How Does Bankruptcies Work In Canada

In the ever-fluctuating landscape of personal finance and economic stability, an understanding of bankruptcy—particularly its workings in Canada—is an indispensable knowledge that everyone should acquire. This extensive discourse explores the complex realm of bankruptcy in the Canadian financial system, breaking it down into three distinct, but interconnected areas. We start by dissecting the fundamentals of bankruptcy in Canada, establishing a solid foundation before delving into the intricate heart of the subject matter. Next, we navigate through the key stages and processes involved in declaring bankruptcy, illuminating the stepwise journey from initiation to discharge. Lastly, the narrative shifts towards a less-discussed, but equally significant aspect—life after bankruptcy—where we explore the path towards recovery and rebuilding one's financial footing. So, as we embark on this exploration of the often-misunderstood world of bankruptcy, we begin with a necessary first step of understanding its fundamental underpinnings in Canada. Ready for the journey? Let's embark, starting with the basic understanding of bankruptcy in the Canadian landscape.

In the ever-fluctuating landscape of personal finance and economic stability, an understanding of bankruptcy—particularly its workings in Canada—is an indispensable knowledge that everyone should acquire. This extensive discourse explores the complex realm of bankruptcy in the Canadian financial system, breaking it down into three distinct, but interconnected areas. We start by dissecting the fundamentals of bankruptcy in Canada, establishing a solid foundation before delving into the intricate heart of the subject matter. Next, we navigate through the key stages and processes involved in declaring bankruptcy, illuminating the stepwise journey from initiation to discharge. Lastly, the narrative shifts towards a less-discussed, but equally significant aspect—life after bankruptcy—where we explore the path towards recovery and rebuilding one's financial footing. So, as we embark on this exploration of the often-misunderstood world of bankruptcy, we begin with a necessary first step of understanding its fundamental underpinnings in Canada. Ready for the journey? Let's embark, starting with the basic understanding of bankruptcy in the Canadian landscape.Understanding the Fundamentals of Bankruptcy in Canada

Understanding the fundamentals of bankruptcy in Canada involves more than just comprehension of financial overstretching; it requires a holistic grasp of the legal, historical, and legislative frameworks that govern this financial aspect. This article delves into key areas such as the Concept of Bankruptcy and its Legal Implications, providing insight into the structural setting that defines insolvency in Canada. Additionally, we explore the historical context of these financial laws within the A Brief History of Bankruptcy Laws in Canada section. This examination will provide an evaluative perspective about changes transpired over time and ramifications these alterations may have on present practices. Finally, we will scrutinize the Role of the Bankruptcy and Insolvency Act, dissecting its fundamental provisions, and understanding how they impact both the debtor and creditors. It serves as the primary piece of legislation that guides insolvency procedures and administration in Canada. Moving forward, we will first delve into The Concept of Bankruptcy and its Legal Implications, a pillar that will lay the groundwork for understanding Canadian insolvency.

The Concept of Bankruptcy and its Legal Implications

Bankruptcy, a legal status typically initiated by an individual or company unable to repay their debts, holds a myriad of implications under the Canadian framework. As an individual or business sinks further into insurmountable debt, they may opt to file for bankruptcy as a last resort to regain financial stability. However, the process is not as simple as it seems and carries a myriad of legal implications, underscoring the need to appreciate its nuances deeply. When a Canadian entity declares bankruptcy, they essentially agree to hand over considerable control of their assets to a Licensed Insolvency Trustee (LIT). This trustee, the central figure in Canada's bankruptcy process, oversees the selling of the debtor's assets to repay creditors. Debts such as secured loans, child and spousal support, student loans less than seven years old, and specific court-imposed fines cannot be expunged by bankruptcy. A critical legal implication to note is that bankruptcy affects one's credit rating severely. A first-time bankrupt’s credit score will be rated as the lowest rating possible (R9) for six years after discharge. This rating can limit the capacity to obtain future credit or loans, affecting your financial autonomy adversely. Furthermore, declaring bankruptcy may influence your social image negatively and impinge on your future entrepreneurial endeavors as some industries may not grant licenses to bankrupt individuals. Relevance to the employer or income-generating ability is another crucial aspect in the bankruptcy process that may require legal intervention. The Federal Divorce Act, for example, considers financial mismanagement, including bankruptcy when deciding alimony or dividing marital property. Therefore, a failure to comprehend such legal ramifications before filing for bankruptcy might lead to unexpected consequences. Lastly, while it provides a debtor a clean slate, bankruptcy may also result in loss of assets, including homes, especially if huge equity is locked in them. Other significant assets, like cars or recreational vehicles, might also be lost unless they are protected by provincial exemption laws. Understanding these legal implications intertwined with bankruptcy is imperative to navigate through such difficult times successfully. The road to financial recovery may not be smooth sailing but arming yourself with the right knowledge can alleviate its frequently overwhelming burdens and help reestablish financial stability. As such, the fundamentals of bankruptcy in Canada impacts not only the debtor but also his/her relationship with the creditors, social standing, official records, and future ability to borrow.

A Brief History of Bankruptcy Laws in Canada

The concept of bankruptcy and its accompanying legal provisions have a lineage that stretches far back into Canadian history. In the early 1700s, the British bankruptcy laws were incorporated into Canadian law implemented to create a fair financial market. However, the original laws were harsh and had a punitive aspect, often leading to severe consequences for those who found themselves unable to repay their debts. It was in 1867, with the creation of Canada's constitution, the BNA Act, that the groundwork for a comprehensive bankruptcy law was laid. This gave the Federal Government authority to create regulations regarding insolvency and bankruptcy. Through the years, numerous amendments were made to make the bankruptcy laws less punitive and more rehabilitative in nature. In 1919, the Canadian Bankruptcy Act was enacted, outlining the legal procedure through which a bankrupt person could discharge their debts and reestablish themselves financially. This was further updated in 1949 and then in 1992, with the newly named Bankruptcy and Insolvency Act of Canada, which stands to date. The contemporary law is a progression from its predecessors and has a more humanistic outlook. It allows individuals and businesses to file for bankruptcy when they can't pay their debts, and most importantly, it focuses on helping them get a fresh start. These laws over the centuries have shaped the financial landscape of the country. The emphasis on rehabilitation rather than punishment has promoted an environment of financial safety and risk-taking, encouraging entrepreneurship and market diversity. Consequently, the intricacies of bankruptcy laws have become pillars of transparency, protection, and integrity that bolster the Canadian economy. They represent a vital component of economic stability and demonstrate Canada's progressive approach to handling financial hardships. By understanding these fundamentals, we can appreciate the importance of the bankruptcy system and its impact on economic behaviors in Canada.

The Role of the Bankruptcy and Insolvency Act

In the midst of monetary predicaments, Canadians find solace in strong financial legislation such as the Bankruptcy and Insolvency Act (BIA), whose role incidates a vital cornerstone in understanding the fundamentals of bankruptcy in Canada. The BIA holds a primary position in financial law as it outlines the procedures and guidelines surrounding bankruptcy and insolvency in the country. It spells out the clear transition through these rocky financial terrains, offering individuals and businesses a legal mechanism to discharge debts, while protecting the interests of creditors. The Bankruptcy and Insolvency Act is designed to help both debtors struggling to manage their debts, and creditors seeking to recover their dues. It structures a fair controlled environment for debt settlement, coordinating the rights and responsibilities of each party involved. It involves the appointment of a Licensed Insolvency Trustee (LIT), a specialist licensed by the federal government to administer the procedures and processes of the Act impartially. Additionally, the BIA distinguishes between personal and corporate insolvencies to cater to unique needs. For individuals, the Act provides two main options: filing for bankruptcy or making a consumer proposal. In a situation where debts are considerable and there are limited assets, the BIA sets out a bankruptcy option - providing a fresh start after a substantial discharge of most debts. Alternatively, a consumer proposal allows one to repay a part of their debts over time, with the remainder being legally forgiven. For corporations, the BIA outlines a corporate proposal option, also known as restructuring, that allows continued operation of the company. It facilitates renegotiations for repayment terms with creditors, preventing a complete shutdown. As the BIA prioritizes repaying creditors as much as possible, this measure seeks to preserve the company's value whilst benefitting the creditors. At all times, the BIA ensures fair dealings by preventing unethical behaviors like bankruptcy fraud. It penalizes those who attempt to take advantage by hiding assets or fabricating financial information, ensuring that bankruptcy's justice isn't waylaid. In summary, the Bankruptcy and Insolvency Act guides the descent into the labyrinth of bankruptcy, showing the way towards financial rehabilitation. Its key role in governing the journey through monetary challenges in Canada is unmatched. Pursing a comprehensive knowledge of this Act provides an insightful understanding into the intricate workings of bankruptcy and the strategic measures for redemption in Canada.

The Bankruptcy Process and Key Stages in Canada

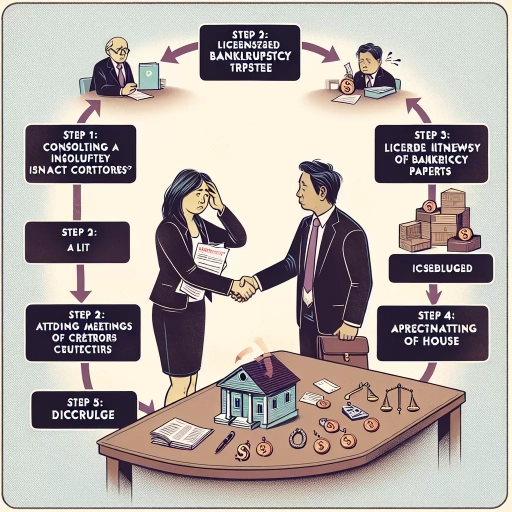

Understanding the bankruptcy process and its key stages in Canada is crucial for anyone facing daunting financial hurdles. From declaring personal bankruptcy to dealing with its repercussions, or even exploring alternative routes, it encompasses an arduous journey. Nonetheless, it presents clear and structured pathways towards financial recovery. This article aims to shed light on three key aspects that often trigger questions and concerns: The steps and procedures involved in declaring personal bankruptcy, the potential repercussions such as the impact on credit scores, asset protection and future loan accessibility. Lastly, we'll delve into viable options to avoid bankruptcy, including debt consolidation, consumer proposals, and credit counselling. The objective is to give you insightful guidance and arm you with knowledge on this complex process, helping you make informed decisions about your financial future. To begin, let's get to grips with the nitty gritty of declaring personal bankruptcy, from understanding what it entails, to the steps and procedures you'll need to follow.

Declaring Personal Bankruptcy: Steps and Procedures

Declaring personal bankruptcy in Canada is a complex and legally involved process; it is not a decision to be made lightly. It means turning over all your assets (with some exceptions) to a licensed insolvency trustee, who will sell them to satisfy your creditors. Navigating this process involves understanding many steps and procedures. To start, you reach out to a licensed insolvency trustee who will analyze your financial situation. They will assess your income, debts, living expenses, and general family situation, walking you through all possible options. In some cases, they might recommend additional solutions such as a consumer proposal instead of bankruptcy. After this consultation, if personal bankruptcy remains the best route, you will need to provide the trustee with detailed information about your assets, liabilities, income, and expenses. Once they’ve compiled all of this, the trustee initiates the bankruptcy by filing an assignment in bankruptcy with the Official Receiver. This document states that you’re handing over all of your property to the trustee for the benefit of your creditors. Immediately after filing, you are legally protected from any debt collectors. The process that follows this, otherwise known as the bankruptcy administration, involves multiple duties on your part. This can include surrendering all credit cards, attending two counselling sessions, and reporting your income to the trustee on a monthly basis. You will also need to attend a meeting of creditors if one is requested. However, bankruptcy isn’t simply a matter of filing the paperwork. The process also encompasses unforeseen aspects of your financial situation, including windfalls during bankruptcy and how bankruptcy affects your credit history. Understanding this will provide a more comprehensive view of your financial future post-bankruptcy. The trustee will guide you throughout this process, serving as an intermediary between you and your creditors until you receive your discharge from bankruptcy, marking the end of your bankruptcy. All these steps and procedures for declaring personal bankruptcy form the key stages of the bankruptcy process in Canada. They give you clear pathways to step forward into a debt-free future.

Repercussions of Bankruptcy: Credit Scores, Assets, and Future Loans

Bankruptcy in Canada is a legal process, managed by licensed insolvency trustees, designed to alleviate the burden of debt for individuals unable to meet their financial obligations. However, the consequences of bankruptcy are serious and can persist long after the initial stress of debt has subsided. One of the most prominent repercussions involves the debtor's credit score. Bankruptcy is a genuine stain on one's financial profile, inevitably resulting in a plummeting credit score that often takes several years to recover. This credit hit significantly affects debtors' ability to secure loans or credit in the future, thus limiting their financial capabilities and freedom. Moreover, bankruptcy doesn't necessarily erase all debts, and not all assets are safe from lenders. Any assets that are non-exempt, meaning they're not protected under the bankruptcy law, could be seized and sold to repay creditors. This might include secondary properties, luxury items, or investments. The thought of losing hard-earned assets is exceptionally daunting for many Canadians considering bankruptcy. Future loans or mortgages can also become challenging barriers post-bankruptcy. After filing for bankruptcy, securing a loan from a reputable source can become a Herculean task in itself. Lenders may apprehend that after once defaulting, a person is more prone to do so again. While not impossible, it might expect the debtor to jump through multiple hoops with rigid terms. They might have to face higher interest rates, need a co-signer, or prove their financial stability over an extended period. Moreover, the bankruptcy record remains on one's credit report for about six to seven years, making it visible to potential lenders, which further adds to their hesitation. As a result, rebuilding credit and regaining financial stability post-bankruptcy can become a painstakingly slow and rigorous process. Thus, before opting for bankruptcy, it's crucial for Canadians to understand the repercussions thoroughly, explore other debt management options, and seek professional advice to make a well-informed decision.

Exploring Bankruptcy Alternatives: Debt Consolidation, Consumer Proposals, and Credit Counselling

Exploring bankruptcy alternatives in Canada is an essential part of understanding the complexity of dealing with financial insolvency. It's crucial to know different paths towards financial recovery that exist, one of which is debt consolidation. This solution allows an individual to merge multiple debts into a single one, often with lower interest rates, potentially making the repayment process more manageable. It can be done through obtaining a personal loan or through a home equity loan for homeowners. There's an opportunity to reduce the burden of high interest and gain control over your financial situation. A consumer proposal, another potential alternative, is a legally binding process administered by a Licensed Insolvency Trustee (LIT). In this scenario, the LIT will work out an agreement between you and your creditors where you repay only a portion of your debts, extends the time you have to repay them, or both. It typically allows for a larger debt reduction than debt consolidation and also puts a stop to interest accumulation - a great relief for those suffocating under the heavy load of interest. Another course to consider is credit counselling. This entails working with a credit counsellor who can negotiate with your creditors to reduce interest rates and consolidate your debts into one monthly payment. This process does not eliminate the debt, but it can help manage it better and create a sustainable repayment plan. These alternatives can be less detrimental to your credit score than filing for bankruptcy and can provide a viable route towards financial stability. They allow you to take control of your financial situation holistically and strategically, aiding in regaining financial health in a controlled and systematic manner. However, it's of utmost importance to seek advice from a knowledgeable financial advisor or a Licensed Insolvency Trustee before making a decision on the path to take, as each situation is unique and requires a tailored approach. Remember, these strategies are preventative measures that can potentially prevent the need for bankruptcy, but aren't absolute solutions on their own. Exploring these bankruptcy alternatives as part of the overall discussion on bankruptcies showcases the multifaceted processes at play when navigating financial turmoil in Canada.

Life After Bankruptcy in Canada: Recovery and Rebuilding

Bankruptcy does not spell the end; rather, it represents a fresh financial start, an opportunity to rebuild creditworthiness and move forward with lessons learned. This article explores life after bankruptcy in Canada, focusing on how individuals can successfully recover and rebuild. First, we delve into 'Post-Bankruptcy Credit Rehabilitation', understanding how essential it is to reconstruct a sound credit history post-bankruptcy. Next, we share effective 'Strategies for Financial Recovery After Declaring Bankruptcy', providing step-by-step advice to help you regain fiscal stability and thrive. Lastly, we examine 'The Moral and Psychological Aspects of Bankruptcy', as recovering emotionally can be as crucial as financial recovery. By shedding light on these crucial aspects, we hope to provide meaningful insights and actionable advise to those bouncing back from bankruptcy. Join us as we introduce the first step to recovery - 'Post-Bankruptcy Credit Rehabilitation'. As you navigate this transformative period, remember, each small step towards credit rehabilitation brings you closer to financial freedom.

Post-Bankruptcy Credit Rehabilitation

Post-bankruptcy credit rehabilitation is a critical stepping stone on the path to financial recovery and rebuilding for individuals who have been through the bankruptcy process in Canada. Bankruptcy, while it can provide necessary relief from crushing financial burdens, impacts a person's credit standing, casting a shadow that often remains on the credit report for seven years. However, this is not doomsday because with patience, perseverance, and certain strategic actions, one can restore their credit status. The first step on this journey is obtaining a discharge from bankruptcy. Without this, it is impossible to start the rehabilitation process. Typically, a first-time bankrupt with no surplus income receives this discharge automatically nine months plus a day after they became bankrupt. The discharged debtor is no longer legally required to pay the debts included in the bankruptcy, laying the foundation to move towards credit rehabilitation. Once discharged, it is advisable to obtain a secured credit card. This is paramount, as it represents a safe way to begin rebuilding credit history. The debtor can deposit a certain amount (usually between $100 and $500) into a secured savings account held by the lender or credit card company, providing a degree of insurance against missed repayments. This way, the debtor can exhibit responsible credit behaviour by making regular payments and maintaining a good standing. Next, creating a budget and sticking to it religiously helps the individual to establish a consistent payment history and control their spending. Showing lenders that they can manage money responsibly and meet payment deadlines can progressively enhance their credit rating. Consolidating existing loans, if any, into one loan with a lower interest rate also helps in managing repayments more efficiently and reflects positively on the credit report. Moreover, embracing financial education can significantly contribute to post-bankruptcy rehabilitation. Resources like credit counselling services can empower the individual with the necessary knowledge and skills to navigate the credit landscape efficiently. Lastly, it's worth remembering that time is a key player in credit rehabilitation post-bankruptcy. As each year passes, the bankruptcy note on the credit report diminishes in its impact, given one has been consistently showcasing good credit behaviour meanwhile. A commitment to sound financial practices and patience in waiting for the efforts to bear fruit will see the shadow of bankruptcy gradually fade, opening the way for a stronger financial future in Canada.

Strategies for Financial Recovery After Declaring Bankruptcy

After declaring bankruptcy in Canada, recovery and rebuilding become the next crucial steps on your financial journey. These strategies for financial recovery are vital in reshaping your monetary stability and regaining control over your financial future. One of the most important actions to take post-bankruptcy is the establishment of a diligent budget. This involves mapping out every aspect of your income and expenditures, prioritizing necessities, and minimizing any non-essential spendings. This provides a clear understanding of your financial possibilities and limitations, allowing you to comfortably live within your means while also working towards your recovery. Additionally, investing in savings is a significant part of financial recovery. This could involve saving a portion of your income or putting money aside for emergencies. This fund would contribute to building a safety net, which can alleviate financial burdens should unexpected costs arise. Gradually, this can play a significant role in rebuilding your credit score, which is essential for your financial standing. Furthermore, it is essential to get familiar with financial literacy. This could involve engaging with financial educational resources or seeking advice from financial advisors. Understanding the nuances of finance can assist in better decision-making and avoid the pitfalls that led to bankruptcy. Choosing the right credit products for rebuilding credit is another practical strategy. Secured credit cards, for example, require you to put down a deposit that becomes your credit limit, helping ensure you don't overspend and afford to pay off your balance monthly. Responsibility using such cards can demonstrate creditworthiness to lenders and positively influence credit scores. Lastly, seeking professional help can play a significant role in recovery. A licensed insolvency trustee, for example, can provide expert advice tailored to your financial situation. They can help you navigate your obligations and responsibilities during the bankruptcy process, giving you a realistic view of your options moving forward. This guidance can be instrumental in your journey towards financial recovery after bankruptcy. Remember that bankruptcy is not an end, but a restart, a new beginning on the path to a secure financial future. With the right strategies and mindset, you can bounce back from bankruptcy, re-establish your credit, and regain financial stability. You survived bankruptcy; now it's time to thrive.

The Moral and Psychological Aspects of Bankruptcy

Bankruptcy is often assessed in purely financial terms, but it has profound moral and psychological aspects to consider. Filing for bankruptcy can evoke feelings of guilt and embarrassment due to societal norms. The stigma surrounding failure, especially financial failure, can be overwhelming for many. Bankruptcy implicitly suggests some level of irresponsibility and recklessness, a label that no individual fancies. Nevertheless, it is crucial to shift one's perspective. Bankruptcy is merely a legal tool provided by Canadian law to help individuals and businesses navigate financial difficulties. In acknowledging this, individuals can begin to alleviate the moral burden they may feel. Equally important are the psychological effects of bankruptcy. It is a commonly stressful and anxious period with many potential triggers for depression. The pressure can arise from various sources - rebuilding credit, repaying creditors, or simply restructuring lifestyles to adjust to a new economic reality. Strikingly, the process can also paradoxically become an impetus for individuals to adopt healthy financial habits. In response to such a harsh lesson, individuals tend to become more cautious about spending, budgeting, and saving, leading to a dramatic improvement in their financial behaviour and understanding. It is important to remember that bankruptcy is a life event, not a life sentence. Associated emotions such as guilt, regret, and embarrassment are normal, but they must be put into context. Conquering the emotional and mental impacts of declaring bankruptcy plays a crucial role in the recovery and rebuilding process. Indeed, increased financial literacy, the reassessment of financial priorities, and changes in spending habits can all be positive offshoots of the bankruptcy journey. Filing for bankruptcy in Canada is a legal process with moral and psychological undertones. It mirrors an individual's struggle between their financial downfall and the hope for sound financial stability, often a distressing reality check. However, understanding its moral and psychological aspects can greatly assist in the path of recovery and rebuilding. Acknowledging that failure is a part of life, and that bankruptcy does not signify perpetual financial doom, is quintessential to not just surviving economic adversity but emerging stronger from it. By taking this path, bankruptcy can be seen as a new beginning rather than an end, fostering resilience, introspection, and innovation in one's financial life.