How Long Do Etransfers Take

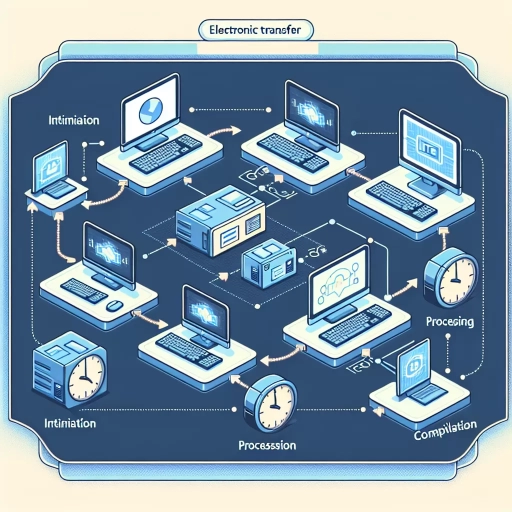

In today's digital age, electronic fund transfers, commonly known as e-transfers, have become a popular method for sending and receiving money. But have you ever wondered how long it takes for an e-transfer to be processed? The answer lies in understanding the factors that affect the speed of an e-transfer. Several elements come into play, including the type of transfer, the recipient's bank, and the time of day. In this article, we will delve into the world of e-transfers and explore what affects their speed, how long they typically take, and what can cause delays. So, let's start by examining what affects the speed of an e-transfer.

What Affects the Speed of an e-Transfer?

The speed of an e-transfer can be affected by several factors, including the recipient's bank and account type, the sender's bank and account type, and the time of day and day of the week. These factors can influence how quickly the funds are processed and made available to the recipient. For instance, if the recipient's bank has a slow processing system or if the sender's bank has a high volume of transactions, it can delay the transfer. Similarly, if the transfer is initiated during peak hours or on a weekend, it may take longer to process. Understanding these factors can help individuals and businesses plan and manage their e-transfers more effectively. Let's take a closer look at how the recipient's bank and account type can impact the speed of an e-transfer.

Recipient's Bank and Account Type

The speed of an e-transfer is influenced by the recipient's bank and account type. Different banks have varying processing times, with some completing transactions in real-time, while others may take several hours or even days. For instance, major banks like TD, RBC, and Scotiabank tend to process e-transfers quickly, often within minutes. On the other hand, smaller banks or credit unions might take longer to process transactions. Additionally, the type of account the recipient has also plays a role. If the recipient has a chequing or savings account, the e-transfer is typically processed faster than if they have a credit card or line of credit account. This is because chequing and savings accounts are designed for everyday transactions, whereas credit card and line of credit accounts are subject to more stringent verification processes. Furthermore, some banks may have specific requirements or restrictions for e-transfers, such as daily limits or verification procedures, which can also impact the speed of the transaction. Overall, the recipient's bank and account type can significantly affect the speed of an e-transfer, and it's essential to consider these factors when sending or receiving funds electronically.

Sender's Bank and Account Type

The speed of an e-transfer is influenced by the sender's bank and account type. Different banks have varying processing times, with some completing transactions in real-time, while others may take several hours or even days. For instance, major banks like TD Canada Trust, RBC Royal Bank, and Scotiabank typically process e-transfers quickly, often within minutes. On the other hand, smaller banks or credit unions might take longer to process transactions. Additionally, the type of account the sender uses can also impact the speed of the e-transfer. For example, if the sender uses a savings account, the transfer might be processed more slowly than if they used a chequing account. This is because savings accounts often have more restrictions and may require additional verification, leading to a longer processing time. Furthermore, some banks may have specific rules or restrictions for e-transfers, such as daily limits or specific cut-off times, which can also affect the speed of the transaction. Overall, the sender's bank and account type play a significant role in determining how quickly an e-transfer is processed.

Time of Day and Day of the Week

The time of day and day of the week can significantly impact the speed of an e-transfer. Typically, e-transfers are processed faster during business hours, which are usually between 9:00 AM and 5:00 PM, Monday to Friday. This is because most financial institutions have more staff and resources available during these hours to process transactions. If you initiate an e-transfer during this time, it's likely to be processed within a few minutes to an hour. However, if you send an e-transfer outside of business hours, such as late at night or on weekends, it may take longer to process, often until the next business day. Additionally, some financial institutions may have specific cut-off times for e-transfers, so it's essential to check with your bank or credit union to determine their processing schedule. For example, if you send an e-transfer at 4:00 PM on a Friday, it may not be processed until Monday morning. Understanding the time of day and day of the week can help you plan and manage your e-transfers more effectively, ensuring that your funds are transferred quickly and efficiently.

How Long Do e-Transfers Typically Take?

The speed at which e-transfers are processed can vary depending on the type of transfer and the financial institutions involved. In general, e-transfers can be categorized into three main types: instant, standard, and international. Instant e-transfers are typically processed in real-time, allowing recipients to access their funds immediately. Standard e-transfers, on the other hand, may take a few hours or up to a day to complete. International e-transfers, which involve cross-border transactions, can take several days to process due to additional security measures and regulatory requirements. In this article, we will explore the typical processing times for each type of e-transfer, starting with instant e-transfers, which offer the fastest and most convenient way to send and receive money electronically.

Instant e-Transfers

Instant e-Transfers are a popular method of transferring funds electronically in Canada, allowing individuals to send and receive money quickly and securely. When using Instant e-Transfers, the recipient typically receives the funds in near real-time, usually within a few minutes, regardless of the time of day or day of the week. This is because the transfer is processed through the Interac network, which operates 24/7, ensuring that transactions are completed rapidly. In most cases, the recipient can access the transferred funds immediately, making it an ideal option for urgent or time-sensitive transactions. However, it's essential to note that some financial institutions may have specific processing times or restrictions, which can affect the speed of the transfer. Nevertheless, Instant e-Transfers remain a reliable and efficient way to transfer funds electronically in Canada.

Standard e-Transfers

Standard e-Transfers are a type of electronic funds transfer that allows individuals and businesses to send and receive money quickly and securely. These transfers are facilitated by the Interac network, which is a widely used payment system in Canada. When a sender initiates a Standard e-Transfer, the funds are typically debited from their account immediately, and the recipient receives a notification that the transfer has been sent. The recipient can then deposit the funds into their account, usually within a few hours, depending on the recipient's bank's processing times. Standard e-Transfers are a popular choice for personal and business transactions, as they offer a convenient and reliable way to transfer funds. They are also relatively fast, with most transfers being completed within a few hours, although some may take up to 24 hours to process. Overall, Standard e-Transfers provide a secure and efficient way to transfer funds, making them a popular choice for many Canadians.

International e-Transfers

International e-transfers are a convenient and efficient way to send and receive money across borders. With the rise of digital banking and online payment systems, international e-transfers have become increasingly popular, allowing individuals and businesses to transfer funds quickly and securely. The process typically involves the sender initiating a transfer through their online banking platform or a specialized money transfer service, specifying the recipient's details and the amount to be transferred. The funds are then transmitted electronically, often through a network of correspondent banks or specialized payment processors, and are usually received by the recipient within a few hours or days, depending on the transfer method and the recipient's location. International e-transfers can be used for a variety of purposes, including paying bills, sending money to family or friends, or conducting business transactions. They offer a range of benefits, including speed, convenience, and cost-effectiveness, making them an attractive option for those who need to transfer funds across borders.

What Can Cause Delays in e-Transfers?

Electronic fund transfers, commonly known as e-transfers, have become a staple in modern banking, offering a convenient and relatively fast way to move money between accounts. However, despite their efficiency, e-transfers are not immune to delays. Several factors can cause these delays, impacting both the sender and the recipient. Incorrect recipient information, insufficient funds or account restrictions, and technical issues or system maintenance are among the primary reasons e-transfers can be held up. Understanding these causes can help individuals and businesses better navigate the e-transfer process and mitigate potential delays. One of the most common and easily avoidable causes of e-transfer delays is incorrect recipient information.

Incorrect Recipient Information

Incorrect recipient information is a common cause of delays in e-transfers. When the sender enters incorrect information, such as a misspelled name, incorrect email address, or wrong phone number, the transfer cannot be processed. This is because the recipient's financial institution relies on the accuracy of the information provided to verify the recipient's identity and facilitate the transfer. If the information is incorrect, the transfer will be rejected, and the sender will need to re-initiate the transfer with the correct information. This can lead to delays of several hours or even days, depending on the sender's promptness in correcting the error. Furthermore, some financial institutions may have additional security measures in place, such as two-factor authentication, which can further complicate the process if the recipient's information is incorrect. To avoid delays, it is essential to double-check the recipient's information before initiating the transfer.

Insufficient Funds or Account Restrictions

When it comes to e-transfers, one of the most frustrating causes of delay is insufficient funds or account restrictions. If the sender's account does not have sufficient funds to cover the transfer amount, the transaction will be declined, and the recipient will not receive the funds. Similarly, if the sender's account is restricted due to suspicious activity, overdrafts, or other issues, the transfer may be put on hold or declined. In such cases, the sender will need to resolve the issue with their bank or financial institution before the transfer can be processed. This can lead to significant delays, often taking several hours or even days to resolve. Furthermore, if the recipient's account is also restricted, the transfer may be delayed or declined, adding to the frustration. To avoid such delays, it is essential for senders to ensure they have sufficient funds in their account and that their account is in good standing before initiating an e-transfer. Recipients should also verify that their account is active and not restricted to receive e-transfers smoothly. By taking these precautions, individuals can minimize the risk of delays caused by insufficient funds or account restrictions and enjoy faster and more convenient e-transfer services.

Technical Issues or System Maintenance

Technical issues or system maintenance can cause significant delays in e-transfers. When a bank's system is down due to technical issues, it can prevent the processing of e-transfers, leading to delays. Similarly, scheduled system maintenance can also cause delays as the bank's system is temporarily unavailable. In such cases, the bank may not be able to process e-transfers, and the sender may receive an error message or be asked to try again later. Technical issues can be caused by a variety of factors, including software glitches, hardware failures, or network connectivity problems. System maintenance, on the other hand, is a routine process that banks undertake to update their systems, fix bugs, and improve security. While system maintenance is necessary to ensure the smooth operation of the bank's system, it can still cause inconvenience to customers who are trying to make e-transfers. In some cases, technical issues or system maintenance can cause delays of several hours or even days, depending on the severity of the issue and the bank's ability to resolve it. Therefore, it's essential for customers to check their bank's website or mobile app for any notifications about system maintenance or technical issues before attempting to make an e-transfer.