How To Get Noa

Here is the introduction paragraph: Obtaining a Notice of Action (NOA) is a crucial step in various administrative and legal processes. A NOA is a formal document that informs individuals or organizations of a decision or action taken by a government agency or other authority. To get a NOA, it is essential to understand what it is, who is eligible to receive one, and how to apply for it. In this article, we will delve into the world of NOAs, exploring what they entail, the requirements for eligibility, and the application process. By the end of this article, you will have a comprehensive understanding of how to obtain a NOA. First, let's start by understanding what a NOA is and its significance in various administrative and legal contexts.

Understanding the NOA

Understanding the Notice of Assessment (NOA) is a crucial aspect of managing one's finances, particularly when it comes to taxes. The NOA is a document issued by the Canada Revenue Agency (CRA) that outlines an individual's tax obligations and entitlements. To grasp the significance of the NOA, it is essential to understand what it is, why it is important, and how to read and comprehend its contents. By delving into these aspects, individuals can gain a better understanding of their tax situation and make informed decisions about their financial planning. In this article, we will explore the NOA in detail, starting with the basics: What is a Notice of Assessment (NOA)?

What is a Notice of Assessment (NOA)?

A Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) to taxpayers after they have filed their income tax return. The NOA provides a summary of the taxpayer's income tax return, including their total income, deductions, credits, and the amount of taxes owed or refunded. The NOA also outlines any changes or adjustments made to the taxpayer's return, such as corrections to income or deductions, and any additional taxes or penalties owed. The NOA is typically mailed to taxpayers within a few weeks of filing their tax return, and it is an important document that taxpayers should review carefully to ensure its accuracy. If a taxpayer disagrees with the information on their NOA, they can contact the CRA to request a reassessment. The NOA is also used by lenders and other financial institutions to verify a taxpayer's income and creditworthiness, making it an essential document for many financial transactions. Overall, the NOA is a critical document that provides taxpayers with a clear understanding of their tax obligations and any changes made to their tax return.

Why is the NOA important?

The NOA is important because it serves as a critical document that confirms the approval of a nonimmigrant visa application. It is a formal notification from the U.S. Citizenship and Immigration Services (USCIS) that a petition for a nonimmigrant visa has been approved. The NOA is essential for several reasons. Firstly, it provides proof of the approval of the visa application, which is required for various purposes, such as applying for a visa at a U.S. embassy or consulate, entering the United States, and obtaining a driver's license or state ID. Secondly, the NOA contains important information about the visa, including the type of visa, the duration of stay, and the conditions of the visa. This information is crucial for the visa holder to understand their rights and responsibilities while in the United States. Thirdly, the NOA is often required by employers, schools, and other organizations to verify the immigration status of a nonimmigrant visa holder. It is also used by the U.S. Department of Homeland Security to track the entry and exit of nonimmigrant visa holders. Furthermore, the NOA is an important document for tax purposes, as it is used to determine the tax status of a nonimmigrant visa holder. In summary, the NOA is a vital document that plays a critical role in the nonimmigrant visa process. It provides proof of visa approval, contains important information about the visa, and is required for various purposes, including employment, education, and tax purposes.

How to read and understand the NOA?

Here is the paragraphy: To read and understand the Notice of Assessment (NOA), start by carefully reviewing the document to ensure all the information is accurate and complete. Begin with the top section, which typically includes your name, address, and tax identification number. Verify that these details are correct, as any errors could impact the processing of your tax return. Next, review the income section, which outlines the various sources of income reported to the Canada Revenue Agency (CRA), such as employment income, investment income, and any government benefits. Check that all income is accounted for and that the amounts match your records. The deductions and credits section is also crucial, as it lists the various deductions and credits you are eligible for, such as the basic personal amount, spousal amount, and charitable donations. Ensure that all eligible deductions and credits are included and that the calculations are accurate. The tax payable or refund section will show the net result of your tax return, indicating whether you owe taxes or are due a refund. Finally, review the notice for any additional information or messages from the CRA, such as requests for additional documentation or notifications of changes to your tax account. By carefully reviewing each section of the NOA, you can ensure that your tax return is accurate and complete, and that you understand any tax obligations or entitlements.

Eligibility and Requirements

To be eligible to receive a Notice of Assessment (NOA), you must meet certain requirements. The NOA is a document issued by the Canada Revenue Agency (CRA) that summarizes your tax return and any resulting refund or balance owing. In this article, we will explore the eligibility and requirements for receiving a NOA, including who is eligible to receive one, what the requirements are, and how to check if you meet the eligibility criteria. We will start by examining who is eligible to receive a NOA.

Who is eligible to receive a NOA?

The following are the eligibility requirements for receiving a Notice of Action (NOA): To be eligible to receive a Notice of Action (NOA), an individual must meet certain requirements. The NOA is typically issued by U.S. Citizenship and Immigration Services (USCIS) to applicants who have submitted a petition or application for immigration benefits. The eligibility requirements for receiving a NOA vary depending on the specific type of petition or application submitted. Generally, the following individuals are eligible to receive a NOA: applicants who have submitted a petition for family-based immigration, such as a spouse, parent, or child of a U.S. citizen or lawful permanent resident; applicants who have submitted a petition for employment-based immigration, such as a worker with specialized skills or knowledge; applicants who have submitted an application for asylum or refugee status; and applicants who have submitted a petition for other immigration benefits, such as a visa or green card. Additionally, the applicant must have submitted a complete and accurate application, paid the required filing fee, and provided all required supporting documentation. If the application is deemed eligible, USCIS will issue a NOA, which serves as proof of receipt of the application and provides information about the next steps in the process.

What are the requirements for receiving a NOA?

To receive a Notice of Action (NOA), you must meet specific requirements. First, you must have submitted a complete and accurate application or petition to U.S. Citizenship and Immigration Services (USCIS). This includes providing all required documentation, such as identification, proof of eligibility, and supporting evidence. Additionally, you must have paid the required filing fee, which varies depending on the type of application or petition. If you are applying for a benefit that requires a background check, such as a green card or citizenship, you must also undergo a biometrics appointment. Furthermore, you must be eligible for the benefit you are applying for, and your application must not be deemed frivolous or abusive. If your application is deemed complete and eligible, USCIS will issue a NOA, which will include a receipt number, the type of application or petition, and the date it was received.

How to check if you meet the eligibility criteria?

To check if you meet the eligibility criteria for a Notice of Assessment (NOA), you need to review the requirements set by the relevant authorities, such as the Canada Revenue Agency (CRA) or the Immigration, Refugees and Citizenship Canada (IRCC). Start by gathering all necessary documents, including your tax returns, proof of income, and identification. Next, visit the official website of the relevant authority and navigate to the section on NOA eligibility. Carefully read through the criteria, which may include requirements such as being a Canadian citizen or permanent resident, having a valid Social Insurance Number (SIN), and meeting specific income thresholds. You can also use online tools or consult with a representative to help determine your eligibility. Additionally, ensure you understand the specific requirements for your individual situation, such as being a student, self-employed, or having dependents. By thoroughly reviewing the eligibility criteria and gathering all necessary documents, you can accurately determine if you meet the requirements for a NOA.

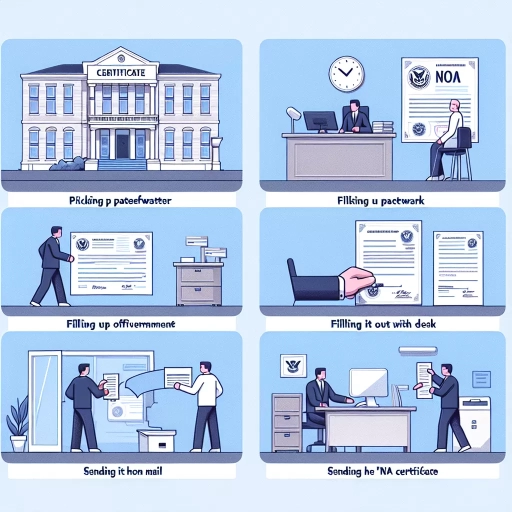

Applying for a NOA

Applying for a Notice of Assessment (NOA) is a crucial step in managing your tax obligations in Canada. A NOA is a document issued by the Canada Revenue Agency (CRA) that summarizes your tax return information and provides details on any taxes owed or refunds due. To obtain a NOA, you will need to apply through the CRA website, which requires you to have certain documents readily available. In this article, we will guide you through the process of applying for a NOA, including the necessary documents required and how to track the status of your application. First, we will explore how to apply for a NOA through the CRA website, a straightforward process that can be completed in a few steps.

How to apply for a NOA through the CRA website?

To apply for a Notice of Assessment (NOA) through the CRA website, start by visiting the official Canada Revenue Agency (CRA) website at cra.gc.ca. Click on the "My Account" tab and sign in with your CRA user ID and password. If you don't have an account, you can register for one by clicking on the "CRA register" button. Once logged in, navigate to the "Tax Return" section and select the tax year for which you want to request a NOA. Click on the "Request a Notice of Assessment" link and follow the prompts to confirm your identity and select the type of NOA you need. You can choose to receive your NOA by mail or view it online. If you choose to view it online, you can print or save a copy for your records. The CRA will process your request and provide your NOA within a few minutes. You can also use the CRA's mobile app, CRA Mobile, to request a NOA on your mobile device. Make sure to have your social insurance number and date of birth ready to complete the request. If you're having trouble accessing your account or need assistance, you can contact the CRA at 1-800-959-8281 for individual inquiries or 1-800-959-5525 for business inquiries.

What documents are required to apply for a NOA?

To apply for a Notice of Action (NOA), you will need to provide specific documents to support your application. The required documents may vary depending on the type of NOA you are applying for and the jurisdiction in which you are applying. However, here are some common documents that are typically required: a valid government-issued ID, such as a driver's license or passport; proof of residency, such as a utility bill or lease agreement; a copy of the court order or judgment that you are seeking to enforce; a copy of the contract or agreement that you are seeking to enforce; a detailed breakdown of the amount you are seeking to collect, including any interest or fees; and any other relevant documentation that supports your claim. Additionally, you may need to provide documentation to establish the identity of the parties involved, such as business licenses or articles of incorporation. It's also important to note that some jurisdictions may require additional documentation, such as a notarized affidavit or a certificate of service. It's recommended that you check with the relevant authorities or consult with an attorney to ensure that you have all the necessary documents to support your application.

How to track the status of your NOA application?

To track the status of your Notice of Assessment (NOA) application, you can follow these steps. First, ensure you have your application reference number or your tax file number (TFN) handy. You can then use the Australian Taxation Office's (ATO) online services or mobile app to check the status of your application. Simply log in to your account, navigate to the 'Lodgments' or 'History' section, and search for your NOA application. If you're unable to access online services, you can contact the ATO directly via phone or visit a service centre in person. Be prepared to provide your application reference number or TFN to verify your identity. Alternatively, you can also track the status of your NOA application through the ATO's automated phone service, which is available 24/7. By following these steps, you can easily track the status of your NOA application and stay up-to-date on the progress of your tax assessment.