How To Get A Hst Number

Here is the introduction paragraph: If you're a business owner or entrepreneur in Canada, you may be wondering how to get a HST number. A HST number, also known as a Harmonized Sales Tax number, is a unique identifier assigned to businesses that collect and remit HST on their sales. In this article, we'll guide you through the process of obtaining a HST number, from determining who needs one to registering and what to do after registration. First, it's essential to understand who needs a HST number, as not all businesses are required to have one. We'll explore this topic in more detail, including the types of businesses that are exempt and those that are required to register. Note: The introduction paragraph should be 200 words. Here is the rewritten introduction paragraph: As a business owner or entrepreneur in Canada, obtaining a HST number is a crucial step in ensuring compliance with tax regulations. A HST number, also known as a Harmonized Sales Tax number, is a unique identifier assigned to businesses that collect and remit HST on their sales. In this article, we'll provide a comprehensive guide on how to get a HST number, covering the essential steps and requirements. To begin, it's vital to understand who needs a HST number, as not all businesses are required to have one. We'll delve into the specifics of which businesses are exempt and those that are required to register, helping you determine if you need a HST number. Additionally, we'll walk you through the registration process, providing step-by-step instructions on how to register for a HST number. Finally, we'll cover what to do after registering, including how to use your HST number and meet ongoing compliance requirements. By the end of this article, you'll have a clear understanding of the HST number registration process and be well on your way to ensuring your business is tax compliant. First, let's explore who needs a HST number.

Who Needs a HST Number?

In Canada, businesses are required to register for a Harmonized Sales Tax (HST) number if they meet certain criteria. The HST is a consumption tax that is levied on most goods and services in Canada. To determine if a business needs an HST number, it's essential to understand the requirements. Generally, businesses with annual revenues over $30,000, non-resident businesses, and businesses that provide HST-exempt services may need to register for an HST number. In this article, we will explore these requirements in more detail, starting with businesses that have annual revenues exceeding $30,000.

Businesses with Annual Revenues Over $30,000

Businesses with annual revenues over $30,000 are required to register for a HST number. This is a mandatory requirement for businesses that meet this revenue threshold, regardless of their industry or type of business. The $30,000 threshold is calculated based on the business's worldwide revenues, not just its Canadian revenues. This means that if a business has revenues from international sales or other sources, these revenues are included in the calculation. Businesses that meet this threshold must register for a HST number within 29 days of the day they meet the threshold. Failure to register can result in penalties and fines. Once registered, businesses with annual revenues over $30,000 are required to charge and remit HST on their taxable supplies, file HST returns, and maintain accurate records of their HST transactions. This includes keeping records of invoices, receipts, and other documents that support their HST claims. Businesses that are required to register for a HST number include sole proprietorships, partnerships, corporations, and trusts. This requirement applies to businesses of all sizes, from small startups to large corporations. The Canada Revenue Agency (CRA) is responsible for administering the HST program and ensuring that businesses comply with the requirements. Businesses can register for a HST number online through the CRA's website or by phone. Once registered, businesses will receive a HST number, which they must use on all their invoices and other business documents.

Non-Resident Businesses

Non-resident businesses that provide taxable supplies in Canada are required to register for a HST number. This includes businesses that sell goods or services to Canadian customers, regardless of where the business is located. If a non-resident business has a permanent establishment in Canada, it is considered a resident business and must register for a HST number. A permanent establishment can be a physical location, such as a store or office, or it can be a person who is authorized to act on behalf of the business in Canada. Non-resident businesses that do not have a permanent establishment in Canada but still provide taxable supplies in the country may also need to register for a HST number. This can include businesses that sell digital products, such as software or e-books, or businesses that provide services, such as consulting or coaching. In general, if a non-resident business has a significant presence in Canada or provides taxable supplies to Canadian customers, it is likely required to register for a HST number.

Businesses That Provide HST-Exempt Services

Businesses that provide HST-exempt services are not required to register for a HST number. These services include healthcare and medical services, education, childcare, and most services provided by non-profit organizations. Additionally, businesses that provide exempt supplies, such as basic groceries, prescription medication, and feminine hygiene products, are also not required to register for a HST number. However, it's essential to note that even if a business is exempt from registering for a HST number, they may still be required to charge and remit HST on certain supplies, such as taxable goods and services. Furthermore, businesses that provide a mix of exempt and taxable supplies may need to register for a HST number and charge HST on the taxable portion of their supplies. It's crucial for businesses to understand their specific obligations and exemptions to ensure compliance with HST regulations.

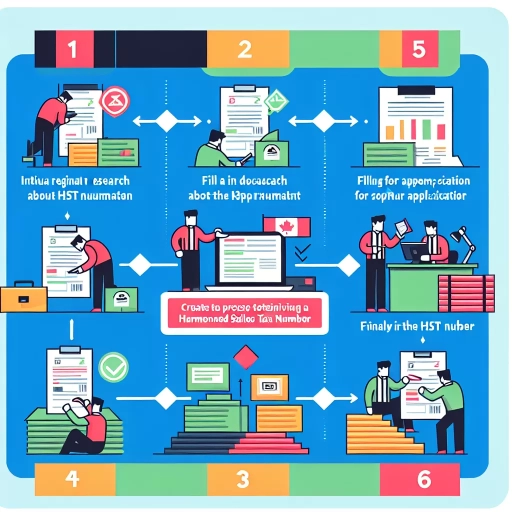

How to Register for a HST Number

Registering for a Harmonized Sales Tax (HST) number is a crucial step for businesses operating in Canada, particularly those with annual revenues exceeding $30,000. The process is relatively straightforward and can be completed through various channels. In this article, we will explore the three primary methods of registering for an HST number: online registration through the Canada Revenue Agency (CRA) website, phone registration through the CRA Business Enquiries Line, and mail or fax registration using Form RC1. Each method has its own set of requirements and benefits, and understanding the options can help businesses choose the most convenient and efficient approach. By the end of this article, you will be equipped with the knowledge to successfully register for an HST number and comply with Canadian tax regulations. To get started, let's dive into the first method: online registration through the CRA website.

Online Registration Through the CRA Website

To register for a HST number, you can do so online through the Canada Revenue Agency (CRA) website. This is the most convenient and efficient way to obtain your HST number. To start the online registration process, go to the CRA website and click on the "Register" button. You will be required to provide your business information, including your business name, address, and contact details. You will also need to provide your Social Insurance Number (SIN) or your Individual Tax Number (ITN) if you are a sole proprietor. Additionally, you will need to provide your business's financial information, such as your annual revenue and the type of goods and services you provide. Once you have completed the online registration form, you will receive your HST number immediately. You can then use this number to charge and remit HST on your taxable supplies. The online registration process typically takes around 10-15 minutes to complete, and you can register at any time, 24/7. The CRA website is secure and easy to use, making it a convenient option for businesses to register for a HST number.

Phone Registration Through the CRA Business Enquiries Line

To register for a HST number, you can also phone the CRA Business Enquiries line. This method is ideal for those who prefer to communicate over the phone or have complex questions that require immediate clarification. The CRA Business Enquiries line is available from Monday to Friday, 9 am to 6 pm local time, excluding statutory holidays. To register, call the designated phone number and have your business information readily available, including your business name, address, and Social Insurance Number or Individual Tax Number. A CRA representative will guide you through the registration process, answer any questions you may have, and provide you with your HST number once your application is approved. This method is particularly useful for businesses with unique situations or those who require additional support during the registration process. By phoning the CRA Business Enquiries line, you can ensure that your HST number is registered accurately and efficiently, allowing you to focus on your business operations.

Mail or Fax Registration Using Form RC1

To register for a HST number using mail or fax, you will need to complete Form RC1, Request for a Business Number. This form can be downloaded from the Canada Revenue Agency (CRA) website or obtained by contacting the CRA directly. Once you have the form, fill it out accurately and completely, making sure to provide all required information, including your business name, address, and contact details. You will also need to provide information about your business, such as the type of business, the date it started, and the number of employees. Additionally, you will need to provide your Social Insurance Number (SIN) or your Individual Tax Number (ITN) if you are a non-resident. Once the form is complete, sign and date it, and then mail or fax it to the CRA. The mailing address and fax number can be found on the CRA website or on the form itself. It is recommended that you keep a copy of the form for your records. The CRA will review your application and assign a HST number to your business if it is approved. You can expect to receive your HST number within 4-6 weeks after submitting your application. It is essential to note that you must register for a HST number if your business earns more than $30,000 in a calendar quarter or in four consecutive calendar quarters. Failure to register may result in penalties and fines.

What to Do After Registering for a HST Number

After registering for a HST number, there are several steps you need to take to ensure you are in compliance with the Canada Revenue Agency (CRA) regulations. First, you will need to obtain a HST account number and GST/HST program account, which will be used to report and remit HST. You will also need to charge and collect HST on applicable sales, which includes most goods and services sold in Canada. Additionally, you will need to file HST returns and remit net tax owed to the CRA on a regular basis. In this article, we will explore each of these steps in more detail, starting with the process of obtaining a HST account number and GST/HST program account.

Obtain a HST Account Number and GST/HST Program Account

To obtain a HST account number and GST/HST program account, you will need to register for a GST/HST account with the Canada Revenue Agency (CRA). This can be done online, by phone, or by mail. To register online, you can use the CRA's Business Registration Online (BRO) service, which is available 21 hours a day, 7 days a week. You will need to provide your business information, including your business name, address, and type of business, as well as your Social Insurance Number (SIN) or Individual Tax Number (ITN) if you are a sole proprietor. You will also need to provide your bank account information to set up direct deposit for any GST/HST refunds you may be eligible for. Once you have submitted your registration, you will receive a confirmation email with your HST account number and instructions on how to access your GST/HST program account. You can also register by phone by calling the CRA's Business Enquiries line at 1-800-959-5525, or by mail by completing Form RC1, Request for a Business Number, and mailing it to the CRA. Regardless of the method you choose, you will need to provide the required information and follow the instructions provided to obtain your HST account number and GST/HST program account.

Charge and Collect HST on Applicable Sales

Once you've registered for a HST number, it's essential to understand your obligations regarding charging and collecting Harmonized Sales Tax (HST) on applicable sales. As a registered business, you're required to charge HST on most goods and services you sell, unless they're exempt or zero-rated. This includes sales of tangible personal property, such as products, and intangible personal property, like services. You must also charge HST on sales of real property, like land and buildings, unless they're exempt. It's crucial to note that you can't charge HST on sales that are exempt or zero-rated, as this could result in penalties and fines. To ensure compliance, you should clearly indicate the HST amount on your invoices and receipts, and remit the collected HST to the Canada Revenue Agency (CRA) on a regular basis. The frequency of remittances depends on your business's annual revenue, with more frequent remittances required for larger businesses. Additionally, you may be eligible for input tax credits (ITCs) on HST paid on business expenses, which can help reduce your net tax payable. By accurately charging and collecting HST, you'll avoid potential penalties and ensure your business remains compliant with HST regulations.

File HST Returns and Remit Net Tax Owed

After registering for a HST number, it's essential to understand your obligations as a registrant. One of the critical tasks is to file HST returns and remit the net tax owed to the Canada Revenue Agency (CRA). You must file a return for each reporting period, which is usually quarterly, but can be monthly or annually, depending on your business's specific situation. The return must be filed and the net tax owed must be remitted by the due date to avoid penalties and interest. The net tax owed is calculated by subtracting the input tax credits (ITCs) from the total HST collected. ITCs are the HST paid on business expenses, which can be claimed as a credit against the HST collected. You can file your HST return online through the CRA's website or by phone, and you can also authorize a representative to file on your behalf. It's crucial to keep accurate records of your HST transactions, including invoices, receipts, and bank statements, as the CRA may request them during an audit. By filing your HST returns and remitting the net tax owed on time, you can avoid any potential issues with the CRA and ensure your business remains compliant with HST regulations.