How To Read A Cheque Canada

Here is the introduction paragraph: In Canada, cheques are a common payment method, but for many, understanding how to read one can be a daunting task. Whether you're a business owner, an individual, or simply someone who wants to ensure they're handling financial transactions correctly, knowing how to read a cheque is essential. A cheque is a legal document that contains vital information, and being able to decipher its components is crucial for successful transactions. To read a cheque effectively, it's necessary to understand its various parts, decipher the numerical and written amounts, and verify its authenticity and validity. In this article, we'll break down the process of reading a cheque in Canada, starting with the fundamental step of understanding the components of a cheque.

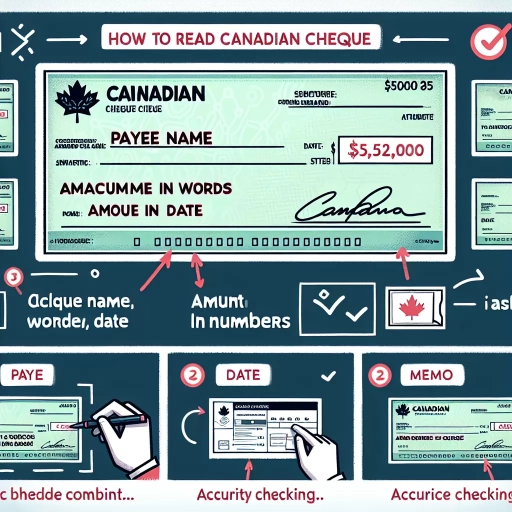

Understanding the Components of a Cheque

Understanding the components of a cheque is crucial for individuals and businesses to ensure secure and efficient financial transactions. A cheque is a written order that instructs a bank to pay a specific amount of money to a designated payee. To navigate the process effectively, it is essential to recognize the key elements of a cheque. This includes identifying the date and cheque number, which serves as a unique identifier for the transaction. Additionally, locating the payee and dollar amount is vital to verify the recipient and the amount being transferred. Furthermore, recognizing the signature and bank information is necessary to authenticate the cheque and ensure it is drawn from a legitimate account. By understanding these components, individuals can confidently manage their financial transactions and avoid potential errors or discrepancies. To begin, let's start by identifying the date and cheque number, which is the first step in processing a cheque.

Identifying the Date and Cheque Number

When it comes to reading a cheque in Canada, identifying the date and cheque number is crucial. The date is usually located in the top right-hand corner of the cheque and is written in the format of day, month, and year. This date indicates when the cheque was written and is important for determining its validity. The cheque number, on the other hand, is a unique identifier assigned to each cheque and is usually located in the top right-hand corner as well. It is essential to verify the cheque number to ensure that the cheque is legitimate and has not been tampered with. By identifying the date and cheque number, you can begin to understand the basic components of a cheque and ensure that it is valid and authentic.

Locating the Payee and Dollar Amount

When it comes to reading a cheque in Canada, locating the payee and dollar amount is crucial. The payee's name is typically printed on the line that says "Pay to the order of" and is usually located on the top right-hand side of the cheque. This is the person or business that the cheque is intended for, and it's essential to ensure that the name is spelled correctly to avoid any issues with the cheque being cashed or deposited. The dollar amount, on the other hand, is usually written in both numbers and words on the cheque. The numerical amount is located on the right-hand side of the cheque, and the written amount is located on the line below the payee's name. It's essential to ensure that both the numerical and written amounts match to avoid any discrepancies. Additionally, it's also important to check for any alterations or corrections to the payee's name or dollar amount, as this could indicate that the cheque has been tampered with. By carefully locating and verifying the payee and dollar amount, you can ensure that the cheque is legitimate and can be processed without any issues.

Recognizing the Signature and Bank Information

When it comes to recognizing the signature and bank information on a cheque, there are a few key elements to look out for. The signature, also known as the endorsement, is typically located in the bottom right-hand corner of the cheque and is the account holder's authorization for the bank to pay the amount specified. A valid signature is crucial, as it confirms the account holder's intent to make the payment. The signature should match the one on file with the bank, and it's essential to verify its authenticity to prevent fraud. In addition to the signature, the bank information is also critical. The bank's name and address are usually printed on the top left-hand corner of the cheque, along with the branch number and transit number. The transit number, also known as the routing number, is a unique identifier that helps the bank process the cheque. The branch number, on the other hand, identifies the specific branch where the account is held. By verifying the bank information, you can ensure that the cheque is legitimate and that the funds will be drawn from the correct account. Furthermore, some cheques may also include additional security features, such as a watermark or a security thread, to prevent counterfeiting. By carefully examining the signature and bank information, you can help prevent cheque fraud and ensure a smooth transaction.

Deciphering the Numerical and Written Amounts

When it comes to deciphering the numerical and written amounts on a cheque, accuracy is crucial to avoid any discrepancies or misunderstandings. To ensure that the transaction is processed correctly, it is essential to understand how to read and interpret both the numerical and written amounts on a cheque. This involves reading the numerical amount in the dollar box, interpreting the written amount on the cheque line, and verifying the consistency of both amounts. By following these steps, individuals can ensure that their financial transactions are accurate and secure. In this article, we will explore each of these steps in detail, starting with the first crucial step: reading the numerical amount in the dollar box.

Reading the Numerical Amount in the Dollar Box

When reading the numerical amount in the dollar box on a Canadian cheque, it is essential to understand the format and conventions used. The dollar box, also known as the numerical amount box, is located on the right-hand side of the cheque and contains the amount of the payment in numerical format. The amount is typically written in dollars and cents, with the dollar amount appearing before the decimal point and the cents appearing after. For example, if the cheque is for $100.50, the dollar box would contain the numbers "100.50". When reading the numerical amount, start from the left and read the numbers as you would any numerical value. In this case, you would read the amount as "one hundred dollars and fifty cents". It is crucial to note that the numerical amount in the dollar box must match the written amount on the line above it, as this is a security feature to prevent cheque tampering. If the amounts do not match, the cheque may be considered invalid. By carefully reading the numerical amount in the dollar box, you can ensure that you accurately understand the payment amount and avoid any potential errors or discrepancies.

Interpreting the Written Amount on the Cheque Line

When interpreting the written amount on the cheque line, it's essential to pay attention to the words and numbers used. The written amount is usually found on the line below the date and is written in both words and numbers. The words should match the numbers, and both should represent the same amount. For instance, if the written amount says "One Hundred Dollars," the numerical amount should be $100.00. If there's a discrepancy between the two, the written amount takes precedence. It's also crucial to check for any alterations or corrections to the written amount, as these can indicate potential fraud. Additionally, be aware of any abbreviations or symbols used, such as "CAD" for Canadian dollars or "%" for percentage. By carefully examining the written amount, you can ensure that the cheque is legitimate and accurate.

Verifying the Consistency of Numerical and Written Amounts

Verifying the consistency of numerical and written amounts is a crucial step in ensuring the accuracy of a cheque. This involves comparing the numerical amount, also known as the "digits," with the written amount, also referred to as the "words." To do this, start by locating the numerical amount, which is usually found in the bottom right-hand corner of the cheque. Next, look for the written amount, which is typically written in words on the same line as the date. Compare the two amounts carefully, making sure they match exactly. If the amounts do not match, the cheque may be invalid or fraudulent. For example, if the numerical amount is $100.00, the written amount should also be "One Hundred Dollars." If the written amount is "One Hundred and Fifty Dollars," the cheque is likely to be invalid. By verifying the consistency of numerical and written amounts, you can help prevent errors and ensure that the cheque is processed correctly.

Verifying the Cheque's Authenticity and Validity

Verifying the authenticity and validity of a cheque is a crucial step in ensuring a smooth and secure transaction. With the rise of cheque fraud, it's essential to take extra precautions to confirm the legitimacy of a cheque before depositing or cashing it. To do this, one must check for security features and watermarks, confirm the cheque's expiration date and status, and inspect the cheque for alterations or tampering. By taking these steps, individuals and businesses can protect themselves from potential financial losses and ensure that their transactions are secure. One of the first steps in verifying a cheque's authenticity is to check for security features and watermarks.

Checking for Security Features and Watermarks

When verifying the authenticity and validity of a cheque in Canada, it is essential to check for security features and watermarks. Most Canadian cheques have a series of security features embedded in the paper to prevent counterfeiting and alteration. One of the most common security features is the watermark, which is a translucent pattern woven into the paper. To check for a watermark, hold the cheque up to a light source and look for a faint image, usually a maple leaf or a repeating pattern of the bank's logo. Another security feature to look for is the security thread, which is a thin strip of paper embedded in the cheque that glows pink when held under ultraviolet (UV) light. Additionally, many Canadian cheques have microprinting, which is tiny text that is difficult to read with the naked eye. Check for microprinting in the cheque's border or in the signature line. Finally, look for a foil strip or hologram, which is a shiny, three-dimensional image that reflects light. By checking for these security features and watermarks, you can increase the chances of detecting a counterfeit or altered cheque.

Confirming the Cheque's Expiration Date and Status

To confirm the cheque's expiration date and status, you need to check the "Date" line, usually located at the top right corner of the cheque. This date indicates when the cheque was written, and it's essential to verify that it's not stale-dated, meaning it's not older than six months. If the cheque is stale-dated, it may not be honored by the bank. Additionally, you should also check the "Void after" date, if present, which specifies the last date the cheque is valid. If the cheque is past this date, it's considered void and cannot be cashed. Furthermore, you can contact the bank or the cheque issuer to verify the cheque's status, ensuring it hasn't been cancelled or reported lost or stolen. By confirming the cheque's expiration date and status, you can ensure that it's valid and can be successfully cashed or deposited.

Inspecting the Cheque for Alterations or Tampering

Inspecting the cheque for alterations or tampering is a crucial step in verifying its authenticity and validity. When examining the cheque, look for any signs of alteration, such as erasures, corrections, or changes to the payee's name, date, or amount. Check if the cheque has been torn, crumpled, or creased, which could indicate that it has been tampered with. Verify that the cheque number, account number, and routing number are printed clearly and have not been altered. Also, check the cheque's security features, such as watermarks, holograms, or microprinting, to ensure they are intact and have not been compromised. Additionally, inspect the cheque's signature, ensuring it matches the account holder's signature on file. If you notice any discrepancies or signs of tampering, do not accept the cheque, and contact the issuer or the bank to verify its authenticity.