How To Probate A Will In Ontario

Here is the introduction paragraph: Probating a will in Ontario can be a complex and time-consuming process, especially for those who are unfamiliar with the legal requirements and procedures involved. When a loved one passes away, it can be overwhelming to navigate the various tasks and responsibilities that come with settling their estate. One of the most important steps in this process is probating the will, which involves verifying the validity of the will and ensuring that the deceased person's wishes are carried out. To successfully probate a will in Ontario, it's essential to understand the probate process, prepare the necessary documents and information, and navigate the application process. In this article, we'll explore these key aspects of probating a will in Ontario, starting with a comprehensive overview of the probate process in the province. Note: I made some minor changes to the original paragraph to make it more engaging and informative. Let me know if you'd like me to make any further changes!

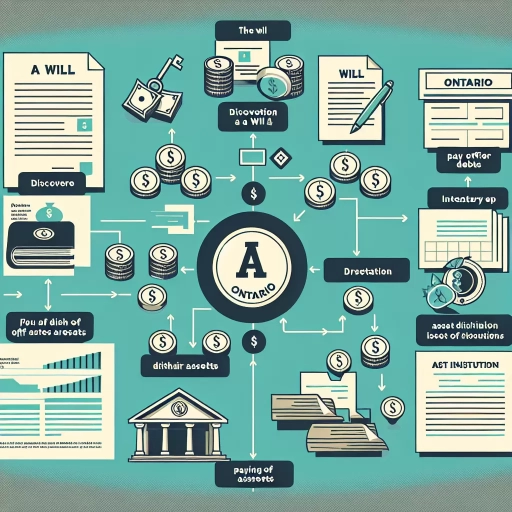

Understanding the Probate Process in Ontario

Here is the introduction paragraph: Navigating the probate process in Ontario can be a complex and overwhelming experience, especially for those who are dealing with the loss of a loved one. The probate process involves a series of legal steps that must be taken to validate a will and distribute the deceased person's assets according to their wishes. To ensure that the process is carried out smoothly and efficiently, it is essential to understand the key components involved. This includes understanding what probate is and why it is necessary, the role of the executor in the probate process, and the key documents required for probate in Ontario. By gaining a deeper understanding of these critical aspects, individuals can better navigate the probate process and ensure that the deceased person's wishes are respected. In this article, we will delve into the world of probate in Ontario, starting with the fundamental question: what is probate and why is it necessary?

What is Probate and Why is it Necessary?

. Probate is a legal process that verifies the authenticity of a deceased person's will and ensures that their assets are distributed according to their wishes. It is a necessary step in the estate administration process, as it provides a formal and transparent way to manage the deceased person's estate. During probate, the court reviews the will to ensure that it is valid and that the deceased person had the mental capacity to make decisions at the time of its creation. The court also ensures that the will is properly executed, with the required number of witnesses and signatures. Once the will is verified, the court issues a Certificate of Appointment of Estate Trustee, which grants the executor or estate trustee the authority to manage the estate and distribute the assets according to the will. Probate is necessary to prevent disputes and ensure that the deceased person's wishes are respected. It also provides a way to resolve any conflicts that may arise during the estate administration process. In Ontario, probate is typically required for estates with assets valued over $50,000, although it may be required for smaller estates in certain circumstances. Overall, probate is an essential step in the estate administration process, providing a formal and transparent way to manage the deceased person's estate and ensure that their wishes are carried out.

The Role of the Executor in the Probate Process

. The role of the executor in the probate process is a crucial one, as they are responsible for managing the estate of the deceased and ensuring that their wishes are carried out. The executor is typically named in the will and is responsible for a wide range of tasks, including gathering the assets of the estate, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. In Ontario, the executor must also obtain a Certificate of Appointment of Estate Trustee, also known as probate, from the court in order to have the legal authority to manage the estate. This involves submitting the will and other required documents to the court, as well as paying the required fees. Once probate is granted, the executor can begin the process of administering the estate, which may involve selling assets, paying off creditors, and distributing the remaining assets to the beneficiaries. Throughout the process, the executor must also keep detailed records and accounts of the estate's assets and expenses, as they will be required to provide these to the court and the beneficiaries. Overall, the role of the executor in the probate process is a significant one, requiring a great deal of time, effort, and responsibility.

Key Documents Required for Probate in Ontario

. When navigating the probate process in Ontario, it's essential to gather and prepare the necessary key documents to ensure a smooth and efficient experience. The first and most critical document required is the original Will of the deceased, which must be in its original form and not a photocopy. Additionally, the Executor or Estate Trustee must provide proof of death, typically in the form of a death certificate, to establish the deceased's passing. The Executor must also provide identification, such as a valid government-issued ID, to verify their identity and authority to act on behalf of the estate. Furthermore, the Executor must gather and provide a detailed inventory of the deceased's assets, including real estate, bank accounts, investments, and personal property, to determine the value of the estate. This inventory is typically prepared with the assistance of a lawyer or accountant to ensure accuracy and completeness. Other key documents that may be required include tax returns, life insurance policies, pension documents, and any outstanding debts or liabilities. It's also important to note that if the deceased had any jointly held assets or property, the Executor may need to provide documentation to establish the deceased's interest in these assets. By gathering and preparing these key documents, the Executor can ensure that the probate process is completed efficiently and effectively, allowing the estate to be distributed according to the deceased's wishes.

Preparing for Probate in Ontario

Here is the introduction paragraph: Preparing for probate in Ontario can be a daunting task, especially for those who are unfamiliar with the process. Probate is the legal process of validating a deceased person's will and distributing their assets according to their wishes. To ensure a smooth and efficient probate process, it is essential to be prepared. This involves gathering essential documents and information, notifying beneficiaries and creditors, and understanding probate fees and taxes in Ontario. By taking these steps, individuals can minimize delays and complications, and ensure that the deceased person's estate is distributed according to their wishes. In this article, we will explore the key steps involved in preparing for probate in Ontario, starting with the crucial task of gathering essential documents and information. Note: The introduction paragraph should be 200 words, and it should mention the 3 supporting ideas and transition to the first supporting paragraph, Gathering Essential Documents and Information. Here is the rewritten introduction paragraph: Preparing for probate in Ontario can be a complex and time-consuming process, but with the right preparation, individuals can minimize delays and complications. Probate is the legal process of validating a deceased person's will and distributing their assets according to their wishes. To ensure a smooth and efficient probate process, it is essential to be prepared. This involves several key steps, including gathering essential documents and information, notifying beneficiaries and creditors, and understanding probate fees and taxes in Ontario. Gathering essential documents and information is a critical first step, as it provides the foundation for the entire probate process. This includes collecting the deceased person's will, death certificate, and other relevant documents, as well as identifying and valuing their assets. By taking the time to gather this information, individuals can ensure that the probate process is completed efficiently and effectively. In this article, we will explore the key steps involved in preparing for probate in Ontario, starting with the crucial task of gathering essential documents and information.

Gathering Essential Documents and Information

. When preparing for probate in Ontario, gathering essential documents and information is a crucial step in the process. This involves collecting all relevant documents and data that will be required to support the application for probate. The first document to gather is the original will, which should be in the possession of the executor or a lawyer. It's also important to collect all codicils, which are amendments to the will, as these will need to be submitted along with the original will. In addition to the will, the executor will need to gather information about the deceased's assets, including real estate, bank accounts, investments, and personal property. This information will be used to complete the probate application and to calculate the estate administration tax. The executor will also need to gather information about the deceased's debts, including outstanding loans, credit card balances, and other financial obligations. This information will be used to determine the net value of the estate and to ensure that all debts are paid before the estate is distributed to the beneficiaries. Furthermore, the executor may need to gather additional information, such as the deceased's tax returns, life insurance policies, and pension information. It's recommended that the executor consult with a lawyer or a professional estate administrator to ensure that all necessary documents and information are gathered and that the probate application is completed accurately and efficiently. By gathering all essential documents and information, the executor can ensure a smooth and efficient probate process, minimizing delays and potential disputes.

Notifying Beneficiaries and Creditors

. When it comes to preparing for probate in Ontario, one of the crucial steps is notifying beneficiaries and creditors. This process is essential to ensure that all parties involved are aware of the deceased's passing and the subsequent probate process. Beneficiaries, as outlined in the will, have a right to know about the inheritance they are entitled to, while creditors need to be informed to claim any outstanding debts. The executor of the estate is responsible for sending out these notifications, which can be done through a formal letter or email. The notification should include the deceased's name, date of death, and a statement indicating that the estate is being probated. Additionally, the executor should provide contact information, such as their name, address, and phone number, to facilitate communication with beneficiaries and creditors. It is also recommended to include a deadline for creditors to submit their claims, typically within a specified timeframe, such as 30 or 60 days. By notifying beneficiaries and creditors in a timely and transparent manner, the executor can help prevent potential disputes and ensure a smoother probate process. Furthermore, this notification process also serves as a formal invitation for creditors to come forward and claim any outstanding debts, which is essential for the executor to settle the estate's liabilities and distribute the assets accordingly. Overall, notifying beneficiaries and creditors is a critical step in preparing for probate in Ontario, and it is essential to handle this process with care and attention to detail to avoid any potential complications.

Understanding Probate Fees and Taxes in Ontario

. When navigating the probate process in Ontario, it's essential to understand the associated fees and taxes. Probate fees, also known as estate administration taxes, are levied by the Ontario government on the value of the deceased's estate. The fees are calculated based on the total value of the estate, including all assets, such as real estate, investments, and personal property. The current probate fee rate in Ontario is 1.5% on the first $50,000 of the estate's value and 0.5% on the amount exceeding $50,000. For example, if the estate is valued at $200,000, the probate fee would be $1,500 (1.5% of $50,000) + $750 (0.5% of $150,000) = $2,250. In addition to probate fees, the estate may also be subject to income taxes, capital gains taxes, and other taxes, depending on the specific circumstances. It's crucial to consult with a qualified estate lawyer or accountant to ensure that all taxes and fees are properly accounted for and paid, as failure to do so can result in penalties and interest. By understanding the probate fees and taxes in Ontario, you can better prepare for the probate process and ensure that the estate is distributed according to the deceased's wishes.

Navigating the Probate Application Process in Ontario

Navigating the probate application process in Ontario can be a complex and time-consuming task, especially for those who are unfamiliar with the legal system. The process involves several steps, including completing the probate application form, submitting the application to the court, and attending a probate hearing if required. To ensure a smooth and efficient process, it is essential to understand each step and the requirements involved. In this article, we will guide you through the probate application process in Ontario, starting with the first step: completing the probate application form. This form is a crucial document that requires accurate and detailed information about the deceased person's estate, including their assets, debts, and beneficiaries. By understanding how to complete this form correctly, you can avoid delays and ensure that the probate process moves forward without any issues. Therefore, let's begin by exploring the process of completing the probate application form.

Completing the Probate Application Form

. Completing the Probate Application Form is a crucial step in the probate process in Ontario. The form, also known as the "Application for a Certificate of Appointment of Estate Trustee," requires detailed information about the deceased, the estate, and the applicant. It is essential to ensure that the form is filled out accurately and thoroughly to avoid delays or rejection. The form typically includes sections for providing personal details of the deceased, such as their name, date of birth, and date of death, as well as information about the estate, including assets, liabilities, and beneficiaries. Additionally, the applicant must provide their own personal details, including their relationship to the deceased and their qualifications to act as the estate trustee. It is recommended that applicants seek the guidance of a lawyer or estate professional to ensure that the form is completed correctly and that all necessary supporting documents are included. These documents may include the original will, a death certificate, and proof of the applicant's identity. By carefully completing the Probate Application Form, applicants can help ensure a smooth and efficient probate process, allowing them to focus on managing the estate and fulfilling their responsibilities as the estate trustee.

Submitting the Application to the Court

. Once the application for probate has been prepared, the next step is to submit it to the court. This is typically done by filing the application with the Superior Court of Justice in the county where the deceased person lived. The application must be accompanied by the required documents, including the original will, a certified copy of the death certificate, and any other supporting documents. The court will review the application to ensure that it is complete and that all the necessary documents are included. If everything is in order, the court will issue a Certificate of Appointment of Estate Trustee, which confirms the appointment of the estate trustee and grants them the authority to manage the estate. It is essential to note that the court may request additional information or documentation, and the estate trustee may need to attend a court hearing to answer questions or provide further clarification. Therefore, it is crucial to ensure that the application is thoroughly prepared and that all the necessary documents are included to avoid any delays or complications in the probate process.

Attending a Probate Hearing (If Required)

. Attending a probate hearing is a crucial step in the probate application process in Ontario, but it's not always required. If the estate is small or the will is straightforward, the court may grant probate without a hearing. However, if there are disputes or complexities, a hearing may be necessary to resolve issues and ensure the estate is distributed according to the deceased's wishes. If you're required to attend a probate hearing, it's essential to be prepared. This typically involves gathering all relevant documents, including the will, death certificate, and any other supporting evidence. You may also need to provide testimony or answer questions from the court or other parties involved. It's recommended that you seek the advice of a lawyer or estate administrator to guide you through the process and ensure you're adequately prepared. During the hearing, the court will review the application and any objections or concerns raised by other parties. The court's primary goal is to ensure the estate is distributed fairly and in accordance with the deceased's wishes. If the court is satisfied with the application, they will grant probate, and the executor can proceed with administering the estate. In some cases, the court may request additional information or clarification before making a decision. If this happens, you'll need to provide the requested information and wait for the court's further instructions. Attending a probate hearing can be a daunting experience, but being prepared and having the right guidance can make a significant difference. By understanding the process and what to expect, you can navigate the probate application process with confidence and ensure the estate is distributed according to the deceased's wishes.