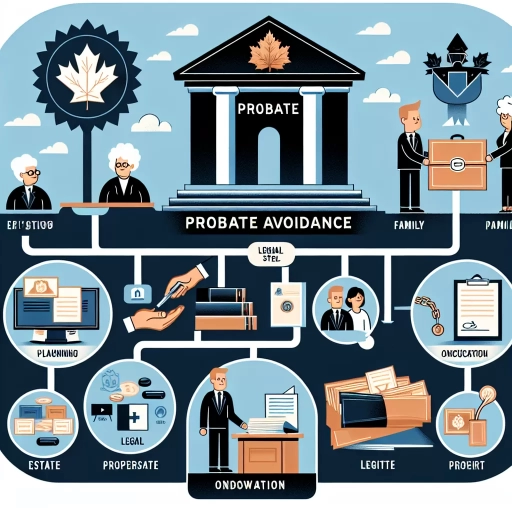

How To Avoid Probate In Ontario

Understanding Probate in Ontario

An overview of probate process in Ontario

Probate is a legal procedure where the court validates a will and gives the approval to the executor to act on the deceased’s estate. In Ontario, this process is officially referred to as 'Certificate of Appointment of Estate Trustee'. It's a rigorous process that involves filing documents, paying taxes and fees, and waiting for the court's approval. It can become expensive and time-consuming, and it's often something that many people want to avoid.

The importance of planning to avoid probate

Effective estate planning is the first step in avoiding probate in Ontario. Proper planning will ensure that your assets are distributed according to your wishes and save your loved ones from the hassles of probate. It targets all possible scenarios, including disability, incapacity, and even death. Even though it can be uncomfortable discussing these topics, it's necessary to ensure that your family is well protected if something unexpected happens.

Differences between probate assets and non-probate assets in Ontario

To understand how to avoid probate, it's crucial first to differentiate between probate and non-probate assets. Probate assets are those that solely belong to the deceased and need the court's validation before they can be inherited. Non-probate assets, on the other hand, don't need to go through the probate process. These assets often include assets owned jointly with right of survivorship and life insurance policies with a named beneficiary.

Strategies to Avoid Probate in Ontario

Beneficiary Designations

One of the simplest ways to avoid probate is by designating beneficiaries for all your assets like life insurance policies, retirement accounts, and other financial accounts. By doing this, these assets will be transferred directly to the beneficiary upon your death, bypassing the probate process in Ontario. However, it's essential to always update these designations, especially after significant events like divorce or death of a loved one.

Joint Ownership

Jointly owning assets with right of survivorship is another way to avoid probate in Ontario. If you pass away, the surviving co-owner automatically becomes the sole owner of the asset. It's commonly used for real estate but can also apply to bank accounts and other financial assets. However, it's crucial to weigh the potential risks of joint ownership, like disagreements in how to manage the jointly owned assets or exposing the assets to the other owner's creditors.

Establishing a Trust

Setting up a trust is an effective strategy to avoid probate. In a living trust, you transfer ownership of your assets to the trust, and you maintain control over these assets during your lifetime. Upon your death, the assets are transferred directly to the beneficiaries, bypassing the probate process. While setting up a trust can be more expensive and time-consuming, it offers several benefits including privacy, control, and flexibility.

Tips for Effectively Implementing Probate Avoidance Strategies

Engaging a legal expert

To implement these strategies effectively, it's advisable to engage a legal professional. Legal experts specialize in estate planning and exactly understand how to navigate the Ontario probate process. They can offer advice tailored to your unique situation, help you avoid common mistakes, and ensure your assets are protected.

Maintaining consistent records

Maintaining consistent and updated records of all your assets and their designated beneficiaries is essential. Regular reviews and updates ensure that unforeseen circumstances don’t invalidate your planning. You can set a reminder to review these designations at least once a year or after every major life event.

Communicating with loved ones

Lastly, it's vital to communicate your plans with your loved ones. Clear communication ensures that everyone involved understands the process, avoids potential conflicts, and ensures a smooth transfer of assets outside the probate process in Ontario.