How To Make A Void Cheque

Understanding the ins and outs of financial transactions is a crucial skill for any individual, and creating a void cheque is one of the most straightforward yet essential tasks to master. This forthcoming comprehensive guide on how to effictively create a void cheque ensures you steer clear of unnecessary financial fumbles. Choosing to go the void cheque way endows you with a powerful tool for setting up automatic bill payments, payroll deposits, or transferring funds between accounts at different banks. This guide is crafted into three easy-to-follow sections namely; the essential basics behind void cheques, the process of voiding a cheque, and common uses and advantages of void cheques. By the end of this riveting read, you'll not only gain practical knowledge on creating void cheques, but you'll also understand its role in the broader spectrum of financial transactions. Let's start by delving into the basic concept behind void cheques in the next section.

Understanding the ins and outs of financial transactions is a crucial skill for any individual, and creating a void cheque is one of the most straightforward yet essential tasks to master. This forthcoming comprehensive guide on how to effictively create a void cheque ensures you steer clear of unnecessary financial fumbles. Choosing to go the void cheque way endows you with a powerful tool for setting up automatic bill payments, payroll deposits, or transferring funds between accounts at different banks. This guide is crafted into three easy-to-follow sections namely; the essential basics behind void cheques, the process of voiding a cheque, and common uses and advantages of void cheques. By the end of this riveting read, you'll not only gain practical knowledge on creating void cheques, but you'll also understand its role in the broader spectrum of financial transactions. Let's start by delving into the basic concept behind void cheques in the next section.Subtitle 1

Subtitle 1 is more than a cursory concept; it is a treasure trove of information that deserves a thorough exploration. To do this, the article will delve into Supporting Idea 1, which lays the foundation for understanding the unravelled complexities of Subtitle 1. In addition, the discourse will journey through Supporting Idea 2, a notion that sheds light on the remarkable intricacies of our topic. Lastly, Supporting Idea 3 will be brought into the limelight, proudly raising the curtain on the subtleties and nuanced aspects of Subtitle 1 which are often under-appreciated. This multi-faceted examination will deepen our understanding and appreciation of the topic, paving the way to a fuller comprehension. As we kick start this intriguing journey, let's begin with Supporting Idea 1; a cornerstone upon which our comprehension of Subtitle 1 is built. This crucial scaffold extends our awareness beyond the superficial facets of Subtitle 1 and into its profound depths.

Supporting Idea 1

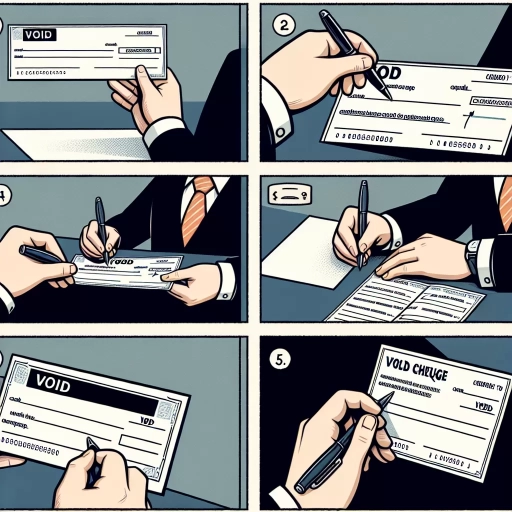

Banks or financial institutions may sometimes demand a void cheque from their customers for different types of transactions, including setting up an automated bill payment or direct deposit. The intention is to acquire vital banking information including bank's address, your specific account number, and the bank’s unique identification or routing number. The void check acts as a safeguard tool, providing crucial bank information without posing a risk of unauthorized usage, given the written words "VOID" render it useless for any transactional purposes. In the process of making a void cheque, there are specific steps to follow. First, you take a blank cheque either from your chequebook or a loose one you have at your disposal. Open your chequebook to a new, blank cheque. Write “VOID” in capital letters that cover most of the cheque. The primary reason for writing large is to ensure that no one can fill any details on it. You need to ensure “VOID” is written across all the critical sections such as the payee line, the amount box, and the signature line. However, remember not to write on the bottom of the cheque where the MICR numbers (routing and account numbers) are printed, since these are the details required by your bank or payroll department. Writing “VOID” on the cheque makes it impossible for the cheque to be filled out or to clear as cash. The idea here is to prevent the cheque from being used for fraudulent transactions. It eliminates the possibility of the cheque getting into the wrong hands and thus causing you monetary losses. However, the cheque can still be used to obtain the necessary banking information for making direct deposits or debits from your account, which is why it is requested in several banking transactions. The process of making a void cheque is straightforward and does not require any special skills. What is needed is a piece of blank cheque and a pen. However, negligence in not writing “VOID” large enough or at the right places can put your financial status at risk. Therefore, it is crucial to ensure that you void your cheque correctly. If you fear making a mistake, you can also ask your bank or credit institution to provide a pre-voided cheque. Understanding how to create a void cheque is a basic knowledge that every individual should possess. It can be especially useful when you are setting up electronic payments. Even while doing this yourself, must remember to keep the details accurate. A void cheque can provide a understanding of your banking details without putting your account at risk, securing your transactions and providing a safe way for money transactions. Keep these simple steps in mind, and you will be able to utilize a void cheque as a beneficial financial tool. Indeed, it acts as the bedrock for numerous banking transactions and provides enhanced financial safety. Therefore, knowing how to make a void cheque correctly is essential for efficient banking operations.

Supporting Idea 2

Banking Canada

Supporting Idea 2: Writing the Word "Void"

One key step in the process of creating a void cheque involves writing the word 'Void'. The primary aim of writing 'Void' on the cheque is essentially to mark it as unusable for regular transactions, effectively neutralizing its earning power. This precaution is vital as it minimizes the risk associated with lost or stolen cheques. This idea is not just crucial for voiding cheques but also serves as a safety net for other similar banking instruments. The process of "Voiding" a cheque should be done with deliberate and clear writing, eliminating any chance of fraudulent modification. The most effective way to void a cheque is simply to write 'VOID' across it in large, clear letters. This should ideally be written across the front of the cheque, spanning all the fields where you would typically write the payee's name, the date, the numerical value, and the written out amount. The ink should be permanent and non-erasable, usually accomplished by using a standard blue or black ballpoint pen. Voiding the cheque in this manner ensures that even if someone were to come into possession of the cheque accidentally or with malintent, they could never fill it out in their favor or modify it to draw money from your account. They may have possession of your cheque, but without the power to assign it a value, it is rendered worthless for all intents and purposes. But why is this necessary? The reality is that when setting up automatic payments, submitting proof of a bank account, or even setting up direct deposits, organizations request a void cheque. Conducting transactions with a void cheque allows companies to verify your banking information without the risk of the cheque being cashed. Your bank account number, bank branch number, and financial institution number— all of this information is readily available at the bottom of your cheque. In summary, writing 'Void' in a noticeable and unchangeable manner across the cheque forms the very bedrock of securing your banking transaction and protecting your money. The explicit invalidation of the payment tool provides essential security against potential financial frauds and misuses. Always remember, it is not just about making a void cheque, it is also about making safe and secure financial decisions. Therefore, the act of writing 'Void' on the cheque is not just a banking protocol, but an important routine that underscores financial security – a principle at the heart of every banking process in Canada.Supporting Idea 3

Supporting Idea 3: Significance of Void Cheque for Direct Deposit An integral component of many financial dealings, including establishing direct deposits, is a void cheque. For the vast majority, having a paycheque directly deposited into their bank account is a great convenience. This process eliminates the necessity to visit a bank branch to cash or deposit a check, allowing for a seamless, automatic transfer of funds. Providing a void cheque can ensure that your pay is deposited in the right account. The primary purpose behind a null cheque is to supply pertinent banking information to the entity that demanded it. For example, your employer might request a voided check to set up an automatic deposit for your paycheck, or your landlord may want one for automatic rent payments. When you hand over a void cheque, you're essentially providing essential banking details. These include your bank account number, bank routing number, and bank's address, all of which are vital for the transaction to occur accurately and efficiently. It's important to note that any potential concerns over security issues linked with providing such sensitive information with a void cheque are generally unwarranted. Voiding the cheque ensures that it cannot be filled out and cashed. This is done by writing "void" across it in a manner that doesn't obscure the essential details, thus ensuring its only use is for providing necessary banking information. It’s a safe and widely accepted strategy for securely exchanging banking information. Furthermore, the significance of a void cheque in this context is vital as it also helps diminish any possibility of error in keying in your banking details. Even a single wrong number could result in your hard-earned salary being deposited into someone else's account or your rent payment being seen as unpaid because it went somewhere else. By providing a void cheque, you ensure the right details are given, added security, and convenience for you. However, not everyone has cheques or even a chequebook, especially in this digital age. For individuals in this situation, there are other ways to gather the information usually found on a void cheque. You can consult an online statement or check your account via your bank’s online banking system. Alternatively, contact your bank to obtain this information. Though this methodology might require a little more effort on your part, it provides the same essential details required to arrange for a direct deposit. Regardless of how you obtain the necessary banking information, the crucial point is to ensure its accuracy. Whether using a void cheque or another method, providing correct, clear banking details supports a smooth, error-free process when setting up direct deposits, whether it's for your salary, rent, or other automated payments. So, always double-check these details to make sure they're correct. It’s worth remembering that, done properly, this procedure provides a convenient, secure, and efficient way to manage your financial transactions. The ultimate advantage, indeed, lies in the ensuing simplicity and peace of mind it brings by ensuring your monetary affairs are managed accurately and on time. In summary, the significance of void cheque in setting up direct deposits cannot be underplayed. It carries the essential banking details required for the process, ensures security, reduces the likelihood of errors, and ultimately, simplifies the financial management for you.

Subtitle 2

of modern enterprises, Subtitle 2, is a topic of considerable interest. Numerous facets contribute to its complexity, richness, and importance. Unraveling these facets, we will delve deeply into three critical elements that qualify Subtitle 2 as a remarkable contributor to business growth and continuity. Firstly, we will explore Supporting Idea 1, which encapsulates the notion that businesses must embrace innovative systems and processes. The second facet, Supporting Idea 2, involves the indispensability of a robust human resource infrastructure, exemplifying the synthesis of man and machine. Finally, we will delve into Supporting Idea 3, which stresses the criticality of continual learning and agility in the face of unpredictable business episodes. Each of these pillars provides invaluable insights into the universe of Subtitle 2. As we embark on this exploratory journey, let’s first understand the profound implications of Supporting Idea 1.

Supporting Idea 1

Supporting Idea 1

The first key element in the process of creating a void cheque involves having a clear and solid understanding of what void cheque is and its functionality. A void cheque, as its name implies, is essentially a cheque with the word 'VOID' written across it, which nullifies its monetary value, hence effectively rendering it unusable as a 'cheque.' However, it's critical to note that while a voided cheque has no direct financial value in terms of providing payment, it retains a level of informational value that lies in its details. A void cheque's details are paramount in setting up an automated direct deposit or withdrawal from your bank account, whether it's for your bills, payroll, or other banking transactions. The cheque presents all the critical information, like your account number, sort code, and bank name - detailed data needed for an electronic link with your account. Moreover, writing 'VOID' on a cheque prevents it from being used maliciously if it fell into the wrong hands, thus providing an additional security measure in the banking process. Ultimately, having knowledge of what a void cheque is furnishes not only an understanding of why it's required but also sheds light on its crucial role in facilitating secure and efficient electronic banking transactions. This fundamental comprehension sets the bedrock for the subsequent steps in making a void cheque correctly, ensuring a sound foundation for the overall process to be carried out smoothly and securely.Supporting Idea 2

Supporting Idea 2

Understanding the necessity and importance of void cheques is crucial when it comes to personal finance management. It may sound a bit daunting, especially if you happen to be a first-time account holder, but it's one of those things you'll eventually need to get the hang of when dealing with accounts management. A void cheque is used in various transactions such as setting up direct deposits for an employer or to set up an automatic payment with a service provider. Essentially, a void cheque is your personal cheque, but with the word 'VOID' written across it to ensure it can't be used to withdraw money from your account. Although it’s termed as a 'void' cheque, it still serves a crucial role. This is because it holds vital information about your bank account details which is useful in setting up electronic linkages for transactions to your bank account. The necessary pieces of information provided by a void cheque include your bank's transit number, institution number, and your personal account number. This trio of numerical codes enables the correct and precise routing of funds to or from your account electronically. They ensure that the money goes where it's intended without any mishap. Creating a void cheque is pretty straightforward although it varies slightly for different banks. The most common way to create a void cheque is to simply write 'VOID' across the face of a blank cheque. This prevents anyone else from being able to use the cheque to make a payment or to withdraw money from your account. It's also advisable to record the cheque number for future reference before you make it void. Nowadays, many banks also offer 'pre-voided' cheques you can obtain directly from them or create using their online platforms. It’s important to handle void cheques with care and only provide them to reliable parties. They do contain sensitive information that, if fallen in wrong hands, could lead to unauthorized transactions and potentially, identity theft. Understanding the process of creating a void cheque can significantly streamline your financial management tasks, eradicate the need for cash transactions, and provide a secure method for handling regular, automated transactions. The whole process may seem a bit complex at first, but once you get it, it's just a matter of routine personal finance management.Supporting Idea 3

Supporting Idea 3: Voiding a Cheque Securely in a Digital Age In the digital era, security is paramount, especially when it comes to banking transactions. Voiding a cheque involves rendering it non-negotiable, ensuring it cannot be used for fraudulent activities. This is an important measure, given the rise in cyber and financial crimes. With the evolution of modern technology, the traditional method of using a blue or black ink pen to write 'VOID' across the cheque may no longer be adequate. Fortunately, advancements in the banking sector have led to new ways to void a cheque safely and securely. One such method is the use of virtual cheques, also known as e-cheques. When the need for a void cheque arises, one can simply create a virtual copy of their cheque, void it, and send it to the required authority. This eliminates the risk involved with handing over a physical cheque while maintaining the necessary function. Furthermore, there is no danger of a voided e-cheque being physically or deliberately altered, which further enhances its security. Moreover, several financial institutions have made it possible to request a void cheque directly from your online banking platform. This service saves customers the hassle and potential risk of voiding a physical cheque manually, providing an easy and safe alternative. Banks often send these void cheques securely via email or through their secure online portal, further ensuring the information's safety. In the fight against financial fraud, technology has also equipped us with methods to detect and void fraudulent cheques. Advanced cheque scanners can identify so-called "rogue cheques" in large batches, rejecting those that display signs of alteration or tampering. Meanwhile, high-resolution imaging technology can capture every detail of a cheque, aiding in the detection and reporting of any suspicious activity. Additionally, businesses can adopt Positive Pay systems, a service offered by many banks that helps prevent cheque fraud. With Positive Pay, the business sends the bank a list of the cheques they've issued. The bank then only pays those cheques appearing on that list, enhancing the security of the transaction and the safety of the business' funds. In conclusion, support for voiding a cheque has transcended standard manual methods, adapting to the needs and security requirements of the digital age. This evolution has provided both individuals and businesses with secure, foolproof methods of voiding cheques, helping to combat financial fraud while maintaining essential transactional operations. This digital transformation, therefore, is a beneficial stride in simplifying banking transactions, safeguarding sensitive information, and enhancing the overall security of our financial system.

Subtitle 3

Subtitle 3

is a critical element of the overall scope of the article. An essential consideration in producing a high-quality, informative and engaging article, it draws strongly on three supporting ideas. These three ideas, each significant in itself, contribute to a broad, comprehensive and impactful understanding of Subtitle 3.Supporting Idea 1

, the first of the concepts underpinning the theme of Subtitle 3, helps form a solid foundation for the article. It provides a grounded approach to the topic and allows for a robust, nuanced explanation of its dynamics. The first of these ties to Subtitle 3 focuses primarily on establishing the groundwork for the rest of the supporting ideas.Supporting Idea 2

goes beyond to delve into the complexities of Subtitle 3. This idea offers a fresh, yet profound perspective, further elucidating the subtleties involved. It enables the readers to grasp the topic in a holistic manner, paving the way for a rich and intricate understanding of Subtitle 3. Lastly,Supporting Idea 3

synthesizes facts from the first two concepts to present a grand summary of all that Subtitle 3 signifies. All these supporting ideas work together providing a multifaceted insight into Subtitle 3 setting the stage for an in-depth exploration of the first,Supporting Idea 1

.Supporting Idea 1

Supporting Idea 1

Understanding and preparing a void cheque is a fundamental aspect in managing one's personal finances and it is imperative that every individual comprehend its significance. The concept of a void cheque functions as the bedrock of financial world, being utilized in various ways, from setting up direct deposit for an employee's paycheck to establishing pre-authorized payments for loans and services. Consequently, knowing how to create a valid void cheque is an essential skill. The bedrock constitutes the solid rock underlying unconsolidated surface materials such as soil. Similarly, a void cheque is the bedrock of a specific financial transaction. It serves as a reliable foundation by providing important banking information without the risk of an unauthorized withdrawal. Creating a void cheque is as simple as one, two, three. All you have to do is acquire a personal blank cheque and inscribe 'VOID' in big letters over the front, making certain it covers the lines where the payment amount and the beneficiary name are called out. This absolves the cheque of its monetary value and prevents it from being used for any transactions, thus mitigating any potential fraudulent activity. Consequently, when you submit this written cheque to the concerned party, you're furnishing them with the vital banking details like the financial institution number, your branch number (transit number), and your bank account number. Without providing them with the ability to withdraw an amount from it, that's an example of a well-founded bedrock—a void cheque. Understanding how to construct a valid void cheque is essential because if you cross out any necessary information or the characters 'VOID' are not written visibly, the cheque might be invalid, potentially leading to banking errors. Moreover, a void cheque is an indispensable component when you are setting up an electronic link to your bank account. Many organizations ask for a void cheque so that they can set up an automatic withdrawal system for payments or deposits. In summary, creating a void cheque is as elementary as writing 'VOID' across your cheque yet the act itself forms the bedrock of numerous monetary processes enabling a smooth flow of financial transactions. Therefore, possessing the knowledge on creation of void cheque becomes a critical tool in personal financial management, hence knowing how to make a void cheque is crucial for everyone who owns a bank account. It is the bedrock of the financial domain, securing automatic processes and payments, and ensuring confidence between parties in the banking chain.Supporting Idea 2

Supporting Idea 2: Understanding the Essential Elements to Include

The necessity of a void cheque arises within many accounts related scenarios, particularly those connected with implementing automated transactions. While creating your void cheque for such necessities, it's crucial to comprehend the essential elements it should encompass. These elements don't just make the cheque valid but they also play a key role in mirroring your financial details accurately. Predominantly, your cheque must exhibit your bank's code or the Institution Number. This figure is usually a three-digit number that identifies your bank within the Canadian banking system. Accompanied by this, your cheque should also illustrate your account number. Typically, it's a number given by your bank that singles out your unique account, ensuring that all the funds are drawn from or sent to the appropriate account. Additionally, it's vital to incorporate your Transit Number, a numeric code that locates your specific bank branch. These three elements act as the bedrock for your void cheque and are essential for setting up direct deposits or automatic payments. It's important to take particular caution in ensuring that these details are legible, exact, and undamaged during the voiding process as errors can lead to significant difficulties in your transactions, subsequently causing financial discrepancies. Therefore, understanding these elements and taking care while voiding a cheque can effectively facilitate a smoother, error-free banking experience.Supporting Idea 3

Banking Supporting Idea 3: The Importance of Handling Void Cheques Safely While creating a void cheque is a straightforward process that involves simply writing 'VOID' across the front, it's crucial to understand the importance of handling and using these instruments with due diligence and safety. Although a void cheque doesn’t hold any cash value, it contains sensitive information, much like the key to your financial identity. It carries important details such as your name, bank name, transit number, bank code, and even your account number. With the rise in virtual crime rates, unscrupulous entities could misuse these details to commit fraudulent transactions. To prevent such a scenario from happening, it is highly recommended to keep the void cheque or its image securely. If you're providing a void cheque online, make sure you're sharing it over a secure connection. Avoid emailing it since email is more susceptible to hacking attempts. Moreover, only share these details with verified and trusted parties like your employer, the bank, or any authorized government institution. If you're maintaining a physical copy of a void cheque, storing it under lock and key would be a wise move. Ensure that the chequebook is kept in a location that is not easily accessible to others. Identity theft is a serious crime and occurs when you least expect it, so always remain vigilant and proactive. Also, it is important to keep track of where you have provided void cheques, whether online or offline. That way, in the unfortunate event of unauthorized access or misuse, you have appropriate records to trace back the root cause and take necessary measures. By following these safety measures, you can safeguard yourself from potential financial hazards and make a void cheque, an effective tool for various banking transactions. Hence, the creation and usage of a void cheque should be handled carefully as it not only makes the transactions hassle-free but also plays a crucial part in maintaining the security of your confidential banking information.