How To Find Void Cheque Scotiabank

Here is the introduction paragraph: When it comes to setting up direct deposit, automatic payments, or verifying account information, a void cheque is often required. For Scotiabank customers, finding a void cheque can be a daunting task, especially for those who are new to online banking or have never had to provide a void cheque before. In this article, we will explore the concept of void cheques, their purpose, and how to locate one for Scotiabank transactions. We will also discuss alternatives to void cheques for Scotiabank transactions, providing you with a comprehensive understanding of the process. By the end of this article, you will be equipped with the knowledge to navigate the process with ease. To start, let's dive into the basics of void cheques and their purpose.

Understanding Void Cheques and Their Purpose

A void cheque is a cheque that has been intentionally cancelled or voided, typically by writing "VOID" across its face. Void cheques are used for various purposes, including setting up direct deposit, verifying account information, and facilitating electronic transactions. In this article, we will delve into the world of void cheques, exploring their purpose, importance, and differences from regular cheques. We will examine the role of void cheques in banking transactions, highlighting their significance in ensuring secure and efficient financial exchanges. Additionally, we will discuss how void cheques differ from regular cheques, shedding light on their unique characteristics. By understanding the concept of void cheques, individuals can better navigate the complexities of modern banking and make informed decisions about their financial transactions. So, let's start by exploring what a void cheque is and how it is used.

What is a Void Cheque and How is it Used?

A void cheque is a cheque that has been intentionally cancelled or invalidated, typically by writing "VOID" across the front of the cheque in large letters. This is done to prevent the cheque from being used or cashed, and to ensure that it cannot be used to withdraw funds from the account. Void cheques are often used as a way to provide banking information, such as the account number and routing number, without actually allowing the cheque to be used for payment. This can be useful for setting up direct deposit, automatic payments, or other financial transactions. For example, when setting up direct deposit with an employer, an employee may be required to provide a void cheque to verify their banking information. The employer can then use this information to deposit the employee's pay directly into their account. Void cheques can also be used to verify account information when setting up online banking or other financial services. Overall, void cheques provide a safe and secure way to share banking information without risking unauthorized access to the account.

The Importance of Void Cheques in Banking Transactions

A void cheque is a crucial document in banking transactions, serving as a vital link between the bank and the account holder. Its importance cannot be overstated, as it provides a secure and efficient way to verify account information and facilitate transactions. By issuing a void cheque, account holders can ensure that their banking information is accurate and up-to-date, reducing the risk of errors or discrepancies. Moreover, void cheques play a significant role in setting up direct deposits, automatic payments, and other electronic transactions, making it easier for individuals and businesses to manage their finances. In the event of a dispute or issue, a void cheque can also serve as proof of account ownership, helping to resolve conflicts quickly and efficiently. Overall, the importance of void cheques in banking transactions lies in their ability to provide a secure, reliable, and efficient way to verify account information and facilitate transactions, making them an essential tool for anyone with a bank account.

How Void Cheques Differ from Regular Cheques

A void cheque is a unique type of cheque that differs significantly from regular cheques. Unlike regular cheques, which are used to make payments or transfer funds, void cheques are used to provide banking information, such as account numbers and routing numbers, to set up direct deposits, pre-authorized payments, or automatic fund transfers. The primary purpose of a void cheque is to verify the account holder's identity and confirm the accuracy of their banking information. Void cheques are typically marked "VOID" across the front to indicate that they cannot be used for payment purposes. This distinguishing feature sets them apart from regular cheques, which can be used to make transactions. Furthermore, void cheques do not require a signature, whereas regular cheques must be signed by the account holder to be valid. Overall, the distinct characteristics of void cheques make them an essential tool for verifying banking information and facilitating secure financial transactions.

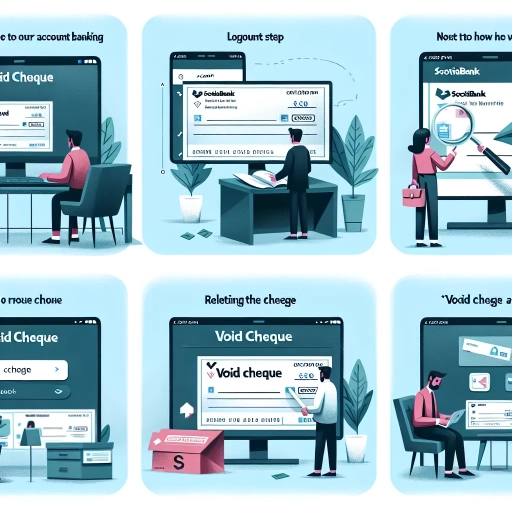

Locating a Void Cheque for Scotiabank

When you need to provide a void cheque for direct deposit, automatic payments, or other financial transactions, it's essential to know where to find one. If you're a Scotiabank customer, you have several options to obtain a void cheque. You can start by checking your chequebook to see if you have a spare cheque that you can void. Alternatively, you can request a void cheque from Scotiabank online through their website or mobile banking app. If you prefer a more personal approach, you can visit a Scotiabank branch in person to request a void cheque. In this article, we'll explore these options in more detail, starting with checking your chequebook for a void cheque.

Checking Your Chequebook for a Void Cheque

When checking your chequebook for a void cheque, it's essential to ensure you're looking at the correct section. Typically, void cheques are located at the back of the chequebook, often marked as "Void" or "Sample." If you're unable to find a void cheque in your current chequebook, you may want to check any previous chequebooks you have stored. It's also possible that your bank, such as Scotiabank, may have included a void cheque with your initial account setup or in a separate package. If you're still unable to locate a void cheque, you can contact Scotiabank's customer service or visit a local branch for assistance. They can provide you with a void cheque or guide you through the process of obtaining one. Additionally, if you're using online banking, you may be able to find a digital version of a void cheque or request one through the online platform. It's crucial to verify the information on the void cheque, including your account number and routing number, to ensure accuracy. By taking these steps, you can successfully locate a void cheque and complete any necessary transactions or account setup.

Requesting a Void Cheque from Scotiabank Online

To request a void cheque from Scotiabank online, follow these steps: Log in to your Scotiabank online banking account, navigate to the "Account Services" or "Account Management" section, and look for the "Void Cheque" or "Order Cheques" option. Click on this option and select the account for which you want to request a void cheque. You will be prompted to confirm your request and may be asked to provide a reason for the void cheque. Once you've submitted your request, Scotiabank will mail a void cheque to you within 3-5 business days. Alternatively, you can also contact Scotiabank's customer service directly to request a void cheque over the phone or through their mobile banking app. Be prepared to provide your account information and verify your identity to complete the request. It's essential to note that Scotiabank may have specific requirements or restrictions for requesting a void cheque, so it's always a good idea to review their policies before making a request. By following these steps, you can easily obtain a void cheque from Scotiabank online and fulfill your banking needs.

Visiting a Scotiabank Branch for a Void Cheque

If you're having trouble finding a void cheque or need assistance with the process, visiting a Scotiabank branch in person is a viable option. Scotiabank has numerous branches across Canada, making it convenient to find one near you. By visiting a branch, you can speak directly with a bank representative who can guide you through the process of obtaining a void cheque. They can also provide you with a pre-printed void cheque or help you create one on the spot. Additionally, the representative can answer any questions you may have regarding the void cheque process, ensuring you have a clear understanding of what's required. To find a Scotiabank branch near you, you can use the bank's online branch locator tool, which allows you to search by location, language, or services offered. Simply enter your location or postal code, and you'll be provided with a list of nearby branches, along with their addresses, phone numbers, and hours of operation. By visiting a Scotiabank branch, you can get the help you need to obtain a void cheque and complete your banking tasks efficiently.

Alternatives to Void Cheques for Scotiabank Transactions

Here is the introduction paragraph: For Scotiabank customers, void cheques are often used to set up direct deposits, pre-authorized payments, and online banking transactions. However, with the advancement of technology, there are now alternative methods that can replace the need for void cheques. In this article, we will explore three alternatives to void cheques for Scotiabank transactions: using the Scotiabank Mobile Banking App, direct deposit and pre-authorized payments, and online banking and bill payments. By understanding these alternatives, customers can enjoy a more convenient and secure way of managing their finances. For instance, customers can use the Scotiabank Mobile Banking App to easily set up and manage their transactions, eliminating the need for void cheques altogether.

Using the Scotiabank Mobile Banking App

Using the Scotiabank Mobile Banking App is a convenient and secure way to manage your finances on the go. With the app, you can easily access your account information, transfer funds, pay bills, and deposit cheques remotely. To get started, simply download the app from the App Store or Google Play, and log in using your ScotiaCard number and password. Once you're logged in, you can navigate to the "Deposit" section to deposit a cheque using your smartphone's camera. The app will guide you through the process, and you'll receive a confirmation once the deposit is complete. You can also use the app to transfer funds between your Scotiabank accounts, pay bills, and check your account balances. Additionally, the app offers a range of security features, including two-factor authentication and encryption, to protect your personal and financial information. Overall, the Scotiabank Mobile Banking App is a convenient and secure way to manage your finances, and it's a great alternative to using a void cheque for transactions.

Direct Deposit and Pre-Authorized Payments

Direct deposit and pre-authorized payments are two convenient and secure alternatives to void cheques for managing Scotiabank transactions. Direct deposit allows you to receive payments, such as paychecks, government benefits, or tax refunds, directly into your Scotiabank account. This eliminates the need for physical cheques, reducing the risk of lost or stolen cheques and ensuring that your funds are deposited quickly and securely. To set up direct deposit, you will need to provide your employer or the relevant authority with your Scotiabank account information, including your account number and transit number. Pre-authorized payments, on the other hand, enable you to make regular payments, such as bill payments or loan payments, from your Scotiabank account. This can be done by providing the payee with your account information, and they will automatically deduct the payment amount from your account on the designated date. Both direct deposit and pre-authorized payments offer a convenient and hassle-free way to manage your Scotiabank transactions, eliminating the need for void cheques and reducing the risk of errors or delays. By taking advantage of these alternatives, you can streamline your financial transactions and enjoy greater peace of mind.

Online Banking and Bill Payments

Online banking and bill payments have revolutionized the way we manage our finances, offering a convenient, efficient, and secure way to conduct transactions from the comfort of our own homes. With online banking, users can access their account information, transfer funds, pay bills, and even deposit cheques remotely using their mobile devices. This eliminates the need for physical visits to the bank, saving time and reducing the risk of lost or stolen cheques. Moreover, online banking platforms often provide real-time updates, allowing users to track their transactions and stay on top of their finances. Bill payments, in particular, have become increasingly streamlined, with many banks offering pre-authorized payment plans and automatic payment reminders. This ensures that bills are paid on time, avoiding late fees and penalties. Furthermore, online banking and bill payments reduce the environmental impact of traditional banking methods, minimizing the need for paper statements and cheques. Overall, online banking and bill payments offer a hassle-free, eco-friendly, and secure way to manage one's finances, making it an attractive alternative to traditional banking methods.