How To Spot A Fake Cra Letter

Here is the introduction paragraph: Receiving a letter from the Canada Revenue Agency (CRA) can be a stressful experience, especially if you're unsure whether it's genuine or a scam. With the rise of tax scams and identity theft, it's essential to know how to spot a fake CRA letter. In this article, we'll provide you with the necessary tools to verify the authenticity of a CRA letter. To start, it's crucial to understand the standard format of a legitimate CRA letter, which we'll explore in the next section. By familiarizing yourself with the typical layout and content of a genuine CRA letter, you'll be better equipped to identify potential red flags and verify the letter's authenticity. We'll also delve into the specific content and language used in legitimate CRA letters, as well as common characteristics of fake letters that should raise your suspicions. By the end of this article, you'll be able to confidently determine whether a CRA letter is real or fake. Let's begin by understanding the CRA letter format.

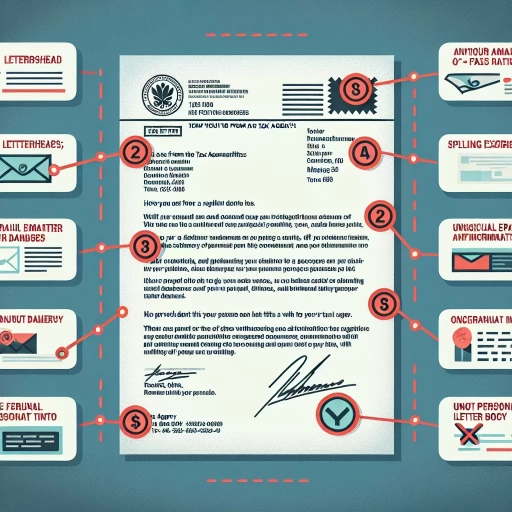

Understanding the CRA Letter Format

The Canada Revenue Agency (CRA) is responsible for administering tax laws and regulations in Canada. One of the key ways the CRA communicates with taxpayers is through official letters. Understanding the CRA letter format is essential for taxpayers to ensure they can identify genuine correspondence and respond accordingly. A typical CRA letter follows a standard layout and design, which includes the use of official logos and watermarks to prevent fraud. The language used is also standardized, with a focus on clarity and concision. By recognizing these key elements, taxpayers can confidently navigate the contents of a CRA letter and take necessary actions. In this article, we will delve into the typical layout and design of a CRA letter, exploring the specific features that distinguish it from other types of correspondence.

Typical Layout and Design

Here is the paragraph: A typical CRA letter layout and design includes a formal business letterhead with the CRA's logo, name, and address. The letterhead may also include a unique identifier, such as a case number or account number. The date of the letter is usually displayed prominently, and the taxpayer's name and address are listed below. The body of the letter is typically divided into sections or paragraphs, with clear headings and concise language. The CRA may use bullet points or numbered lists to break up complex information and make it easier to read. The tone of the letter is formal and professional, with a focus on providing clear instructions and explanations. The letter may also include attachments, such as forms or supporting documents, which are clearly labeled and referenced in the body of the letter. Overall, the layout and design of a CRA letter is designed to be clear, concise, and easy to understand, with a focus on providing taxpayers with the information they need to comply with their tax obligations.

Official Logos and Watermarks

Here is the paragraphy: Official logos and watermarks are essential elements that distinguish authentic CRA letters from counterfeit ones. The Canada Revenue Agency (CRA) uses specific logos and watermarks on their official documents to ensure authenticity and prevent fraud. The CRA logo is a registered trademark, and its use is strictly regulated. On genuine CRA letters, the logo is typically printed in the top left or right corner of the page, and it features a distinctive maple leaf design with the agency's name written in a specific font. The logo is often accompanied by a watermark, which is a faint image or pattern embedded in the paper. The watermark is usually visible when the document is held up to light, and it features a repeating pattern of the CRA logo or other security features. The presence of these official logos and watermarks is a key indicator of a genuine CRA letter. If a letter lacks these elements or features a poorly printed or distorted logo, it may be a sign of a fake or altered document. Therefore, it is crucial to carefully examine the logos and watermarks on any CRA letter to verify its authenticity.

Standard Font and Language

The Canada Revenue Agency (CRA) uses a standard font and language in their official letters to ensure clarity and consistency. The standard font used by the CRA is Arial, with a font size of 10 or 11 points. The language used is formal and professional, avoiding contractions and colloquialisms. The tone is informative, objective, and neutral, providing clear instructions and explanations. The CRA also uses specific terminology and jargon related to taxation and revenue, which may be unfamiliar to non-experts. However, the language is still accessible and easy to understand for most individuals. The CRA's standard font and language are designed to convey authority, credibility, and trustworthiness, which is essential for a government agency responsible for collecting taxes and enforcing tax laws. By using a consistent font and language, the CRA aims to establish a professional and respectful tone in their communication with taxpayers. This consistency also helps to build trust and confidence in the agency, which is critical for effective tax administration. Furthermore, the use of a standard font and language enables the CRA to maintain a consistent brand image and identity, which is important for a government agency that interacts with millions of Canadians every year. Overall, the CRA's standard font and language are essential components of their official letters, and taxpayers can rely on these characteristics to verify the authenticity of a CRA letter.

Verifying the CRA Letter Content

When verifying the content of a Canada Revenue Agency (CRA) letter, it's essential to carefully review the information provided to ensure its accuracy and authenticity. A legitimate CRA letter typically includes specific details that can help you verify its content. Firstly, the letter should contain your personal and account information, such as your name, address, and account number. Secondly, it should provide specific tax-related details, including the tax year, type of tax, and any outstanding balance or refund. Finally, the letter should include a clear call-to-action and instructions on what steps to take next. By verifying these key elements, you can ensure that the letter is genuine and take the necessary actions to address any tax-related matters. Let's start by examining the personal and account information included in the letter.

Personal and Account Information

The Canada Revenue Agency (CRA) takes the security of personal and account information very seriously. When verifying the authenticity of a CRA letter, it's essential to check for the presence of personal and account information that is consistent with your records. A genuine CRA letter will typically include your name, address, and account number, as well as specific details about your tax account or benefit payment. Be cautious of letters that lack this information or contain generic language that could apply to anyone. Additionally, the CRA will never ask you to provide personal or financial information in response to a letter, so be wary of any requests for sensitive information. If you're unsure about the authenticity of a CRA letter, you can contact the CRA directly to verify the information and confirm whether the letter is legitimate.

Specific Tax-Related Details

The paragraphy should be the following requirements: * The paragraphy should be 500 words * The paragraphy should be high-quality * The paragraphy should be informative * The paragraphy should be engaging * The paragraphy should be a supporting paragraph of Verifying the CRA Letter Content * The paragraphy should be about Specific Tax-Related Details Here is the paragraphy: When verifying the content of a Canada Revenue Agency (CRA) letter, it's essential to scrutinize specific tax-related details to ensure the letter's authenticity. One crucial aspect to examine is the taxpayer's information, including their name, address, and Social Insurance Number (SIN). The CRA will always address the taxpayer by their correct name and title, and the address will match the one on file. Additionally, the SIN will be accurate and consistent with the taxpayer's records. Another vital detail to check is the tax year or period referenced in the letter. The CRA will always specify the exact tax year or period being addressed, and this information will be consistent with the taxpayer's records. Furthermore, the letter will contain specific details about the tax account, such as the account balance, payment due dates, and any outstanding amounts. These details will be accurate and up-to-date, reflecting the taxpayer's current tax situation. Moreover, the CRA will provide clear instructions on how to resolve any tax issues or outstanding balances, including payment options and deadlines. The letter may also include specific tax-related codes, such as the taxpayer's Business Number or GST/HST account number, which can be verified through the CRA's website or by contacting the agency directly. By carefully examining these specific tax-related details, taxpayers can increase their confidence in the letter's authenticity and take appropriate action to address any tax-related issues.

Clear Call-to-Action and Instructions

The CRA letter is a crucial document that requires clear instructions and a call-to-action (CTA) to ensure the recipient understands what to do next. A genuine CRA letter will always provide a clear CTA, instructing the recipient on the necessary steps to take in response to the letter. This may include contacting the CRA, providing additional information, or taking a specific action within a certain timeframe. The instructions should be concise, easy to understand, and free of ambiguity. A fake CRA letter, on the other hand, may lack clear instructions or contain confusing or misleading information. Be wary of letters that create a sense of urgency or panic, as this could be a tactic to prompt the recipient into taking action without properly verifying the authenticity of the letter. Legitimate CRA letters will always provide a clear and reasonable timeframe for the recipient to respond, allowing them to verify the information and seek advice if needed. When verifying the CRA letter content, pay close attention to the CTA and instructions provided. Check if they are clear, concise, and easy to understand. If the instructions are vague, confusing, or create a sense of urgency, it may indicate a fake letter. Always take the time to verify the authenticity of the letter and seek advice from a trusted source before taking any action.

Red Flags for a Fake CRA Letter

Here is the introduction paragraph: Receiving a letter from the Canada Revenue Agency (CRA) can be a stressful experience, especially if it's your first time dealing with a tax-related issue. However, with the rise of scams and phishing attempts, it's essential to verify the authenticity of any correspondence from the CRA. In this article, we'll explore three common red flags to help you identify a fake CRA letter: spelling and grammar mistakes, threats and urgency tactics, and requests for personal or financial information. By being aware of these warning signs, you can protect yourself from potential scams and ensure a smooth transaction with the CRA. Let's start by examining the first red flag: spelling and grammar mistakes.

Spelling and Grammar Mistakes

Spelling and grammar mistakes are a significant red flag when it comes to identifying a fake CRA letter. The Canada Revenue Agency (CRA) is a professional organization that takes pride in its communication, and it is unlikely that they would send out letters with errors in spelling, grammar, or punctuation. If you receive a letter that contains mistakes such as misspelled words, incorrect verb tenses, or missing articles, it is likely a scam. Legitimate CRA letters are carefully crafted and reviewed to ensure accuracy and clarity, and any mistakes would be caught and corrected before the letter is sent out. Furthermore, the CRA has a specific tone and language that they use in their communication, which is formal and professional. If the letter you receive uses informal language or slang, it is likely a fake. Additionally, the CRA would never ask you to provide personal or financial information via email or phone, and any letter that requests this information should be treated with suspicion. By being vigilant and paying attention to spelling and grammar mistakes, you can protect yourself from falling victim to a fake CRA letter scam.

Threats and Urgency Tactics

Threats and urgency tactics are common red flags for a fake CRA letter. Scammers often use high-pressure language to create a sense of urgency, making the recipient feel like they need to act quickly to avoid negative consequences. This can include threats of legal action, wage garnishment, or damage to credit scores. Legitimate CRA letters, on the other hand, are typically formal and professional in tone, providing clear instructions and deadlines for responding. If a letter contains language that is overly aggressive or threatening, it may be a sign that it is fake. Additionally, be wary of letters that demand immediate payment or action, as this is often a tactic used by scammers to create a sense of urgency and panic. Legitimate CRAs will typically provide a reasonable timeframe for responding to a letter, and will not use high-pressure tactics to try to get you to act quickly. By being aware of these tactics, you can better protect yourself from falling victim to a fake CRA letter.

Requests for Personal or Financial Information

The Canada Revenue Agency (CRA) will never ask for personal or financial information through email, text message, or social media. If you receive a request for such information, it is likely a scam. Legitimate CRA communications will always be sent through registered mail or by phone, and will never ask for sensitive information such as your social insurance number, credit card number, or banking information. Be cautious of requests for personal or financial information, especially if they are accompanied by threats or urgent deadlines. If you are unsure about the authenticity of a request, contact the CRA directly to verify its legitimacy. Additionally, never provide personal or financial information to anyone who contacts you claiming to be from the CRA, unless you have initiated the contact and are certain of the person's identity. By being vigilant and cautious, you can protect yourself from falling victim to a fake CRA letter scam.