How Do You Cancel An E Transfer

Here is the introduction paragraph: Canceling an e-transfer can be a stressful and confusing process, especially if you're not familiar with the steps involved. Whether you've sent money to the wrong recipient or need to stop a payment for another reason, it's essential to understand how to cancel an e-transfer quickly and efficiently. In this article, we'll guide you through the process, starting with understanding the e-transfer cancellation process, including the rules and timelines that apply. We'll also cover how to initiate the cancellation process, including the steps you need to take and the information you'll need to provide. Finally, we'll discuss how to resolve any issues that may arise and avoid delays in the cancellation process. By the end of this article, you'll be equipped with the knowledge you need to cancel an e-transfer with confidence. Let's start by understanding the e-transfer cancellation process.

Understanding the E-Transfer Cancellation Process

Electronic funds transfers, commonly referred to as e-transfers, have become a popular method of transferring money between individuals and businesses. However, there may be instances where you need to cancel an e-transfer. To understand the e-transfer cancellation process, it's essential to first comprehend what an e-transfer is and how it works. Additionally, knowing why you might need to cancel an e-transfer and the consequences of not doing so can also be beneficial. In this article, we will explore these topics in more detail, starting with the basics of e-transfers. What is an E-Transfer and How Does it Work?

What is an E-Transfer and How Does it Work?

An e-transfer, also known as an Interac e-transfer, is a convenient and secure way to send and receive money electronically in Canada. It allows individuals to transfer funds from their bank account to another person's bank account using their email address or mobile phone number. To initiate an e-transfer, the sender logs into their online banking platform, selects the recipient's email address or mobile phone number, and enters the amount they wish to transfer. The sender's bank then sends a notification to the recipient's email address or mobile phone number, which includes a link to deposit the funds into their bank account. The recipient can then log into their online banking platform and accept the transfer, which is usually deposited into their account within a few minutes. E-transfers are a popular way to send money to friends, family, or businesses, and they offer a secure and efficient alternative to traditional payment methods like cheques or cash.

Why Would You Need to Cancel an E-Transfer?

There are several reasons why you may need to cancel an e-transfer. One common reason is if you accidentally send money to the wrong recipient. This can happen if you enter the wrong email address or phone number, or if you select the wrong recipient from your contact list. In this case, cancelling the e-transfer as soon as possible can help prevent the wrong person from receiving your money. Another reason to cancel an e-transfer is if you change your mind about sending the money. This can happen if you realize you don't have enough funds in your account, or if you decide that you no longer want to make the payment. Additionally, if you suspect that your account has been compromised or that someone is trying to scam you, cancelling any pending e-transfers can help protect your money. Finally, if you need to make changes to the e-transfer, such as updating the recipient's information or changing the amount, cancelling the original transfer and sending a new one may be the best option. In any case, it's essential to act quickly to cancel the e-transfer and prevent any potential issues.

What are the Consequences of Not Cancelling an E-Transfer?

If you fail to cancel an e-transfer, the consequences can be severe. The recipient may receive the funds, even if they were not intended for them, and you may not be able to recover the money. In some cases, the recipient may not even be aware that they have received the funds, as they may not have been expecting the transfer. This can lead to a situation where the recipient spends the money, thinking it is theirs, and you are left with a significant financial loss. Additionally, if the recipient is a scammer, they may use the funds for malicious purposes, such as funding illegal activities or laundering money. Furthermore, if you are unable to cancel the e-transfer, you may be held liable for any losses or damages that result from the transfer, which can damage your credit score and financial reputation. In extreme cases, you may even be subject to legal action if the recipient uses the funds for illegal activities. Therefore, it is essential to take immediate action to cancel an e-transfer if you realize that it was sent in error or to the wrong recipient.

Initiating the Cancellation Process

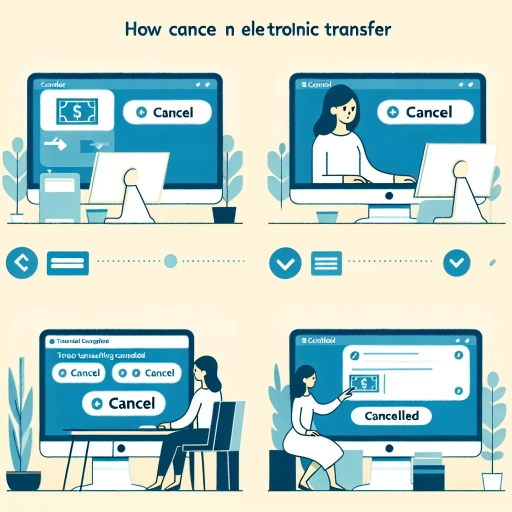

Initiating the cancellation process for an e-transfer can be a straightforward process, but it's essential to understand the steps involved and the information required to complete the cancellation successfully. If you need to cancel an e-transfer, you can do so through your bank's website or mobile app. To cancel an e-transfer through your bank's website, you will need to log in to your online banking account and navigate to the e-transfer section. Additionally, you will need to provide specific information to cancel the e-transfer, such as the transfer amount and the recipient's email address or mobile number. By following these steps and providing the required information, you can successfully cancel an e-transfer and prevent any potential issues. To learn more about the cancellation process, let's start by exploring how to cancel an e-transfer through your bank's website.

How to Cancel an E-Transfer Through Your Bank's Website

To cancel an e-transfer through your bank's website, start by logging into your online banking account using your credentials. Once you're logged in, navigate to the "Transfers" or "Payments" section, where you'll find a list of your recent transactions, including the e-transfer you want to cancel. Look for the specific e-transfer and click on it to view its details. If the e-transfer is still pending, you should see a "Cancel" or "Stop Payment" option. Click on this option to initiate the cancellation process. You may be prompted to confirm that you want to cancel the e-transfer, so review the details carefully before proceeding. If the e-transfer has already been processed, you may not be able to cancel it through your bank's website, and you'll need to contact the recipient or your bank's customer support for assistance. It's also important to note that some banks may have specific requirements or restrictions for cancelling e-transfers, so it's a good idea to review your bank's policies before attempting to cancel a transfer.

How to Cancel an E-Transfer Through Your Bank's Mobile App

To cancel an e-transfer through your bank's mobile app, start by opening the app and navigating to the "Transfers" or "Payments" section. Look for the e-transfer you want to cancel and select it. You may need to enter your password or use biometric authentication to access the transfer details. Once you're in, check if the e-transfer is still pending or if it has already been processed. If it's still pending, you should see a "Cancel" or "Stop" button next to the transfer. Tap on this button to initiate the cancellation process. You may be asked to confirm that you want to cancel the transfer, so review the details carefully before proceeding. If the e-transfer has already been processed, you may not be able to cancel it through the app, and you'll need to contact the recipient or your bank's customer support for assistance. It's also a good idea to review your bank's policies on e-transfer cancellations, as some may have specific rules or time limits for cancelling transfers.

What Information Do You Need to Provide to Cancel an E-Transfer?

To cancel an e-transfer, you will need to provide specific information to your bank or financial institution. This typically includes the e-transfer transaction details, such as the transaction ID, the recipient's name and email address or mobile number, and the amount transferred. You may also be required to provide your account information, including your account number and the type of account from which the e-transfer was sent. Additionally, you may need to provide a reason for the cancellation, although this is not always required. It's also important to note that some banks may have specific requirements or procedures for cancelling e-transfers, so it's best to check with your bank directly for their specific policies and procedures.

Resolving Issues and Avoiding Delays

When it comes to resolving issues and avoiding delays with e-transfers, there are several key considerations to keep in mind. If the recipient has already accepted the e-transfer, there are specific steps you can take to address any issues that may arise. Additionally, understanding how to handle cancellation errors or delays is crucial in minimizing disruptions to your financial transactions. It's also essential to be aware of the time limits for cancelling an e-transfer, as this can impact your ability to resolve issues promptly. By understanding these key aspects, you can navigate the e-transfer process with confidence and minimize the risk of delays or complications. If the recipient has already accepted the e-transfer, what are your next steps?

What to Do if the Recipient Has Already Accepted the E-Transfer

If the recipient has already accepted the e-transfer, you have limited options to cancel or reverse the transaction. In this scenario, the best course of action is to contact the recipient directly and request that they return the funds to you. You can explain the situation and provide any necessary documentation to support your claim. If the recipient is unwilling to return the funds, you may need to consider other options, such as seeking mediation or taking legal action. It's essential to note that once the recipient has accepted the e-transfer, the transaction is considered complete, and the funds are no longer in your control. Therefore, it's crucial to act quickly and communicate effectively with the recipient to resolve the issue amicably.

How to Handle Cancellation Errors or Delays

When dealing with cancellation errors or delays, it's essential to remain calm and take prompt action to minimize any potential consequences. First, contact the recipient immediately to inform them of the situation and request their assistance in resolving the issue. If the error or delay is due to a technical issue, reach out to the bank's customer support team for assistance. They can help you identify the cause of the problem and provide guidance on the next steps to take. If the error or delay is due to an incorrect account number or other user error, you may need to re-initiate the transfer with the correct information. In some cases, you may need to wait for the bank to investigate and resolve the issue, which can take several days. To avoid delays in the future, double-check the recipient's account information and ensure that you have sufficient funds in your account before initiating the transfer. Additionally, consider using a transfer service that offers real-time tracking and notifications to help you stay on top of the transfer process. By taking proactive steps to address cancellation errors or delays, you can minimize the risk of further complications and ensure a smooth transfer process.

What are the Time Limits for Cancelling an E-Transfer?

When it comes to cancelling an e-transfer, time is of the essence. The time limits for cancelling an e-transfer vary depending on the financial institution and the type of transfer. Generally, most banks and credit unions allow you to cancel an e-transfer within a certain timeframe, usually ranging from a few minutes to several hours after the transfer is initiated. For example, some banks may allow you to cancel an e-transfer within 30 minutes to 1 hour after it is sent, while others may give you up to 24 hours to cancel. It's essential to check with your financial institution to determine their specific time limits for cancelling an e-transfer. If you miss the cancellation window, the transfer will be processed, and the recipient will receive the funds. In some cases, you may be able to request a reversal of the transfer, but this is not guaranteed and may incur additional fees. To avoid delays and ensure a smooth cancellation process, it's crucial to act quickly and follow the instructions provided by your financial institution.