How To Write A Cheque Canada

Understanding the Basics of a Cheque

Fundamental Elements of a Cheque

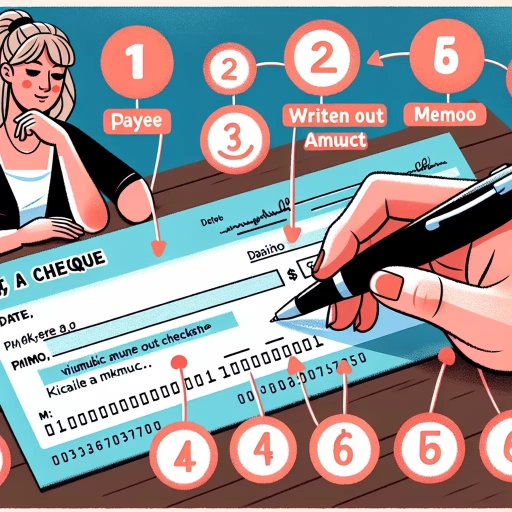

Before diving into the specifics of how to write a cheque in Canada, it is crucial to understand the fundamental elements that each cheque should have. These are the date, payee line, numerical and written amount lines, the memo line, and the signature line. Every cheque, regardless of the issuing bank or country, contains these essential elements. Understanding these universal parts of a cheque will provide a backdrop for the rest of the discussion about writing cheques in Canada.

- Date: This is the day when the cheque is written. In Canada, it's recommended to write dates in the DD-MMM-YYYY format.

- Payee Line: This is the line where you write who the cheque is for.

- Numerical and Written Amount Lines: Here, you include the amount of money in numerical and written formats.

- Memo Line (optional): The line where you can recall why you issued the cheque.

- Signature Line: This is where you sign the cheque, thus authorising the payment.

Why Understanding Cheque Basics are Important

Understanding how a cheque works and the information it requires are an integral part of financial literacy. Misstepping in cheque-writing, such as writing the wrong amount or forgetting to sign, can cause irreparable damage. It can lead to bounced cheques, fees, or even legal trouble. Therefore, taking the time to understand the basics of a cheque is worth the effort and can save future hassles. This is true regardless of where you live, but this article is specifically geared towards those living or conducting business in Canada.

Impact of Digital Transactions on Cheque Handling

With the rise of digital banking and cashless transactions, fewer people are writing cheques. However, cheques still play a critical role in the Canadian financial system. They are often used for large transactions and payments, where digital methods may not be either possible or safe. Cheques also leave a clear paper trail, making them desirable for record-keeping purposes. Therefore, knowing how to write a cheque in Canada is still an important skill to have.

Steps in Writing a Cheque in Canada

Key Instructions in Writing Cheques

Writing a cheque in Canada follows the same basic steps as in other countries, albeit with a few tweaks. It's a straightforward process: date the cheque, fill out the payee line, write out the amount in numbers and words, sign the cheque, and fill out the memo section (if necessary). For accuracy, use a pen – preferably black or blue – and make sure your writing is clear and easy to read. This section provides more detailed instructions on how to fill out each part of a cheque properly.

Corrects Ways in Writing the Amount Line

When writing the amount on the cheque, it's crucial to ensure clarity to avoid potential fraud or alterations. In Canada, amounts are generally written in the format "15.00" for fifteen dollars. Never leave gaps before the numbers as it can allow for fraudulent alterations. Always start writing as close to the left-hand edge of the box as possible, and if you have cents to include, include them even if they are 00. On the written line, for example, "fifteen dollars and 00/100 cents".

How to Safeguard Your Cheque Against Fraud

In addition to following the proper steps in writing a cheque, there are other precautions one should undertake to ensure the cheque does not become a vehicle for fraud. Always use a pen, cross out empty spaces after the Payee's name and the amount in words and figures, and never sign a cheque before it is completely filled out. These steps help to ensure that your cheque cannot be altered without your knowledge, providing an added level of security.

Common Mistakes to Avoid When Writing a Cheque

Post-dating Cheques

Many people believe that if they write a future date on a cheque (known as post-dating), the cheque cannot be cashed until that date. However, in Canada, this is not the case. Banks can process a post-dated cheque before the date on the cheque if they do not notice the future date. Therefore, you should only give out a cheque when you are ready for the money to be withdrawn from your account.

Incorrectly Written Amounts

Incorrectly written amounts are a common mistake when writing a cheque. Whether it's a discrepancy between the numerical and written amounts or an incorrect number or name spelling, such errors can lead to a returned cheque. As a rule of thumb, the bank will process the cheque based on the written-out amount in words if there is a discrepancy between the number amount and written-out amount. Therefore, ensure that the written-out amount and numerical amount match perfectly.

Ignoring the Memo Line

While the memo line is not mandatory, it is a handy reference tool. Filling it in can be especially useful for personal cheques, where the memo can serve as a reminder of why the cheque was written (for example, "January rent" or "birthday present"). Businesses also often use the memo line to keep track of invoice or order numbers associated with the payment. While banks do not require it, using the memo line is a best practice for keeping your finances in order.