How To Find Bank Transit Number

The Basics of Bank Transit Numbers

Understanding What a Bank Transit Number Is

A bank transit number, also commonly referred to as the routing number, is a nine-digit code that is used to identify the financial institution associated with a particular account. This numerical system was established by the American Bankers Association (ABA) in 1910 to streamline the process of cash and check transfers between banks. Essentially, these numbers serve as the identification for your bank, telling the financial system where your money needs to go. The first four numbers in the code represent the Federal Reserve routing symbol, the next four digits are the ABA institution identifier, while the last digit is the check digit.

Finding Your Bank Transit Number

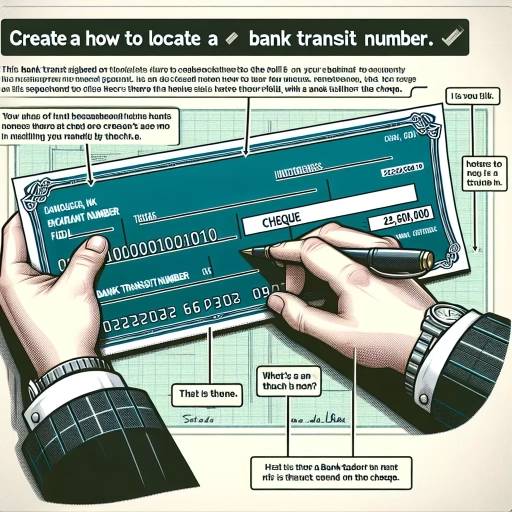

Your bank transit number can be found in multiple places. Firstly, on a paper check, the transit number is located at the bottom, in between the account number and the check number. It can also be found online through your bank's website or mobile application - usually under account details or account information. You may also find this information on your bank statement, both in digital and printed format. If you are unsure, it is advisable to contact your bank customer service for assistance.

The Importance of Bank Transit Numbers

Bank transit numbers are vital to the banking and financial system as they allow for smooth and error-free money transfers. They are used for various financial transactions, including direct deposits, automated bill payments, wire transfers, and check-processing. Not providing the correct bank transit number can cause delays or errors in transactions. Therefore, it's important to double-check this number before providing it for any banking or financial transaction.

The Role of ABA in Assigning Bank Transit Numbers

Federal Reserve Routing Symboli

In deciding the bank transit number, the first four numbers represent the Federal Reserve routing symbol. These digits indicate which Federal Reserve bank the associated institution uses. Each Federal Reserve bank has a specific number, allowing for swift and accurate financial transactions within the federal banking system. Knowing this code is essential in the domestic money transfer process.

ABA Institution Identifier

The next four digits of the bank transit number symbolize the ABA institution identifier. This code identifies the specific financial entity where your account is held. It is significant because it ensures that the money gets routed to the correct bank. When exchanging funds between different banks, this code provides the necessary institution's identity.

Check Digit

The final digit of the transit number is referred to as the check digit. It's a single number chosen through a specific algorithm from the first eight digits. The purpose of the check digit is to conduct a final verification, preventing any fraudulent activity or human error. If the check digit doesn't match the algorithm's result, the transaction would be flagged and halted.

Major Benefits of Using Bank Transit Numbers

Successful Transactions

Bank transit numbers play a huge part in achieving successful bank transactions. They are the backbone of financial transfers, as inaccuracies in these numbers could cause transactions to fail. Consequently, knowing and verifying your bank transit number ensures smooth and successful transactions.

Security and Fraud Prevention

Bank transit numbers add an extra layer of security to your banking transactions. The inclusion of a check digit ensures that only correct and valid transactions take place, preventing chances of financial scams or fraudulent activities. In essence, the bank transit number safeguards your assets from potential threats.

Convenience and Efficiency

With the correct bank transit number, banking processes become more convenient and efficient. It streamlines the process of fund transfer, making it quicker and hassle-free. This applies to both domestic and international wire transfers, performing a critical role in the globalization of our financial system.