How To Fill Out Personal Tax Credits Return

Understanding and correctly filling out a Personal Tax Credits Return can seem like a daunting chore, but this informational article aims to not only debunk that myth but offer a clear path to completing this important tax task. We'll begin by unpacking the fundamentals of Personal Tax Credits Return, demystifying its complexities and rendering it a simple, essential practice of responsible financial management while highlighting its far-reaching implications. Then, we'll walk you step by step through the process, turning a challenging task into an easily manageable operation. Additionally, we aim to save you from common pitfalls by identifying frequent mistakes many stumble upon while filling out a Personal Tax Credits Return. Our ultimate goal is to provide a comprehensive guide that will not only make the process clear and straightforward but also ensure you maximize your potential deductions and avoid any potential penalties. Let's initiate our journey of understanding Personal Tax Credits Return in depth.

Understanding and correctly filling out a Personal Tax Credits Return can seem like a daunting chore, but this informational article aims to not only debunk that myth but offer a clear path to completing this important tax task. We'll begin by unpacking the fundamentals of Personal Tax Credits Return, demystifying its complexities and rendering it a simple, essential practice of responsible financial management while highlighting its far-reaching implications. Then, we'll walk you step by step through the process, turning a challenging task into an easily manageable operation. Additionally, we aim to save you from common pitfalls by identifying frequent mistakes many stumble upon while filling out a Personal Tax Credits Return. Our ultimate goal is to provide a comprehensive guide that will not only make the process clear and straightforward but also ensure you maximize your potential deductions and avoid any potential penalties. Let's initiate our journey of understanding Personal Tax Credits Return in depth.Understanding Personal Tax Credits Return

The world of personal tax can often be perplexing for many, especially when it comes to personal tax credit returns. Understanding this compelling subject is essential as it directly impacts your financial reality. In this informative and engaging article, we delve deep into the world of personal tax credits return, aiming to offer clarity and aid you in making informed financial decisions. We start by examining the essence of personal tax credits returns and why they matter when it comes to your financial health. We then go on to discuss the various types of personal tax credits available to you. Not all tax credits are created equal, and understanding the distinctions can be supremely beneficial in maximizing your return. Ultimately, we will explore how these credits actually work in the real world. Armed with this knowledge, you can strategically use these tax credits to your advantage. Let's begin by dissecting the essence of personal tax credits and why it matters to your overall financial journey.

The Essence of Personal Tax Credits Return: Why it matters

Personal tax credits return is not just another document you need to fill; it is an essential aspect of your financial management. Its relevance lies in minimizing the tax obligations where possible and is, therefore, viewed as a financial lever. Tax credits work by reducing the actual amount of tax you owe. If, for example, you owe $3,000 in income taxes but qualify for $1,000 in tax credits, your net payable tax will be $2,000. That's a substantial saving on your part. This underscores why understanding and correctly filing personal tax credit returns is critical: it can lead to significant saving. The beauty of these tax credits is that they cater to a wide range of personal circumstances. There are tax credits for parents, for students, for senior citizens, for the disabled, and even for specific home improvements. Effectively, these credits attempt to lighten the tax burden within those societal segments where the additional financial relief is often most needed. In essence, they're provisions in the law to ensure our tax system is not just fair, but empathetic as well. But the question is, how can you take advantage of these credits if you don't know what they are or if you're eligible? This is where understanding personal tax credits return comes into play. You have to understand the types of credits available, which ones apply to your situation, and how you can maximize those credits. It's not enough to just fill out the forms; you need to comprehend the potential financial impact of each credit. The information-filled age we live in has made it easier to access necessary materials and guides. However, understanding the semantics and intricacies can be challenging, which is why professional help could also be beneficial. Educating yourself about your obligations and potential savings within the tax system is a savvy financial move. And at the end of the day, it's not just about saving money but also about understanding how this system contributes to the overall societal structure. Personal tax credits return matters because it's an exercise in financial prudence. It's about understanding how to navigate within a system designed to cater to various needs. You may not be able to control tax laws, but you can certainly control your understanding of them and how to leverage them to your benefit. Granted, the process can be complex and sometime tedious, but the potential savings make them worth understanding. Ultimately, the essence of personal tax credits return lies in its ability to provide relief, encourage financial independence and promote societal fairness.

Different Types of Personal Tax Credits

Personal Tax Credits play a critical role in reducing the overall tax burden. Just as your fiscal identity is unique, so are the types of Personal Tax Credits available at your disposal. The first key aspect is the Individual Tax Credit. This provision helps single taxpayers decrease their financial liabilities and increase their potential refunds. This credit is determined by factors like income level, filling status, and whether one can be claimed as a dependent on someone else's tax return. Secondly, we have the Child and Dependent Care Tax Credit, which is a boon for working parents or guardians. This credit can cover a percentage of the cost of childcare for dependents under the age of 13 or for disabled dependents, of any age, as long as they are incapable of self-care. The third type is the Education Tax Credits. There are two main types - the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). The AOTC allows credit for eligible expenses for the first four years of higher education, while the LLC provides for unlimited years of eligible education expenses. These credits serve to ease the financial burden of those pursuing higher education. Another important type is the Earned Income Tax Credit (EITC), primarily aimed at low-to-moderate-income working individuals and couples, particularly those with children, to decrease their tax liability. Additionally, the Retirement Savings contribution Credit or Saver's Credit helps low-to-moderate income individuals to save for retirement. If you contribute to a retirement plan, you may be eligible for a credit equal to a percentage of your contribution. The Health Coverage Tax Credit (HCTC) deserves mention too. It is a 72.5% advance monthly payment or end-of-year credit for past due health insurance premiums for eligible taxpayers and their family members. Finally, let’s look at the Adoption Credit. This is for those who have adopted a child and had to pay adoption fees, legal fees, and traveling expenses. Depending on their income and the amount of qualified adoption expenses, they can avail this credit to offset the adoption expenses. Thus, understanding these different types of Personal Tax Credits is essential when filling out your Personal Tax Credits Return. They not only significantly reduce your tax liability but also ensure that you utilize every provision under the tax laws designed for your benefit.

How Personal Tax Credits Work

Personal tax credits work by reducing the amount of tax an individual owes to the government. Understanding how these credits operate is crucial when filling out a personal tax credit return. Fundamentally, personal tax credits are subtracted from your annual tax liability, lowering the total amount you'll pay the taxman. If your tax credits exceed your tax, you might even end up getting a refund. However, the intricacies lie in the types of tax credits available and who qualifies for them. There are two key types of credits: refundable and non-refundable. Refundable credits can reduce your taxable amount to a negative figure, meaning the Internal Revenue Service (IRS) owes you money. On the other hand, non-refundable credits can only reduce your tax liability to zero - anything left over isn't redeemable. There’s a broad range of tax credits you may be eligible for based on your individual circumstances. These include but aren't limited to the Earned Income Tax Credit (EITC) for low to moderate-income workers, the Child Tax Credit (CTC) for parents or guardians of children under 18, and the American Opportunity Tax Credit (AOTC) for students. Eligibility for these tax credits hinges on several factors like your income level, your filing status (whether you're single, married filing jointly, or a head of the household), and your number of dependents. It's paramount to understand that having eligibility for a tax credit doesn't automatically mean you'll receive it. The IRS takes into consideration a combination of factors like how much you earn, and how many dependents you have, among other criteria. In the scenario where you don't have enough liabilities to claim the full tax credit, carryovers may come into play. With a carryover, you can apply your remaining tax credit to the following tax year, increasing your odds of qualifying for refunds. In summary, understanding how personal tax credits work can help you achieve reductions in your tax liability, potentially saving you hundreds or even thousands of dollars each year. Hence, when filling out your personal tax credits return, it's essential to comprehend the types of credits, who qualifies, and what benefits they can offer. Knowing these can prove to be a huge advantage, aiding in navigating the tricky terrain of tax forms and regulations. With thorough research and sound advice, you could maximize your returns and better manage your financial affairs. So, get in-depth with your understanding of personal tax credits, it's one knowledge that indeed pays off.

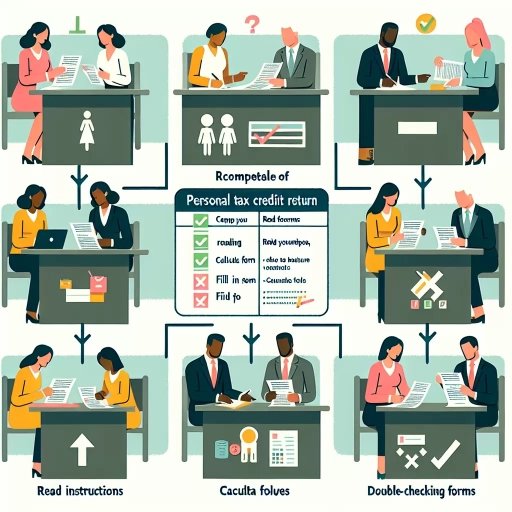

Step-by-Step Guide on How to Fill Out Personal Tax Credits Return

Understanding how to accurately fill out your Personal Tax Credits Return can often feel like a daunting task. But fear not, this article will provide a step-by-step guide to simplify this process for you. The guide is divided into three easily digestible sections: 'Preparation: Things you Need Before Filling Out the Form', providing an essential checklist to help you gather everything you need; 'Filling Out the Form: A Detailed Breakdown of Each Section', dedicated to making sense of each part of the form and how to fill it out properly; and 'Confirmation & Submission: Finalizing Your Personal Tax Credits Return', we ensure every detail is correct before you send it off. These three aspects combined will make the process of completing your Personal Tax Credits return smooth and stress-free. Never again will you feel flummoxed or overwhelmed by its intricacies. Our first step focuses on 'Preparation: Things You Need Before Filling Out the Form', so let’s delve into it and start this journey right.

Preparation: Things You Need Before Filling Out the Form

Preparation is a crucial step before you commit to the serious task of filling out your Personal Tax Credits Return. This stage cannot be stressed enough due to the importance of accuracy in this task. Before you dive into the form, there are certain things you need to have at your disposal. To begin with, make sure you familiarize yourself with the basic vernacular in the tax language. Terms such as ‘tax credit,’ ‘deduction,' 'personal amount,' and ‘tax payable’ should become part of your everyday vocabulary during this time. Understanding these concepts is essential in navigating the form and making sure your data is accurate. Secondly, assemble all the necessary financial documents that reflect your monetary activities throughout the tax year. This includes income slips (like your T4 or T4A), receipts for all your deductibles, and information about your various sources of income. If you had more than one employer or earned freelance income, you need these documents as well. Having them ready will give you a quicker and smoother experience. Next, ensure you have your Social Insurance Number (SIN) within arm's reach. This nine-digit number is fundamental for submitting your tax return, as it identifies you to the Canada Revenue Agency (CRA). If you're married or in a common-law relationship, details about your spouse or partner's income and their SIN will be required as well. Consequently, it's necessary to have this information available. Moreover, any changes in your personal life that might affect your tax situation should also be taken into account. From getting married, having or adopting a child, retiring, or buying a house – these significant life changes could potentially impact your tax credits. Lastly, setting up a clear, tranquil workspace cannot be overlooked. A stress-free environment allows for better concentration and minimized errors. By mentioning these items, this preparatory phase may appear daunting. However, with proper organization and understanding, you can confidently complete your Personal Tax Credit Return. Preparation is your best ally in this endeavor, providing you with the peace of mind knowing you've accurately and completely filled out your form when tax season arrives. Remember, when it comes to taxes, being prepared sets the tone for a seamless and efficient tax-filing experience.

Filling Out the Form: A Detailed Breakdown of Each Section

Filling out the forms for your Personal Tax Credits Return might seem daunting due to their complex nature, but this detailed breakdown will provide clear-cut instructions making the process effortlessly straightforward. Firstly, let's simplify some of the terminologies - a Personal Tax Credits Return details your eligibility to claim specific tax deductions, alleviating your overall tax burden. Know that the form is divided into various sections, each requiring a unique set of information. The top of the form, typically the Identification section, is where you put your basic details such as your name, address and social insurance number. Be careful with this information, as trivial errors can cause significant delays. Following this, the claim sections approach - starting with the basic personal amount. Here, unless for rare circumstances, you’re eligible for a full claim. Next comes the spouse or common-law partner amount segment, if applicable. Enter your spouse’s net income here, but remember, lower income here results in a higher claim amount. Similarly, you may encounter the eligible dependant sections. If you're single and support a child or relative, fill in these spaces accordingly. Further down the form, you'll encounter lines for less common claims. These include amounts for infirm dependants age 18 or older, caregiver amounts, and the disability amount - if you or your dependant is disabled, be mindful to fill out these accurately to receive appropriate tax deductions. Every subsequent section has an 'amount claimable' column. It may require a little arithmetic; it's crucial because these figures ultimately decide your non-refundable tax credits. Review these sections diligently and extract exact numbers. This detailed breakdown for each section of the form is a significant step towards you successfully completing your Personal Tax Credits Return. Filling out the form isn't just about providing data; it's also about comprehending the tax deductions you're eligible for. Remember to be attentive, patient, and precise. Your attention to detail can mean the difference between a grueling tax season and a smooth sailing one. Always consider all the tax credit opportunities available to you, and don't hesitate to consult a tax professional if you're unsure.

Confirmation & Submission: Finalizing Your Personal Tax Credits Return

Once you've filled out the entirety of the Personal Tax Credits Return, confirmed the accuracy of the information provided, and made sure that it accurately reflects your credits, the next step involves confirmation and submission. This pivotal phase involves double-checking and finalizing your inputs before finally submitting them to the Canada Revenue Agency. It is essential to understand that thoroughness and honesty are integral during the verification process. Mistakes or discrepancies can result in audit complications or penalties. It's therefore critical to ensure that your submission matches your financial situation accurately. Cross-reference your income statements, tax slips, and other relevant financial documents to ensure you've claimed all eligible tax credits while avoiding claims on ineligible ones. After confirming the details, it's time for the submission process. If you're employed, you will submit the form TD1 to your employer. If you're receiving benefits such as the Canadian Pension Plan or employment insurance, you will have to provide this form to Service Canada. For those who are self-employed, the form will be used for your income tax return. Keep in mind that while the process might seem complicated initially, multiple resources are available to help you navigate this process. Verification tools, help lines, and consultation services can provide additional assistance in ensuring your Personal Tax Credits Return is completed correctly. Also, remember that changes in life circumstances such as marriage, divorce, birth of a child, or a significant change in income must be promptly reported by submitting a new Personal Tax Credits Return form. Transparency and promptness in these scenarios will help avoid future headaches during the tax season. By taking a considered and meticulous approach to confirming and submitting your Personal Tax Credits Return, you're ensuring a smoother, more streamlined process come tax time. This not only provides peace of mind but ensures that you're operating within the framework of the CRA's regulations, setting yourself up for financial security and success.

Common Mistakes to Avoid When Filling Out Personal Tax Credits Return

Filing personal tax credit returns is a critical process that opens doors to several financial benefits. However, many taxpayers often encounter numerous challenges, such as calculation errors, missed deadlines, and inconsistent information that disrupt the smooth process. Firstly, issues of calculation errors are common due to the complex nature of tax return forms, which require keenness and a deep understanding of tax computations. It is crucial to ensure accuracy during this process, as such errors can result in severe penalties or delayed tax refunds. Secondly, understanding timelines and penalties for missed deadlines is another pivotal aspect. Given the rigid nature of taxation laws and protocols, breaching submission deadlines can lead to unnecessary penalties. Lastly, maintaining accurate and consistent information throughout your tax documentation is necessary for a hassle-free return process. The information provided needs to coincide with the data held by the tax authorities. Misrepresentation or inconsistencies can lead to audits or legal repercussions. With these potential mistakes in mind, we're going to delve deeper into the first issue—calculation errors, analyzing how to secure accuracy to preserve your fiscal integrity.

Calculation Errors: How to Ensure Accuracy

When filling out a Personal Tax Credits Return form, one of the most common error to avoid is calculation mistakes. These can dramatically affect the accuracy of your submission. One of the easiest ways to ensure accuracy is by using online tax calculators and credits tools. These digital platforms are designed to automatically compute your tax credits based on the information you provide, minimizing the chance of a miscalculation. A considerable advantage to utilizing these tools is the update in real-time according to the current laws and tax guidelines, ensuring that you benefit from any newly instituted tax credit regulations. However, while these tools are handy, they should never replace a thorough understanding of how tax calculations work. You should always double-check your figures before submitting them. Additionally, consider seeking help from a tax professional or licensed accountant. These experts possess in-depth knowledge of complicated tax laws, credits, and computations, which can prove invaluable for high-income earners or individuals with numerous assets and income sources. Furthermore, remember to account for any changes in your personal circumstances as these can cause substantial changes in your tax computation. For example, having a child, getting a new job, losing a job, or buying a house can significantly impact your tax liability and credits. Therefore, always update your records in case of any changes in your personal circumstance. Lastly, keep in mind that errors in deductions can lead to heavy fines and penalties from the tax authorities. Therefore, it's crucial that you take the time to ensure that your calculations are accurate and the credits you're claiming are entirely legal and justified. A small investment in time or the expense of a professional review could save you a significant amount of money down the line. By taking these precautions, you can avoid common calculation errors whilst filling out your Personal Tax Credits Return and ensure a smoother, more accurate process. Remember, preventing mistakes is often easier – and less stressful – than correcting them later!

Missed Deadlines: Understanding Timelines & Penalties

Understanding timelines and assessing penalties is a crucial aspect when filling out a personal tax credits return to avoid common pitfalls like missed deadlines. Recent research shows that one common blunder among tax credit claimants is an overlook of deadlines, leading to unanticipated penalties and lost credits that can gravely impact one's financial scenario. The nature of tax procedures is inherently time-bound, an element that adds to the intricacy of the process. Deadlines for submitting tax credits returns vary by state and in some cases, by the type of credit claimed. It's imperative to understand that penalties for late submissions can be steep, depending on the severity of the delay. In the worst cases, missed deadlines may result in the forfeiture of the tax credits entirely, subsequently inflating your tax bill and straining your financial resources. Why do many taxpayers fall into this trap? The reasons are as manifold as they are preventable. The primary culprit is usually a lack of updated knowledge on the altering landscape of tax laws, resulting in either missing critical updates about tax deadlines or misunderstanding the term in which one must file. Complacency and disorganization can also contribute to this costly error. Consider implementing an efficient method to track vital dates related to your personal tax credits return. Technology makes this task simple, with myriad apps and digital calendars that can alert you to upcoming deadlines. Additionally, consulting with a tax professional or using professional tax software ensures that you are up-to-date with the latest tax laws and can further streamline the filing process while minimizing common errors like missing schedules. Penalties for overlooked deadlines should not be underestimated. These financial penalties can range from a small percentage of the amount due to up to 25% under certain conditions. Also, interest on unpaid amounts is typically compounded daily, creating an expensive snowball effect. In conclusion, understanding tax credit return timelines and the financial implications of penalties can prevent commonly made mistakes while filling out tax returns, thereby preserving your bottom line. It's not just about entering the correct data in a tax form, but managing it strategically, ensuring timeliness, and ultimately reaping the financial benefits intended by these tax credits.

Information Inconsistencies: Why Accuracy and Consistency Matter

Information inconsistencies can significantly affect the processing of your personal tax credits return, underlining the importance of accuracy and consistency. When it comes to tax affairs, even the smallest discrepancies can lead to unintentional errors, trigger an audit, or prolong processing times. The precision of your information essentially becomes the foundation of your tax health. The relevance of these elements is amplified by the fact that tax agencies worldwide, particularly the Internal Revenue Service (IRS) in the U.S., utilize advanced data comparison tools to analyze each submission for inconsistencies. Inconsistent information not only presents a threat to your credibility but also hampers your financial wellness. Inaccurate data, be it understated income or overstated deductions, might result in you paying more than what's fair, or inversely, less than you should, putting you at risk of subsequent penalties. Aside from the financial implications, such irregularities may also draw unnecessary attention from the tax agencies leading to a time-consuming and stressful tax audit, which could have been avoided with a more meticulous approach to consistency and accuracy. Moreover, tax credits are formulated to alleviate fiscal burdens and propel socio-economic growth. Applied correctly, they potentially reduce your tax liability and might increase your chances for a refund. However, inconsistency or inaccuracy with your personal tax credits return can undermine these benefits. For instance, claiming for a tax credit that you aren't entitled to due to an oversight or data inconsistency, might result in fines or legal repercussions. In a world where details are scrutinized, and data is power, keeping your tax information accurate and consistent is pivotal. A clear understanding of tax regulations, thorough documentation, and a careful eye for detail while filling out your personal tax credit return can help circumvent these common mistakes. Couple this with consulting a tax professional, and you stand a much better chance of avoiding any problematic discrepancies. In conclusion, accuracy and consistency, in regards to your personal tax credits return, are much more than mere suggestions. They are a necessity for a smooth, stress-free tax experience. A single element of erroneous data can upset the apple cart and invite unwanted repercussions, financial and otherwise. Therefore, it's always prudent to ensure you're conveying the most accurate and consistent information on your tax return forms.