How To Find Transit Number

Understanding The Basics of Transit Numbers

What is a Transit Number?

At the core of every financial transaction, whether it's direct deposits, checks, or electronic transfers, is a unique numerical identifier known as a transit number. The transit number, also referred to as a routing number in the United States, is a 9-digit code used by banks to identify where your account was opened. Without it, your transactions may not go through, highlighting its essential role. This code transcends beyond mere numbers to a system that enables smooth banking across different financial institutions.

The Composition of a Transit Number

A transit number comprises of three integral parts. First, the initial four digits which represent the Federal Reserve Routing Symbol. This denotes the Federal Reserve Bank location for your bank. Next are the four digits that represent the American Bankers Association Institution Identifier – the unique code for your bank. Lastly, the final digit is the check digit which verifies the authenticity of the first eight digits to avoid errors in data entry. Understanding these segments enables one to discern the intricate information told by a mere 9-digit code.

The Role of a Transit Number in Banking

A transit number is essentially a bank's address for your specific account. It facilitates the accurate and swift processing of checks, automates deposits and payments, and enables wire transfers between banks. For instance, if you want to set up payments for utilities, you will need your account number and the transit number. Or, if you're being paid by wire for a service you provided, your client will need your transit number. It's the circulatory system in today's digital banking world.

Finding Your Transit Number

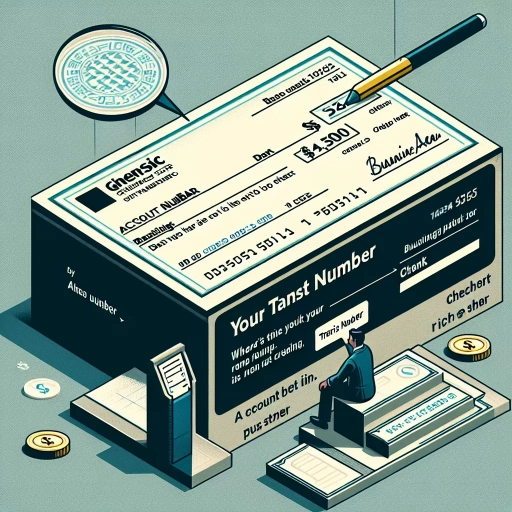

On Checks

If you have a checkbook, finding your transit number is quite straightforward. On the bottom left of a check, you usually find the transit number, followed by your account number and then the check number. It is important to note that the order of these numbers may vary depending on your bank. Therefore, you should always confirm this information with your bank to ensure you have the correct details.

Online Banking

In today's digital age, most people perform their banking transactions online. As such, you can easily find your transit number by logging into your bank's online system. Usually, this information is found under the "Account Details" or "Account Information" tab. However, different banks have different online interfaces, and the location of this information can vary. It's always best to use your bank's FAQ or Help section if you encounter difficulties retrieving your transit number.

Bank Statements

Bank statements are another handy source to find your transit number. Whether its electronic or paper statements, your transit number is often included in your account details. Similar to a check, the transit number precedes the account number. Be sure always to check for the 9-digit code, because account numbers may vary in length.

Ensuring the Correct Use of Transit Numbers

Confirming Transit Numbers with Your Bank

Although the aforementioned methods are effective in finding your transit number, the most reliable way is to confirm it with your bank. You can do so by contacting customer service through the phone or visiting the bank physically. By doing this, it eliminates the chance of errors that may arise from misreading or misidentifying the transit number.

Using Transit Numbers for Direct Deposits and Automatic Payments

When setting up direct deposits or automatic payments, you'll typically need your bank's transit number. It guarantees that your deposits reach the right bank and the correct account, increasing efficiency in managing your finances. It's important to input the correct transit number to avoid delays or issues with transactions.

Caveats to Transit Numbers

It’s critical to understand that sometimes, your banking institution may have different transit numbers for different types of transactions or branches. As a result, you may need to use a different transit number for wire transfers and electronic transactions than you would for checks. This adds another layer of complexity and reinforces the importance of confirming the correct transit number with your bank for each unique transaction.