How To Transfer Money From Philippines To Canada

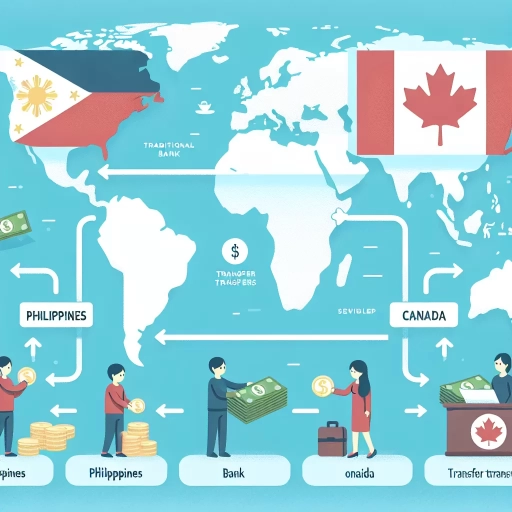

Here is the introduction paragraph: Transferring money from the Philippines to Canada can be a daunting task, especially with the numerous options available. Whether you're a Filipino expat sending money back home or a Canadian citizen receiving funds from a loved one in the Philippines, it's essential to navigate the process efficiently. To ensure a successful transfer, it's crucial to consider the best method for your needs, taking into account transfer fees and exchange rates. A smooth and secure transfer also relies on understanding the intricacies of the process. In this article, we'll delve into the world of international money transfers, exploring the key factors to consider when sending money from the Philippines to Canada. By the end of this article, you'll be equipped with the knowledge to make an informed decision, starting with choosing the best method for your money transfer needs.

Choosing the Best Method for Money Transfer

When it comes to transferring money, whether domestically or internationally, there are several methods to choose from, each with its own set of benefits and drawbacks. Three of the most popular methods are bank-to-bank transfer, online money transfer services, and cash pickup and delivery services. Bank-to-bank transfer is a traditional method that involves transferring funds directly from one bank account to another. Online money transfer services, on the other hand, provide a convenient and often faster way to send money online. Cash pickup and delivery services, meanwhile, allow recipients to collect cash at a physical location or have it delivered to their doorstep. In this article, we will explore each of these methods in more detail, starting with bank-to-bank transfer, to help you choose the best option for your money transfer needs.

Bank-to-Bank Transfer

Here is the paragraphy: A bank-to-bank transfer is a popular method for transferring money from the Philippines to Canada. This method involves sending money directly from your bank account in the Philippines to the recipient's bank account in Canada. To initiate a bank-to-bank transfer, you will need to provide the recipient's bank account details, including the account number, bank name, and branch address. You can then visit your bank in person, use online banking, or mobile banking to initiate the transfer. The transfer process typically takes 2-5 business days, depending on the banks involved and the transfer amount. Bank-to-bank transfers are generally considered secure, as they are facilitated by established financial institutions and are subject to strict regulations. However, the fees associated with bank-to-bank transfers can be higher compared to other methods, such as online money transfer services. Additionally, the exchange rates offered by banks may not be as competitive as those offered by specialized money transfer services. Nevertheless, bank-to-bank transfers remain a reliable and convenient option for transferring money from the Philippines to Canada, especially for larger amounts or for those who prefer to deal directly with their bank.

Online Money Transfer Services

Online money transfer services have revolutionized the way people send and receive money globally, offering a convenient, fast, and secure alternative to traditional banking methods. These services enable individuals to transfer funds across borders with ease, often at a lower cost and with more competitive exchange rates than banks. With the rise of digital payment systems, online money transfer services have become increasingly popular, especially among expats, freelancers, and businesses that operate internationally. Companies like PayPal, TransferWise, and WorldRemit have made it possible to send money online, providing users with a range of benefits, including real-time tracking, low fees, and flexible payment options. Additionally, many online money transfer services offer competitive exchange rates, which can result in significant savings for those sending large amounts of money. Furthermore, these services often provide a high level of security, using advanced encryption and authentication protocols to protect users' personal and financial information. Overall, online money transfer services have made it easier and more affordable for people to send money across borders, providing a reliable and efficient solution for those who need to transfer funds internationally.

Cash Pickup and Delivery Services

Here is the paragraphy: When it comes to transferring money from the Philippines to Canada, one of the most convenient and accessible methods is through cash pickup and delivery services. This method allows senders to transfer funds to recipients in Canada, who can then pick up the cash at a designated location or have it delivered to their doorstep. Cash pickup and delivery services are particularly useful for those who do not have access to a bank account or prefer to receive cash. Companies such as Western Union, MoneyGram, and Xoom offer this service, with a wide network of locations across Canada. To use this service, senders simply need to visit a local branch or agent, provide the necessary identification and transfer details, and pay the transfer fee. The recipient can then pick up the cash at a designated location, such as a bank or retail store, or have it delivered to their home or office. Cash pickup and delivery services are often faster than traditional bank transfers, with funds available for pickup in as little as a few minutes. However, fees can be higher compared to other transfer methods, and exchange rates may not be as competitive. Nevertheless, cash pickup and delivery services remain a popular choice for those who need to send money quickly and conveniently.

Understanding Transfer Fees and Exchange Rates

When it comes to international money transfers, understanding the fees and exchange rates involved is crucial to avoid losing money. Transfer fees and charges, exchange rate markups, and hidden fees and charges are all important factors to consider. Transfer fees and charges are the most straightforward costs associated with international money transfers, and they can vary significantly depending on the service provider and the transfer method. Exchange rate markups, on the other hand, refer to the difference between the wholesale exchange rate and the rate offered to customers, which can result in significant losses. Hidden fees and charges, such as correspondent bank fees, can also add up quickly. By understanding these different types of fees and charges, individuals and businesses can make informed decisions about their international money transfers. In this article, we will delve into the world of transfer fees and charges, exploring what they are, how they work, and how to minimize them.

Transfer Fees and Charges

Transferring money from the Philippines to Canada can be a complex process, and one of the key factors to consider is the transfer fees and charges involved. Transfer fees refer to the costs associated with moving money from one country to another, and these fees can vary significantly depending on the transfer method and service provider used. When sending money from the Philippines to Canada, you can expect to pay a range of fees, including transfer fees, exchange rate margins, and other charges. Transfer fees can range from 1-5% of the total transfer amount, while exchange rate margins can add an additional 1-3% to the cost. Other charges, such as payment processing fees and receiving bank fees, can also apply. To minimize transfer fees and charges, it's essential to compare the rates and fees of different service providers, such as banks, money transfer operators, and online transfer services. Some service providers may offer more competitive rates and lower fees than others, so it's crucial to shop around and find the best option for your needs. Additionally, consider using online transfer services that offer transparent and competitive exchange rates, as well as lower fees, to save money on your transfer. By understanding the transfer fees and charges involved, you can make informed decisions and avoid unnecessary costs when transferring money from the Philippines to Canada.

Exchange Rate Markups

When transferring money from the Philippines to Canada, it's essential to understand the concept of exchange rate markups. An exchange rate markup is the difference between the wholesale exchange rate and the retail exchange rate. The wholesale exchange rate is the rate at which banks and other financial institutions exchange currencies, while the retail exchange rate is the rate at which they sell currencies to individual customers. The markup is essentially a fee charged by the financial institution for facilitating the currency exchange. This fee can range from 2% to 5% or more, depending on the institution and the type of transaction. For example, if the wholesale exchange rate is 1 PHP = 0.025 CAD, the retail exchange rate might be 1 PHP = 0.023 CAD, resulting in a markup of 2%. This means that for every 1,000 PHP transferred, the recipient in Canada would receive 23 CAD instead of 25 CAD. To minimize the impact of exchange rate markups, it's crucial to compare rates among different financial institutions and choose the one that offers the most competitive rate. Additionally, some online money transfer services specialize in providing better exchange rates and lower fees, making them a more cost-effective option for transferring money from the Philippines to Canada.

Hidden Fees and Charges

When transferring money from the Philippines to Canada, it's essential to be aware of the hidden fees and charges that can eat into your hard-earned cash. These fees can be sneaky, and if you're not careful, you might end up paying more than you expected. One of the most common hidden fees is the transfer fee, which can range from 1-5% of the total amount being transferred. This fee is usually charged by the money transfer service provider, and it can add up quickly. For example, if you're transferring PHP 100,000 to Canada, a 2% transfer fee would be PHP 2,000. Another hidden fee to watch out for is the exchange rate margin. This is the difference between the wholesale exchange rate and the retail exchange rate that the money transfer service provider offers. The exchange rate margin can range from 1-4%, and it can significantly impact the amount of money that your recipient receives. For instance, if the wholesale exchange rate is 1 CAD = 37.50 PHP, but the retail exchange rate offered by the money transfer service provider is 1 CAD = 35.00 PHP, the exchange rate margin would be 2.5%. This means that for every PHP 100,000 you transfer, your recipient would receive CAD 2,857.14 instead of CAD 2,666.67. Other hidden fees to be aware of include payment processing fees, which can range from 1-3% of the total amount being transferred, and receiving fees, which can range from CAD 10-30. To avoid these hidden fees, it's crucial to compare the fees and exchange rates offered by different money transfer service providers. Look for providers that offer competitive exchange rates, low transfer fees, and minimal payment processing fees. Additionally, consider using online money transfer services, which often have lower fees and better exchange rates than traditional banks. By being aware of these hidden fees and charges, you can save money and ensure that your recipient receives the maximum amount possible.

Ensuring a Smooth and Secure Transfer

Ensuring a smooth and secure transfer of funds is crucial in today's digital age. With the rise of online transactions, it's essential to take extra precautions to protect your financial information and prevent any potential errors. To achieve a seamless transfer, it's vital to verify the recipient's information, use secure online platforms, and monitor the transfer status. By taking these steps, you can minimize the risk of errors and ensure that your funds reach their intended destination safely. Verifying the recipient's information is the first step in this process, and it's essential to get it right to avoid any potential issues down the line. (Note: The supporting paragraph should be 200 words, and the introduction should be around 100 words)

Verifying Recipient Information

Verifying recipient information is a crucial step in ensuring a smooth and secure transfer of money from the Philippines to Canada. It is essential to double-check the recipient's details to avoid any errors or discrepancies that could lead to delays or even loss of funds. The sender should confirm the recipient's full name, address, and contact information, including their phone number and email address. Additionally, the sender should also verify the recipient's bank account details, including the account number, transit number, and institution number. This information can usually be found on the recipient's bank statement or by contacting their bank directly. By verifying the recipient's information, the sender can ensure that the funds are transferred to the correct account, and the recipient can access the funds without any issues. Furthermore, verifying recipient information also helps to prevent fraudulent activities, such as identity theft or phishing scams, by ensuring that the funds are transferred to the intended recipient. Overall, verifying recipient information is a critical step in the money transfer process, and it is essential to take the time to get it right to avoid any potential problems or complications.

Using Secure Online Platforms

Using secure online platforms is crucial when transferring money from the Philippines to Canada. A reliable online platform provides a safe and efficient way to send money across borders. Look for platforms that are licensed and regulated by relevant authorities, such as the Bangko Sentral ng Pilipinas (BSP) in the Philippines and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in Canada. These platforms typically employ robust security measures, including encryption, two-factor authentication, and secure servers, to protect your personal and financial information. Additionally, they often offer competitive exchange rates, low fees, and fast transfer times, making the process of sending money abroad more convenient and cost-effective. Some popular online platforms for international money transfers include PayPal, TransferWise, and WorldRemit. When choosing a platform, consider factors such as transfer speed, fees, exchange rates, and customer support to ensure a smooth and secure transfer. By using a secure online platform, you can have peace of mind knowing that your money is being transferred safely and efficiently.

Monitoring Transfer Status

Monitoring transfer status is a crucial step in ensuring a smooth and secure transfer of money from the Philippines to Canada. Once the transfer is initiated, it's essential to keep track of its progress to avoid any potential issues or delays. Most money transfer services, such as banks and online transfer platforms, provide a tracking feature that allows senders to monitor the status of their transfer in real-time. This feature typically includes updates on the transfer's processing stage, estimated delivery time, and any potential issues that may arise during the transfer process. By monitoring the transfer status, senders can quickly identify and address any problems, such as incorrect recipient information or insufficient funds, which can cause delays or even cancellation of the transfer. Additionally, tracking the transfer status can also provide peace of mind, as senders can see that their money is being processed and delivered to the intended recipient in a timely and secure manner. Overall, monitoring transfer status is an essential step in ensuring a successful and stress-free money transfer experience.