How To Get Gst Number

Understanding the GST Number

The Importance of GST

The concept of the Goods and Services Tax (GST) is a significant aspect of financial transactions in several countries. It helps streamline several indirect taxes into one consolidated tax, alleviating the cascading effects of multiple taxations present in traditional commercial systems. The importance of GST is far-reaching and can affect both businesses and individuals in different ways. It eliminates the "tax on tax" formula, levies a uniform tax nationwide, and fosters transparency in the system.

What is a GST Number?

A GST Number, also known as GSTIN (Goods and Service Tax Identification Number), is a 15-digit unique number assigned by the tax authorities to taxpayers registered under GST. It replaces several previous tax registration numbers such as VAT, service tax, and more. This number is essential as it identifies the taxpayer's state, facilitates the taxpayer's compliance process, recognizes the taxpayer's legal identity in other states/countries, and is mandatory for businesses to avail several benefits under the GST Act.

Who Needs a GST Number?

A GST number is necessary for all businesses that provide goods or services where the total gross turnover exceeds a specified limit. This limit varies from country to country. Nevertheless, irrespective of the turnover, some businesses like interstate suppliers, non-resident taxable persons, agents of a supplier, those paying tax under reverse charge, E-commerce operators, and several other categories must be registered under GST. By doing this, they remain compliant with the legislation and avoid potential penalties.

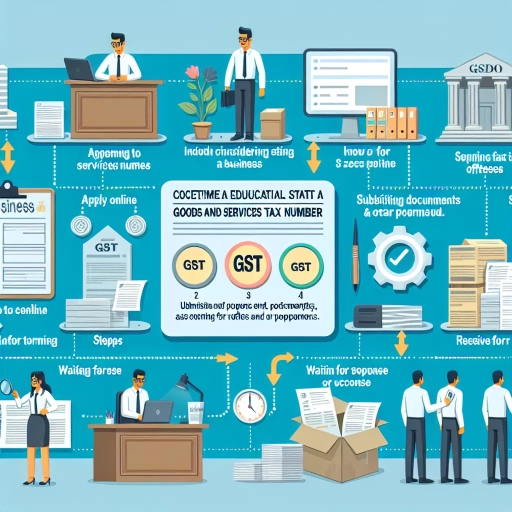

Procedure to Get a GST Number

Online Registration

The process to get a GST number is predominantly online which makes it accessible and convenient for businesses. The online process includes visiting the GST portal, filling the registration form, and uploading required documents like PAN card, proof of business registration, identity, and photographs of the business owner, etc. Once the form is verified and approved by the concerned officer, a GSTIN is issued.

Offline Registration

Although online registration is the preferred method, the tax authorities accommodate those unable to access the internet. In such cases, they can visit the local GST Seva Kendra and fill the application manually. After submission and approval, a GSTIN is allotted. Though offline methods are lengthy, they are crucial for inclusivity.

Points to Remember during Registration

Diligent attention to detail is required during the registration process. The businesses have to ensure that the details mentioned are accurate, the required documents are proper, and the application is complete in all respects. Any mistake can cause delay, reapplication, or even rejection.

Why You Should Get GST Number

Legal Recognition

Getting a GST number lends credibility to businesses. They get legal recognition, which can not only help them avoid penalties but also in building trust among their customers and stakeholders.

Avail Benefits under GST Act

A registered GSTIN holder can avail of several benefits under the GST Act. This includes availing input tax credit, GST refunds, and being exempt from certain taxes. Moreover, it allows businesses to legally collect tax from purchasers and pass the credit of the taxes paid on the goods/services supplied to purchasers or recipients.

Threshold Exemption

In certain jurisdictions, businesses with a turnover under the prescribed limit can opt for a GST number to enjoy threshold exemptions. This can lead to a decrease in tax liability and can offer small suppliers a level playing field.