessed your SIN without your consent, report it to the authorities immediately. By taking these precautions, you can protect your SIN and prevent identity theft.

Update Your SIN Information if Necessary

If you've recently moved, changed your name, or experienced another life change, you may need to update your SIN information. To do this, you'll need to provide documentation to support the change, such as a marriage certificate or a utility bill with your new address. You can update your SIN information by mail or in person at a Service Canada office. If you're updating your name, you'll need to provide proof of your identity and citizenship, as well as documentation that supports the name change. If you're updating your address, you'll need to provide proof of your new address, such as a utility bill or lease agreement. Once you've updated your SIN information, you'll receive a confirmation letter from Service Canada. It's essential to keep your SIN information up to date to ensure that you can access government services and benefits, and to prevent any delays or issues with your SIN.