How To Pay Property Tax Edmonton

Here is the introduction paragraph: As a homeowner in Edmonton, paying property tax is an essential responsibility that cannot be overlooked. Property taxes are a significant source of revenue for the City of Edmonton, funding various municipal services and infrastructure projects. However, navigating the process of paying property tax can be complex and overwhelming, especially for new homeowners. To ensure you meet your property tax obligations, it's crucial to understand the payment options available, the consequences of late or unpaid taxes, and the underlying principles of property taxation in Edmonton. In this article, we'll delve into the world of property tax in Edmonton, starting with the basics of how property tax works in the city. Understanding Property Tax in Edmonton is the first step in managing your property tax obligations effectively.

Understanding Property Tax in Edmonton

As a homeowner in Edmonton, understanding property tax is crucial to managing your finances effectively. Property tax is a significant expense for homeowners, and it's essential to know how it's calculated and what types of properties are subject to taxation. In Edmonton, property tax is used to fund various municipal services and infrastructure projects that benefit the community. In this article, we will delve into the world of property tax in Edmonton, exploring what it is, how it's calculated, and the types of properties that are subject to taxation. We will also discuss the benefits of paying property tax in Edmonton. By the end of this article, you will have a comprehensive understanding of property tax in Edmonton and be able to make informed decisions about your property. So, let's start by understanding the basics of property tax and how it's calculated.

What is Property Tax and How is it Calculated?

Property tax is a type of tax levied by the municipal government on real estate properties, including residential, commercial, and industrial properties. The tax is calculated based on the assessed value of the property, which is determined by the municipal assessor. The assessed value is typically a percentage of the property's market value, and it can vary depending on the location, size, and type of property. In Edmonton, the assessed value is calculated using a mass appraisal system, which takes into account factors such as the property's age, size, location, and amenities. The property tax rate is then applied to the assessed value to determine the total tax amount. The tax rate is set by the municipal government and can vary from year to year. In Edmonton, the property tax rate is typically around 0.5% to 1.5% of the assessed value. For example, if a property has an assessed value of $500,000, the property tax would be around $2,500 to $7,500 per year. Property tax is usually paid annually, and homeowners can pay it in a lump sum or through monthly installments. The tax revenue is used to fund municipal services such as road maintenance, public transportation, police and fire services, and community programs.

Types of Properties Subject to Taxation in Edmonton

In Edmonton, various types of properties are subject to taxation, including residential, commercial, and industrial properties. Residential properties, such as single-family homes, condominiums, and apartments, are taxed based on their assessed value. Commercial properties, including office buildings, retail stores, and restaurants, are also taxed on their assessed value, with rates varying depending on the type of business and location. Industrial properties, such as warehouses and manufacturing facilities, are taxed similarly to commercial properties. Additionally, vacant land, farmland, and special purpose properties, like churches and non-profit organizations, are also subject to taxation. Furthermore, properties with multiple units, such as duplexes and triplexes, are taxed as a single entity, while properties with multiple titles, like condominiums, are taxed individually. The City of Edmonton also taxes properties with special features, such as billboards and cell towers, as well as properties with environmental concerns, like contaminated sites. Overall, the City of Edmonton's taxation system aims to distribute the tax burden fairly among property owners, taking into account the type and value of each property.

Benefits of Paying Property Tax in Edmonton

Paying property tax in Edmonton is a crucial civic responsibility that offers numerous benefits to homeowners and the community at large. By paying property tax, homeowners contribute to the overall development and maintenance of the city's infrastructure, including roads, public transportation, and community facilities. This, in turn, enhances the quality of life for residents, making Edmonton a more attractive and livable city. Property tax revenue also funds essential public services such as police and fire departments, healthcare, and education, ensuring that citizens have access to these vital services. Furthermore, paying property tax can increase property values, as a well-maintained and developed community is more desirable to potential buyers. Additionally, property tax payments can be used as a tax deduction, reducing the amount of income tax owed. In Edmonton, property tax payments are also used to fund local initiatives and projects, such as park development, community programs, and cultural events, which foster a sense of community and social cohesion. Overall, paying property tax in Edmonton is not only a legal requirement but also a vital investment in the city's future, contributing to its growth, development, and prosperity.

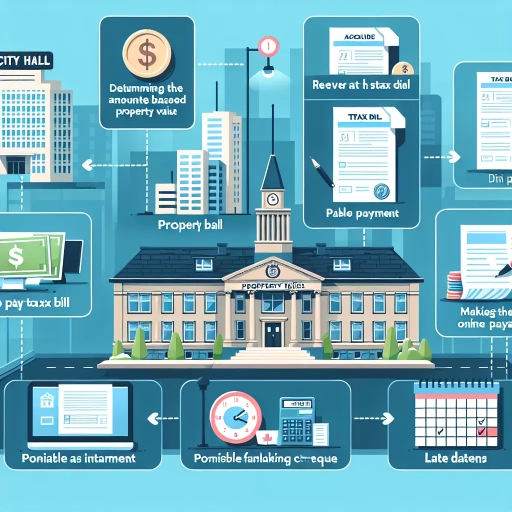

Payment Options for Property Tax in Edmonton

Here is the introduction paragraph: Paying property taxes in Edmonton can be a daunting task, especially with the various payment options available. As a homeowner, it's essential to understand the different payment methods to ensure timely and hassle-free transactions. In this article, we'll explore the various payment options for property tax in Edmonton, including online payment methods, offline payment options, and payment plans and installment options. By understanding these options, homeowners can choose the most convenient and suitable method for their needs. For those who prefer the convenience of digital transactions, online payment methods offer a quick and easy way to pay property taxes. Note: The introduction paragraph should be 200 words. Here is the rewritten introduction paragraph: Paying property taxes in Edmonton can be a complex and time-consuming process, especially with the numerous payment options available. As a homeowner, it's crucial to understand the different payment methods to ensure timely and hassle-free transactions. In Edmonton, property taxes can be paid through various channels, catering to different preferences and needs. This article will delve into the various payment options for property tax in Edmonton, including online payment methods, offline payment options, and payment plans and installment options. By understanding these options, homeowners can choose the most convenient and suitable method for their needs, avoiding potential penalties and late fees. Online payment methods, for instance, offer a quick and easy way to pay property taxes, allowing homeowners to settle their dues from the comfort of their own homes. With the rise of digital transactions, online payment methods have become increasingly popular, providing a secure and efficient way to pay property taxes. In the next section, we'll explore the online payment methods available for property tax in Edmonton, including the City of Edmonton's online payment portal and other digital payment options.

Online Payment Methods for Property Tax in Edmonton

The City of Edmonton offers various online payment methods for property tax, providing residents with convenient and secure options to settle their tax bills. One of the most popular online payment methods is through the city's online payment portal, where property owners can log in using their account number and access code to make a payment using their credit card or debit card. Additionally, residents can also pay their property tax online through their financial institution's website or mobile banking app, using the city's payee name "City of Edmonton - Property Tax". Another option is to set up a pre-authorized payment plan, which allows property owners to make monthly or quarterly payments automatically from their bank account. Furthermore, the city also accepts online payments through third-party service providers, such as Plastiq and PaySimply, which allow residents to pay their property tax using their credit card. It's worth noting that some online payment methods may incur a service fee, so it's essential to review the payment options carefully before making a payment. Overall, the City of Edmonton's online payment methods provide a convenient and efficient way for residents to pay their property tax, saving time and reducing the risk of late payment penalties.

Offline Payment Options for Property Tax in Edmonton

If you are unable to pay your property tax online or through other electronic means, there are several offline payment options available in Edmonton. You can pay your property tax in person at the Edmonton Service Centre, located at 2nd Floor, 10111 104 Avenue NW. The centre is open Monday to Friday from 8am to 4:30pm, excluding statutory holidays. You can pay by cash, cheque, debit card, or credit card. Additionally, you can also pay at any financial institution in Edmonton that accepts property tax payments. You can also drop off your payment at the City of Edmonton's 24-hour payment drop box located at the Edmonton Service Centre. Please ensure to include your payment stub and make your cheque payable to the City of Edmonton. If you are paying by mail, please send your payment to City of Edmonton, PO Box 2670, Edmonton, AB T5J 2G4. Please note that mailed payments must be received by the due date to avoid late payment penalties. Furthermore, you can also pay your property tax through a mortgage company or a financial institution that offers this service. Please contact your mortgage company or financial institution to confirm if they offer this service and to obtain more information. It is essential to keep in mind that some offline payment options may have additional fees or requirements, so it is crucial to verify the details before making your payment. By exploring these offline payment options, you can ensure that your property tax payment is made on time and avoid any potential penalties or interest charges.

Payment Plans and Installment Options for Property Tax in Edmonton

Payment plans and installment options are available for property tax in Edmonton, allowing homeowners to manage their tax payments more effectively. The City of Edmonton offers a monthly payment plan, which enables property owners to pay their taxes in 12 equal installments from January to December. This plan helps to reduce the financial burden of a single large payment and provides a more manageable monthly expense. Additionally, the city offers a quarterly payment plan, where property owners can pay their taxes in four installments due on the last day of March, June, September, and December. Both plans require a one-time setup fee, and payments can be made through various methods, including online banking, telephone banking, and in-person at a financial institution. Furthermore, the city also offers a pre-authorized payment plan, which allows property owners to set up automatic monthly or quarterly payments from their bank account. This plan provides an added convenience and helps to ensure timely payments, avoiding late payment penalties. It is essential to note that property owners must apply for these payment plans before the tax due date to avoid penalties and interest charges. By taking advantage of these payment plans and installment options, Edmonton property owners can better manage their property tax payments and avoid financial stress.

Consequences of Late or Unpaid Property Tax in Edmonton

As a homeowner in Edmonton, it's essential to understand the consequences of late or unpaid property tax. Failing to pay property taxes on time can lead to severe penalties, fines, and even damage to your credit score. In this article, we'll explore the consequences of late or unpaid property tax in Edmonton, including the penalties and fines you may face, the impact on your credit score, and the risk of property tax liens and foreclosure. If you're struggling to pay your property taxes, it's crucial to address the issue promptly to avoid these consequences. So, what happens when you fail to pay your property taxes on time? Let's start by examining the penalties and fines for late or unpaid property tax in Edmonton.

Penalties and Fines for Late or Unpaid Property Tax in Edmonton

Property owners in Edmonton who fail to pay their property taxes on time or in full may face penalties and fines. The City of Edmonton imposes a penalty of 3.5% on unpaid taxes on July 1st of each year, and an additional 1.25% on the first day of each month thereafter until the taxes are paid in full. This means that if a property owner owes $10,000 in taxes and fails to pay by July 1st, they will be charged a $350 penalty (3.5% of $10,000) plus $125 per month (1.25% of $10,000) until the taxes are paid. In addition to these penalties, the City of Edmonton may also charge interest on outstanding tax balances at a rate set by the Province of Alberta. If the property owner continues to neglect their tax obligations, the City may take further action, including filing a tax lien on the property, which can lead to additional fees and costs. It is essential for property owners to pay their taxes on time to avoid these penalties and fines, and to consider seeking assistance from the City or a financial advisor if they are experiencing difficulties making their tax payments.

Impact of Unpaid Property Tax on Credit Score in Edmonton

The impact of unpaid property tax on credit score in Edmonton can be significant. When property taxes are not paid on time, the City of Edmonton may send the account to a collection agency, which can negatively affect an individual's credit score. In Edmonton, unpaid property taxes are considered a type of debt, and failure to pay can lead to a decrease in credit score. This is because credit reporting agencies, such as Equifax and TransUnion, consider property tax payments as part of an individual's credit history. If property taxes are not paid, it can indicate to lenders that an individual is not responsible with their financial obligations, making it more challenging to obtain credit in the future. Furthermore, a poor credit score can also lead to higher interest rates on loans and credit cards, making it more expensive to borrow money. In extreme cases, unpaid property taxes can even lead to a tax lien being placed on the property, which can further damage an individual's credit score. It is essential for Edmonton property owners to prioritize paying their property taxes on time to avoid any negative impact on their credit score.

Property Tax Liens and Foreclosure in Edmonton

When a property owner in Edmonton fails to pay their property taxes, the City of Edmonton may place a property tax lien on the property. A property tax lien is a claim against the property for the amount of unpaid taxes, and it gives the city a legal interest in the property. If the property owner continues to neglect their tax payments, the city may initiate foreclosure proceedings to collect the debt. Foreclosure is a legal process where the city takes ownership of the property and sells it to recover the outstanding tax debt. In Edmonton, the foreclosure process typically involves a series of steps, including a notice of foreclosure, a court application, and a public auction. Property owners who are facing foreclosure due to unpaid property taxes should seek professional advice to understand their options and potential consequences. It is essential to address property tax arrears promptly to avoid the severe consequences of foreclosure, including loss of ownership and damage to credit scores. By paying property taxes on time, Edmonton property owners can avoid the risk of property tax liens and foreclosure, ensuring they maintain control over their properties and avoid financial difficulties.