How To Cancel An E Transfer

Understanding the Basics of E-Transfer

The Definition of E-Transfer

E-Transfers, also known as electronic transfers, are a convenient, fast, and secure way to send money directly from one bank account to another. The transfer is processed through secure systems such as Interac in Canada or Automated Clearing House (ACH) in the United States. The transaction is carried out online, typically via a bank's online banking platform or mobile app. The sender simply needs to know the recipient's email address or mobile phone number.

The Process of E-Transfer

First, the sender logs into their online banking account or app and selects the option to send an e-transfer. They specify the amount they wish to send, the account from which the money will be withdrawn, and the recipient's email address or mobile number. The sender can also include a message or reference note for the recipient. Next, they will set a security question and answer, which the recipient will need to know or guess correctly to receive the money. The bank then sends an alert to the recipient, who must log into their online banking to answer the security question and deposit the money.

Benefits and Limitations of E-Transfer

E-transfers are extremely useful in many settings. They allow people to send money quickly and easily without needing to know the recipient's bank details. They are typically faster than traditional methods like cheques or cash, and the money is usually available to the recipient within 30 minutes to a few hours. However, e-transfers also have some limitations. There may be transaction fees (although many banks now offer free e-transfers), and there could be limits on the amount you can send or receive. Finally, if you make a mistake in the recipient's email or phone number, or they fail to answer the security question correctly, the e-transfer may fail or go to the wrong person.

Steps To Cancel an E-Transfer

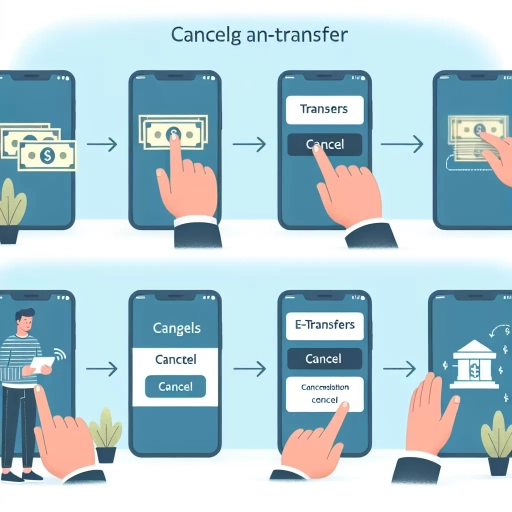

Checking the Status

Before attempting to cancel an e-transfer, one should check its status. If the e-transfer is still listed as 'pending' or 'unclaimed', that means the recipient has not yet received or deposited the money, and cancellation is possible. If the e-transfer is listed as 'completed', then the money has been deposited into the recipient's account, and cancellation is no longer possible.

Initiating the Cancellation

If the e-transfer is still 'pending' or 'unclaimed', the sender can initiate the cancellation. They should log into their online banking or mobile app and navigate to their e-transfer history. From there, they should select the e-transfer they wish to cancel and click on the 'cancel' button. There may be a cancellation fee, which typically ranges from $3 to $5. Some banks may also have specific policies for cancelling e-transfers, so it's important to read and understand these before proceeding.

Confirming the Cancellation

Once the cancellation is initiated, the sender should receive a confirmation from their bank. The cancelled funds, minus any cancellation fee, will usually be returned to the sender's account within a few business days. Additionally, an email notification of the cancellation may be sent to the recipient. It’s also advisable that the sender check their account statement or online banking history to confirm that the funds have been re-deposited into their account.

Preventive Measures To Avoid E-Transfer Fraud

Creating a Secure Question and Answer

A secure question and answer are essential to ensure that only the intended recipient can deposit the e-transfer funds. The question should be something that only the recipient will know the answer to. Avoid using easily guessable questions or answers that could be found through social engineering or online searches. For example, instead of "What is my mother's maiden name?", which could potentially be found online, try more obscure personal trivia like "What was the name of our high school English teacher?".

Verifying Recipient Information

Before sending the e-transfer, make sure to double-check the recipient's email address or phone number. Even a single misplaced character could send the money to the wrong party. Confirm their contact details verbally or through a trusted method before initiating the e-transfer. Additionally, avoid sending e-transfers to strangers or unverified parties. These transactions are not easily reversible, so it's better to be safe than sorry.

Securing Online Banking

Secure your online banking account by setting a strong and unique password. Don't share this password with anyone, and avoid using it for other online accounts or websites. Enable two-step verification if your bank offers it. Lastly, regularly update and secure your devices and networks. Keep your smartphone, laptop, and WiFi router updated with the latest security patches, and only access your online banking from secure, trusted networks.