How To Open A Paypal Account

In today's digital age, having a reliable online payment system is crucial for individuals and businesses alike. PayPal is one of the most popular and widely used online payment platforms, offering a secure and convenient way to send and receive payments. To get started with PayPal, it's essential to understand the eligibility and requirements to open an account, as well as the step-by-step process of creating one. Additionally, managing and securing your PayPal account is vital to prevent unauthorized transactions and protect your financial information. In this article, we will guide you through the process of opening a PayPal account, from meeting the eligibility requirements to managing your account securely. First, let's start with the basics: what are the eligibility and requirements to open a PayPal account?

Eligibility and Requirements to Open a PayPal Account

To open a PayPal account, you must meet certain eligibility and requirements. These requirements are in place to ensure the security and integrity of the platform, as well as to comply with regulatory obligations. There are three key areas that PayPal focuses on when verifying the eligibility of its users: age and identity verification, valid email address and phone number, and physical address and proof of residency. By meeting these requirements, users can ensure a smooth and secure experience when using PayPal for their online transactions. In this article, we will delve into each of these areas, starting with the importance of age and identity verification in the PayPal account opening process.

Age and Identity Verification

To ensure the security and integrity of its platform, PayPal requires users to undergo age and identity verification. This process is a crucial step in opening a PayPal account, as it helps to prevent fraudulent activities and protect users' sensitive information. When creating a PayPal account, users must provide their date of birth to verify their age. In most countries, users must be at least 18 years old to open a PayPal account, although this age requirement may vary depending on the country's laws and regulations. In addition to age verification, PayPal also requires users to provide identification documents, such as a government-issued ID, passport, or driver's license, to confirm their identity. This information is used to verify the user's name, address, and other personal details. PayPal may also use third-party services to verify users' identities and detect any potential risks. By verifying users' ages and identities, PayPal can ensure that its platform is used for legitimate purposes and that users' accounts are secure. This verification process is an essential part of PayPal's efforts to maintain a safe and trustworthy online payment system.

Valid Email Address and Phone Number

To open a PayPal account, you must provide a valid email address and phone number. A valid email address is one that is active, not already linked to another PayPal account, and can receive emails from PayPal. This email address will be used as your primary contact method, and you will receive important notifications, such as payment confirmations and account updates, via email. Additionally, a valid phone number is required to verify your account and to receive security codes and notifications. This phone number should be a working number that can receive SMS or voice calls. Providing a valid email address and phone number is crucial to ensure that you can access your account, receive important notifications, and comply with PayPal's security measures. Furthermore, having a valid email address and phone number also helps to prevent unauthorized access to your account and ensures that you can recover your account in case you forget your password or encounter any issues. By providing accurate and up-to-date contact information, you can ensure a smooth and secure experience with PayPal.

Physical Address and Proof of Residency

A physical address and proof of residency are essential requirements to open a PayPal account. A physical address is a street address where you can receive mail and packages, and it must be a valid address that is associated with your name. This address will be used as your billing address and will be verified by PayPal to ensure that it matches the information on your government-issued ID. Proof of residency, on the other hand, is a document that confirms your address and proves that you live at the physical address you provided. Acceptable documents for proof of residency include utility bills, bank statements, lease agreements, and government-issued IDs. The document must be dated within the last three months and must show your name and address clearly. PayPal requires a physical address and proof of residency to comply with anti-money laundering and know-your-customer regulations, and to ensure that your account is secure and protected from unauthorized access. By providing a physical address and proof of residency, you can help PayPal verify your identity and prevent fraudulent activities on your account. Additionally, a physical address is necessary for PayPal to send you important documents and notifications, such as account statements and security alerts. Overall, providing a physical address and proof of residency is a crucial step in opening a PayPal account and ensuring that your account is secure and compliant with regulatory requirements.

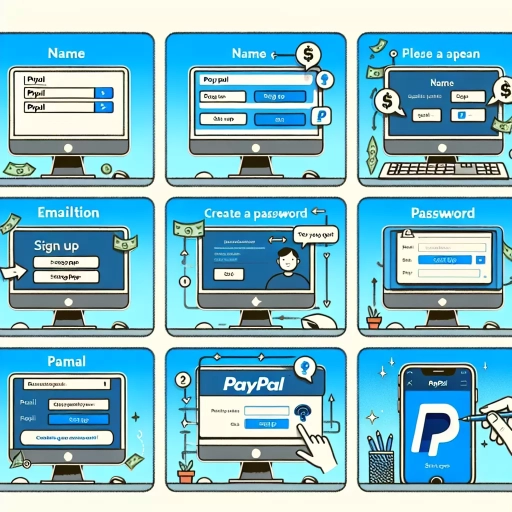

Step-by-Step Guide to Creating a PayPal Account

Creating a PayPal account is a straightforward process that can be completed in a few simple steps. To get started, you'll need to sign up for a PayPal account, which involves providing some basic information such as your name, email address, and password. Once you've signed up, you'll need to verify your email address and phone number to ensure that your account is secure and can be used for transactions. After verification, you'll be able to set up your account and security features, such as two-factor authentication and a secure password. In this article, we'll take you through each of these steps in detail, starting with the first step: signing up for a PayPal account.

Signing Up for a PayPal Account

Signing up for a PayPal account is a straightforward process that can be completed in a few simple steps. To get started, navigate to the PayPal website and click on the "Sign Up" button, usually located in the top right corner of the page. You will be asked to choose the type of account you want to create, either a personal or business account. A personal account is ideal for individuals who want to use PayPal for online shopping, sending and receiving money from friends and family, and paying bills. On the other hand, a business account is designed for merchants who want to accept payments from customers, send invoices, and track their sales. Once you have selected the type of account, you will be prompted to provide some basic information, such as your name, email address, and password. You will also need to provide your address, phone number, and social security number or tax ID number, depending on your location. After submitting your information, you will receive an email from PayPal to confirm your email address. Click on the link provided in the email to activate your account. You will then be asked to link a bank account or credit card to your PayPal account, which will allow you to add funds and make payments. Finally, you will need to verify your account by confirming your bank account or credit card information. Once your account is verified, you can start using PayPal to make payments, send money, and receive funds from others.

Verifying Your Email Address and Phone Number

Verifying your email address and phone number is a crucial step in creating a PayPal account. This process helps PayPal to ensure that the account is legitimate and belongs to the actual owner. To verify your email address, PayPal will send a confirmation email to the email address you provided during the sign-up process. You will need to click on the "Confirm Email Address" button in the email to activate your account. This step is essential to prevent unauthorized access to your account and to ensure that you receive important notifications from PayPal. Additionally, verifying your phone number helps PayPal to add an extra layer of security to your account. You will need to enter the verification code sent to your phone number to complete the verification process. This step helps to prevent phishing attacks and ensures that you are the actual owner of the account. By verifying your email address and phone number, you can ensure that your PayPal account is secure and ready for use.

Setting Up Your Account and Security Features

Setting up your account and security features is a crucial step in creating a PayPal account. To start, you'll need to provide some basic information, such as your name, email address, and password. Make sure to choose a strong and unique password that includes a combination of letters, numbers, and special characters. Next, you'll need to add a payment method, such as a bank account, credit card, or debit card. This will allow you to link your PayPal account to your bank account or card, making it easy to transfer funds. PayPal also offers a range of security features to protect your account, including two-factor authentication, which requires you to enter a code sent to your phone or email in addition to your password. You can also set up a security question and answer, which will be used to verify your identity if you forget your password. Additionally, PayPal offers a feature called "Account Key," which allows you to access your account using a unique code sent to your phone or email, eliminating the need for a password. By setting up these security features, you can ensure that your PayPal account is protected from unauthorized access and that your transactions are secure.

Managing and Securing Your PayPal Account

Managing and securing your PayPal account is crucial to protect your financial information and prevent unauthorized transactions. With millions of users worldwide, PayPal is a popular target for hackers and scammers. To ensure your account remains safe, it's essential to understand the fees and transaction limits associated with your account, set up robust security measures, and regularly monitor your account activity. In this article, we'll explore three key aspects of managing and securing your PayPal account: understanding PayPal fees and transaction limits, setting up two-factor authentication and password recovery, and monitoring your account activity and resolving disputes. By following these best practices, you can significantly reduce the risk of your account being compromised and ensure a secure online payment experience. Let's start by understanding the fees and transaction limits that apply to your PayPal account.

Understanding PayPal Fees and Transaction Limits

When using PayPal, it's essential to understand the fees and transaction limits associated with your account. PayPal charges various fees for different types of transactions, including payment processing fees, cross-border fees, and currency conversion fees. The payment processing fee typically ranges from 2.9% + $0.30 per transaction for domestic transactions, while cross-border fees can range from 0.5% to 2% of the transaction amount. Currency conversion fees can also apply when sending or receiving payments in a different currency. Additionally, PayPal has transaction limits in place to prevent unauthorized activity and protect users' accounts. These limits vary depending on the type of account and the user's location, but typically include limits on the amount that can be sent or received per transaction, as well as daily and monthly limits. Understanding these fees and limits can help you manage your PayPal account effectively and avoid any potential issues or restrictions. By being aware of the fees and limits, you can plan your transactions accordingly and make the most of your PayPal account.

Setting Up Two-Factor Authentication and Password Recovery

Setting up two-factor authentication (2FA) and password recovery is a crucial step in securing your PayPal account. To enable 2FA, log in to your PayPal account and go to the "Security" section. Click on "2-step verification" and follow the prompts to set up a 2FA method, such as a mobile authenticator app or a physical security key. This adds an extra layer of security to your account, requiring both your password and a verification code sent to your phone or generated by the authenticator app to access your account. Additionally, set up password recovery options, such as a security question or a backup email address, to ensure you can regain access to your account in case you forget your password. PayPal also offers a feature called "One Touch," which allows you to stay logged in to your account on a trusted device, eliminating the need to enter your password every time you make a purchase. By setting up 2FA and password recovery, you can significantly reduce the risk of unauthorized access to your PayPal account and protect your financial information.

Monitoring Your Account Activity and Resolving Disputes

Monitoring your account activity and resolving disputes are crucial aspects of managing and securing your PayPal account. Regularly reviewing your account transactions helps you detect any suspicious or unauthorized activity, allowing you to take prompt action to prevent potential losses. To monitor your account activity, log in to your PayPal account and navigate to the "Activity" or "Transaction History" section, where you can view a detailed list of all transactions, including payments, transfers, and refunds. You can also set up notifications to alert you of specific account activities, such as large transactions or login attempts from unfamiliar devices. If you notice any discrepancies or suspicious activity, report it to PayPal immediately, and they will guide you through the process of resolving the issue. In the event of a dispute, PayPal offers a resolution center where you can file a claim and provide supporting documentation. PayPal's dispute resolution process typically involves investigating the issue, communicating with the buyer or seller, and making a decision based on their findings. To avoid disputes, it's essential to clearly communicate with buyers and sellers, provide detailed descriptions of goods or services, and ensure that you have a clear refund and return policy in place. By monitoring your account activity and resolving disputes promptly, you can maintain a secure and trustworthy PayPal account, protecting your financial information and reputation.